Permian Resources: Catering To Growth And Mr. Market

Summary

- Permian Resources' cost saving transactions have been announced.

- A potential rig reduction is another money saver.

- The transactions point towards a detail oriented and driven management that often signals success for investors in the industry.

- The low acreage cost if the pattern continues will lead to above average profitability.

- This management does not receive a salary.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

Leonid Ikan

Permian Resources (NYSE:PR) appears to be backed by entities that want to grow the company significantly to enhance profitability. But the latest transaction appears to demonstrate the operations are also being closely watched so that no pennies "are left on the table". This is a concept that is very important to the commodity business. Generally, managements that settle for "good enough" sooner or later get into trouble. But managements that are driven to watch every penny are far more likely to out-perform the industry in the long run. Permian Resources is likely one of those detail-oriented managements.

Transactions Announced

Management announced a bolt-on acquisition along with some divestitures. Part of the key here is that the prices appear to be decent. I have long covered companies that have left "money on the table" which costs shareholders.

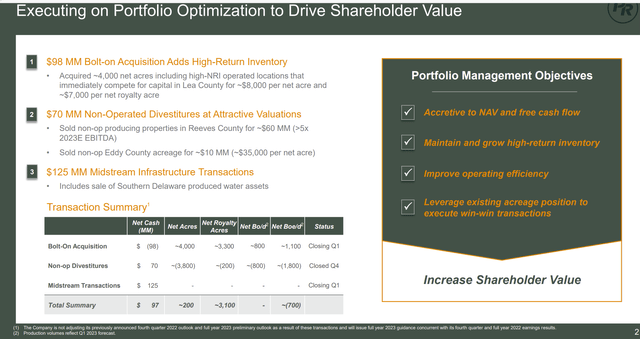

Permian Resources Summary Of Recent Transactions (Permian Resources Corporate Presentation Of Transactions January 2023)

(source)

A lot of managements do not bother with something like this because "it does not move the needle". Yet over time it often leads to those "extra pennies" that are so precious in a commodity industry. Management adds they did a large number of small acreage swaps to improve contiguous positions when they reported fourth quarter results. Oftentimes this is one of the signs of a detail oriented and driven management that is so essential to long term success in this industry.

Management got rid of acreage that is fully developed and likely has seen its more profitable times. Since it is not operated by management, they have no way of optimizing costs.

On the other hand, management acquired some acreage at a small fraction of the typical cost for good Permian acreage. That low acreage cost over time will lead to superior profitability.

Acreage itself does not depreciate. However, the money spent on acreage acquisition is important to return of capital. The more capital spent, then the lower the profitability of the company when drilling on that acreage. Many managements do not include acreage in the decision to drill or not drill. That is entirely proper. But a true breakeven of a well includes the acreage or location cost as part of the well profitability and how it influences corporate profitability. Therefore, well profitability when presented to shareholders should include a location cost.

Much of the industry avoids that discussion. Shareholders end up wondering about the difference between well profitability and corporate profitability. This is a key decision in that difference. Further clouding the issue is the tendency of management to "clear the decks" using very conservative assumptions during a downturn followed by more liberal assumptions during the rising part of the industry cycle.

Was Divesting Good?

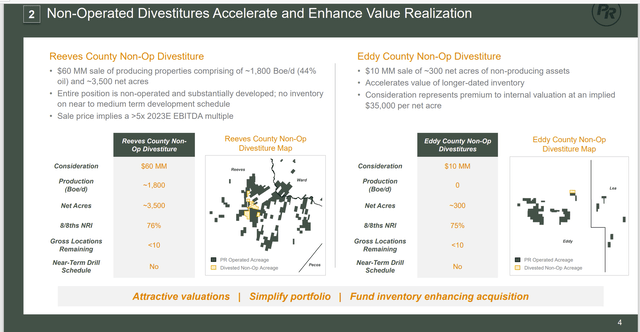

The price that was received for the divested acreage appears to be darn good.

Permian Resources Summary Of Acreage Sold (Permian Resources Transaction Summary January 2023)

What shareholders should expect is that over time management will seek to consolidate some of the properties surrounding the remaining acreage positions. That often allows for longer-more profitable wells. A solid acreage position often allows for lower operating costs. Given the map above, there appears to be plenty of work to still be done with the company's acreage. It is just a matter of when suitable sellers can be found.

A buyer might be willing to pay a decent price for small acreage positions because it could create more drilling opportunities or higher profit opportunities than current exist. Therefore, this could be a "win-win" for both sides of the transaction.

Management Record

The current management has a largely non-public record.

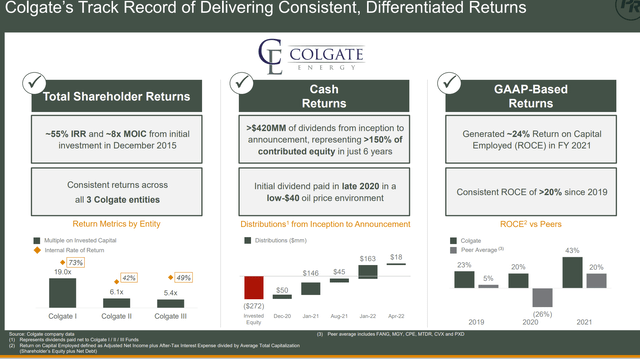

Permian Resources Management Returns To Shareholders History As Colgate Management (Permian Resources Presentation At Barclays CEO Energy-Power Conference September 2022)

(source)

However, that past record looks very attractive. Now the current transactions appear to verify that record. It may be a little bit early to form a firm conclusion on new management. But right now, this management appears to be going in the right direction that superior managements head. That is what any shareholder wants to see.

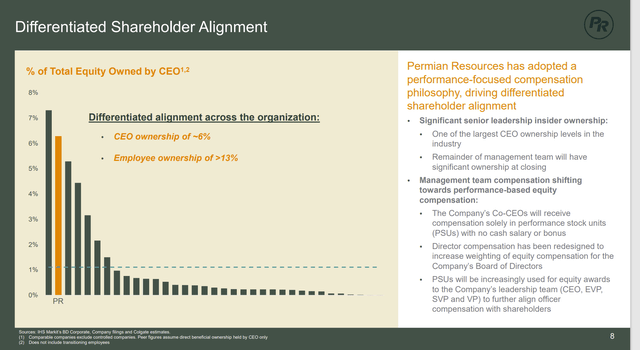

Permian Resources Management Compensation Arrangement (Permian Resources Presentation At Barclays CEO Energy-Power Conference September 2022)

This management does not take a salary as noted above. The sole compensation is in performance units. Therefore, shareholders should expect a growth emphasis resulting in a potential future sale. While management has announced a dividend, that is not going to be the main source of profit returns for shareholders.

Clearly, it should not be either because management can make a lot of money for shareholders producing oil in the current commodity price environment. A massive return of money to shareholders should only occur when management runs out of profitable opportunities. From the looks of things, that will not be for a while.

Management is furthermore on the side of shareholders through the considerable amount of stock owned by the CEO and employees. Basically, everyone is either going to do well or hurt along with the shareholders.

Looking Forward

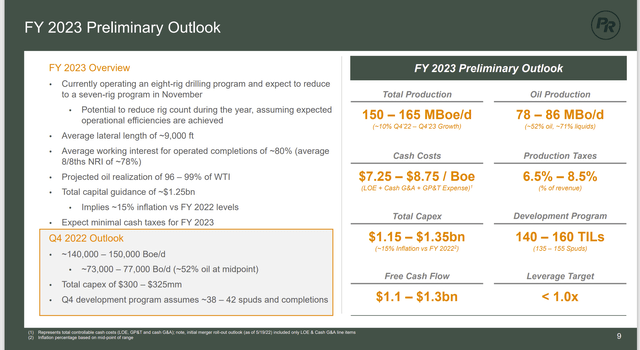

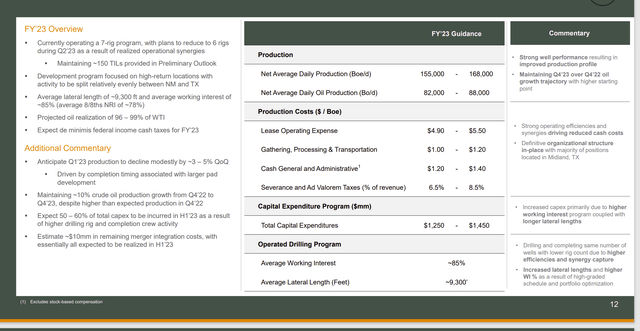

The growth goal is in the forward 2023 guidance.

Permian Resources Preliminary 2023 Guidance Or Capital Budget (Permian Resources Presentation At Barclays CEO Energy-Power Conference September 2022)

Management is already planning to grow while using less rigs. It appears that the proposed cost savings are well underway to being achieved. There still seems to be a general attitude that production is cheaper to purchase than it is to drill. So, there may be more potential accretive combinations ahead before the company is sold. Based upon the first transaction series at the start of the article, it would appear that management has the controls in pace to avoid overpaying for an acquisition.

An Aside

A side issue is the component of management action taken when production comes in greater than expected in the fourth quarter.

Permian Resources Guidance Adjusted For Unexpectedly Strong Fourth Quarter (Permian Resources Fourth Quarter 2022, Earnings Conference Call Slides)

One of the things that rarely happens with any management clearly happened here and you can compare the update to confirm what management stated (with the original guidance shown before). The fourth quarter came in above the midpoint of guidance a significant amount. So, management simply "moved the goal posts" further to accommodate that unexpected result. This enabled management to build upon that result at the previously planned rate.

I rarely see something like this. Usually, most managements take a strong quarter as a "gift" and then they do not have to do as much to achieve their guidance. This management appears to be more driven then most to achieve growth.

Some Advantages Of This Management

Smaller companies like this one generally have a better investment track record when management is experienced as shown before. That experience takes away a lot of the small company risk.

Similarly, this management appears to be keeping financial leverage low. That also minimizes the risk of total investment loss. Generally low financial leverage companies get as many attempts as they need to succeed whereas highly leveraged companies are not nearly as well able to handle unexpected events or management missteps. Even though this is a smaller company, the risk is probably lower than one would expect for such an investment.

For me, this is a buy and hold type situation unless the future story changes materially. I would generally sell when management decides to sell. The ride can be very volatile in a commodity industry. But following insiders with the experience level of these insiders tends to result in above average levels of profits.

I analyze oil and gas companies like Permian Resources and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Disclosure: I/we have a beneficial long position in the shares of PR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.