Eastman Chemical: A Sporty Valuation But A Bearish Chart Post-Earnings

Summary

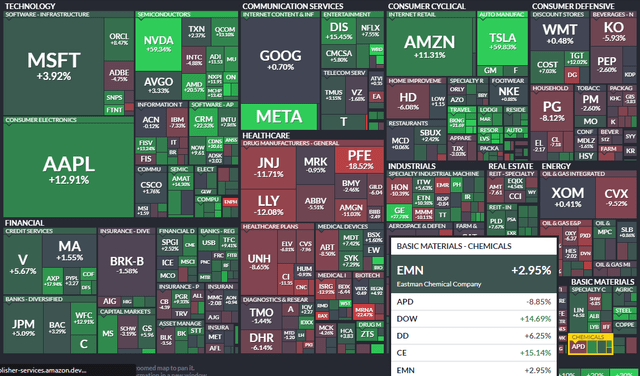

- The Chemicals industry has been ho-hum to start this year after a relatively strong 2022.

- Eastman Chemical features an attractive P/E even after an earnings miss and light guide.

- I spot bearish risks on the chart though and outline a pair of price levels to get long for a good risk/reward play.

Kittisak Kaewchalun

The Chemicals industry within the Materials sector featured some relative strength during 2022. This year, though, it is more of a mixed bag. Eastman Chemical recently reported lackluster quarterly results, and the outlook left something to be desired. I can make a strong value case on the S&P 500-listed stock, but the charts suggest a more cautious stance.

Chemicals in 2023: Mixed Performances

According to Bank of America Global Research, Eastman Chemical’s (NYSE:EMN) portfolio of businesses represents a highly diversified set of chemical products delivering exposure to an equally diverse number of end markets. This is accomplished through an expertise in four primary chemical chains, coal gasification and acetyls, para-xylene and polyesters, olefins, and methanol and alkylamines. EMN then markets these products to customers across the product chain, starting at upstream commodities and moving down to highly differentiated chemical derivatives.

The Tennessee-based $10.0 billion market cap Chemicals industry company within the Materials sector trades at a low 13.3 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.8% dividend yield, according to The Wall Street Journal. EMN declared a $0.79 quarterly dividend earlier this month after missing on earnings estimates.

Lower demand was cited, and guidance was short of analysts’ expectations. Still, lower raw material costs should help the firm this year, but unlike many Materials sector names, Eastman Chem does not benefit much from a China reopening. This year, investors want to see multiple expansion as earnings growth should be tepid. Also, keep any further shareholder-friendly initiatives on your radar as the dividend has been on the rise. Volatility in commodity prices is a key risk while and further weakness in the global economy would also be troublesome for Eastman.

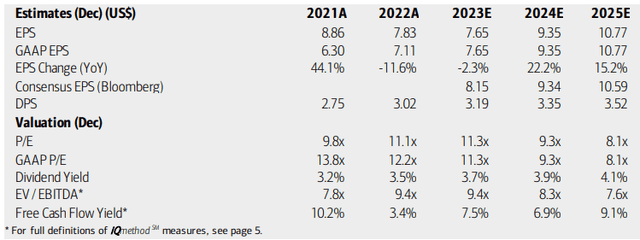

On valuation, analysts at BofA see earnings falling modestly this year but then bouncing back big in 2024 and 2025. The Bloomberg consensus forecast is about on par with what BofA sees, but other analysts are more upbeat about this year.

Dividends should continue to rise while the operating and GAAP earnings multiples are seen as attractive in my eye around 10 going forward. The EV/EBITDA is not a screaming buy, but ample free cash flow should help the firm pounce on high ROI projects. I think a mid-teens multiple is right given earnings growth beyond this year. That would put the stock price around $130 if we assume $8.50 of EPS.

Eastman Chemical: Earnings, Valuation, Dividend Forecasts

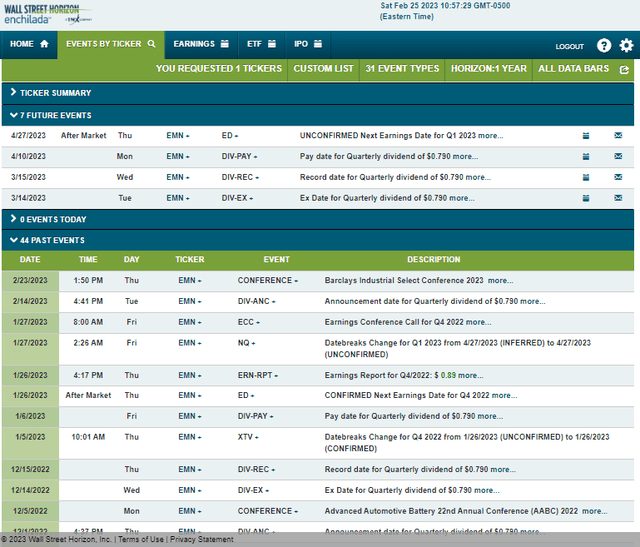

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q1 2023 earnings date of Thursday, April 27 AMC. Before that, shares trade ex-div on March 14. No other volatility catalysts are expected per the calendar.

Corporate Event Risk Calendar

The Technical Take

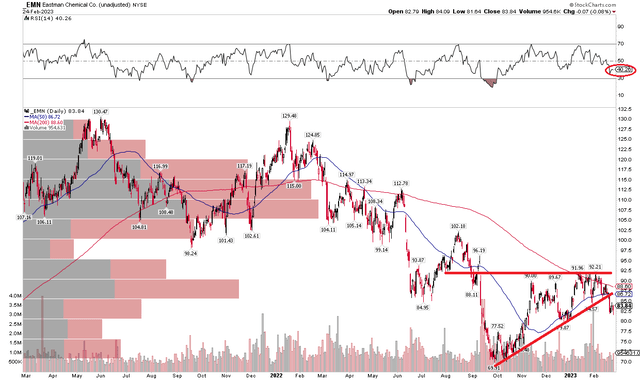

I had a buy recommendation on EMN back in September last year. I noted key support in the mid-$80s, but the stock dropped through that zone. Shares then recovered to the low $90s, but the rally did not last. Notice in the chart below that the stock consolidated in an ascending triangle pattern – often a continuation feature. In this case, that played out as the broader downtrend appears tough to break.

Just in the last few sessions, EMN has fallen below the uptrend support line drawn while the move comes on a new low in RSI momentum – confirming the price trend break. While I still like the valuation and yield, the chart is more of a concern here. EMN also failed to rally above its falling 200-day moving average as the short-term 50-day turns negatively sloped. A climb above $93 would help support a bullish trend break and getting long in the low $70s with a stop under $69 is a more favorable risk/reward.

EMN: Bearish Trend Break Confirmed By RSI

The Bottom Line

I continue to like EMN stock on a value basis, but patience is needed according to the charts.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.