B2Gold: Market Should Have A Second Look At This One

Summary

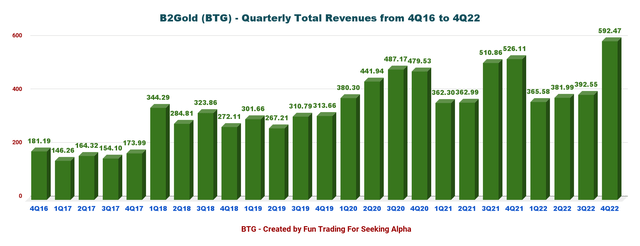

- The company announced consolidated gold revenues of $592.47 million in the fourth quarter of 2022, up from $526.11 million in the year-ago period and up 50.9% sequentially.

- Total gold production in the fourth quarter of 2022 was 367,870 ounces (including 15,101 Au ounces for its 25% Calibre Mine plus 1.5% NSR).

- I recommend buying BTG between $3.25 and $3.15, with possible lower support at $2.85.

- Looking for a helping hand in the market? Members of The Gold And Oil Corner get exclusive ideas and guidance to navigate any climate. Learn More »

bodnarchuk

Part I - Introduction

Vancouver-based gold miner B2Gold Corp. (NYSE:BTG) released its fourth-quarter and full-year 2022 results on February 22, 2023.

Note: I have followed BTG quarterly since July 2019. This new article is a quarterly update of my article published on January 22, 2023. BTG owns three producing mines, one production mine in a 50/50 JV, and two exploration projects.

BTG Assets map Presentation (BTG Presentation)

Note:

- The flagship asset for the company is the Fekola Mine in Mali, West Africa.

- Also, Gramalote JV in Colombia, a joint venture between B2Gold and AngloGold (AU), is for sale. CFO Michael Cinnamond said in the conference call:

we decided jointly with our partners AGA to begin a sales process on Gramalote. And so, that process has been started so it's underway. So, we'll provide updates on that in due course.

1 - 4Q22 and FY22 results snapshot

B2Gold posted a net income attributable to the shareholders of $157.76 million, or $0.15 per diluted share, compared with $136.94 million, or $0.13 per share, in 3Q21.

Revenues for 4Q22 were $592.47 million, up 50.9% sequentially and up 12.6% compared to the same quarter a year ago. Cash flow provided by operating activities before changes in non-cash working capital was $270.49 million, up from $266.29 million made in 4Q21.

Total gold production in the fourth quarter of 2022 was 367,870 ounces (including 15,101 Au ounces for its 25% Calibre Mine plus 1.5% NSR).

On February 13, 2023, B2Gold agreed to acquire Sabina Gold & Silver Corp in a deal valued at C$1.1 billion ($820 million in an all-share deal). Sabina owns the Back River Gold District project located in Nunavut, Canada.

Upon completion, existing B2Gold shareholders and former Sabina shareholders will own roughly 83% and 17% of outstanding B2Gold Shares, respectively.

Note: Closing expected in 2Q23. The deal requires shareholder approvals of Sabina (66 2/3%).

As shown below, the balance sheet will be different in 1Q23. Shares outstanding will increase by approximately 215 million shares to 1,290 million after the acquisition is completed.

BTG Acquisition of Regina Pro-forma (BTG Presentation)

2 - Stock performance

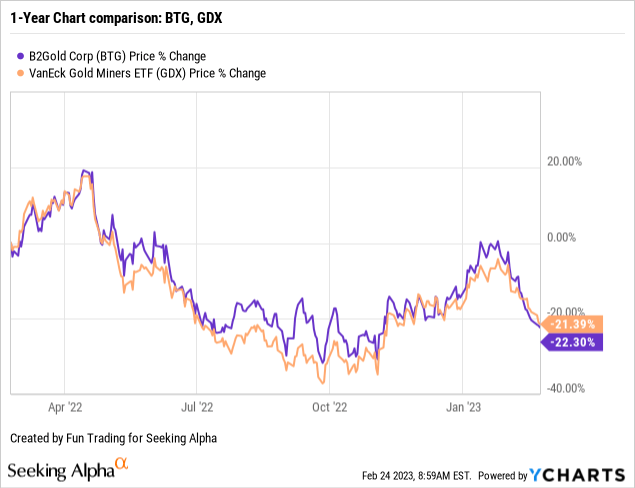

B2Gold has slightly outperformed the VanEck Vectors Gold Miners ETF (GDX) and is down 22% on a one-year basis. BTG has dropped significantly since April-May this year in correlation with the Fed's actions against rampant inflation.

3 - Investment thesis

BTG is a strong mid-tier gold miner with well-diversified assets. I am optimistic about the stock, even if the Fekola mine presents an additional risk due to the political instability in Mali, West Africa.

A quick look at the balance sheet explains why I feel confident. BTG has an excellent cash position and nearly no debt. Moreover, it pays a quarterly dividend of $0.04 per share or a yield of almost 5%.

Thus, one winning strategy I often recommend in the gold sector in my marketplace, "The Gold and Oil Corner," is trading about 50%-60% LIFO of your BTG position and keeping a core long-term position for an eventual higher stock price.

I believe it is the best strategy (the centerpiece of my marketplace) that will protect you from "surprises" and rewards you with a sizeable profit.

Part II - B2Gold - Historical balance sheet until 4Q22 - The Raw Numbers

| B2Gold | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

| Total Revenues in $ Million | 526.11 | 365.58 | 381.99 | 392.55 | 592.47 |

| Net Income in $ Million | 136.94 | 80.72 | 37.80 | -23.41 | 157.76 |

| EBITDA $ Million | 360.19 | 222.42 | 188.78 | 143.60 | 368.92 |

| EPS Diluted in $/share | 0.13 | 0.09 | 0.04 | -0.02 | 0.15 |

| Cash from Operations in $ Million | 266.29 | 107.31 | 124.88 | 93.12 | 270.49 |

| Capital Expenditure in $ Million | 112.50 | 67.93 | 132.49 | 76.50 | 87.10 |

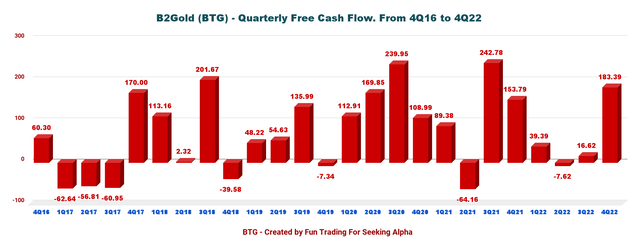

| Free Cash Flow in $ Million | 153.79 | 39.39 | -7.62 | 16.62 | 183.39 |

| Total Cash $ Million | 673.0 | 648.76 | 586.70 | 549.46 | 651.95 |

| Total Long-term Debt in $ Million (including current) | 75.13 | 72.66 | 66.64 | 14.32 | 13.36 |

| Dividend $/share | 0.04 | 0.04 | 0.04 | 0.04 | 0.04 |

| Shares Outstanding (diluted) in Billion | 1,061 | 1,062 | 1,068 | 1,064 | 1,075* |

| Production | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

| Total production gold | 304,897 | 209,365 | 223,623 | 227,016 | 367,870 |

| AISC from continuing operations/consolidated | 888 | 1,036 | 1,111 | 1,169 | 1,030 |

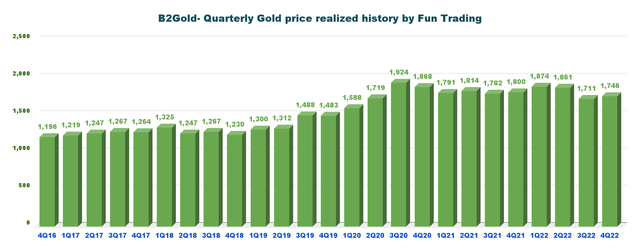

| Gold Price | 1,800 | 1,874 | 1,861 | 1,711 | 1,746 |

Data Source: Company press release

* Share outstanding count is about to increase to 1,290 million after the merger with Sabina is completed.

Analysis: Revenues, And Gold Production

1 - Quarterly revenues were $592.47 million for 4Q22

BTG Quarterly Revenue history (Fun Trading) The company announced consolidated gold revenues of $592.47 million in the fourth quarter of 2022, up from $ 526.11 million in the year-ago period and up 50.9% sequentially (see table above for details and history). The company sold its gold at $1,746 per ounce this quarter. BTG Quarterly gold price history (Fun Trading) The gold price progression since 2019 has been excellent, but gold has weakened recently due to the Fed's action on the interest rates. Inflation pressures have been a constant issue. CEO Clive Johnson said in the conference call: We had a very good year again and achieved our production and consolidated cost guidance and in a very strong financial position for the year. And also, we also declared another dividend of $0.04 share for three quarter.

2 - The fourth quarter's free cash flow was a record $183.39 million

BTG Quarterly Free cash flow history (Fun Trading)

Note: Generic free cash flow is cash from operating activities minus CapEx.

B2Gold had a quarterly free cash flow of $183.39 million in 4Q22 and a trailing 12-month FCF is $231.78 million.

B2Gold's board pays a quarterly dividend of $0.04 per share or a yield of 4.8%, which is one of the best in the gold industry.

3 - B2Gold is net debt-free and has $651.95 million in total cash at the end of December

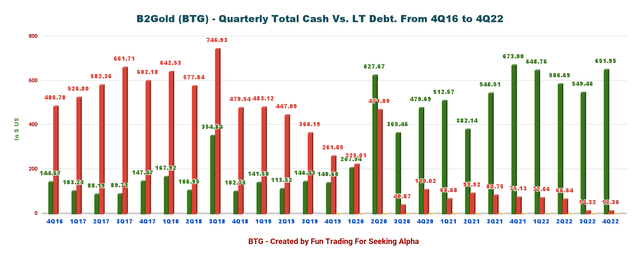

BTG Quarterly Cash versus Debt history (Fun Trading) B2Gold continues to maintain a solid financial position and liquidity. As shown in the chart above, the company has a long-term debt (including current) of $13.36 million. The situation will not change drastically after the merger of Regina is completed.

On December 31, 2022, the company had cash and cash equivalents of $651.95 million.

In addition, the company's $600 million Revolving Credit Facility ("RCF") remains fully undrawn and available. The liquidity is estimated at $1,252 million in 4Q22. In the press release:

At December 31, 2022, the full amount of the Company's $600 million revolving credit facility was undrawn and available. The maximum available for drawdown under the facility remains at $600 million with an accordion feature, available on the receipt of additional binding commitments, for a further $200 million.

4 - 4Q22 and Full-year 2022 Gold Production Snapshot

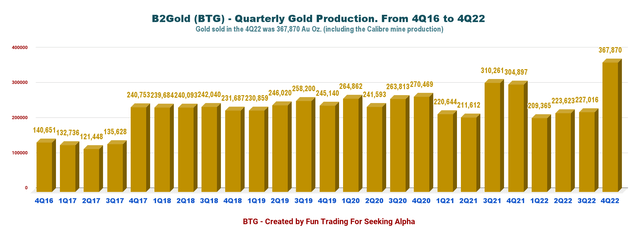

B2Gold posted a solid gold production of 367,870 Au ounces (including 15,101 Au ounces for its 30.8% Calibre Mine) in the fourth quarter of 2022. It was a solid gold production that allowed BTG to meet guidance.

BTG Quarterly Production history (Fun Trading)

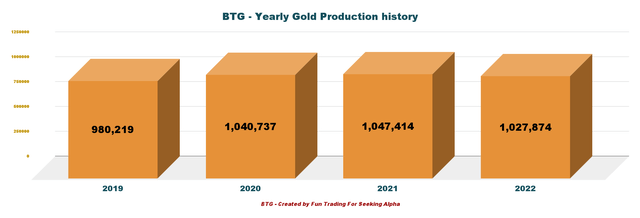

BTG production 1,027,874 Au ounces in 2022, reaching the upper half of 2022 Guidance. The seventh consecutive year of meeting or exceeding annual production guidance.

BTG Yearly Production history (Fun Trading)

Note: B2Gold is considered a related party by its equity interest in Calibre, as they own approximately 25% of the company. Under an agreement with B2Gold in November 2016, B2Gold retains a 1.5% NSR on production from certain concessions.

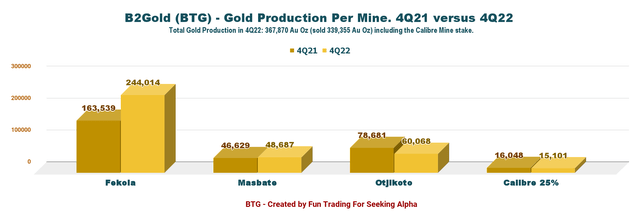

BTG Gold production per mine 4Q21 versus 4Q22 (Fun Trading)

4.1.1 - The Fekola Mine In Mali:

Gold production was a whopping 244,014 ounces in the fourth quarter of 2022.

The company said, "High-grade ore from Fekola open-pit Phase 6 contributed to consecutive monthly production records in October and November 2022. The full-year 2022 gold production from Fekola of 598,661 ounces, at the upper end of the annual guidance range of 570,000 to 600,000 ounces."

4.1.2 - The Masbate Mine In The Philippines:

Gold production from the Masbate Mine was 48,687 ounces in the fourth quarter of 2022.

The company said: "The full year 2022 gold production from Masbate of 212,728 ounces, slightly below the revised guidance range of 215,000 to 225,000 ounces (but at the upper end of the original guidance range of 205,000 to 215,000 ounces)."

4.1.3 - The Otjikoto Mine In Namibia:

4.2 - All-in Sustaining Costs AISC and gold price history

BTG Quarterly Gold price and AISC history (Fun Trading)

One good news during the 4Q22 is that AISC decreased from $1,169 in 3Q22 to $1,060 in 4Q22 despite inflationary pressures.

The gold price for 4Q22 averaged $1,746 per ounce, above the $1,711 per ounce realized the previous quarter. AISC for 4Q22 is estimated at $1,030 per ounce.

4.3 - Outlook

B2Gold expects to continue its strong operational performance in 2023, with total gold production forecast to be between 1 Moz and 1.08 Moz (including 60K to 70K attributable ounces from Calibre).

The Company's total consolidated cash operating costs for the year (including estimated attributable results for Calibre) are expected to be between $670 and $730 per ounce, and total consolidated AISC (including estimated attributable results for Calibre) will be between $1,195 and $1,255 per ounce.

Part III - Technical Analysis And Commentary

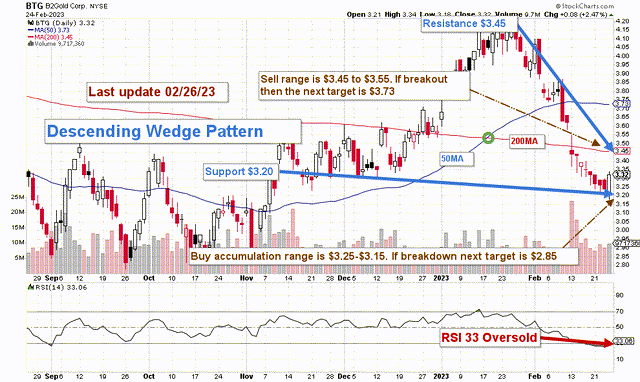

BTG TA Chart short-term (Fun Trading StockCharts) Note: The chart is adjusted for the dividend.

BTG forms a Descending Wedge pattern with resistance at $3.45 and support at $3.20.

A Descending Wedge is a bullish chart pattern, and we should expect a breakout of the pattern soon. The RSI is 33 and is oversold, showing a buy signal. However, BTG could go a little lower before the breakout happens.

The dominant strategy I usually promote in my marketplace, "The Gold and Oil Corner," is to keep a core long-term position and use about 50%-60% to trade LIFO while waiting for a higher final price target to sell your core position. This strategy is perfectly adapted to BTG, letting you trade the short-term volatility and get a good dividend for your long-term position.

I recommend selling partially between $3.45 and $3.55, with higher possible resistance at $3.73. Conversely, it is reasonable to buy back on any weakness between $3.25 and $3.15, with possible lower support at $2.85.

Watch gold like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author's note: If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks.

Join my "Gold and Oil Corner" today, and discuss ideas and strategies freely in my private chat room. Click here to subscribe now.

You will have access to 57+ stocks at your fingertips with my exclusive Fun Trading's stock tracker. Do not be alone and enjoy an honest exchange with a veteran trader with more than thirty years of experience.

"It's not only moving that creates new starting points. Sometimes all it takes is a subtle shift in perspective," Kristin Armstrong.

Fun Trading has been writing since 2014, and you will have total access to his 1,988 articles and counting.

This article was written by

I am a former test & measurement doctor engineer (geodetic metrology). I was interested in quantum metrology for a while.

I live mostly in Sweden with my loving wife.

I have also managed an old and broad private family Portfolio successfully -- now officially retired but still active -- and trade personally a medium-size portfolio for over 40 years.

“Logic will get you from A to B. Imagination will take you everywhere.” Einstein.

Note: I am not a financial advisor. All articles are my honest opinion. It is your responsibility to conduct your own due diligence before investing or trading.

Disclosure: I/we have a beneficial long position in the shares of BTG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I trade short-term BTG and own a long-term position, as explained in my article.