General Electric Breakup Redux

Summary

- General Electric recently spun off the healthcare business into GEHC.

- The company is planning on spinning off the energy and power businesses next year into a newly traded company called GE Vernova.

- The current break-up value compared to the value of GE stock results in the potential for further gains for shareholders.

jetcityimage

Several months ago, I wrote an article detailing the breakup plan for General Electric (NYSE:GE). Now that the dust has settled after the first spin-off, this analysis will revisit the current company and refresh the estimated valuation for the final spin-offs, scheduled to happen early next year.

The plan was for the company to split into three separate businesses – the healthcare business to be named GE HealthCare, the energy businesses to be named GE Vernova and the aviation business to be named GE Aerospace. GE Vernova will combine the company’s existing Renewable Energy, Power, Digital and Energy Financial Services lines.

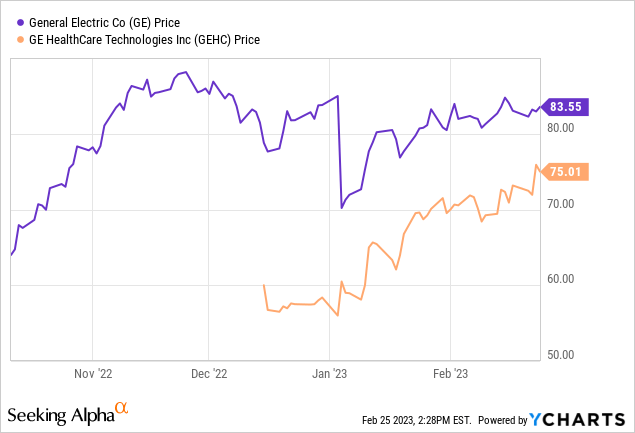

The company has by all indications successfully completed the spin-off of the healthcare business into GE HealthCare Technologies Inc. GE shareholders received 1 share of GEHC for every 3 shares of GE they held. When my original analysis was published, GE stock was trading at about $65 per share. GE stock is now trading at a recent price of $83.55, and GEHC is trading at a price of $75.01. Furthermore, GE is retaining approximately 19.9% of the shares of GEHC, today worth about $6.7 billion.

There is a lot of background information in my original article which I will not repeat in this article for the purposes of brevity. The spin-off of the energy and power businesses will be completed in early 2024. The new company will be named GE Vernova. In my original analysis, this was the business that probably had the most upside, yet its recent financial results were the most inconsistent. With the results for 2022 finally reported, unfortunately, the financial outlook for these businesses is still quite cloudy, yet the potential for future gains remains very high.

The Renewable Energy business finished 2022 with revenues of $13.0 billion, down 17% from the prior year, mainly due to lower volume on Onshore Wind. Operating margins contracted further due to the lower revenues, higher warranty and related reserves and continued inflationary pressures. Total backlog for Renewable Energy was $32.8 billion at the end of the year, up 4% from the prior year. This is a sign of future growth for the company. Management is expecting continued profit improvement and low-single digit revenue growth in 2023.

| GE Renewable Energy (billions) | 2019 | 2020 | 2021 | 2022 | 2023 est |

| Sales | $15.3 | $15.7 | $15.7 | $13.0 | $13.5 |

| Sales growth % | 2% | 0% | -17% | 4% | |

| Operating income (loss) | ($0.8) | ($0.7) | ($0.8) | ($2.2) | ($1.8) |

| Operating margin | -5.2% | -4.6% | -5.1% | -17.3% | -13.0% |

The comparable companies for GE Renewable Energy are Siemens Gamesa Renewable Energy and Vestas Wind Systems. The Siemens company is being absorbed into Siemens Energy, so we will only use Vestas for this comparison. Vestas finished fiscal 2022 with revenues of 14.5 billion euros, down 7% from the prior year. Like GE Renewable Energy, the company reported an operating loss for the year, which was a turnaround from a profitable 2021. Based on the company’s earnings announcement, I have estimated revenue for 2023 to be about 14.3 billion euros, with slightly improving operating margins. At a recent market cap of 27.8 billion euros, the stock trades at about 2x revenues, which is higher than it was for my original analysis. Back then, the stock was trading at just 1.2x revenues. The revenue estimate for next year has declined and the market value has increased, resulting in a higher sales multiple. Nevertheless, applying that multiple to GE Renewable Energy results in an estimated value of about $26 billion, which is quite a bit higher than the original estimate. I am not as comfortable with this valuation on this business which is clearly struggling. But, we can account for this later in a comment about the risks.

The Power business had a decent year, with revenues decreasing 4% to $16.3 billion, but operating income increasing 68% and operating margins of 7.5% improving by 320 bps from 2021. The Services business helped mitigate the declines in revenue. The segment’s improved profit picture was mainly due to favorable pricing, productivity and restructuring savings. The company did note that the Gas Power line had unfavorable equipment mix and like many businesses, inflation continues to be detrimental to financial performance. It should also be noted that the segment did generate $1.9 billion of free cash flow in the year. Finally, total backlog at year end was $74.3 billion, unchanged from the prior year.

| GE Power (billions) | 2019 | 2020 | 2021 | 2022 | 2023 est |

| Sales | $18.6 | $17.6 | $16.9 | $16.3 | $16.6 |

| Sales growth % | -6% | -4% | -4% | 2% | |

| Operating income (loss) | $0.2 | $0.3 | $0.7 | $1.2 | $1.3 |

| Operating margin | 1.6% | 1.6% | 4.3% | 7.5% | 8.0% |

Comparable companies include Siemens Energy and Mitsubishi Heavy Industries. Siemens is the largest of the bunch with a market capitalization of about 14 billion euros, or 0.4x revenues. Revenue growth was decent in fiscal 2022, but operating margins are still negative. Mitsubishi has not yet reported its fiscal 2022 numbers, but currently has a market cap of about $12.8 billion (converted from Yen), or 0.4x revenues.

Based on management’s guidance, I estimate that GE Power can produce slightly positive revenue growth with very modest operating margin improvements this year. As such, the company would have a value of about $6.5 billion, which is consistent with my original valuation. The peers are valued at well less than 1x sales, so this seems reasonable for this slow-growing, yet moderately profitable business.

Combining these parts gives GE Vernova an estimated valuation of approximately $33 billion, with combined revenues of about $30 billion. The estimated market value is higher than my previous analysis, but that is primarily due to a higher peer multiples. The estimated revenues for next year are also somewhat lower, as revenues in the Renewable Energy group are project to be lower than in my original analysis.

As mentioned previously, these businesses have been very volatile in recent years, but do stand at the forefront of the energy craze that seems to be consuming the globe. There could be a very high upside for these businesses, or they could continue to flounder. Perhaps independent management is just what they need to right the ship going forward.

After the energy and power businesses are separated, all that remains is today’s Aviation business, which will be renamed GE Aerospace. This business produces many of the world’s commercial and military flight engines, components, electric power and aircraft systems. With commercial air travel returning to some semblance of normal, the recent weather shutdowns notwithstanding, this business stands to do very well. And on the military side, well, take a look at the global headlines and it appears that the demand for military equipment will continue to be robust in the near future.

GE Aerospace finished 2022 with revenues of $26.1 billion, up 22% from the prior year, mainly due to Commercial Services. Operating income was $4.8 billion, compared to $2.9 billion in 2021 and operating margin increased 480 bps due to growth in services and favorable pricing. The segment reported free cash flow of $4.9 billion during the year. Total backlog at the end of the year was $352.6 billion, which was 16% higher than the previous year.

| GE Aerospace (billions) | 2019 | 2020 | 2021 | 2022 | 2023 est |

| Sales | $32.9 | $22.0 | $21.3 | $26.1 | $30.2 |

| Sales growth % | -33% | -3% | 22% | 16% | |

| Operating income (loss) | $6.8 | $1.2 | $2.9 | $4.8 | $5.3 |

| Operating margin | 20.7% | 5.6% | 13.5% | 18.3% | 17.5% |

The comparable companies in this segment include Raytheon Technologies, Safran Group of France, and Rolls Royce. Raytheon competes with GE via their Pratt & Whitney subsidiary, so it’s not a perfect comparable, but we will use it anyway. Raytheon has a market value of $149 billion on 2023 estimated sales of $72.5 billion and operating income of $5.9 billion. Safran, a French company, has a market cap of approximately 58 billion euros on 2023 estimated sales of 23 billion euros and operating income of 3 billion euros. Finally, Rolls Royce has a market cap of approximately 9.4 billion pounds. 2022 results for Rolls Royce are not yet final, but 2023 estimated sales are 5.3 billion pounds. Based on the sales multiples, GE Aerospace could be worth about $69 billion, while based on the operating income multiples, it could be as high as $119 billion. Averaging the two gets a value somewhere around $94 billion. That is somewhat higher than my previous analysis, largely due to a slight expansion in peer multiples and a higher revenue forecast for 2023.

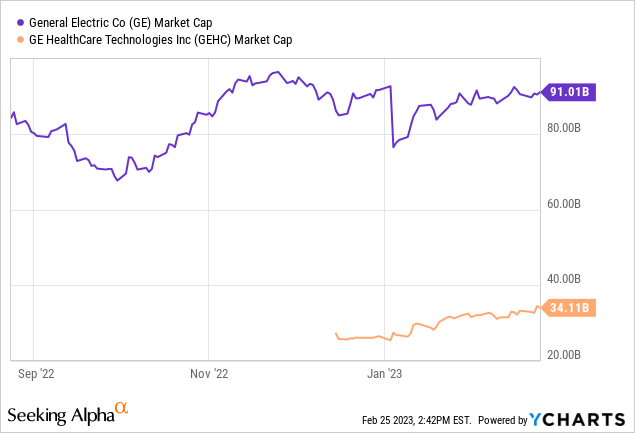

Put it all together, subtract out some net debt, a billion for separation and some incremental costs and the sum of the parts is about $111 billion, compared to the $91 billion of GE today.

| Segment | Est. Value |

| GE Vernova | $33 billion |

| GE Aerospace | $94 billion |

| Less: | |

| Net debt | ($15 billion) |

| Separation costs | ($1 billion) |

| Incremental transactions costs | ($0.3 billion) |

| Total estimated value of parts | $111 billion |

| Current value of GE | $91 billion |

The value proposition is not as compelling today as it was in October when I first published the article. Especially given the higher estimated value for GE Vernova. I think that is a real risk in this analysis. However, by buying GE today, investors are basically only paying for a highly profitable, market-leading Aerospace business, while getting a high-potential energy business and 20% of GE Healthcare for free. That is not a bad deal. Certainly, a lot can happen between now and next year when GE Vernova is spun off. Risks include, but are not limited to, a collapse in stock market valuations, a global recession causing a decline in demand for commercial air travel and a decline in the shares of GEHC, which would negatively impact the shares of GE stock. Remember, GE HealthCare Technologies is a newly traded and independently managed public company. They could have some growing pains as management adjusts to the public markets. Nevertheless, I am going to Hold my GE shares for now, as I think that this presents a good opportunity to gain exposure to several different businesses for what looks to be a decent value. As we get close to the spin-off date, I will do another analysis to see if it continues to make sense for investors to consider GE as it winds down into a single business.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of GE, GEHC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Past performance is no guarantee of future results. Investing comes with risks. This article is neither a solicitation to buy or sell nor should it be considered as investment advice. You should do your own research before making an investment decision. Not all investments are appropriate for every investor. Consult your tax or investment advisor before investing.