Vonovia: Still Bottoming, But May Be Turning Around - I'm Buying More

Summary

- Vonovia had a spectacular crash in terms of valuation in the past couple of months, which saw its yield peak close to 7%. Investors were predictably questioning the thesis.

- Like with most European real estate companies I'm invested in, I stayed the course.

- I update my thesis on Vonovia for 2023 - and I consider it perhaps one of the best potential real estate investments in Europe for the year at this price.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

taranchic/iStock Editorial via Getty Images

Author's Note: This article was published on iREIT on Alpha in late January/Early February

Dear subscribers,

It's time once again to update my thesis for German Real Estate giant Vonovia (OTCPK:VONOY). Vonovia saw a spectacular valuation crash, about the same time that most of the market in Europe bottomed, but has seen a significant short-term reversal in the past few weeks.

This begs the question if the drop might have been completed at this time. I'll take a look at this and give you my opinion on the subject.

Vonovia - updating on one of Europe's largest real estate companies

While the bearish thesis on Vonovia has never been hard to understand, the degree of undervaluation and "dislike", for lack of a better word, that the market has applied has been surprising to me (and other) analysts. Like office REITS, the way the market has punished Vonovia would suggest that the company is suffering from material deterioration in some fundamental aspect - such as credit, vacancy, dividend safety, or the like.

And indeed, while there is some expected reductions in earnings and OCF (or equivalent) coming in 2023 and 2024, the company's dividend is expected and communicated to remain stable as the company moves through the current macro.

The current price for Vonovia is one we have not seen since 2016. Granted, during the low-interest mania we saw in Europe for the past 10 years, the market assigned a massive premium to anything that offered even close to acceptable, annual returns, typically with a decent yield. The apartment/real estate sector was one of the few places where this was still possible.

We saw the same mania in Northern Europe - that's why I sold out of 95% of my Castellum (OTCPK:CWQXF) position when it peaked at over 250 SEK at over 150% profit, only to "BUY" it back at about 158 SEK, only to once again rotate most of it prior to the worst of the dividend decline back in late 2021.

Valuation matters. And this is also why Vonovia is so interesting here (and why Castellum is today, but that's a different topic).

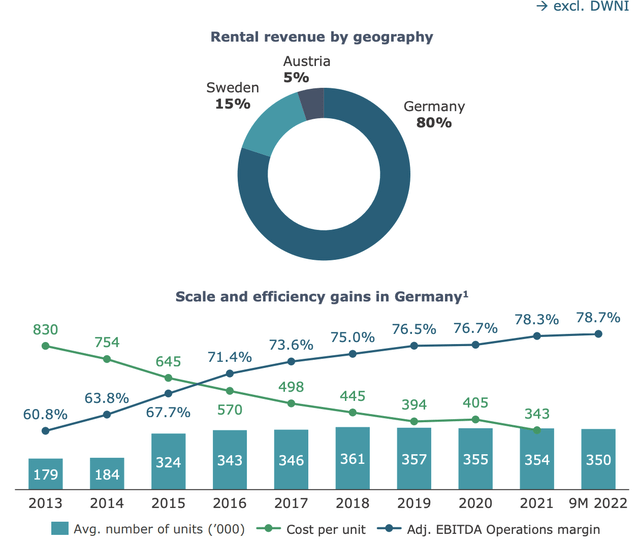

Vonovia has one of the largest real estate holdings in all of Europe. It represents an oligopoly for the Berlin housing market. It's a BBB+ rated dividend stalwart with a good payout tradition, and it's extremely well-capitalized, with a superb asset portfolio stretching not only across Germany but including Sweden and other nations as well.

Vonovia IR (Vonovia IR)

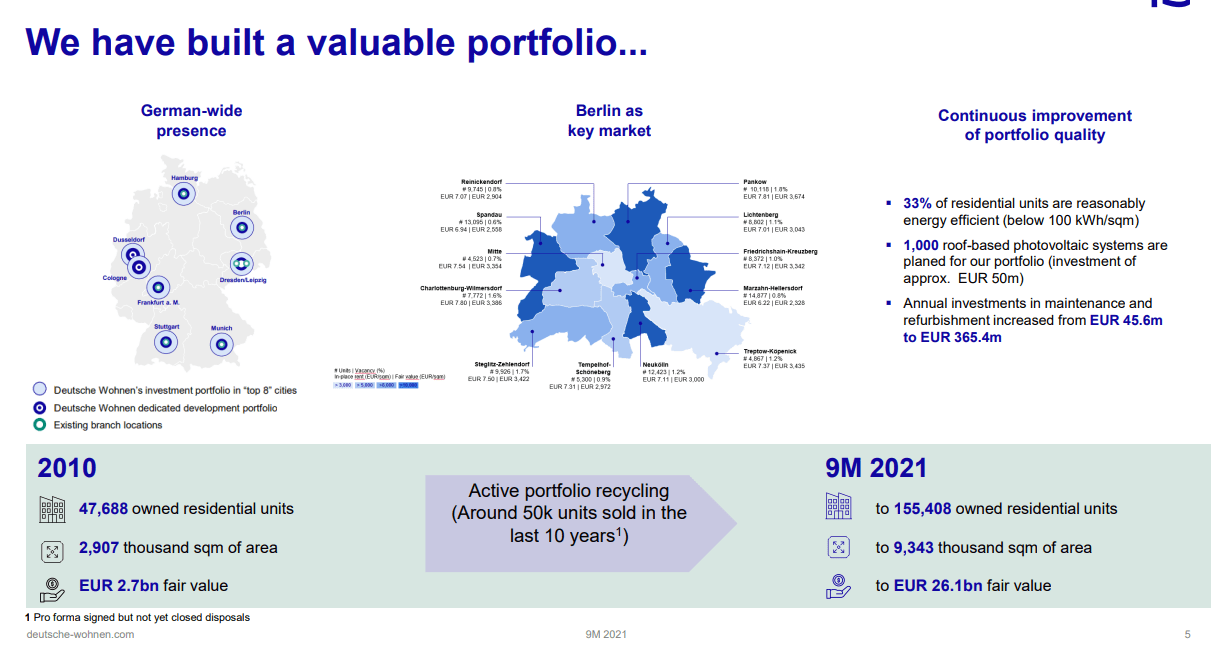

The company's mergers and company play over the past few years culminated in a much-discussed deal with Deutsche Wohnen, which has left Vonovia somewhat overextended going into an interest rate crunch, which increases costs of capital, cost of debt, and the profit the company may be able to squeeze.

Still, Vonovia remains one of the best-capitalized Real estate companies in the entire German market - and the latest results, which came in 9M22 in November, do not show any fundamental deterioration of KPIs in a way that would justify the recent development.

How so?

- Continued organic rent growth above 2%

- Record-low vacancy rates of 2.1%, meaning 97.9% company-wide occupancy. Try beating that as an apartment REIT.

- Peak rent collection.

- 4.2% increase in YoY Group FFO

Challenges come in the following shape/s.

- Continued inflation

- Energy prices

- Wage inflation

In addition to the above positives and challenges, the Deutsche Wohnen integration is working well, expected to live in very early 2023. The company expects no large value loss and remains at a positive 2023E guidance despite the challenges.

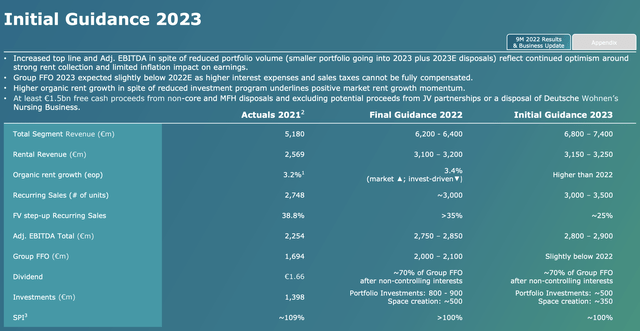

Currently, the company expects a 2023E FCF of €2.8B, and this is before the proceeds of JV's and the Deutsche Wohnen nursing business, which the company has planned to rotate.

I want to repeat this because it really bears mentioning. The KPIs and results show no indications of weakness across the core company sectors. In fact, they remain fully intact with expectations.

Rent growth is stable, if not at inflation levels. The company has managed to keep maintenance expenses in line, despite cost increases, and the demand for company units remains at peak interest.

Remember, unlike the US, living space is not easy to find, almost anywhere in Europe. Sweden is the same way. That is why I'm very "chill" about the markets in these countries because it really doesn't matter where prices go - up or down - there will always be people who require and are willing to pay a premium during an upmarket, or invest in a down market because we've seen decades of underbuilding.

In the Gothenburg Area in Sweden alone, we need 500,000 new apartments/living spaces by 2028. How many are being built? 50,000.

Most of Northern Europe is the same way, and for a very simple reason. Building profitably with today's codes and legal framework is only possible if you overcharge rent, build expensive condos, or build at a loss.

This makes any existing assets, even those that are somewhat ramshackle, very valuable, because depending on the cap rates, you don't need to overcharge, or you can retrofit at attractive rates/prices.

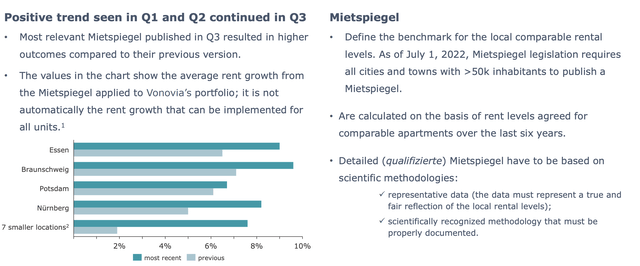

You need to understand the challenges of European real estate or lack of it if you look at Vonovia. Once you do, the occupancy makes sense. The main challenge and bearish argument against Vonovia have been the political realities of the Mietspiegel rent increases, and what will happen there.

However, recent results in this area remain positive as well.

Most of the arguments I have over Vonovia with bearish investors and analysts simply show a lack of understanding of the realities of this market. Granted, we've seen valuation pushed down - but the mere fact that some are seriously arguing that Vonovia could "go under", shows a remarkable lack of comprehension of fundamentals.

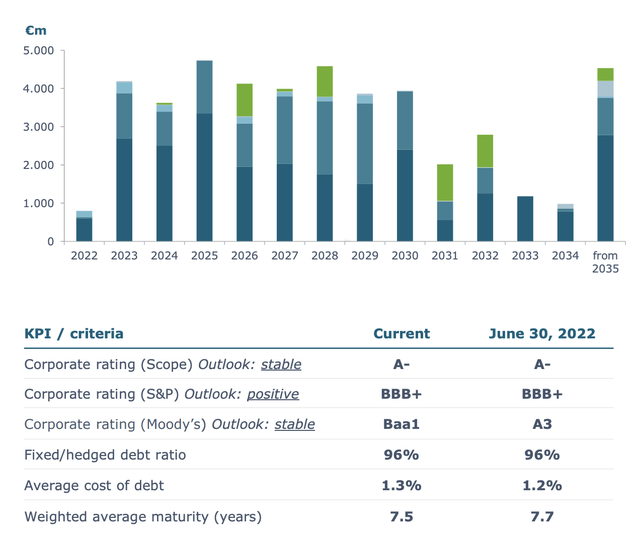

The company has no more than 11% of its debt maturing annually, and all of its financing needs are pretty much covered. The company has stellar credit ratings from all of the company's agencies and has an average cost of debt of 1.3%.

1.3% - with corporate ratings ranging from A- to BBB+/Baa1.

Granted, if you look at the core definitions of net debt/EBITDA - that's currently elevated. But LTV is still no higher than 43.3%, which makes it very low in a European context, and those valuations have recently been updated, with an adjusted fair value of around €100B.

The company is slowing down investments going into 2023 and this new interest rate environment. We also have full initial guidance for the next fiscal.

None of those targets are especially "flighty", as I see it. The expected €1.66 dividend means that we're looking at a conservative yield of 6.1% here, which is well above where this company trades historically.

Let's move onto the crux of the matter - Valuation

Vonovia's Valuation

In my last article, I made clear what I called the "mathematics of tears" - tears, in this case, being specific to the market valuing Vonovia at under €26/share. We use NAV comparisons, yield comparisons, public comps, growth estimates, book valuations, and earnings/cash flow multiples. Remember, this is not a REIT, so REIT-specific valuation metrics don't really apply well here. We're no longer at under €26 either, which means at least part of my position is in the green, even if it's not yet much.

For peers, Vonovia currently offers a higher dividend yield than the peer group, and most of its peers follow the decline. At today's price, the company's 2022E dividend implies a yield of over 6.1%. This puts it well above Deutsche Wohnen's legacy yield of 3.26%, in the range of Covivio, and above the legacy yield of Icade which pays over 6% (but is also far less safe).

The fundamentals remain the primary arguments for investing in Vonovia. No peer has the size, vertical integration, or position that Vonovia has. It trades at a P/E of below 10x for the native to a normalized GAP EPS. I would continue to apply a premium to Vonovia, but I'm lowering it to 5% here to reflect the higher interest rates and increased cost of capital.

A standard assumption is that Vonovia is a "bond proxy". This is not really the case. Given its delivery of an asset and earnings yield, the spread between actual bonds and Vonovia's earnings are as high as 7-8% historically. The view of the company as a sort of bond alternative is also completely wrong, when you consider that the company had a very positive yield, during a time when Europe was negative.

Vonovia offers access to one of the most conservative, regulated residential markets on the planet, and I'm not exaggerating when I say that this is probably one of the best management teams in this space in all of Europe. Remember the guidance they gave half a year ago - that guidance is, even with everything, intact today. And the company's guidance for 2023E is intact as it stands now - given the Mietspiegel developments, I don't see reasons for why the company shouldn't see much of its targets materialize as expected - at least for the longer term.

This strength is the backdrop for my applying a premium to the company's valuation, allowing for a combined PT of 1.1x (no longer 1.2x) to a conservatively-calculated NAV and a decent P/E premium. On an average weighted basis, my PT for Vonovia comes to €48/share - and I'm not shifting this a cent for this article.

I've made it very clear that I do not shift my targets due to market temperament, and while I do lower it some to account for aforementioned capital cost increases, I'm unwilling to go much lower than this - because we're already at incredibly cheap levels for what is a superb business.

S&P Global comes to the price range of €30 on the low side and €70 on the high side, including the consolidation with Deutsche Wohnen. Out of 17 analysts, 12 have either a "BUY" or "Outperformance" rating on the company at a price of €37/share.

Due to the fundamental quality of this business, and the continued undervaluation, even if we're up slightly since m last piece, I continue to view Vonovia as a very interesting investment here. If it does go above €60/share or so, I obviously wouldn't be buying more, but at these multiples and a market capitalization that is essentially a fifth of their fair asset value, I'm more than happy to invest in what I view as a massive valuation discount.

Traditional US REITs have a definite advantage over Vonovia when comparing them as investments. However, if you fully include Deutsche Wohnen's portfolio in the company, then the company's current NAV comes to 0.4X. There's a massive discount on Vonovia 2023E here, and given that I know exactly what sort of properties we're talking about, I know I want to own them cheap.

I have been building my position in Vonovia for several months, and while FX has prevented me from going all in, I'm now up over 2% of the company in my portfolio, with higher allocation targets in mind.

Thesis

My view on Vonovia is as follows:

- The largest, most significant real estate company in all of Europe is at a great discount looking at every single perspective you could possibly consider.

- Based on its fundamentals and valuation, I view Vonovia as one of the most real estate companies in all of Europe. Coupled with its credit rating of BBB+, this makes it a "BUY" to me.

- My target PT remains €48/share, and I believe this is one of the more interesting real estate plays in Europe in 2023.

Questions? Let me know!

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Disclosure: I/we have a beneficial long position in the shares of VONOY, CWQXF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks i write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.