CGW: Smidcaps Driving Strong Start To Year, But Not Enough To Upgrade

Summary

- CGW tracks an index of global water utilities, infrastructure, and water equipment companies.

- This ETF is off to a strong start in 2023, thanks to contributions from small/mid-cap holdings, and some positive impact from a lower US Dollar.

- We maintain our Sell rating, as CGW is a good long-term idea but is currently at a very elevated price.

vitapix

By Rob Isbitts

Note: The first time we write about an ETF, we issue an ETF profile report. Use this link to see that profile, as it will provide helpful background for this ETF update report.

Review of Key Factors

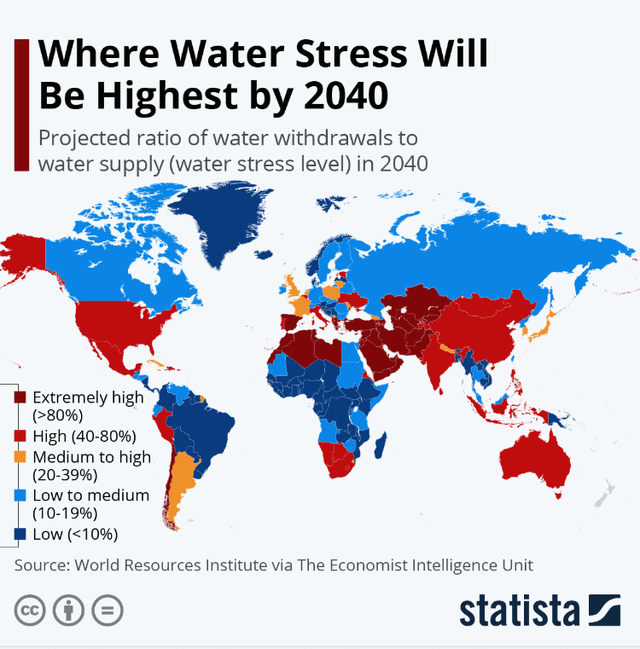

Invesco S&P Global Water Index ETF (NYSEARCA:CGW) includes a diversified group of water utilities, infrastructure and water equipment companies. There has certainly been no change in the secular issues regarding the shortage of potable water, and risk of famine. It is still uncomfortably high in many parts of the world.

Recent Highlights

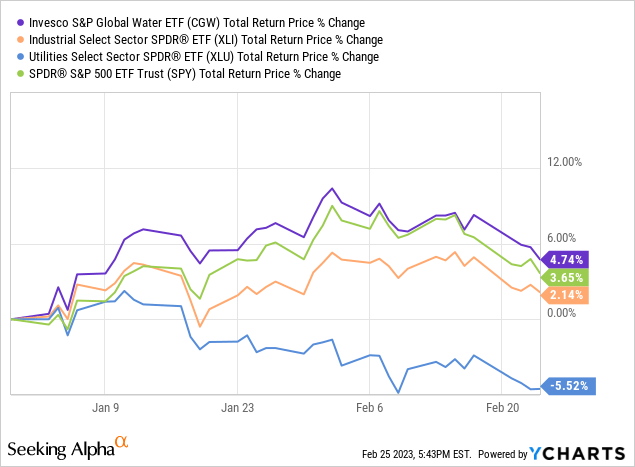

Yet as this chart shows, CGW is off to a flying start this year, especially when comparing it to the Utilities sector of the S&P 500. CGW has a nearly 40% allocation to Utilities, and most of the rest of this ETF is invested in industrial stocks. Yet both of those sectors are lagging the S&P 500, and CGW has outperformed all of the above market segments. What's that all about, and what does it mean for the rest of 2023 and beyond?

In investing, the simple answer is often the most straightforward. CGW's recent performance spurt is the so-called small cap and mid cap effect in play to start the year. The broad market has done pretty well until very recently, but smaller company stocks have been leaders. In fact CGW's performance recently tracks the S&P Midcap Index quite closely.

This is a great reminder to ETF investors that more concentrated funds are worth a strong look. Their limited number of holdings allows for an easier look-through, in the same way that an investor might analyze the individual stock holdings in a portfolio. In the case of CGW, its largest components have generally not performed well as of late. But in an ETF with 53 holdings, but where the top 25 account for 86% of assets, it only takes a small batch of those higher-weighted stocks to carry the ETF at times. Several of CGW's holdings with market caps of under $10B have produced returns of over 20% this year. And, this ETF's global nature has added return from its European stocks, as that market segment has rallied on a sharp drop (over 10% from its 2022 peak) in the US Dollar Index.

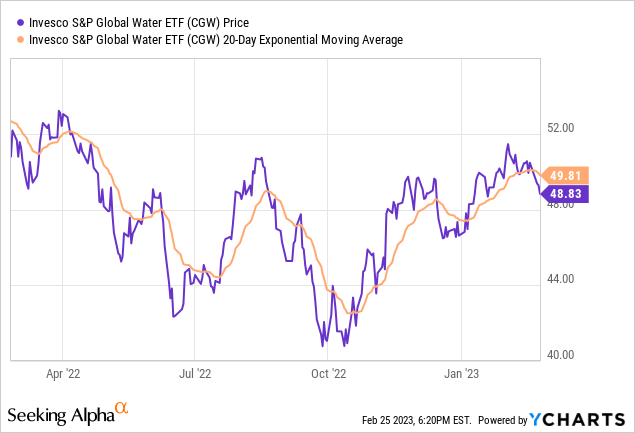

This is all to say that CGW's short-term performance is certainly helpful, but it does not erase some of the more sustainable issues it faces for the rest of 2023 and into next year. The broader market is weak and getting weaker, and my analysis of CGW's price pattern indicates that it has been infected with the same illness that has recently befallen the broader stock market. Namely, that it has repeatedly failed to break into new high ground, with the $50 area proving to be strong resistance. This type of "fake out-breakout" as I call it is symptomatic of an environment that still suffers from over-exuberance on every bear market rally. This is one critical element for our case that CGW is still a sell.

Technical Ratings

- Short-Term Rating (next 3 months): D

Long-Term Rating (next 12 months): D

(guide - A=Strong Buy, B=Buy, C=Hold, D=Sell, F=Strong Sell)

Current Bull Case

But despite the current macro-market malaise, this problem is not going away. As the graphic below shows, water shortages and availability of clean, drinkable water ("potable water") are an ever-growing global concern. As I see it, this makes CGW a must-follow for my portfolio strategies. However, that doesn't mean it is a timely holding.

Water stress (Statista.com)

Current Bear Case

The aforementioned technical analysis-related factors are just one part of my bear case. CGW's current portfolio sells at more than 24x trailing earnings, and at more than 3x book value. That paints a picture of a group of companies that are overvalued, for now. And, while some investors may look at the presence of utilities, a regulated and typically high-yield stock sector, that is not the case with CGW. It only yields about 1%. So, the bull case here is likely to be made only at a significantly lower price point than where it trades today.

Current Investment Opinion

There's a lot to like here from a mission standpoint, and the role that these businesses should ultimately play in solving a major long-term issue for the planet. But investing is a combination of finding good investments, owning them when they are priced well, and selling them when they no longer are. Thus, we are leaving our Sell rating for CGW intact for now.

* These ETF Grades and Ratings are a proprietary ETF evaluation system developed by Rob Isbitts and his team at Sungarden Investment Publishing, who publishes on Seeking Alpha under the brand name, "Modern Income Investor." You can read more about Mr. Isbitts' professional background in his Seeking Alpha profile page, and on the profile page for Modern Income Investor.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.