Just Turned 40? Aim For A $2 Million Portfolio For Retirement

Summary

- Saving early and regularly, investing wisely, and budgeting your expenses (keeping them less than your income) are some of the essential elements of successful retirement planning.

- Start saving early in life and investing for the long term are two goals everyone needs to establish - the earlier, the better.

- But if you just turned 40, you should make retirement savings goal as your No. 1 financial priority.

- We discuss how a couple at age 40 with minimal savings can still aim and achieve a comfortable retirement with retirement assets nearing $2 million.

- Looking for a portfolio of ideas like this one? Members of High Income DIY Portfolios get exclusive access to our subscriber-only portfolios. Learn More »

olm26250

Retirement planning is not as complicated as it is sometimes made out to be. But it does require having a well-thought-out plan, strong will and determination, some level of consistent effort, and due diligence. Retirement planning really comes to two important factors - savings on a regular basis and investing those savings wisely and relatively safely. The third factor is the amount of time we may have for those savings to compound and grow. This article focuses on folks who are in their early 40s, so we assume they have roughly 20-25 years, which is an ample amount of time.

It makes retirement planning so much easier if you start early. However, unfortunately, that wisdom is hard to come by when you are young. However, when you turn 40, it should not be delayed any further. The more you delay, the path will be harder and tougher.

For the purpose of this article, we will assume a hypothetical couple - John and Lisa, both recently turned 40. Let's also assume they wish to retire by the time they are 60 or 62. As of now, they have saved about $100,000 in retirement savings. The current savings are not a lot but still OK, considering they still have 20 years of saving and investing ahead of them. However, their target at retirement is much higher at $2 million. So, they have no time to waste and need to get on the task immediately. They need to recognize that for their long-term financial security, retirement savings will be the number one priority. At the same time, being over 40 brings its advantages as well. Most folks are much more mature, usually at the peak of their career and earnings, and have the ability to save and invest. More than likely, by this time, they have had some exposure to investing and already have made their share of mistakes and have learned from them.

What's the good age to retire?

Currently, a majority of folks retire sometime between 60 and 65. Currently, Medicare eligibility starts at 65, so it becomes a big incentive to keep working until the age of 65 to be able to get employer-sponsored medical insurance benefits. However, things can change in the next 20-25 years, and it's difficult to predict in what shape or form it will take. So, it may be best to plan with the current system. At the same time, there are folks who genuinely want to work beyond 65 for various reasons, which certainly can help with accumulating more retirement savings.

Another important pillar of retirement support are Social Security benefits. However, for a 40-year-old, there are many open questions about the viability of Social Security in the next 20 years. As we all know, the Social Security Trust is going to be underfunded in the next few years, and unless Congress makes certain reforms to the program, it will not be in a position to pay 100% of the benefits. The future is unknown, and we cannot predict future outcomes, especially for a hot-button political issue like Social security. That said, it may be reasonable to assume that today's 40-year-olds will at least get 50% benefits (from the current levels) when they get to retire. If they get more, all the better.

As life expectancy is generally increasing, and we need to support many more years of retirement, most folks want to and plan to work longer. However, for the sake of planning, it's better to plan for a bit of early retirement as there could be unforeseen circumstances in the future that could impact your decisions.

How much is good enough to retire?

So, back in the early 2000s, $1 million was considered the gold standard to retire comfortably. However, since then, inflation has done its trick, and the same $1 million would not go that far. But, if we assume that in the year 2000, $800,000 was a reasonable amount to fund 30 years of retirement, it would be equivalent to roughly $1.40 million in 2023 due to inflation. So, in the next 20 years, the same amount would roughly be equal to $2.2 million (in the year 2043), assuming a similar level of inflation as in the last 20 years. So, for a 40-year-old couple, it's best to target at least $2.0 million or more. That said, as we stated earlier, one size does not fit all, and these goals can vary widely based on many personal factors.

Importance of saving and investing:

We believe the two most important factors that determine how wealthy you are going to be later in life are:

- How much you can save regularly and the time you have to compound your investments.

- The rate of return on your investments, especially over and above the rate of inflation.

The first factor is obvious to most. You should be willing to start saving today for the sake of a better future tomorrow and always pay yourself first. However, the second factor is equally important as to how you invest your savings.

Sure, we strongly encourage everyone should keep an emergency cash reserve of roughly six months' worth of living expenses. But, over and above that, almost everything should be mostly invested.

You just turned 40 and have saved $100,000

Let's assume that you, as a couple, have saved $100,000 by the age of 40. It's a good start but certainly not enough if your target is to save $2 million by age 62. The good thing is that you still have a lot of time on your side and plenty of potential future earnings. However, any delay now will make your choices more and more difficult.

Retirement Planning for our hypothetical couple: John and Lisa

We will use our hypothetical couple - John and Lisa - to help with the illustration.

We assume both John and Lisa recently turned 40. They both work full time, and their combined annual salary is $140,000, which falls squarely in the middle-income group. So far, they have about $100,000 in their retirement accounts. We also assume that John and Lisa would want to retire by the age of 62. Sure, they could work longer, but that would depend on many situational factors. By no means is it an easy task, and some adjustments in their budget and possibly some lifestyle changes may be required.

John and Lisa take the following decisions, in the order of priority:

- Going forward, they would save roughly 16% of each of their salaries toward their 401K savings accounts. Since these savings will be tax-deferred, it would reduce their current tax liabilities. Further, we will assume that they were previously saving only 6% of their income. We will also assume that their employers provide an 80% match on the first 6% of the employee's contributions.

- The second big decision they take is to contribute $8,000 ($4,000 each) toward their IRAs (Individual Retirement Accounts). Based on their combined annual income of $140,000, they would qualify for tax-deductible IRAs. This also will help bring down their current taxes even more.

- They also will open a college education fund for their kids and deposit $6,000 in a 529-like plan every year. However, 529 contributions are after tax, but the qualified tuition withdrawals, including the growth, are generally tax free.

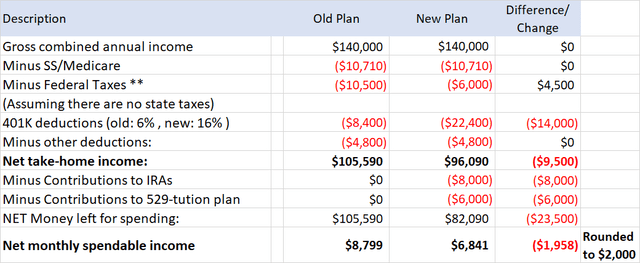

We have calculated that with the above plan, and after accounting for the tax savings (due to pre-tax contributions), their take-home spendable monthly income will reduce by roughly $2,000 (see table-1). However, the impressive thing is that they will be putting roughly $3,600 per month (or nearly $42,000 per year) into savings and investments by way of various means like 401Ks, IRAs, and 529s.

The table below presents the current take-home income for the couple, with the new plan vis-à-vis the previous situation:

Table-1:

**This is a generalized rough estimate only, and every individual should look at their personal situation to re-estimate or adjust accordingly.

Where to find an extra $2,000 a month?

John and Lisa will need to cut their monthly budget by roughly $2,000. Obviously, there would be several ways to find those extra $2,000. Though it may seem difficult to achieve at first glance, it's still very doable. Sure, they may have to make some lifestyle changes.

One possible way to find the saving of $2,000 per month is listed in the table below. However, this is very personal to each individual and can vary greatly.

Growth of Portfolio from 40 to 62 years

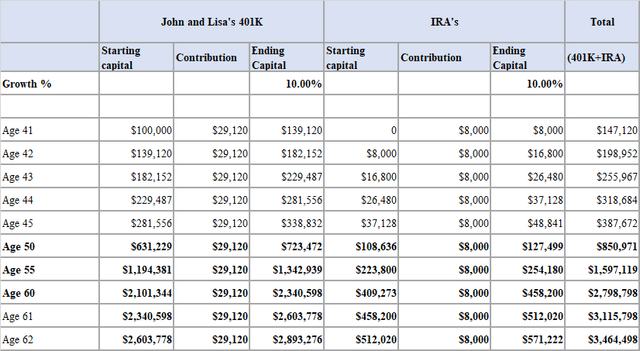

We will present two tables, the first with an assumed rate of return as 10% (annualized) and the second one with only a 7% return.

Table-2:

You can see that they far exceed their savings target if they could get a 10% average annualized rate of return. To achieve a 10% rate of growth, they not only need to be consistent and methodical in their investment approach but also will need some luck. However, now let's see a scenario where they only manage to get an average annualized return of 7%. We can all probably agree that 7% is highly achievable even in some adverse market conditions.

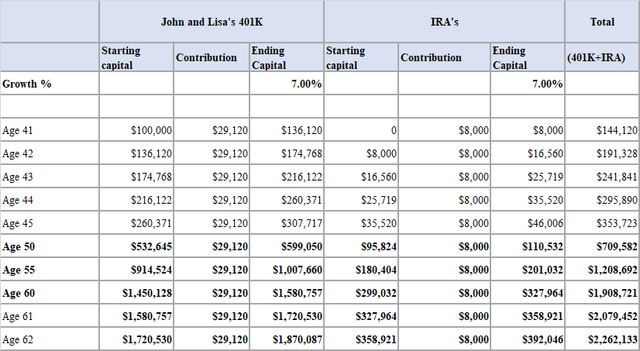

Table-3: Assumed annual growth being 7%

Even with a 7% average return, they will still be able to reach their target of $2 million plus.

Part II: Retirement Planning - How to aim for 10% long-term growth?

To be able to achieve a decent return of 10% and to avoid the ups and downs of the market, John and Lisa decide to implement a multi-basket strategy:

John and Lisa's 401K:

For the purpose of this discussion, we will assume their 401K accounts as one account. In reality, they would be separate accounts, possibly with a different set of 401-K sponsors. We recommend a two-basket strategy.

In most cases, 401-K accounts do not permit buying or trading individual securities but only allow certain mutual funds and ETFs (exchange-traded funds). John and Lisa decided to divide their 401-K investments into two buckets, roughly 50:50, and invest in two strategies, as presented below.

Note: Some brokerage houses (managing 401K accounts) do allow a certain percentage of the account to be traded in individual stocks/securities.

401-K: Strategy-1

For half of the funds in their 401-K, they would deploy the following strategy. This strategy is widely followed in 401K-type accounts where there are only limited funds or ETFs available. The strategy has the potential to return at least 7%-10% returns on a long-term basis.

- 25% in the S&P 500 equivalent fund

- 25% in the Total Stock Market fund

- 15% in high-growth Technology funds

- 15% in the Developed International fund

- 10% in Emerging Markets fund

- 10% in Bonds and Treasury funds

Most 401K accounts provide funds that are equivalent or similar to the funds mentioned above. They should be aware of the fee structure and try to select the lowest-cost funds, as these are mostly passive funds based on an index. Once they have made the selections, there's really nothing more to do (except some periodic rebalancing) as these investments will be made on auto-pilot after each paycheck. More than likely, their long-term returns will be in line with the broader market.

401K: Strategy-2

We recommend deploying the second half of 401-K money in a risk-adjusted strategy. A rotation strategy will help in hedging against large corrections or deep recessions. However, this strategy also will provide market-comparable returns when the times are good. We can hope to get at least a 10% return (if not more) from this strategy, in fact, much higher if the past backtesting is any indicator. A second added advantage would be that it would reduce or eliminate the risk of sequential returns as they approach retirement age.

Risk-hedged rotation strategy for low drawdowns:

Since this strategy is being implemented inside 401-K accounts, we want to keep this simplified. The 401-K accounts usually offer a limited number of funds that one can choose from.

The strategy will be invested in one of the following five securities (or equivalent funds):

- Vanguard 500 Index Fund Investor (VFINX)

- Vanguard Total International Stock Index Fund Inv (VGTSX)

- Vanguard Long-Term Treasury Fund (VUSTX)

- Vanguard Short-Term Treasury ETF (VGSH) or iShares 1-3 Year (Short-term) Treasury Bond ETF (SHY)

- Invesco QQQ ETF (QQQ) ***

***We included QQQ ETF to provide faster growth while still providing hedging as and when needed. This is suggested for investors in the age group of 40-55. As they get closer to retirement, they can remove QQQ from this strategy. Also, there are only a few funds that are similar to QQQ, but they hold many more positions than the top 100 stocks of the NASDAQ index. Some of them are VGT (Vanguard Information Technology ETF), ONEQ (Fidelity Nasdaq Composite Index ETF), and FNCMX (Fidelity NASDAQ Composite Index Fund).

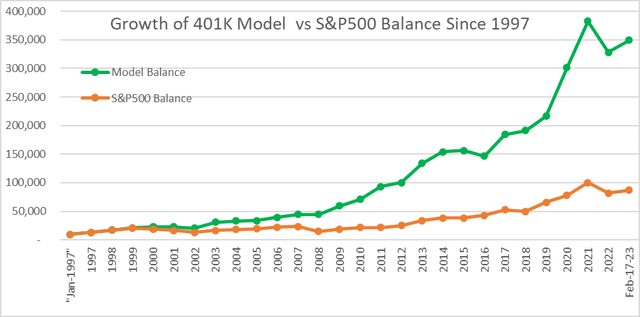

Here, it's important to note the two hedging assets, VUSTX and VGSH. The hedging assets come into play when other main assets are not performing well. The model strategy returned 14.57% on an annualized basis since Jan. 1997, whereas the S&P 500 returned 8.63%.

A note of caution, though, backtesting results should not be treated as a guarantee of similar results in the future, as the future could bring new factors into play.

Note: In our backtesting testing model, we used the ETF SHY instead of VGSH. Also, prior to Jan. 2003, SHY and QQQ were not considered in the model since we did not have data prior to 2002.

Equivalent or similar ETFs that can be used for the above mutual funds:

Table-4:

Vanguard or Fidelity Fund Name | Equivalent or Similar ETF Name |

(VFINX) | (SPY) |

(VGTSX) | |

(VUSTX) | (TLT) |

(VGSH) | (SHY) |

(FNCMX) |

Rotation methodology: The frequency of rotation will be on a monthly basis. The strategy involves checking and comparing the total performance (including distributions or dividends) over the previous three months and selecting the best-performing asset.

The process will be repeated every month. We present below the results from backtesting since 1997 and also compare the results with the S&P500. The model portfolio accumulated more than three times that of the S&P500, mainly because of smaller drawdowns and lower volatility during tougher times.

Chart-1:

Strategy-3: IRAs

Assuming John and Lisa will be saving $8,000 in their IRAs every year, this will provide them with tax deductions at the assumed income level.

DGI Portfolio:

For the IRAs, we recommend building a DGI (dividend growth investing) portfolio. We recommend at least 15-20 blue-chip stocks that you can hold for many years. We recommend reviewing the selection of stocks at least on an annual basis.

For the DGI portfolio, we need to be careful in selecting stocks of companies that have a wide moat, large market capitalization, and stable revenue streams and have paid and raised their dividends for many years. Since our investors are relatively in the younger age group and they need growth of their capital at this stage, so roughly 30% of our selections are high-growth but relatively safe and well-established companies (including one non-dividend paying stock). At the same time, 70% of the selections are stocks that are somewhat resistant to recessions and corrections.

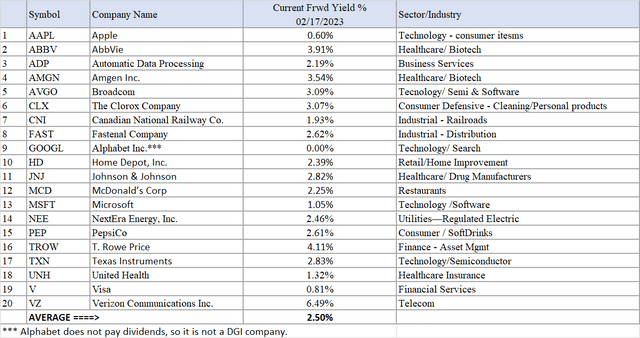

Stocks selected:

Apple (AAPL), AbbVie (ABBV), Automatic Data (ADP), Amgen (AMGN), Broadcom (AVGO), Clorox (CLX), Canadian National Railway (CNI), Fastenal (FAST), Alphabet (GOOGL), Home Depot (HD), Johnson & Johnson (JNJ), McDonald's (MCD), Microsoft (MSFT), NextEra Energy (NEE), PepsiCo (PEP), T. Rowe Price (TROW), Texas Instruments (TXN), UnitedHealth (UNH), Visa (V), and Verizon (VZ).

Table-5:

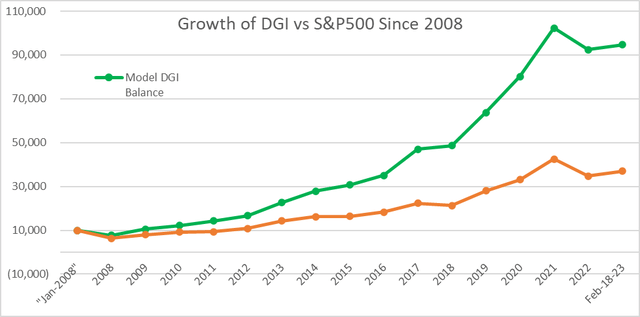

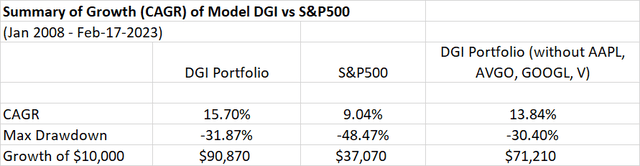

Chart-2: Growth of DGI portfolio

Table-6:

The above table shows the comparison with the 20-stock DGI portfolio. The third column shows the comparison if we are to exclude the four high-growth stocks (Apple, Alphabet, Broadcom, and Visa).

Summary of investments:

Table-7:

Type of funds | Strategy | Type of Strategy |

50% of 401K accounts | Strategy-1 | Mutual funds or ETFs from the available pool with the 401-K sponsor/broker |

50% of 401K accounts | Strategy-2 | Rotation strategy suited for 401-K using funds |

IRA funds | Strategy-3 | DGI portfolio |

Conclusion

This article is focused on folks who are relatively younger (nearing or about 40). They may or may not have saved enough yet, but they still have plenty of time to save and compound their investments for a comfortable retirement. As we like to say frequently, there are three important factors, the rate of savings, time to compound, and the investment returns. The first two are fully in your control. However, the third factor can also be greatly impacted by your decisions.

In the above hypothetical model, as we demonstrated that with an average 10% return, John and Lisa would exceed their target of $2 million by about 50%. This is entirely possible as this also happens to be the long-term stock market returns. But as we said before, there are some extraneous elements that could impact these expectations. However, as we demonstrated in the article, they just need 7% average returns to reach their goal of $2 million. Now, most people would agree this is highly achievable as long as they're doing their homework and avoiding big mistakes.

High Income DIY Portfolios: The primary goal of our "High Income DIY Portfolios" Marketplace service is high income with low risk and preservation of capital. It provides DIY investors with vital information and portfolio/asset allocation strategies to help create stable, long-term passive income with sustainable yields. We believe it's appropriate for income-seeking investors including retirees or near-retirees. We provide ten portfolios: 3 buy-and-hold and 7 Rotational portfolios. This includes two High-Income portfolios, a DGI portfolio, a conservative strategy for 401K accounts, and a few High-Growth portfolios. For more details or a two-week free trial, please click here.

This article was written by

I am an individual investor, an SA Author/Contributor, and manage the “High Income DIY (HIDIY)” SA-Marketplace service. However, I am not a Financial Advisor. I have been investing for the last 25 years and consider myself an experienced investor. I share my experiences on SA by way of writing three or four articles a month as well as my portfolio strategies. You could also visit my website “FinanciallyFreeInvestor.com” for additional information.

I focus on investing in dividend-growing stocks with a long-term horizon. In addition to a DGI portfolio, I manage and invest in a few high-income portfolios as well as some Risk-adjusted Rotation Strategies. I believe "Passive Income" is what makes you 'Financially Free.' My personal goal is to generate at least 60-65% of my retirement income from dividends and the rest from other sources like real estate etc.

My current "long-term" long positions (DGI-dividend-paying) include ABT, ABBV, CI, JNJ, PFE, NVS, NVO, AZN, UNH, CL, CLX, UL, NSRGY, PG, KHC, TSN, ADM, MO, PM, BUD, KO, PEP, EXC, D, DEA, DEO, ENB, MCD, BAC, PRU, UPS, WMT, WBA, CVS, LOW, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, VOD, CVX, XOM, VLO, ABB, ITW, MMM, LMT, LYB, RIO, O, NNN, WPC, TLT.

My High-Income CEF/BDC/REIT positions include:

ARCC, ARDC, GBDC, NRZ, AWF, CHI, DNP, EVT, FFC, GOF, HQH, HTA, IIF, IFN, HYB, JPC, JPS, JRI, LGI, KYN, MAIN, NBB, NLY, OHI, PDI, PCM, PTY, RFI, RNP, RQI, STAG, STK, USA, UTF, UTG, BST, CET, VTR.

In addition to my long-term positions, I use several "Rotational" risk-adjusted portfolios, where positions are traded/rotated on a monthly basis. Besides, at times, I use "Options" to generate income. I am also invested in a small growth-oriented Fin/Tech portfolio (NFLX, PYPL, GOOGL, AAPL, JPM, AMGN, BMY, MSFT, TSLA, MA, V, FB, AMZN, BABA, SQ, ARKK). From time to time, I may also own other stocks for trading purposes, which I do not consider long-term (currently own AVB, MAA, BX, BXMT, CPT, MPW, DAL, DWX, FAGIX, SBUX, RWX, ALC). I may use some experimental portfolios or mimic some portfolios (10-Bagger and Deep Value) from my HIDIY Marketplace service, which are not part of my long-term holdings. Thank you for reading.

Disclosure: I/we have a beneficial long position in the shares of ABT, ABBV, CI, JNJ, PFE, NVS, NVO, AZN, UNH, CL, CLX, UL, NSRGY, PG, TSN, ADM, MO, PM, KO, PEP, EXC, D, DEA, DEO, ENB, MCD, BAC, PRU, UPS, WMT, WBA, CVS, LOW, AAPL, IBM, CSCO, MSFT, INTC, T, VZ, CVX, XOM, VLO, ABB, ITW, MMM, LMT, LYB, RIO, O, NNN, WPC, ARCC, ARDC, AWF, CHI, DNP, EVT, FFC, GOF, HQH, HTA, IFN, HYB, JPC, JPS, JRI, LGI, KYN, MAIN, NBB, MCI, NLY, OHI, PDI, PCM, PTY, RFI, RNP, RQI, STAG, STK, USA, UTF, TLT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: The information presented in this article is for informational purposes only and in no way should be construed as financial advice or recommendation to buy or sell any stock. The author is not a financial advisor. Please always do further research and do your own due diligence before making any investments. Every effort has been made to present the data/information accurately; however, the author does not claim 100% accuracy. The stock portfolios presented here are model portfolios for demonstration purposes. For the complete list of our LONG positions, please see our profile on Seeking Alpha.