Your Retirement At Risk: Wake Up To Reality!

Summary

- Life has a way of coming and hitting you when you're down.

- The entrance to retirement is going to feel abusive to countless retirees who are unaware and unprepared.

- We look at how to avoid this crisis in the wings.

- Looking for a portfolio of ideas like this one? Members of High Dividend Opportunities get exclusive access to our subscriber-only portfolios. Learn More »

StockPlanets/E+ via Getty Images

Co-produced with Treading Softly.

Life has a way of coming at you and not giving you the time to be prepared.

Perhaps you've had a moment in your life like this? You're living life, everything seems great, but then the phone rings. You answer it and find out that your mother or father has been diagnosed with terminal cancer.

Life came from the back row and threw a sucker punch into your plans.

In those moments, everything seems to come to a standstill as you attempt to process this new information. It clouds your mind and makes decision-making seem like an insurmountable task. Everything you want to do or plan to do is now filtered through your ability to be present to encourage and support your loved one.

For many, there is a long-coming sucker punch when they do their final checkout from their working career. In reality, it shouldn't be a "sucker punch" as it's something they should've been aware of, but too often we choose not to be.

According to Bankrate.com, everyday working Americans are falling behind in saving for retirement

If you're reading Seeking Alpha, you are likely more aware of your retirement status than others, which is excellent. Some of you might be here because you got the wake-up call of a lifetime when you projected your retirement income using classic tools like the 4% withdrawal rate and realized how pitiful your retirement income would be with your portfolio plus Social Security.

Yet, we all know that Social Security is on the edge of a massive cut:

If no changes are made to deal with the trust fund shortfall, benefits will have to be reduced by 24.9%, according to the 2022 annual report from the board of trustees. - GoBankingRates.

The issue is a shortfall in coverage - Social Security is not bringing in enough to cover what it is paying out. According to the Trust's self-evaluation in 2022, the deadline is 2035 before a cut must be made if no other action is taken by the government.

So what should you do today to ensure you don't face a painful wake-up call in 2035 or when you start focusing on your retirement plans?

Take a Moment to Check Up on Your Savings and Returns

The biggest issue for many workers is that they have no idea what is going on with their retirement plans or savings. They often do not take full advantage of their 401k plans, and more often do not have outside IRAs to save their money with. So please take a moment to figure out how much you have and where you have it. Don't forget to roll forward any prior employer 401ks to avoid excessive fees that usually get applied to plans held by prior employers.

Next, evaluate the returns you are getting from those holdings. This is especially true for retirees who are entrusting their holdings to wealth advisors. These types of accounts shouldn't be forgotten and ignored. If you are ignoring them and not paying attention, chances are your advisor might be doing the same thing! The last thing you want to discover is your hard-earned money has returned next to nothing after advisor fees because you both neglected to fine-tune your risk tolerance and holdings over time.

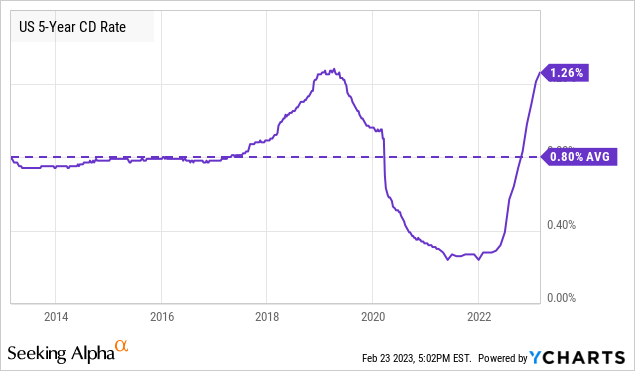

If you've invested in the "safest" places, perhaps long-term CDs for example, you've enjoyed only a 0.8% yield on average from your hard-earned money.

For example, if you put $100,000 in those CDs 10 years ago, assuming you received a flat 0.8% annual interest, compounded monthly, you'd end up with $108,325.82. In other words, your $100k only earned just a hair over $8k in a decade. If instead, you had invested the same into a market-wide fund, like SPDR S&P 500 Trust ETF (SPY), you would end up with $375,330. This calculation uses the 2012-2022 timeframe which also includes the large drop we saw last year.

Those avoiding the market generally missed out on $267k - over 2.5x what they originally saved themselves. That's a massive opportunity cost for avoiding the "risky" market entirely. Sadly, I personally know too many working Americans and would-be retirees facing the reality that sitting out of the market is making retirement starker than desired.

If you haven't given your retirement holdings a check-up lately - do so. If you entrust your hard-earned money to an advisory firm, check up on it today. The best time to get your reality rocked is when you have time to fix the problem and not when it's time to depend on that money.

Figure Out Your Income Needs and Projected Income

The next step to giving yourself an early wake-up call instead of a reality-provided sucker punch is to take a moment to estimate how much income you're going to need.

I recommend estimating high when projecting costs for the future. You'll want to determine the lifestyle you want to maintain, where you might want to live, and the cost of living at that location. The cost of living varies significantly depending on where you choose to live in the United States or globally. So use available resources to determine the perspective costs and estimate on the high side.

With all of this done, you should have a base case for the income you might need. I recommend adding 25-50% more to your income estimation to cover your "wants" and unexpected costs. Wiggle room in a budget is a good thing in case life comes by to hit you again.

Next, you can use the estimation tool on the Social Security website (or create a "my Social Security" account) to determine your potential payouts. I'd use this projection, plus one where benefits are cut heavily to see how much income you need to generate from your savings. My personal goal is to cover my entire income projection from my portfolio alone, and not have to depend on Social Security at all. That way anything they do provide is all extra money.

Build a Portfolio to Generate Your Income Needs

The last step to help prevent a reality shock at retirement is to construct a portfolio that will generate what you need to cover your income goals. If your savings can do so easily with exceptionally low-yielding holdings, go for it!

However, most of us will need to up the ante to see success achieved. The Model Portfolio for High Dividend Opportunities yields 9% on average and provides plenty of income. Members of HDO readily fine-tune their personal portfolio to yield more or less depending on what they decide to put into it. This is the beauty of income investing, the method is uniform, but the goal and results depend on your choices.

Once you know what you must earn to pay the projected bills, it's time to get to work and buy investments that will help you achieve that goal. I recommend a 40% allocation to fixed-income investments like preferred securities, baby bonds, and traditional bonds - or funds that invest in them primarily - so that you have a stable foundation upon which to build the rest of your income portfolio.

I don't want you to get a sucker punch at the end of your working career. I want you to enter into a period of rest and ease as you cross the threshold of your golden years.

Income investing can help make that transition possible and easier.

If you want full access to our Model Portfolio and our current Top Picks, join us for a 2-week free trial at High Dividend Opportunities (*Free trial only valid for first-time subscribers).

We are the largest income investor and retiree community on Seeking Alpha with over 6000 members actively working together to make amazing retirements happen. With over 40 individual picks yielding +8%, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale get 28% off your first year!

Start Your 2-Week Free Trial Today!

This article was written by

I am a former Investment and Commercial Banker with over 35 years experience in the field. I have been advising both individuals and institutional clients on high-yield investment strategies since 1991. As author of High Dividend Opportunities, the #1 service on Seeking Alpha for the 6th year in a row.

Our unique Income Method fuels our portfolio and generates yields of +9% along side steady capital gains. We have generated 16% average annual returns for our members, so they see their portfolio's grow even while living off of their income! 7500+ members have joined us already, come and give our service a try! Join us for a 2-week free trial and get access to our model portfolio targeting 9-10% overall yield. No one needs to invest alone.

In addition to being a former Certified Public Accountant ("CPA") from the State of Arizona (License # 8693-E), I hold a BS Degree from Indiana University, Bloomington, and a Masters degree from Thunderbird School of Global Management (Arizona). I currently serve as a CEO of Aiko Capital Ltd, an investment research company incorporated in the UK. My Research and Articles have been featured on Forbes, Yahoo Finance, TheStreet, Seeking Alpha, Investing.com, ETFdailynews, NASDAQ.Com, FXEmpire, and others.

The service is supported by a large team of seasoned income authors who specialize in all sub-sectors of the high-yield space to bring you the best available opportunities. By having 6 experts on your side who invest in our own recommendations, you can count on the best advice!

In addition to myself, our experts include:

3) Philip Mause

4) PendragonY

5) Hidden Opportunities

We cover all aspects and sectors in the high yield space! For more information on “High Dividend Opportunities” please check out our landing page:

High Dividend Opportunities ('HDO') is a service by Aiko Capital Ltd, a limited company - All rights are reserved.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Treading Softly, Beyond Saving, PendragonY, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities.

Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.