Paramount: Eating Crow

Summary

- My Paramount thesis broke, but the market was nice enough to give an off-ramp with a massive share price spike a couple years ago.

- The inflection point is now projected to be this year, with improving profitability and free cash flow in 2024. I think it's worth waiting to see it first.

- Paramount has a path to make some money for shareholders. We need to see DTC break-even, advertising grow, and success in the promised Showtime synergies. Paramount is a hold.

Jesse Grant/Getty Images Entertainment

I've written plenty of articles looking back at my wins. It's time to eat some crow, and look at a miss. Well, almost a miss. I wrote twice on ViacomCBS, now renamed Paramount Global (NASDAQ:PARA), discussing it was not properly valued by the market. The stock went absolutely bananas within a year, where I did sell off a majority of my position. The price increase was unsustainable and not based on underlying changes in the business. However, my overall thesis was incorrect, and broke as the goalposts moved for streaming to add to the bottom line.

Paramount has been a value trap, and continues to be. I've written plenty recently about the need to find the best compounders in the market, the true winners, and saddle up with them. Finding them at a decent valuation is an added bonus.

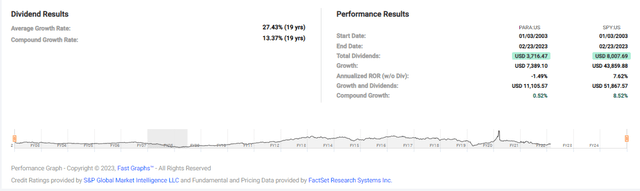

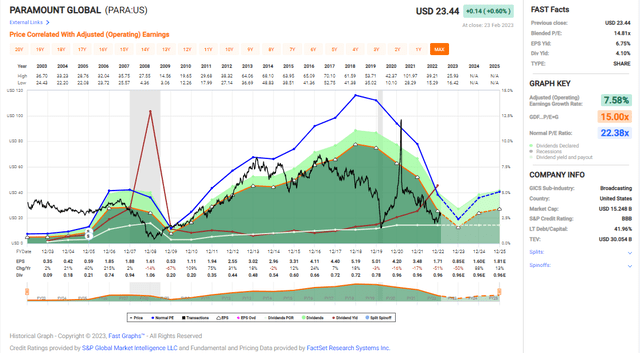

Paramount over the past 2 decades has barely made any money for investors. Your investment would have returned 0.52% annualized total returns. I looked past that in my past articles, thinking their new streaming strategy would bear fruit more quickly than it has.

I'm still waiting.

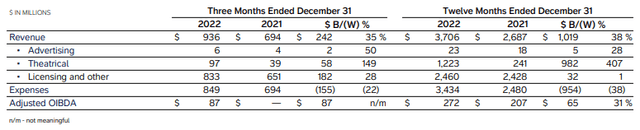

DTC

TV Media

Filmed Entertainment

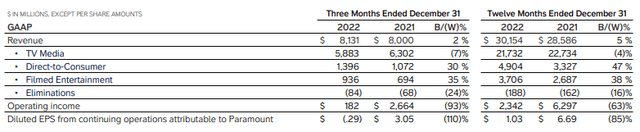

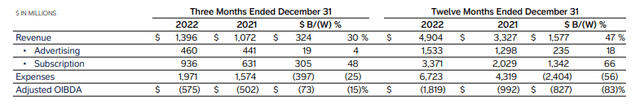

Looking at the most recent operating results for the company above, DTC, including Paramount+ and PlutoTV, is hemmoraghing money. The segment lost the company $1.8B adjusted operating income last year.

Paramount doesn't have the luxury that many other streaming companies have. Although their content library is vast and impressive, it likely still plays second fiddle to Disney's (DIS). Netflix owns more content, though the quality is more hit or miss. The rest of the streamers are able to draw on considerable funds from other portions of their operations. Disney has the parks, Amazon and Apple obviously have effectively unlimited resources in comparison, and Netflix has first-mover advantages in the space.

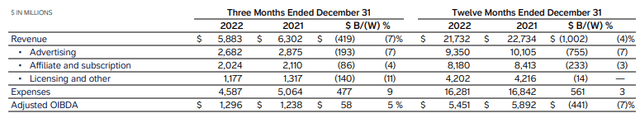

Paramount has its legacy TV business, and movies. Movies did well this past year, with Top Gun Maverick and Smile driving $272M in OIBDA for the company. However, this segment is lumpy, and it's difficult to project hits. TV Media is a declining business overall. Although sports and slow-movers in cord-cutting have kept eyeballs on traditional TV, it's in a negative growth phase and it appears to be in inevitable decline into irrelevance. Paramount maintains strong NFL rights, but will lose its SEC college football rights this next year to ESPN.

All in all, Paramount still has profitable portions of its business, but the clock is ticking on them generating meaningful profitability in streaming to complete their business shift. Revenues for DTC were up strongly at 30% growth, with management citing a $5.5B run-rate going into next year. Paramount was noted as #1 in new sign-ups in 2022, and the company signed on 9.9M new subscribers, bringing the total to 55M. However, the segment was a $500M hit to FCF, and drove it negative on the year with no turn expected until 2024. The path to profitability lies in pricing increases. Paramount+ with Showtime integrated is raising prices to $11.99 soon, while the essential ad-supported tier is hiking by $1 to

What's also concerning is advertising revenues. PlutoTV operates on an advertising business model, and Paramount+ has an ad-supported tier. Revenues only grew 4%, which is not up to par. Management discussed weaknesses in the advertising market, but that's one place the company needs to see strong growth if they intend on reaching DTC break-even. Advertising declined in TV Media, which isn't great but was expected.

Management is laser focused on the currently successful franchises. Yellowstone, Top Gun, Criminal Minds, and the like were the bright spots in the content catalog this past year. Star Trek continues to be a strong driver to Paramount+, and franchises are overall more consistent in driving customer responses. They are a known quantity. Disney has made a fortune off of their franchises, so this strategy makes sense. Despite the strength of Paramount's catalog, you won't hear me comparing any of them to Marvel, Star Wars, or the classic Disney characters any time soon.

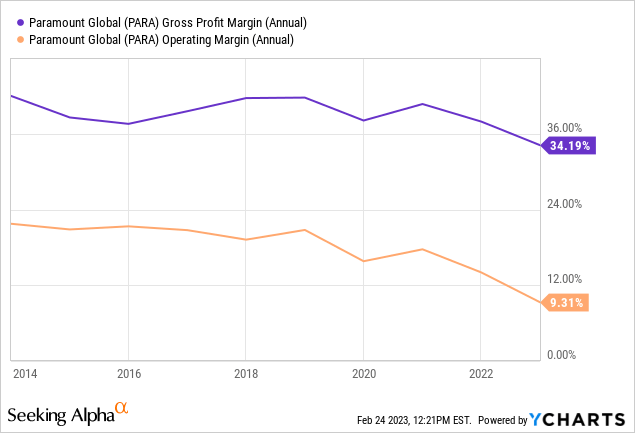

Margins are declining, with no real end-point in sight. Management is projecting improvements overall by 2024. The company is working through integration of Showtime, which they project will result in $700M of synergies on a go-forward basis following a $1.3-$1.5B restructuring charge. Synergies are likely, but integration risk remains and churn could easily come in worse than anticipated.

Margins are effectively a lagging indicator here. The margins will improve once the company cuts cash burn in DTC.

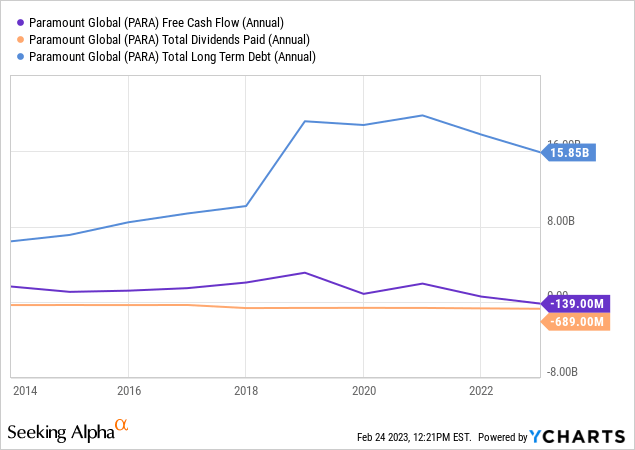

The company's balance sheet is a bit of a mess. However, we are seeing an inflection point in the debt load. You won't hear me say this often, but I wish Paramount would just kill the dividend. They suspended growing it in 2020, and have paid a $0.96 dividend for three straight years. Considering the breadth of the company's shift to streaming, they would put me more at ease by slashing it to 0, paying down debt aggressively considering the interest rate environment, and reinstating it once the dust settles and the business transformation is complete. I won't hold my breath. Free cash flow is projected to turn back to positive in 2024, but it is really contingent on how well the company manages content costs and drives profitability.

In one spot, management executed a master stroke that gave them some breathing room. During the massive, ridiculous run-up in the company's stock price, the company executed an equity raise for $2.6B at an inflated share price. This was a fantastic forward-looking move, and should be remembered considering some of the missteps Paramount management has had. Here's some color from the earnings call on cash flows:

Moving on to cash flow. Free cash flow was a use of $500 million for the full year, reflecting streaming investment and weakness in the advertising market. This figure also includes $289 million in payments for restructuring, merger-related costs and transformation initiatives. Consistent with our plans for peak streaming investment in 2023, we expect cash flow to continue to be impacted in advance of meaningful year-over-year improvement in 2024 when we return to positive cash flow.

We will continue to manage our balance sheet with an eye to navigating the short-term cash flow dynamic. Importantly, our focus on working capital optimization meant the year-over-year change in free cash flow in 2022 was better than the year-over-year change in OIBDA, a trend we expect will continue in 2023 as the gap between cash content spend and P&L content expense continues to narrow.

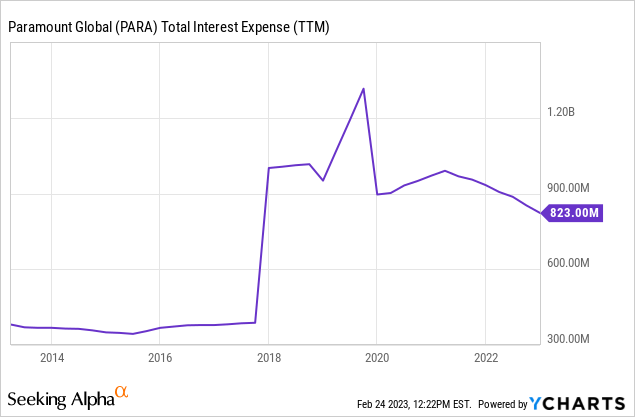

I'm not currently concerned about the company's solvency. Interest expense isn't great, but the company is generating cash and we are seeing the debt load decrease. It will remain an overhang as we move forward, though.

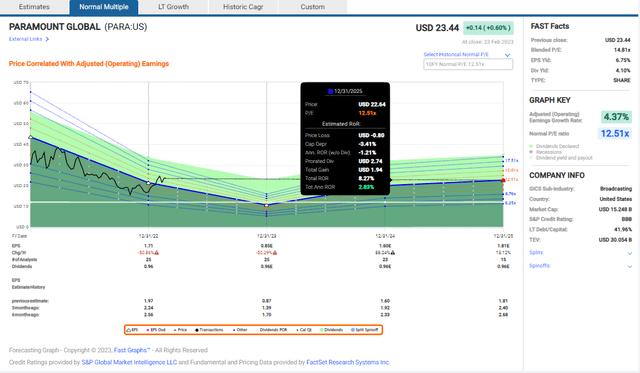

FAST Graphs

The company is currently cheap based on all of the uncertainties mentioned above. As earnings have declined, we are looking at a multiple closer to 15X, but everything hinges on the transformation. The second DTC generates a profit, Paramount could skyrocket. If it doesn't, it's pretty binary. Eventually, Paramount would likely be acquired or merge to save itself.

Based on analyst estimates, you're looking at basically dead money, which is par for the course over the past two decades.

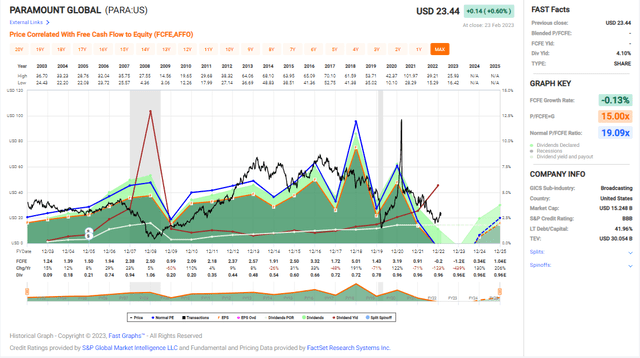

As I mentioned above, free cash flow is negative, and isn't projected to return until 2024. Management is all-in on the transformation, and that costs tons of cash.

Based on analyst estimates for free cash flow, you're looking at about 7% annualized total returns by 2025 if the company is able to cut investments and starts generating cash again.

Ultimately, Paramount is executing a difficult transition. They don't have the same levers as their competition, and streaming profitability has been hard to come by across the space. Recent turnover at Disney shows this isn't an easy spot to operate in, and Paramount wasn't exactly a shining star before.

I wanted to write this article to look back at one of my bad calls. Although the share price gave investors an opportunity to jump ship, my thesis broke when the goalposts kept moving further away on profit growth. I fell into the value trap, and I've reflected some on why that happened. Paramount's content catalog and foray into streaming seemed like a no-brainer. However, the real failure here was not focusing on the bottom line. Regardless of how well they grew subscriber counts, the rest of the company wasn't going to hold up with the content spend forever. Streaming overall has been rough and value destructive for investors (though I love it as a content consumer), and it seems clear as day in hindsight.

Cash flows should return regardless of whether the company is successful in DTC, but they would be generated by a declining TV and lumpy movie business. This is really the only path forward now for Paramount, and one they have the ability to execute on. The content catalog is solid, PlutoTV should perform well if advertising starts growing more consistently, and Paramount+ continues to grow its subscriber count strongly. Management has cited this next year as the inflection point for peak streaming spend. Step 1 - content and platform, step 2- spend like crazy, step 3-profit. I'm holding on to the remainder of my position, but I won't be adding to it here. I'm willing to buy the company a little higher once we see this inflection point materialize.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of DIS, PARA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.