Why I Quit Buying Rental Properties To Buy REITs Instead

Summary

- Rental properties can be great investments.

- But I think that REITs are even better investments in most cases.

- The risk-and-hassle adjusted returns are far superior.

- We're currently running a sale at my private investing ideas service, High Yield Landlord, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Feverpitched

I started my career in private equity real estate, and for a long time, I was convinced that real estate was the best available investment.

The idea of buying a cash-flowing property with mainly the bank's money and then letting your tenant pay off your mortgage was very appealing to me.

Within a few decades, you would own the property free and clear, and by then, the rents will have grown and the property will have likely gained significant value.

There are also important tax benefits, which only make real estate even more rewarding when compared to regular stocks (SPY) or bonds (IEF).

But despite that, I actually don't invest directly in real estate anymore.

I stopped buying rental properties as I learned more about real estate investment trusts, or REITs, which are publicly listed real estate investment vehicles.

I am convinced that they offer even better risk-and-hassle-adjusted returns than private real estate, and here is why:

Reason #1: REITs Offer Higher Returns In Most Cases

Most private equity real estate investors appear to think that they can easily out-earn the returns of publicly listed REITs (VNQ).

They believe so because they can use a lot of leverage to buy properties and enjoy tax benefits that are unique to private real estate.

But this is a big misconception.

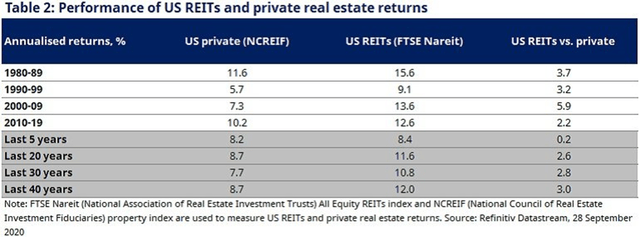

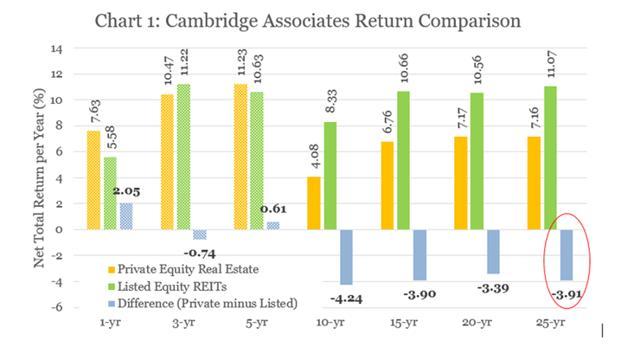

According to various studies, REITs have outperformed the returns of private real estate investments in most cases by 2-4%, depending on the study:

EPRA

Cambridge

How is this possible?

Well, first of all, it is important to correct a few misconceptions:

Misconception #1: Rental properties are more rewarding because of leverage - WRONG. REITs are also leveraged investments. When you buy shares of a REIT, you provide the equity and the REIT then adds debt on top of it. So what you see traded in the market is the equity value of the company, not the total asset value. Your equity enjoys the same benefits of leverage, but it is even better because REITs will typically enjoy lower cost of capital and you don't have to take any of the loans yourself. Then if you want even more leverage, you can of course add some margin to your investment, but that's not needed. REITs are already leveraged.

Misconception #2: Rental properties are better because of tax benefits -WRONG. Yes, rentals have some unique tax advantages, but so do REITs. In my case, I actually pay fewer taxes investing in REITs than in rental properties. Rental property investors are able to defer taxes thanks to depreciation, but they then get hit with a huge tax bill if and when they sell the property. They could use a 1031 exchange, but that forces them to remain invested in real estate even if real estate becomes overpriced. The loss in flexibility can have a significant indirect cost. REITs, on the other hand, are highly tax efficient because: (1) Most of the returns come from growth/appreciation, which is tax deferred. (2) REITs retain a lot of cash flow for growth, and this is tax-deferred as well. (3) A portion of the dividend is classified as "return of capital" in many cases, and again, this is tax-deferred. (4) You get a 20% deduction on the portion that's taxable. (5) Finally, you can use tax-deferred accounts.

Misconception #3: Rental properties can consistently earn 25%+ annual returns - WRONG. I often see rental property investors claim that they can earn huge returns, far surpassing those of REITs. I see many investors claim that they earn 25% or even 30% annual returns. But the reality is that Warren Buffett became the richest man on earth by compounding Berkshire Hathaway (BRK.B) at 20% annually, so I can guarantee you that rental property investors are not casually compounding at 25%+. Otherwise, we would have a lot of rental property billionaires!

Here's why the actual rentals are far lower: investors miscalculate their returns in 2 ways. (1) They don't account for the value of their own time and work. Rental property investors will work long hours on their property and put in a lot of effort, but fail to account for the value of this time, assuming that their work is free. In reality, they could have used this time to work extra hours at their job and so their work has a real cost that needs to be taken into account. If you now deduct $30 for each hour that you worked on the property, the returns would come down very considerably. (2) Rental property investors will only look at the returns during the good years and compare those returns to the average annual returns of REITs over a full cycle. REITs also commonly earn ~15% annual returns during bull cycles, but you need to include the downturns to compare apples-to-apples. Rental properties are often more heavily leveraged so they lose a larger portion of their returns during downturns.

Misconception #4: REITs are less rewarding because you need to pay managers - WRONG. REITs pay millions to their managers, but despite that, they are far more cost-efficient than rental properties. That's because they enjoy huge economies of scale. REITs own 100s or even 1,000s of properties, allowing them to save money on lots of things from property management to brokerage and everything in between. REIT management is far more cost-efficient than the DIY management of rental property investors.

In short, leverage and tax efficiency are not unique advantages of rental properties, and besides, rental property investors will typically miscalculate their returns, thinking that they earn far more than they really do. REITs are also real estate investments and so they enjoy the same exact benefits and it would be irrational to think that REITs would be far less rewarding.

But REITs actually enjoy many unique advantages that make them a lot more rewarding than rental properties:

- They have access to cheaper capital.

- They have access to more sources of capital, including preferred equity, convertible debt, bonds, etc.

- They have the best talent working for them and can afford to pay them handsomely thanks to their scale.

- They enjoy huge economies of scale. Imagine a REIT using a contractor to change 1,000 carpets compared to you changing just one.

- REITs will often develop their own properties to earn higher returns.

- REITs skip brokers and brokerage fees by doing sale-and-leaseback transactions.

- REITs can access public markets to raise equity and reinvest it in a positive spread to grow externally. In other words, they are not limited to organic growth, unlike rental property investors.

- REIT investors skip transaction costs by buying a small interest in an existing portfolio.

- REIT investors can at times buy REITs at discount to their net asset value. Example: AvalonBay (AVB) is currently priced at an estimated 25% discount.

- ... And many more reasons.

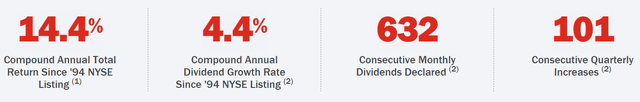

This explains why some REITs like Realty Income (O) have been able to compound investors' capital at ~15% per year for decades, despite following a low-risk net lease investing strategy and using little debt. Private investors would be happy to earn 8-12% by buying comparable properties:

Reason #2: REITs Are A Lot Safer Investments

Rental properties are private, illiquid, concentrated, highly leveraged investments with significant liability risk and a social element.

REITs are public, liquid, diversified, moderately leveraged investments that enjoy limited liability and professional management.

Clearly, REITs are far safer investments.

Some rental property investors may claim that REITs are riskier because they trade like stocks, which at times, leads to high volatility.

But in reality, rental properties are far more volatile. You just don't know about it because there is no daily quotation. But if you tried to sell your property on a daily basis, you would get lots of different offers and very high volatility.

Assuming that you bought your property with an 80% LTV, then a 5% lower offer to buy your property would result in a 25% dip in your equity value. Remember that what you see traded on the REIT market is the equity value.

Since your property is a private, illiquid, capex-heavy, and highly leveraged investment, it would be extremely volatile in most cases. This is especially true since there are also liability issues and a social element.

With REITs, you are not signing on any of the loans or dealing with tenants. But rental property investors put their personal liability on the line and this explains why plenty of rental property investors file for bankruptcy protection each year, but no REIT investor has ever lost money in the long run if he/she held a diversified portfolio.

Reason #3: REITs Allow You to Optimize Your Career and Lifestyle

This is a very important point, and yet, it is greatly underappreciated.

Your main source of income and wealth is your career. If you want to become wealthier, your number #1 focus should be on growing your income. REITs allow you to do that because they are professionally managed. You can make investments and then forget about them. But rental properties are very time-consuming and energy-draining, and they also lower your geographical flexibility.

As such, they will hinder your ability to get that next promotion and reduce your earning potential.

If let's say you live in NYC and now receive a very lucrative offer to go work in Miami, you may be a lot more reluctant to move if you own a bunch of properties in NYC. And all the time and energy taken by rental properties will be taken away from your career.

Rental properties will also hinder your lifestyle. I would much rather earn a 10% annual return than earn a 12% annual return if the 10% return allowed me to travel and worry about other things that I am more passionate about. Life isn't just about money.

Bottom Line

REITs are more rewarding investments in most cases.

REITs are also far safer investments.

And REITs also allow you to focus on your career and lifestyle, which will ultimately yield you more money and enjoyment in the long run.

With that in mind, I think that REITs are far better investments than private real estate investments in most cases and this explains why I invest mostly in REITs rather than private real estate.

Rental property investors typically suffer many misconceptions about REITs and this leads to biased decision-making when favoring rentals over REITs. I know this because I used to be in this situation as well.

Today, I am a professional REIT investor and I wouldn't go back to private equity.

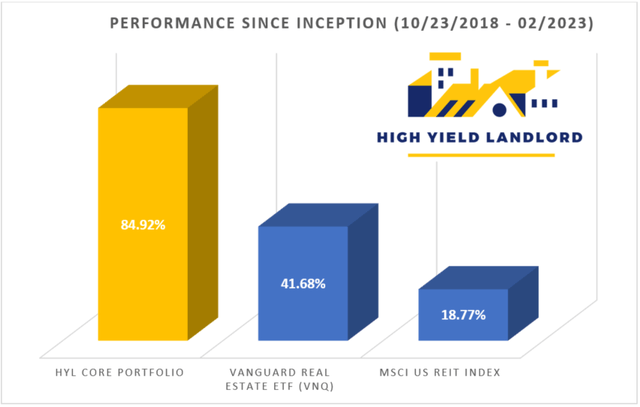

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Disclosure: I/we have a beneficial long position in the shares of O; AVB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.