Paramount Global: Top Gun But Not A 'Top Stock'

Summary

- Streaming is becoming increasingly popular as customers opt for cost-effective alternatives to traditional cable packages.

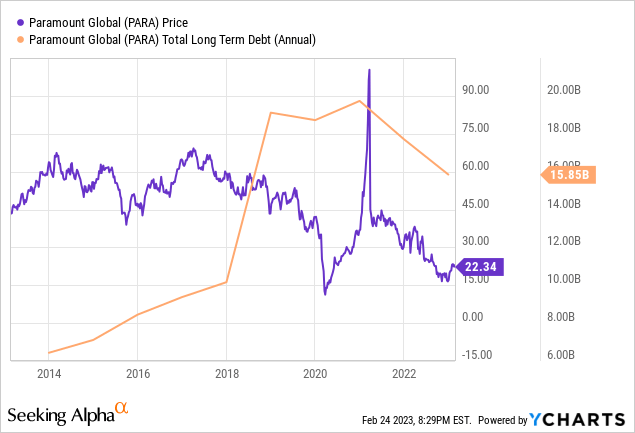

- Despite making progress in growing its subscriber base and revenue, Paramount is hindered by an overwhelming debt of over $15 billion.

- Sony's strategy of licensing its content to other DTC streamers could be advantageous for Paramount to consider.

Gareth Cattermole

Introduction

Streaming, streaming, streaming. Some of us do it every day. As customers have shunned expensive traditional cable packages many have chosen streaming as a cost-effective alternative.

But what services do you subscribe to?

We all know the big ones, Netflix (NFLX), and Disney (DIS), but what about Paramount+ (NASDAQ:PARA)?

Personally, I can say that I do not. And I don't think I am alone in that.

As the streaming market expands, Paramount Global faces the daunting task to keep up with its rivals which boast better IP, more capital, or sometimes both.

Although the company has made progress in growing its subscriber base and revenue through its Direct-to-Consumer segment, it is still hindered by an overwhelming debt of over $15 billion. Raising the question, where will Paramount go from here?

Within this article, I'll:

Provide an overview of the company and industry dynamics

Explain the long-term challenges that Paramount faces

Examine their financial performance and valuation versus peers

The questionable strategy of Paramount +

Paramount Global's streaming service, Paramount+, has seen some impressive growth, attracting a record 9.9 million subscribers in Q4 of 2022 and reaching almost 77 million subscribers globally.

In Q4 of 2022, DTC revenue grew by 30% year-over-year, with Paramount+ revenue increasing by 81% and subscription revenue growing by 48%. On the other side, advertising revenue only grew by 4% YoY, indicating that Paramount Global's future growth relies heavily on its DTC segment, which is a risky bet in a market that requires continuous investment in content and technology at a time when capital is very, very expensive.

When compared to Netflix and Disney, Paramount's content library simply falls short, placing it at a disadvantage in a highly competitive market where companies are spending huge sums of money on content and marketing to attract and retain subscribers.

The net result is that Paramount will be forced to continue to invest in expensive productions to chase after the streaming market where consumer taste is always in flux.

This is no small task.

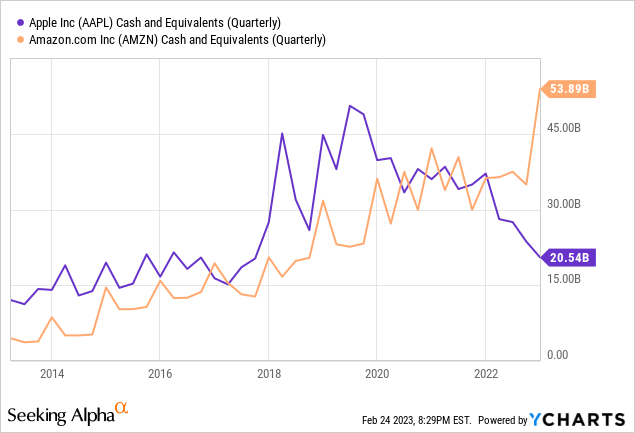

But it's not just powerful IP they must contend with, they have some deep-pocketed competitors: Apple (AAPL) and Amazon (AMZN). Apple has $20B in cash and Amazon has $54B, they could throw $2B at content in one year and it barely makes a dent.

Whereas the tech giants sit on piles of cash, Paramount sits on piles of "IOUs" vis-a-vis their debt which stands at over $15B. The problem doesn't stop there, if interest rates continue to rise or stay elevated for longer, the pressure on the company will increase, reducing its flexibility. Apple and Amazon, with their nearly unlimited financial resources, could make it very hard for Paramount Global to survive this battle.

Although Paramount Global has made strides in its Filmed Entertainment segment, producing blockbuster films like Top Gun: Maverick, its success in this area is insufficient to offset its mounting debt and limited IP.

Top Gun, as great as it is, is no Star Wars or Marvel….

An alternate path

Sony's (SONY) strategy differs from Paramount's in that it licenses its content to other DTC streamers like Netflix and Disney, rather than solely relying on its own streaming platform. This approach allows Sony to benefit from multiple revenue streams while also expanding the reach of its content.

Given the challenges of the streaming industry and the need for significant capital investment, it may be advantageous for Paramount to consider increasing its scale by licensing its content to other DTC streamers or merging with a peer.

Doing so would free up significant resources, albeit at the price of becoming reliant on a competitor to distribute your own content. Still, despite that risk, I would still make that move. Better to let your peers compete away all the profit using your IP as ammunition rather than the other way around.

Financials

Let's take a look to see how Paramount has fared versus its peers in Revenue Growth, Return on Invested Capital, and Debt Load.

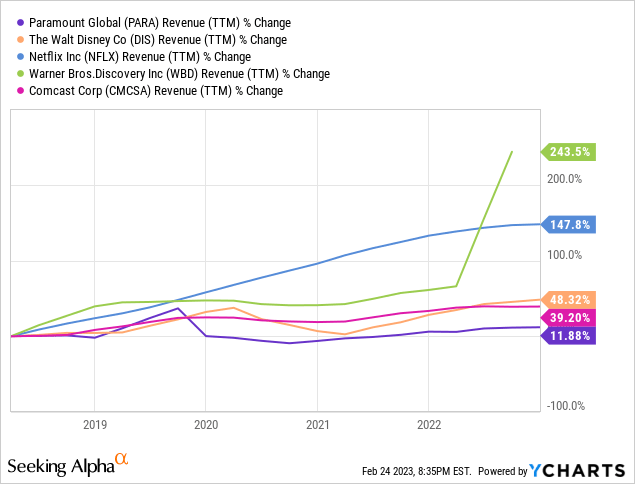

Revenue Growth

Paramount has suffered from low revenue growth these past years and has only expanded its top line by 12%. Sure, Discovery (WBD) merged with Warner Bros, and Netflix is a DTC pureplay, but even Disney and Universal (CMCSA), two legacy players, outgrew Paramount by 30-40% in the time frame. This is a disturbing trend that suggests to me changes must be made.

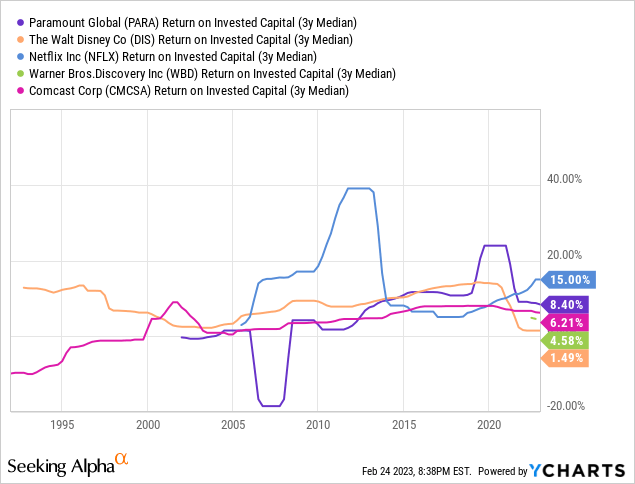

Return on Invested Capital

One area that used to be a relative bright spot for Paramount was its relatively high return on invested capital that it maintained over the past decade which often hovered in the high single-digit range while its peers were in the low-mid single-digit range. While still higher than Disney, Warner, and Comcast, we can see that these returns have trended lower in recent quarters suggesting competition may be eating away at profits.

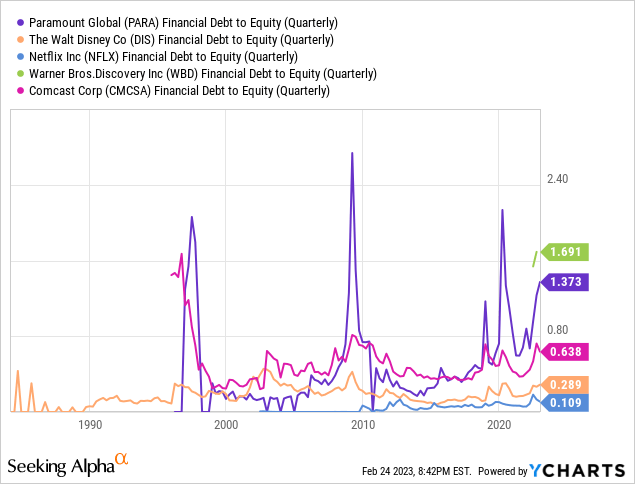

Debt to Equity

As mentioned earlier, something else making the problem worse for Paramount is its high level of debt at 1.4x Financial Debt to Equity. This is only topped by Warner Bros Discovery at 1.7x which took on massive sums of debt when they combined as the asset was spun out from AT&T (T). I view both of these debt levels as unsustainably high and would like to see them reduced to less than 1x before I could get comfortable with them as an investment.

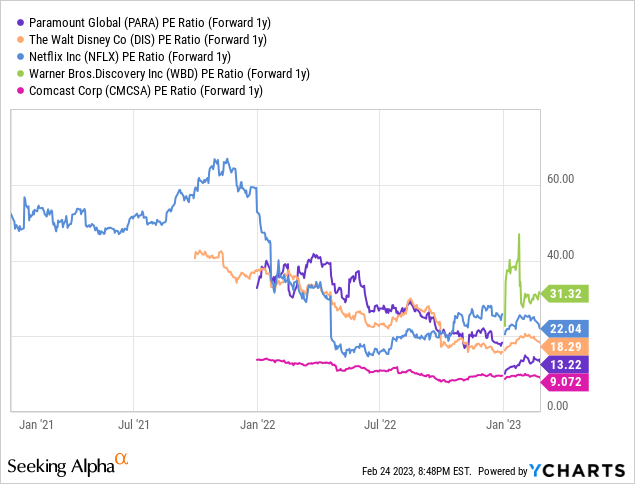

Valuation

Compared to the forward PE ratio of its peers Paramount is cheaply priced at 13.2x forward earnings, but on an absolute basis, this may be too high in my opinion. Given its high debt load refinancing costs are likely to eat away at earnings and competition may further compress profitability.

Conclusion

In conclusion, while Paramount has made strides with its streaming service, Paramount+ the company still faces significant challenges in the highly competitive streaming market. Paramount's content library falls short compared to rivals like Netflix and Disney, and the company's overwhelming debt of over $15 billion makes it difficult for Paramount to invest in expensive productions to attract and retain subscribers. Furthermore, the company faces deep-pocketed competitors like Apple and Amazon, which have unlimited financial resources to pour into content and technology.

Sony's strategy of licensing its content to other DTC streamers could be an alternate path for Paramount, allowing it to free up resources and benefit from multiple revenue streams. Paramount's low revenue growth, declining return on invested capital, and high debt load are also concerning factors. While Paramount is cheaply priced compared to its peers, on an absolute basis, its valuation may be too high given its challenges.

For those reasons, I rate Paramount a Sell.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please note that this article is for informational purposes only and should not be construed as investment advice. It is important to do your own research and consult with a financial advisor before making any investment decisions.