Zedge: Mobile Content Provider Posting Improving Fundamentals

Summary

- Zedge is a micro cap mobile content provider that saw significant (>30%) intraday appreciation without an immediately identifiable catalyst or news event.

- The company has posted a record fiscal year and looks to improve on that this year, with record cash flows and cash flow per share.

- Additionally, it has a margin of safety as to its capital structure, with close to 50% of its market cap (post today's uptick) in cash.

- As such, I would cautiously (due to its micro cap status) rate this a buy.

FreshSplash/E+ via Getty Images

Overview

Zedge Inc (NYSE:ZDGE) is a digital content provider for smartphones. Offering wallpapers, ringtones, and even NFTs for your home screen, Zedge has a large library of both free and premium content. The company states that it has 30M active users and 436M downloads of its mobile app, through which it delivers its content. The company allows creators to publish their content and earn affiliate fees through their work.

The stock is particularly active today on February 21st 2023, appreciating 37% intraday to $3.70 as of this article. While there doesn’t appear to be an immediate catalyst for the move, clearly something is up – moves like this tend to happen for a reason. While we wait for some kind of news to contextualize this significant appreciation, it’s worth reviewing the financial performance of the company to see how ZDGE stock stacks up on the fundamental side of things.

Financials

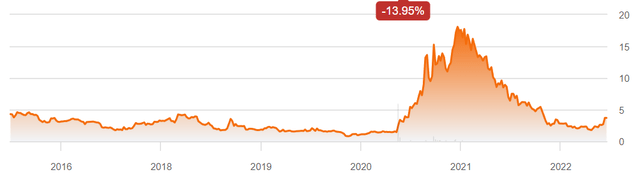

Zedge has been trading publicly since it was spun off from IDT Corporation (IDT), listing itself at $4.30 per share. Even in light of today’s material uptick, the stock is still trading at a 14% discount to its initial trading price.

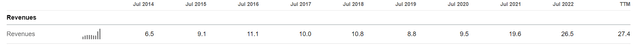

The firm also has listed financials through Jul 2014 (note that the fiscal year for this company concludes in July of each year).

seekingalpha.com ZDGE 2.21.23 seekingalpha.com ZDGE 2.21.23

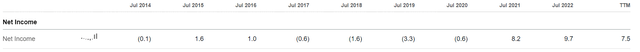

The company has scaled its revenues since then, although not in a particularly dramatic fashion. Its most recent full fiscal year saw revenues of $26.5M – 408% of what they were for the fiscal year ending July 2014. The growth has been volatile, with the firm first hitting revenues of over $10M in the fiscal year ending July 2016 and subsequently dropping off below $10M for 2018 & 2019. The previous two years have been strong, and it’s evident that the next two earnings reports should culminate in a record $30M+ year for Zedge.

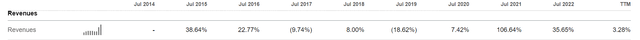

Along with this, Zedge appears to have swung into consistent profitability over the last 2 years, generating $8.2M in profits for the fiscal year ending July 2021 and $9.7M for the fiscal year ending July 2022. Since the firm has already posted $7.5 in net income for the first two quarters of its fiscal year, this current fiscal period should also be a record as to net income for the firm.

This profitability has also come with an improving cash flow picture, with Zedge generating record FCF for the fiscal year ending July 2020. This number has moved the most relative to the others in the current period, with Zedge generating $11.6M in free cash flow for the fiscal year ending July 2022 – a significant increase over any of its previous years in operation. Notably, free cash flow per share is also at record levels for the past fiscal year, with the firm generating 18.9% of its current share price in free cash flow yearly. This appears to be a breakout year for the firm’s capacity to generate cash flows.

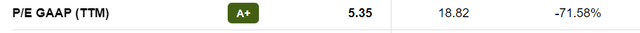

With its improving fundamental picture, it seems that Zedge has actually become relatively cheap as to its valuation. Looking at it vis-à-vis its peers in the GICS sector for Interactive Media & Services, we see that it is now trading quite cheaply on both a GAAP P/E basis (71.6% discount) as well as a cash flow basis (48.6% discount).

seekingalpha.com ZDGE 2.21.23 seekingalpha.com ZDGE 2.21.23

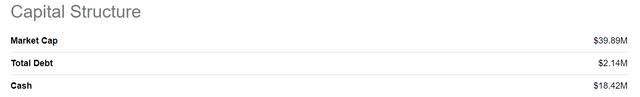

Along with this, we can note the relatively robust capital structure of the firm; its cash holdings are 46.2% of its market capitalization. That’s a solid margin of safety, even though we must always exercise caution in micro-cap stocks such as this one.

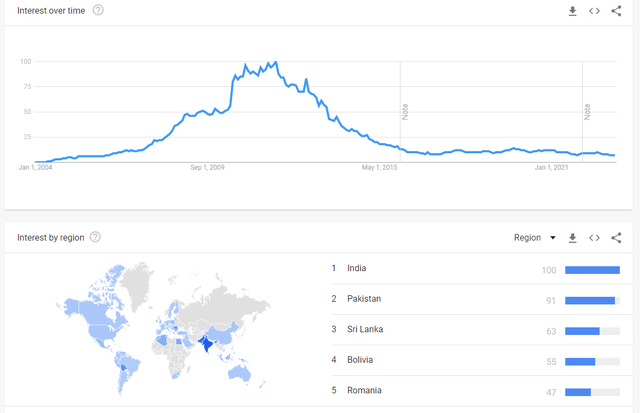

This picture looks to be an improving one for this security. Since this is a company that derives its revenues from B2C consumer purchasing, we can also take a quick look at its performance on Google Trends; this is usually a good proxy for levels of consumer interest.

Here the picture is less clear. Whilst Zedge appeared to achieve peak interest in 2010-2011, it has trailed off since. Although we can chalk this up to it having ‘saturated’ interested consumers by having its app already on their phones, it is also evident that this company isn’t generating new user interest remotely close to the levels that it was previously. Worth noting is that Zedge appears to be seeing the most ongoing interest in countries other than the USA, where its search performance is much more middling.

Risks

Micro cap stocks such as this one are inherently risky and subject to greater price volatility than entities with greater market capitalization. Relatively small dollar amounts of selling off can push the price down by large percentages. For example, a $1M sell-off here would wipe out 3% of the market cap in one fell swoop; caveat emptor.

Furthermore, micro cap stocks tend to have lower levels of institutional ownership - and retail capital can be much more flighty than longer-duration holdings by asset managers and related institutions. The institutional ownership percentage for Zedge presently stands at 20.77%.

Additionally, since this stock is only generating net income in the low double-digit range, and even a $1-2M decrease in their business will have significant ramifications for its business performance. The business risk here takes the form of Zedge losing traction on its content distribution to customers. Simply put, there isn't much of a competitive moat to selling pictures and other forms of content for mobile phone customization; these can be sourced from myriad places, including (most commonly) the pictures that one simply has on their phone.

Conclusion

Zedge looks set to have a record year. Its valuation is cheap relative to its sector and its fundamental metrics are their best yet. If this company can continue to generate profits and concomitant cash flows through its internationalized mobile content offering, I think that it can continue to do well. Nonetheless, I must reiterate that investors should be cautious with any security at this scale of capitalization, although as noted its capital structure is a healthy one. With these considerations and caveats in mind, I will rate this a buy.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.