ADX: Solid Equity Fund Yielding 6%

Summary

- The ADX fund has been in operation since 1929. It provides long-term capital appreciation and high current distributions from a portfolio of diversified equities.

- The ADX fund pays a 6%+ distribution yield.

- The fund may appeal to long-term income-oriented investors who don't mind trading 70-100 bps of returns for 3-4x the yield of the S&P 500.

William_Potter

The Adams Diversified Equity Fund (NYSE:ADX) is a solid closed-end fund that has survived the great depression and a dozen recessions since its inception. The ADX fund generates high long-term average annual returns and pays a generous 6%+ distribution.

I believe the ADX fund may appeal to income-oriented investors who don't mind trading 70-100 bps of returns relative to the S&P 500 Index for 4x the market's distribution yield.

Fund Overview

The Adams Diversified Equity Fund is one of the oldest closed-end funds ("CEF") in the market with an operating history of over 90 years. In fact, the predecessor of ADX, the Adams Express Company, was a leading express company (19th-century freight and cargo transport business) for 75 years prior to converting into a closed-end fund in 1929.

The ADX fund seeks to deliver superior returns over time from a portfolio of broadly-diversified equities. The fund also aims to pay a consistent distribution to shareholders. ADX has $2.1 billion in assets as of December 31, 2022 and charges a 0.54% expense ratio (Figure 1).

Figure 1 - ADX fund details (adamsfunds.com)

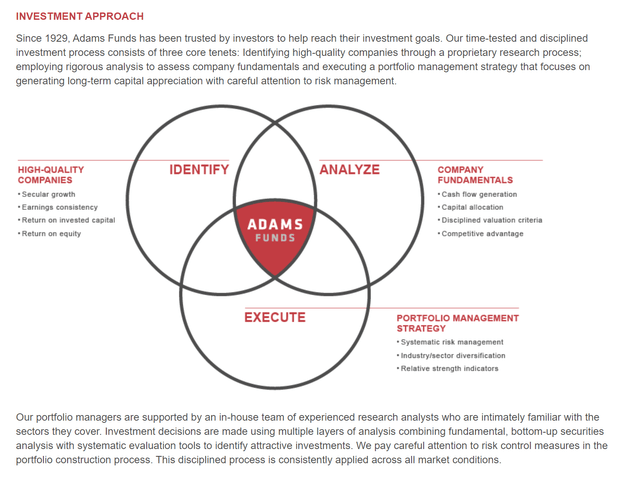

Time-Tested Investment Process

ADX's time-tested (ADX has survived the Great Depression and 12 recessions since its inception) investment approach identifies high-quality companies by looking at secular growth drivers and finding those with consistent earnings growth and returns on capital. These companies are placed into a portfolio that is constantly monitored and managed by a team of portfolio managers and research analysts (Figure 2).

Figure 2 - ADX investment process (adamsfunds.com)

Portfolio Holdings

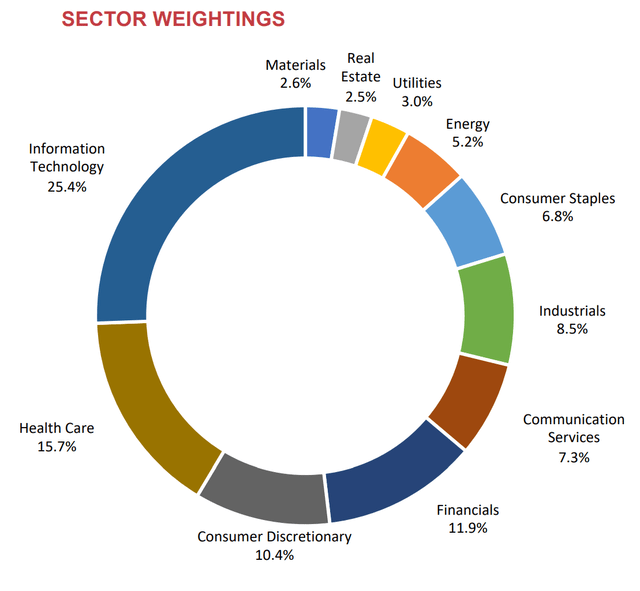

The ADX fund currently has 94 positions; sector weights shown in figure 3.

Figure 3 - ADX sector weights (ADX factsheet)

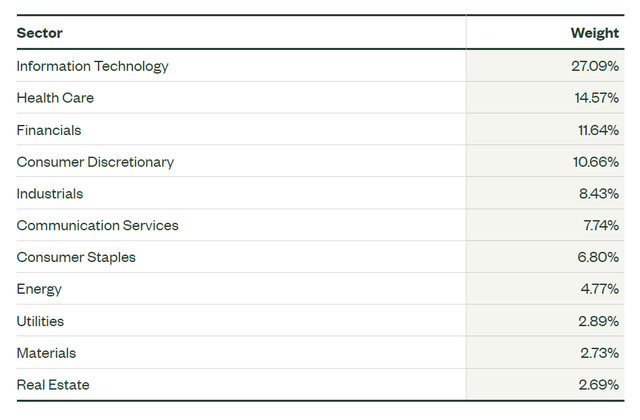

ADX's sector weights are very similar to that of the market, as represented by the SPDR S&P 500 ETF Trust's (SPY) sector weights (Figure 4). The notable differences are a slight underweight in Information Technology for ADX (25.4% vs. 27.1%) and a slight overweight in Health Care (15.7% vs. 14.6%).

Figure 4 - SPY sector weights (ssga.com)

Returns

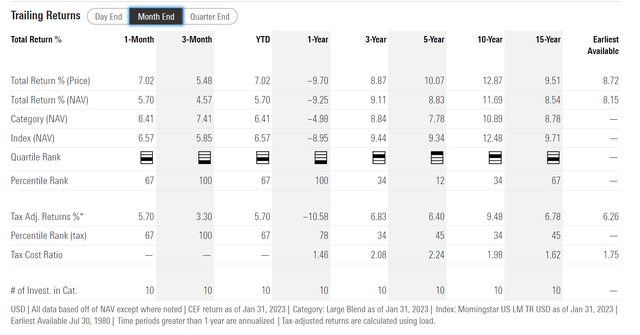

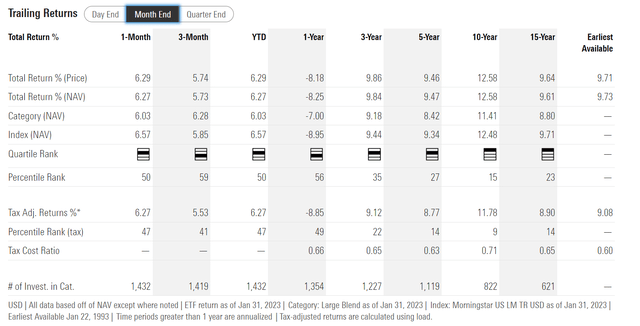

The ADX fund has delivered excellent long-term historical returns with 3/5/10/15Yr average annual returns of 9.1%/8.8%/11.7%/8.5% respectively to January 31, 2023 (Figure 5).

Figure 5 - ADX historical returns (morningstar.com)

However, investors should note that ADX's historical returns on NAV are approximately 70-100 bps below that of a passive market fund like the SPY ETF (Figure 6).

Figure 6 - SPY historical returns (morningstar.com)

Distribution & Yield

To compensate for a lower total return, the ADX fund pays a generous quarterly distribution set at a minimum of 6% annually. In 2022, the fund paid $1.07, or a trailing yield of 7.0% on market price. This is more than 4x the yield of the SPY ETF, which is only paying a trailing yield of 1.6%.

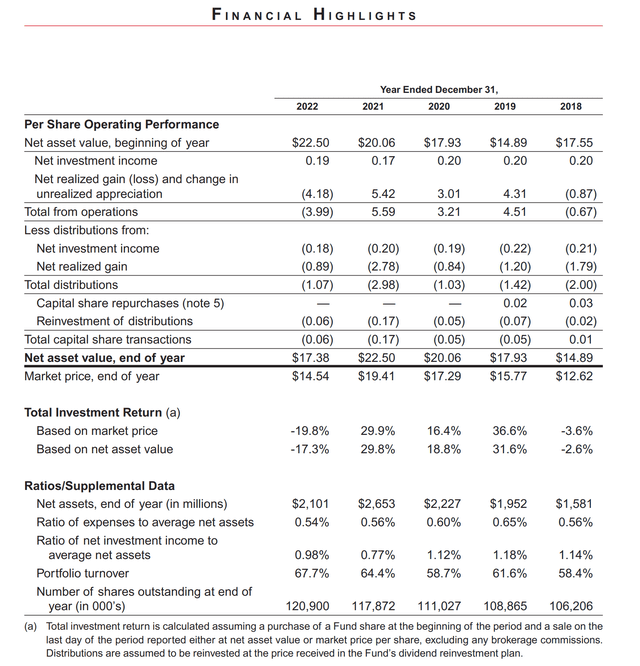

Historically, the ADX fund has paid distributions from a combination of net investment income ("NII") and realized gains (Figure 7). In good years, the ADX fund can pay large special distributions from realized gains, like the $2.78 / share distribution that was paid in 2021.

Figure 7 - ADX financial summary (ADX 2022 annual report)

Another Fine Example Of How High Distributions Should Be Paid

Readers of my articles know that I am often critical of CEFs that pay high distribution yields that are unsupported by their income or returns; for example, the Eaton Vance Short Duration Diversified Income Fund (EVG) pays a 10% yield on NAV but only earns 2.6% average annual returns over 10 years. I call these funds 'return of principal' funds, because their high distribution rates are funded by liquidating their NAV.

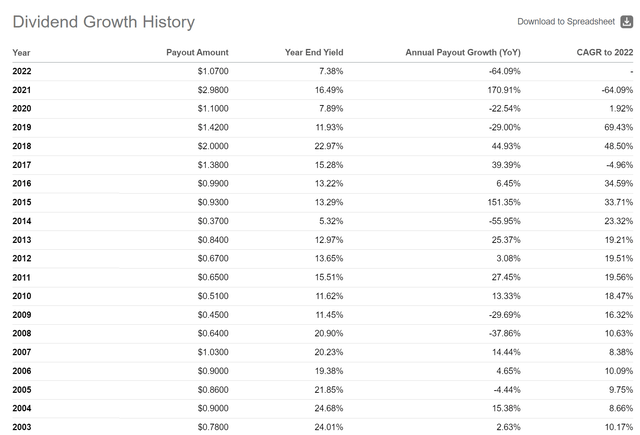

In contrast, while ADX also pays a very generous distribution, I believe ADX's distribution is long-term sustainable because the fund earns 3/5/10Yr average annual returns of 9.1%/8.8%/11.7% respectively. Furthermore, the ADX fund pays a 'minimum' distribution of 6%, but in good years, the yield can be as high as 23.0% in 2021 (Figure 8).

Figure 8 - ADX historical distributions (Seeking Alpha)

I believe ADX's model of paying a high, but reasonable quarterly distribution and rewarding stockholders with special distributions in good years is the way all high-yielding CEFs should manage their distributions. it does not lock the fund into paying a NAV destroying distribution rate during tough times.

ADX vs. TY

A few months ago, I reviewed another long-operating CEF, Tri-Continental (TY) with a long history of strong performance and generous distributions. How does the Adams Diversified Equity Fund compare to TY?

Comparing the two funds using my proprietary scorecard, we can see that both funds are popular with investors, with $2.2 and $1.7 billion in net assets respectively. TY has a slightly lower expense ratio, and also a slightly lower turnover rate (Figure 9).

Figure 9 - ADX vs. TY (Author created with fund and distribution details from Seeking Alpha and returns and risk metrics from Morningstar)

With respect to returns, TY has better short term performance, while ADX has better long-term returns.

On risk metrics, TY has lower volatility than ADX, and a smaller maximum drawdown. However, ADX has a better 5 Yr Sharpe Ratio due to its higher long-term returns.

Investors should note that this comparison is not exactly 'apples to apples' as TY's mandate includes high yield bonds and other fixed income instruments (TY has 19% exposure to fixed income as of December 31, 2022), so it is natural for TY to have lower returns and lower volatility.

Finally, comparing the two funds' distribution, we can see that both funds pay generous distributions, although TY's trailing 12 month distribution yield on NAV is higher. While ADX's distribution policy is a minimum of 6% distribution, TY does not have a set minimum. Instead, TY's quarterly distribution rate of ~$0.27 / share yields approximately 4%.

I believe both ADX and TY are solid funds to hold in one's portfolio, especially for income-oriented investors who prefer a generous quarterly distribution in exchange for slightly lower returns. ADX has slightly higher long-term returns due to its all-equity focus while TY is less volatile due to its fixed income component.

Persistent Discount To NAV

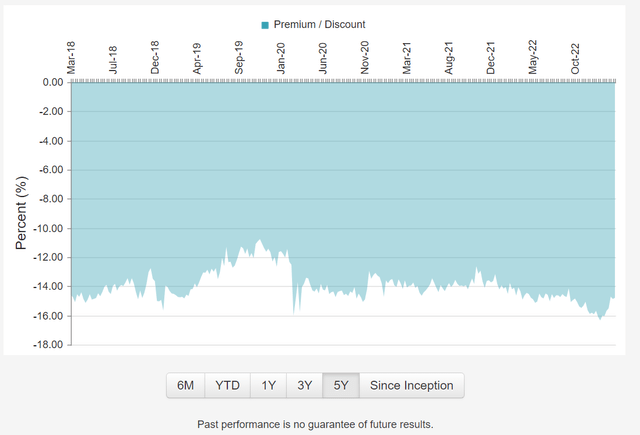

The ADX fund trades at a persistent ~15% discount to NAV (Figure 10). This result is surprising, as one would have thought an equity fund generating 10Yr average annual returns of 11.7% with a 6%+ distribution yield should be well received by investors. Unfortunately, investors seem to prefer funds that promise to pay unsustainably high 10%+ distribution rates, even if that distribution comes at the expense of liquidating NAV.

Figure 10 - ADX fund trades at a 15%+ discount (cefconnect.com)

Conclusion

In summary, I think the Adams Diversified Equity Fund is a solid closed-end fund that generates high long-term average annual returns and pays a generous 6%+ distribution. The ADX fund may appeal to income-oriented investors who don't mind trading 70-100 bps of returns for 4x the market's distribution yield. The ADX fund also trades at a 15% discount to NAV; however, investors should not expect the NAV discount to close.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.