e.l.f. Beauty Is Riding Some Powerful Trends

Summary

- ELF has done a great job of adding shelf space, and has more white space gains ahead.

- Category expansion is another big opportunity.

- Beauty companies tend to do well during periods of economic weakness.

Kharchenko_irina7/iStock via Getty Images

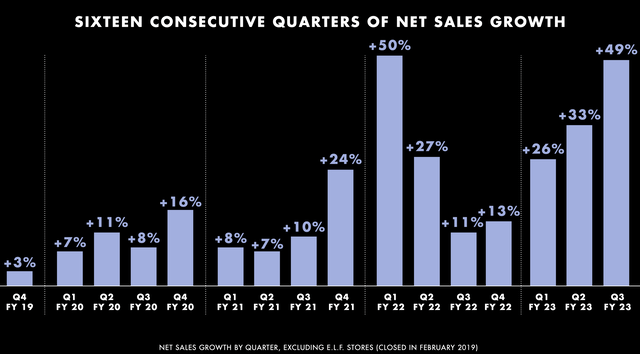

e.l.f. Beauty (NYSE:ELF) is riding strong momentum, and history says even a recession won’t slow it down. Shelf gains, price increases, and new product introductions all bode well for the company moving forward.

Company Profile

ELF offers a variety of beauty and skincare products under its e.l.f. Cosmetics, e.l.f. SKIN, Well People, and Keys Soulcare brands. The company touts that its products are 100% cruelty free with clean ingredients

The company sells its products in the U.S. primarily through the mass, drug store, food and specialty retail channels. Walmart (WMT), Target (TGT), and Ulta Beauty (ULTA) accounted for 26%, 23%, and 12% of its sales, respectively, in fiscal 2022. It also sells its products through its own e-commerce website

In addition, ELF sells its beauty products in several international markets, including the U.K., Germany, Canada, and Australia.

ELF does not do traditional TV or print advertising. Instead it relies heavily on social media and influencers. The company claims it was one of the first beauty brands on TikTok, and it also has many advocates on other social media sites including Twitter, Instagram, YouTube, and Facebook.

Its brands have historically overindexed with younger demographics and minorities.

The company sources and manufactures its products in China through various third-party manufacturers.

Opportunity

Distribution and innovation remain two key focuses for the company. ELF has done a great job getting into retail giants WMT and TGT, and it’s been gaining space within these retailers as well. Nonetheless, it still has room to both expand its shelf space with both these retailers, especially WMT, as well as get into others.

On its FYQ2 call in November, CEO Tarang Amin discussed the shelf gains and opportunity ahead, saying:

“So I'd say on space expansion, we've had a good track record over the years. If I back up 9 years ago, we probably have about 11,000 linear feet of space in the U.S. We have over 130,000 linear feet now. And if you look year-over-year, there were a couple of years early in our life where you had, I'd call it, a massive step change. There was 1 year where I feel Target gave us 50% more space across all their doors. But other than that, it's really been a pretty methodical subset of a retailer's chain doors that will give us some incremental space with. So we like that cadence.

“Our primary focus is always going to be on productivity being able to drive strong comp store growth regardless whether retailer gives us some space. So I would say, yes, definitely significant, particularly Targets, our most longest-standing national retail partner then making a further statement on e.l.f. e.l.f is also now, I think they're top brand across all of cosmetics and facial skincare. So it definitely goes hand in hand with our growth. Walmart, we have a massive opportunity. And I'd say still have quite a bit of white space even with the space they're about to give us.

“But really across the board, I feel there’s space opportunities everywhere we look. But having this approach of a pretty disciplined rollout and being able to build that on top of our overall productivity model is pretty healthy and a pretty consistent approach.”

Innovation also remains a key for the company. The company uses a fast-follower model where it often will copy popular products from prestige brands, then offer them at a fraction of the price. This has been a highly successful strategy it has used for years.

On the ELF’s Q3 call, Amin gave an example of this strategy in action, saying:

“I'll start with primers. A few years ago, a prestige brand introduced a new primer format at a $52 price point that quickly became a top primer in prestige. We took inspiration from this item, added our own unique e.l.f. Twist and launched Poreless Putty Primer. Our price point of $8 invited a much wider range of consumers into the space, significantly expanding the entire Putty Primer category. In fact, looking at data over the last year, we've sold over 9x the units of the prestige primer. And both e.l.f. and the prestige item have continued to grow units at a double-digit pace.”

The company is looking to innovate in a few areas where it currently under-index, including mascara, lip color, and skin care. These are all large markets where the company can introduce new products to gain share.

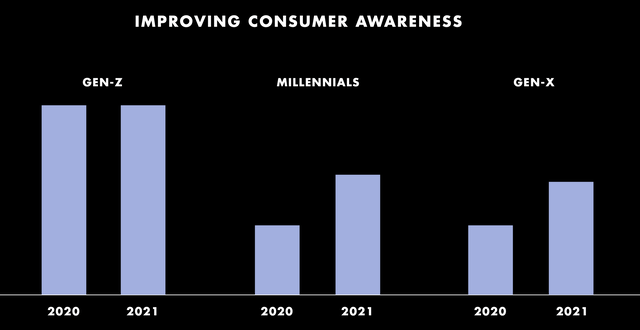

ELF also has an opportunity to expand its demographic to older customers. Its brands have great brand recognition among Gen Z consumers, but lags a bit with Millennials and Gen-X. International is another underpenetrated opportunity as well.

Company Presentation

Risks

The macroenvironment could be a risk as the economy weakens. However, cosmetic companies typically perform very well during periods of economic weakness or even recessions. This phenomena has become known as the "lipstick index." That said, we’d have to see how ELF’s sales hold up in such an environment given its young-leaning customer base.

Competition is always another potential risk. This is more likely to come from a new and upcoming brand, like Drunk Elephant but cheaper, than an older established brand. It’s also an industry that seems to draw a lot of celebrities into it, with Kylie Jenner and Kim Kardashian successfully launching and selling beauty businesses in recent years.

Finally, any damage to its brand reputation could be a big blow. The company really plays up the clean ingredients and cruelty-free nature of its products. However, it sources everything from China and sells its products at cheap prices, so there is always the possibility there could be some break down along the way.

Valuation

ELF stock trades around 29x the FY2024 (ending March) consensus EBITDA of $133.2 million and 26x the FY2025 consensus of $150 million.

It trades at a forward P/E of 47x the FY24 consensus of $1.56. Based on 2025 analyst estimates of $1.81, it trades at 40x.

Comparatively, Estee Lauder (EL) is valued at ~21x fiscal ’24 EBITDA (ending June). Fragrance company Inter Parfums (IPAR) has a multiple of ~19.5x ’23 EBITDA, while cosmetic retailer Ulta Beauty (ULTA) is valued at ~15x FY’24 EBITDA (ending January).

Conclusion

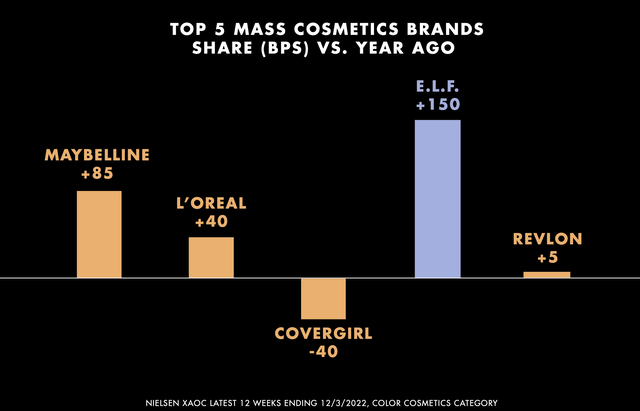

ELF has been on fire and you certainly can’t argue with its results. Its revenue growth this fiscal year has been astounding. It’s been able to raise prices, but also take market share.

Company Presentation

Company Presentation

The company also has plenty of opportunities ahead with store-shelf increases, additional product categories, international expansion and improved brand awareness among Millennial and Gen-X consumers.

ELF is clearly a momentum stock in a market generally lacking momentum. However, cosmetic companies tend to perform well during weak economic periods, so if you’re a momentum investor, this is a train to hop on board.

If you prefer turnarounds instead, I’d take a look at my initial write-up on rival Coty (COTY) and my post-earnings follow-up.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.