Vipshop Holdings Could Trade Lower As Online Shopping Cools Down In China

Summary

- Vipshop Holdings Limited is an online discount brand store in China.

- Vipshop Holdings could face additional headwinds from Chinese taking a break from online shopping.

- Sales, total orders and active customers metrics are not performing as they should and the trend could continue impacting the share price.

BongkarnThanyakij/iStock via Getty Images

Vipshop Holdings Limited to Face Headwinds from Consumers Who Appear to Be Taking a Break from Online Shopping

Shares of Vipshop Holdings Limited (NYSE:VIPS), an online discount brand retailer in China, may face some headwinds in the coming weeks as its consumers appear to be taking a break from online shopping according to some trends in certain business metrics.

At these levels of share prices, which do not seem low, the possibility of easing the position could be considered if a good profit can be made from the sale of the shares.

About Vipshop Holdings Limited in the Internet Retail Industry

Vipshop Holdings Limited, headquartered in Guangzhou, People's Republic of China, Vipshop offers high-quality and popular branded products through its web store that consumers across China buy at a discount from retail prices.

Looking at recent sales trends and the number of new customers the company has acquired, Vipshop Holdings Limited may be experiencing a decline in consumer visits and purchases from its online stores.

It could be that during the restrictive measures against the COVID-19 virus, a suppressed desire was fueled to be able to go out and visit brick-and-mortar stores instead.

From now on, after all the restrictions have been lifted, this pent-up desire to return to all the activities that could not be done from home, including shopping in brick-and-mortar stores, could continue to impact some key metrics of this online shopper such as sales and active customers, which eventually leads to some negative pressure on the share price.

Indeed, from this market analysis by Jing Daily, it appears consumers are returning to brick-and-mortar stores as China reopens borders and travel returns. Otherwise, luxury brands wouldn't invest heavily in physical stores to capitalize on in-person shopping.

Current Trends in Sales, Profitability and New Customer Acquisition

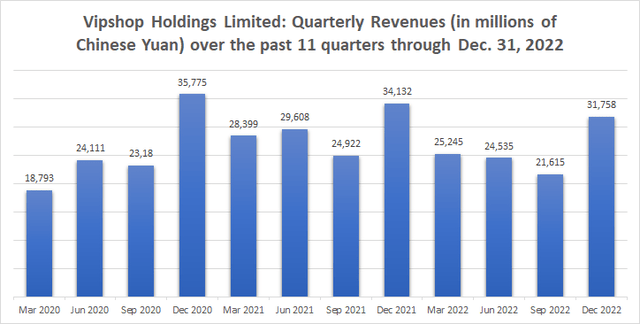

For the fourth quarter of 2022, Vipshop Holdings Limited recorded total revenue of 31.81 billion Chinese yuan [$4.6 billion], down 6.74% year-on-year.

The Chinese online store believes the drop in sales is mainly due to short-term disruptions in economic activities that have occurred during the strong resurgence of the COVID-19 virus in China.

However, as the graph shows, the trend was also negative when comparing other quarters of 2022 with the corresponding quarters of the previous year.

Gross Merchandise Value [GMV], which represents the total value of all products and services sold across the entire online retail business of Vipshop Holdings Limited, fell 4.6% year-on-year to 54.4 billion Chinese yuan (or ≈ $7.85 billion) in the fourth quarter of 2022.

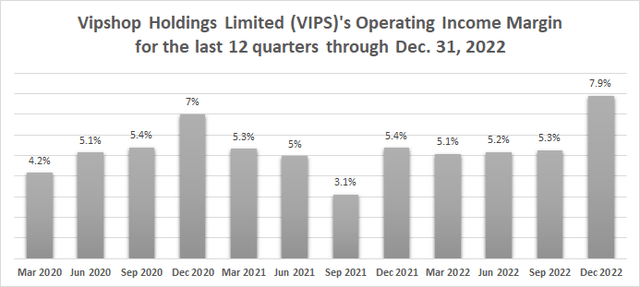

Instead, the operating margin increased 250 basis points year over year to 7.9% in the fourth quarter of 2022, as shown in the chart below.

The following trends may indicate a change in behavior among many Chinese consumers, who may be turning their backs on online shopping from Vipshop Holdings Limited for a while and prefer visiting more brick-and-mortar stores.

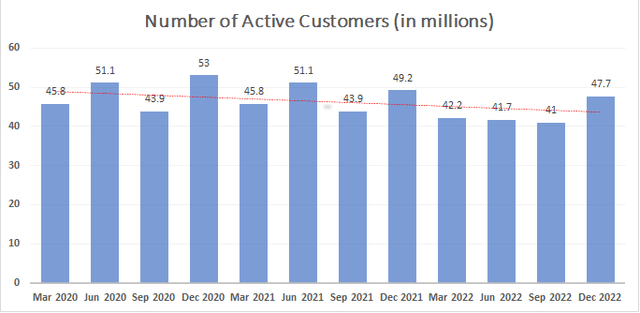

It doesn't come as much reassurance to know that the number of active customers fell by 3.05% year-on-year to 47.7 million in the fourth quarter of 2022.

Active customers are registered members who have made at least one purchase on the company's online retail marketplaces during the period in question.

In addition, the chart below illustrates the negative trend in the number of active customers on the web shop of Vipshop Holdings Limited, from one quarter to the corresponding one of the year before, and across all quarters (see dotted red trend line) from Q1 2020 to Q4 2022.

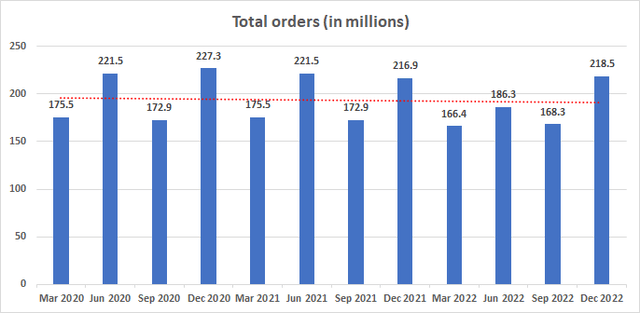

Regarding total orders, these have increased as Vipshop Holdings Limited recorded 218.5 million in the fourth quarter of 2022 compared to the corresponding quarter of 2021 when total orders were slightly lower at 216.9 million.

However, the improvement in total orders should have been much stronger considering that the first week of October was a National Day Holiday in China and online shopping was more likely due to the zero-tolerance period for the COVID-19 virus. When they stayed at home due to holidays or corona, the chance of online shopping was higher than normal.

Plus, as the chart below shows, total quarterly orders are generally down year-on-year, while the overall trend across quarters (see dotted red line) from Q1 2020 to Q4 2022 is also negative.

The total number of orders could certainly have been influenced by customers who prefer to combine all purchased items into one order to save on shipping costs. However, when the drop in total orders is combined with the drop in sales and GMV, it could indicate that people are also buying fewer products and services and then shopping less from Vipshop Holdings Limited's web-shop.

As the Chinese economy is currently under no threat of recession, the government and central bank continue to support consumption while inflation remains within the target range of 2%, thus fewer purchases from Vipshop Holdings Limited's web store are likely due to physical stores becoming more popular these days, according to market analysis by Jing Daily.

Now that Chinese consumers are able to visit physical stores again as all measures under the zero-tolerance policy towards COVID-19 have been lifted, investors need to consider that the negative trend in Vipshop key metrics could continue for a while affecting the share price.

The Financial Condition of the Company

In terms of the balance sheet, Vipshop Holdings Limited appears to be solid.

As of December 30, 2022, the balance sheet showed a total of ≈ 24.7 billion Chinese yuan (≈ $3.58 billion) in cash and short-term investment, of which 89% was cash (including restricted cash) and the rest was in short-term investments.

Net cash was ≈ 20.42 billion Chinese yuan (≈ $2.95 billion) when current borrowings of 2.69 billion Chinese yuan (≈ $388 million) are taken off from total available cash and cash equivalents (including restricted cash).

The company's total debt was 3.66 billion Chinese yuan (≈ $530.2 million), as it also included 136.4 million Chinese yuan in short-term lease obligations (≈ $19.8 million) and 833 million Chinese yuan (≈ $120.8 million) in capital leases.

As of December 30, 2022, Vipshop Holdings Limited incurred a 12-month interest expense of 24.3 million Chinese yuan (≈ $3.5 million), which was fully covered by the 12-month operating income of 6.2 billion Chinese yuan (≈ $895 million).

According to analysts at GuruFocus, Vipshop Holdings has a weighted average cost of capital of around 3.95%, while the return on invested capital is around 12.97%.

Vipshop Holdings generates returns in excess of the company's costs for the capital it has to raise for its investment, indicating Vipshop's ability to create value for its shareholders.

The balance sheet also has an Altman Z-Score of 3.93, which means that the financial position of Vipshop Holdings is in safe areas and there is no risk of bankruptcy.

Vipshop Holdings Limited does not currently pay dividends.

Analysts' Estimate of Earnings and Sales

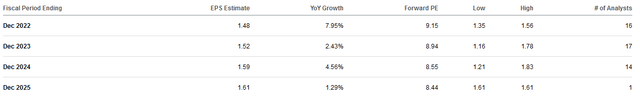

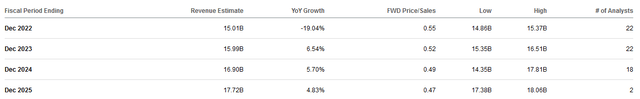

Compared to previous years, analysts are assuming significantly lower growth rates in profit and sales for the next few years.

The table below illustrates year-over-year growth rates in EPS for 2022 and the following 3 years, while 20.62% and 20.06% were the growth rates in diluted EPS in the past 3 and 5 years.

The table below illustrates year-over-year growth rates in revenues for 2022 and the following 3 years, while 5.54, 9.26% and 40.42% were the growth rates in revenues in the past 3, 5 and 10 years.

The Stock Valuation

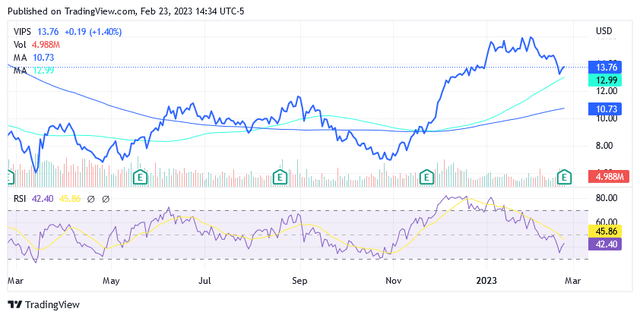

Vipshop Holdings Limited shares are trading at $13.76 per unit at the time of this writing, giving it a market capitalization of $8.28 billion.

Shares are not trading low as they are above the 200-day and 75-day simple moving average lines. Shares also trade above the midpoint of the 52-week range of $5.75 to $16.18.

As such, investors may want to take advantage of these stock prices as they may appear to be on the brink of potential devaluation based on the following trend. Sales and active customer data could suffer further as customers are more willing to visit brick-and-mortar stores than online shops as China freed society and economy from the restrictive COVID-19 measures.

It is also possible that sales and profitability will grow much faster than before, creating the confidence that would propel the stock price back up.

However, this scenario has a very low probability as the zero tolerance to COVID-19 has created such a pent-up need to personally return to the shops and spend some of the Chinese's free time in this way, which, for shares of Vipshop Holdings Limited, may not have fully exhausted its headwinds.

Additionally, there is currently the following risk to take into account: ownership of shares in Chinese companies listed on American markets imply the potential to be delisted in retaliation due to ongoing geopolitical tensions between the US and China, recently exacerbated by the U.S. shot down of "spy" balloons.

Upside Risks Section

The company has recently slashed much of its marketing spend as the item fell 44.4% year over year to 2.83 Chinese yuan (about $409 million) in 2022.

Investors do not welcome this company's move as a positive trend in marketing spend would instead be seen as a key to increasing Vipshop Holdings Limited's sales.

If the company can send a strong signal in that direction, enthusiasm for this stock could return soon, potentially pushing the share price higher than it is today.

The offering of more discounts on the products and services available on the website could divert some of the demand that's been pouring more into physical stores lately. This type of policy could result in better metrics for active customers and total orders, and ultimately higher sales, offsetting headwinds from brick-and-mortar stores that have recently gained popularity.

The company could provide customers with better returns management terms, and this kind of development could also generate some demand.

Vipshop Holdings Limited could also equip the website with other fintech technologies to facilitate the successful completion of the orders and thus reduce the occurrence of relinquishment.

All these website empowerments are possible, as Mr. Eric Shen, Chairman and CEO of Vipshop, said that Vipshop now has merchandising, operations and technology capabilities.

A solid balance sheet with massive cash balances gives the company ample financial resources to create more exceptional value on its platform and attract more online shopping activity.

Conclusion

Vipshop Holdings Limited continues to pay for the negative trend that is causing consumers to put online shopping aside for a while as they have developed a strong desire to engage more in other activities such as physical shopping during the Covid-19 and others away from home walls.

This negative trend is reflected in some business metrics, such as declining sales and the number of active customers, which could put further pressure on the share price.

The current share prices are not low, which would allow for a good return if the shares were sold. Therefore, given the deterioration in the growth prospects of the company, investors should consider a Sell rating on Vipshop Holdings Limited.

Targeted empowerment in the areas of merchandising, operations and technology could promote online shopping on the company's web shop and counteract the current trend in customer behavior. The company has the financial ability to improve its key metrics.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.