Caesars: Q4 Earnings And FY Totals Point To A Happy Ides Of March

Summary

- Caesars Entertainment, Inc.'s Vegas properties showed a healthy y/y 11% pop in 4Q22.

- Total FY revenue hit $10.8b - a strong showing considering the persistence of covid through at least mid-year in many markets.

- The corporate culture change since the EL Dorado merger has shown how a far more savvy management can make a difference.

- Looking for a helping hand in the market? Members of The House Edge get exclusive ideas and guidance to navigate any climate. Learn More »

lucky-photographer/iStock Editorial via Getty Images

“Experience is the teacher of all things….” - Julius Caesar

As always when making calls on Caesars Entertainment, Inc. (NASDAQ:CZR) shares, I invoke my view of the trail of management coming from my years in the c-suite of that company back in the day. The transformation from the corporate culture when I was part of the group that created it has been dramatic. I am in touch with many friends, associates, and people I mentored to stay tuned in as it were to the company’s shifts in how they plan and execute their goals.

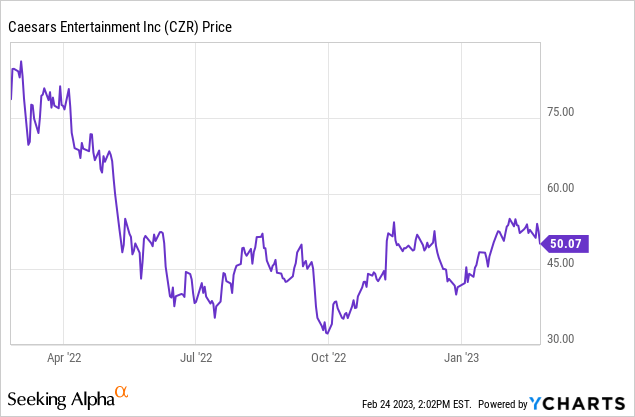

To begin with, I note that my last analysis of CZR for Seeking Alpha was published on July 2, 2022. The price at publication was $42.65, my guidance was strong buy. Since then, the stock has wobbled and thrusted with the head and tailwinds of the U.S. gaming market. At this writing it trades at $53.89. It spiked last week on the release of its 4Q22 quarter plus its FY totals by 3.5%.

Above: The stock has more run room now that we are at the early but robust recovery cycle of the post-covid era for Vegas and U.S. gaming in general.

Caesars Entertainment, Inc. in 2022 showed a net loss ($899m) vs. ($1b in 2021). This is one part of the investor scenario that continues as a concern, especially if we hit a recession sometime in the second half of this year and even though losses have gone down. Bear in mind we are still at the early stages of the post-covid era. The Strip is healthy again, and the regional business is holding its own. Also key here is that while CZR’s sports betting unit had revenues ~$600m for 2022 on handle of $12.8b, its hold was below a normalized 7% at 5.4%.

This was undoubtedly due to the generally higher average number of sharps in the CZR customer base. Its 4Q digital business shaved losses considerably and management’s guidance of turning digital profitable this year should hit its target. CZR was among the first of the 14 sports betting platforms to slam the brakes on marketing spend for new customer acquisition.

No major legalizations are expected to go live this year, so all 30 sports betting markets will be operating against existing organic growth in the sector. We are forecasting that CZR’s digital revenues will rise above $1b for 2023, keeping it within the top tier of operators with leader FanDuel (OTCPK:PDYPY), DraftKings (DKNG) and BetMGM (MGM). Its ability to hold or increase share is related to many factors. Its live casino sports books in the states where legal and where it inherited the William Hill customers when it bought the company in the spring of 2021.

While this analysis looks at the recent historical transformation of the company, I worked for through many slings and many arrows of outrageous fortune, I think a flashback from the recent past is in order.

I am boosting my PT on CZR to $78 by 2Q23.

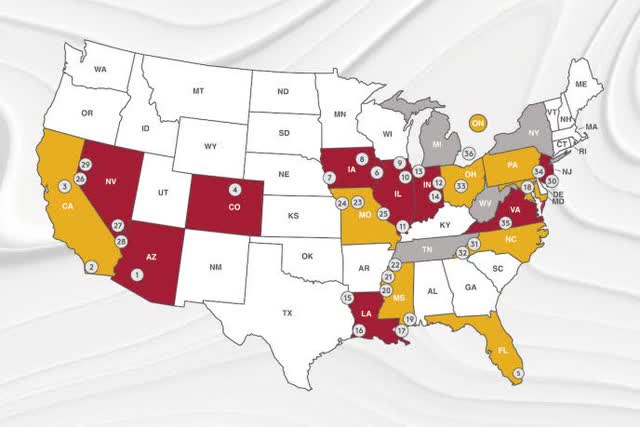

Caesars corp.

Above: CZR's national geography of 50 properties gives it an ability to manage through headwinds and benefit from tailwinds from a broad geography.

For context, a brief history follows and the rationale for my bull scenario for my alma mater. It hangs on the premise that the past is prologue, as uttered by Antonio in Shakespeare’s The Tempest. That means what was is always an echo of what is. And a succession of storms is exactly what the company has endured since 2008 to reach what I believe is the takeoff point now for a $78 stock by the end of IQ23.

2008: Caesars is bought by private equity operators Apollo Global and TPG for $31b paying a 31% premium. At the time, CZR was the nation’s biggest casino operator without an Asian presence. It was a bad deal on many levels, but a happy time for CEO Gary Loveman, who got a huge haul. The deal closed in the teeth of the 2007/9 financial crisis. Las Vegas gaming will have sunk over 10% during the recession that followed the mortgage crisis.

The TPG guys publicly admitted that the CZR transaction had proven to be “a bad deal.” Private equity brought nothing to the table but more complications to management and bad asset allocation decisions. My former associates in the company, almost to a person, complained that CZR was in trouble and upper management nee private equity did not appear to have a solution.

2015: The inevitable combination of massive debt incurred by the private equity deal, the financial crisis and a management group filling old wine solutions into new bottles triggered an $18b bankruptcy with the company $24b in debt.

Second tier note holders in hedge funds battled a proposed settlement that kept first tier holders whole, and dumped most of the haircut on them. After a prolonged legal war, where accusations of illegal asset transfers abounded, an appointed master held for the hedge funds, forcing the bankruptcy deal to significantly improve their recovery.

2017: After the steel cage battle royal with the hedgie noteholders, Caesars Entertainment, Inc. emerged from the bankruptcy. CEO Loveman took the money and ran. He was replaced by a former Hertz executive whose primary task was to be a steward who knew zilch about gaming, but was a cost cutter.

2020: Eagle-eyed Carl Icahn, who over his career has cleaned up on the blunders of several gaming operators, knew a bargain when he saw it. Early that year, he bought 20.88% of the company (~21m shares), averaging around $8.45 to $9. He quickly joined the board, dismissed the placeholder CEO, and installed gaming pro Anthony Rodio to head the company. Rodio immediately returned key decision making to property heads by eliminating many corporate oversight mandates.

Icahn’s long view of the casino business is that it is such a mathematically pristine business that only mismanagement can screw up its inherent profitability. And each time he’s acted on that strategy, he has taken billions of dollars off the table. His CZR move clearly met that standard.

Mid-July 2020: Icahn had been searching around for a merger for CZR. Tom Reeg, CEO, of highly profitable regional gaming operator El Dorado Resorts, stepped up to the plate and was first to lay money on the table. Despite much skepticism from many analysts about the mountain of debt incurred, Reeg and Icahn went ahead. El Dorado bought CZR for $17.3bm of which $7,2b was in cash and the balance in CZR shares.

Since then, Reeg and his team have narrowed focus on five key areas: manage through the covid crisis, preserve and build on solid Las Vegas presence anchored by Caesars Palace, focus its 55m Caesars Rewards database on its most valued repeat customers, launch Caesars Sportsbook and attain market share leadership among the top platforms in the space. Atop the must-do list, escalate as feasible the reduction of the company’s $24.4b in long-term debt speedier than ever.

2023 and beyond

Several key issues were clarified by the 4Q22 earnings call. Primary among them was the long-awaited news by investors of a sale of a CZR Vegas strip property. The presumed strategy was to apply most if not all of the proceeds of such a sale to debt reduction. (CZR has 4.5X leverage after $200m in pay downs last year and is aiming at 4X or less for this year.) It shows cash and equivalents on hand (mrq) of $1.0b plus $2.2b in available revolvers. Its next maturity decisions are 2.5 years away.

The ongoing $4.5b portion of debt has now been refinanced at a fixed rate of 7%. Nobody can fight the Fed, for sure, so whatever happens to rates going forward is anyone’s guess. One certainty is that it is highly likely that the era of free money is gone and that Powell is far from finished raising rates. We think 7% at this juncture is a prudent forward guess by CZR.

Among the properties that appeared to be candidates for sale were two: The Rio, off the strip, and the dowager of the famous four corners of the strip, the legacy Flamingo. The Rio realty was sold in 2019 to Dreamscape, an investment firm. CZR will run the property until Dreamscape takes on management as well, already in motion.

Caesars corp.

Above: The Flamingo at the four corners, the single best chunk of realty on the Las Vegas strip began with Mr. B. Siegel in 1946 and became Barron Hilton's pride and joy money machine by the 1980s.

The Rio had been a tough tiger to tame all these years due to its off-the-strip location. But prior managements kept the property going on its famous buffet targeting locals, its attractive pricing, and its share of the convention and meeting business, which has been key to Vegas growth for a decade or more. That was an easy layup. The Flamingo presented a tougher decision.

The Flamingo, on the other hand, has been a long-term cash cow. When it was owned by Hilton, Baron Hilton himself once told me it was his proudest success. The property was a basic price leader with a super location. Its slot business was the envy of the entire town. And it was able to feed off the Southern California weekend package deal market for decades. But as the saying goes, the old order changeth.

Hence, the decision to hold the property. CZR will invest $850m, to bring the 3,400 room hotel into today’s customer mindset. In a broader context, we have seen how expansion continues in Vegas with the arrival of the mammoth Resorts World property bringing 3,500 rooms to the strip in 2021. Add to that the $3.7b Fountainbleu scheduled to open late this year with 3,700 more rooms. Furthermore, there are the pending plans of billionaire Tillman Fertitta for another major strip resort. So, the clear conclusion of CZR was the right one.

The decision facing Caesars Entertainment, Inc. was to ponder selling it, losing the cash flow, yet understanding that a buyer would pour money into a renovation. Though the strip geography as it were has moved to a spread-out, somewhat blurred “center,” the Flamingo is pure realty gold where it sits. So the decision came down this way: Instead of selling the property, why not do what any buyer would do and update it yourself? What could the Flamingo be if it were updated to appeal to today’s Vegas visitor with lots more 21 st century bells and whistles?

Given the cost of a ground-up development to be on a leftover strip location as it were, that could easily cost between $3b and $4b, the sensible move was to put $850m in the Flamingo rather than sell it. And on the other side of that redo, you have an operating property churning tons of cash that would have cost 4X as much to build from scratch.

The Flamingo will not be closed during the reno process.

Though the possibility of a recession hit looms ahead, I believe Caesars Entertainment, Inc. management has demonstrated its resiliency and focus that will catch tailwinds I expect to be ahead in 2023.

Our Price Target on CZR is essentially a management story. It is a company that has weathered a series of mishaps, firestorms and management blunders beyond measure for the last 14 years. Yet it has emerged from the multiple messes and its management appears to be in good control of its destiny going forward. It is committed to improving its debt profile, it has participated in the recovery of Las Vegas, holding its own in the regions and moving toward maintaining its share of the sports betting leadership group.

Alphaspread’s formula of discounted cash flow ("DCF") values Caesars Entertainment, Inc. at $63 a share, or ~14% undervalued. Analyst consensus forecast for EPS is at $0.93 for this year. Our calculations foresee improving performance of CZR regional properties in areas less likely to be impacted by recession—if there is one. It also considers the ramping operation of its new Danville, Virginia temp casino. Based on our intelligence network discussions with industry associates, all expect Las Vegas strip recovery to continue and even beat this record year, with a building return of meeting and convention business plus sustaining pent-up demand business facing down recession to a reasonable degree.

We are looking at 2023 for Caesars Entertainment, Inc. stock to produce EPS of $2.30 a share if a recession is a relative soft landing. If not, we continue to see an earnings range of $1.45 to $1.55 EPS based on the above scenario.

For in-depth and deep dive research on the casino and gmaing sector, subscribe to The House Edge. New: Free excerpts from our book in progress "The Smartest ever Guide to Gaming Stocks" - free to existing members and new subscribers.

This article was written by

For 30 years I held senior vp and exec VP positions in major casino hotel operations among them Caesars, Ballys, Trump Taj Mahal and have done extensive consulting assignments for many others in the US, including the native American property Mohegan Sun, in Connecticut. I have also done special projects for Caesars Palace in Las Vegas. I was the founder and publisher of Gaming Business Magazine, first ever publication covering the gaming industry and have written extensively about the industry.

MY INVESTMENT STRATEGY: Due to the necessities of my casino consulting business which encompasses many top gaming companies, I have placed my own gaming portfolio into a blind trust over ten years ago. At that time I instructed my money manager(who is a former industry colleague herself as well as a corporate lawyer and money manager) to follow my gaming investment strategy along these lines.

1. I am a value investor first. Knowing the industry in depth I am able to plumb opportunities and problems others cannot see. Mostly I like to identify price ranges over given periods where I believe the market is asleep and I can buy in at the lowest possible risk. 2. I am a strong believer in management quality. Knowing so many top people in the industry allows me to evaluate which ones I believe have the "right stuff" to move a stock and which are populated by corporate drones. 3. I have instructed my manager never to trade on sugar high spikes in earnings or news per se but use the "string theory" I have developed which in brief, follows a skein of news and earnings releases over set periods of time for each stock and then move in or out. 4. I have instructed her to keep the portfolio diverse with holdings in four basic areas: Casino stocks in Las Vegas, Macau and the regionals, gaming tech stocks with real moats not just cute apps.

I am pleased to announce that as of September 1, 2022 I am expanding my coverage to include entertainment stocks, a sector undergoing a massive revolution on many fronts. This has sprung loose many investment ideas in the space I expect to share with members. The coverage is added at no extra cost.

I have been involved in the entertainment sector as well for decades involved in overseeing show and events in my properties as well as independent productions. I currently sit on the board of privately held Atlas Media Corporation, one of America;s premium non-fiction producers of tv and film programming.

Overall I have done immensely well and share my views with SA readers and more specifically with strong recommendations and gaming stock strategy analysis based on my network of industry contacts for subscribers to my SA Premium Site: THE HOUSE EDGE.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.