USRT: More Downside Risk Than The Broader Market In 2023

Summary

- USRT invests in U.S. REITs.

- The fund is sensitive to changes in the economy.

- The elevated rate environment can cause distress to many stocks in USRT’s portfolio and some may have to cut their dividends.

- The fund has underperformed in the S&P 500 index in the long run and is more vulnerable in a bear market.

Kwarkot

ETF Overview

iShares Core U.S. REIT ETF (NYSEARCA:USRT) owns a portfolio of U.S. REITs. These REITs can be quite sensitive to changes in the economy. A growing economy means higher demand for rental space and will result in higher rental income. On the other hand, a weakening economy will result in lower demand and impact their rental incomes negatively. Given that we are in an environment where the rate will likely stay elevated for a lengthy period and that the economy may continue to weaken, many stocks in USRT's portfolio may be forced to cut their dividends as the year unfolds. Therefore, we currently have a neutral rating on USRT especially in this time of uncertainty.

YCharts

Fund Analysis

REITs is sensitive to changes in the economy

REITs tend to do well in an economic boom. Strong economic activities often lead to higher rental incomes as business expansions typically will require more rental space. As a result, REITs can earn more rental income. On the other hand, in an economic downturn, many businesses will be more careful about any expansion plan. Some may even choose to reduce their rental space. This will result in lower occupancy rates and may lead to lower rental incomes.

The fund has more downside risks and less upside potential than the broader market

Many investors often perceive REITs as defensive stocks because they offer attractive dividends. This is a misconception though. The reality is that REITs are often more volatile than the broader market. When we look at USRT's portfolio characteristics, we realized that it has a 3-year and 5-year betas of 1.07 and 1.09 respectively. For reader's information, beta is a measure of the tendency of securities to move with the market. A beta of 1 indicates that the security's price will move with the market which is often measured vs. the S&P 500 Index. A beta less than 1 indicates the security tends to be less volatile than the S&P 500, while a beta greater than 1 indicates the security is more volatile than the S&P 500. Therefore, USRT's beta ratio above 1 means that it is more volatile than the S&P 500.

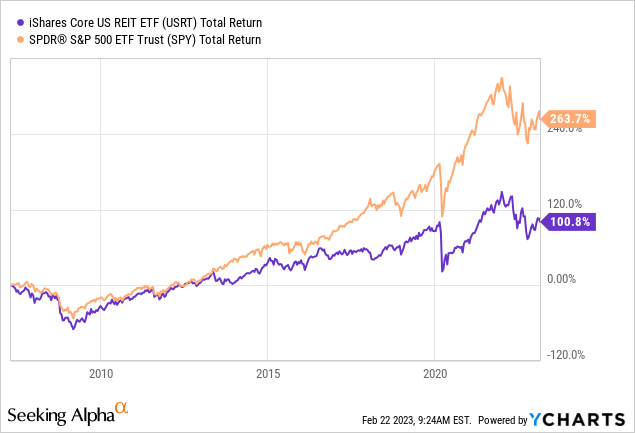

This higher volatility than the broader market is acceptable if it can earn better total returns in the long run. However, USRT appears to have lower total returns than the S&P 500 index in the long run. As can be seen from the chart below, USRT's total return since its inception in May 2007 was about 100.8%. This significantly underperformed the 263.7% total return of SPDR S&P 500 ETF (SPY) which tracks the S&P 500 Index.

YCharts

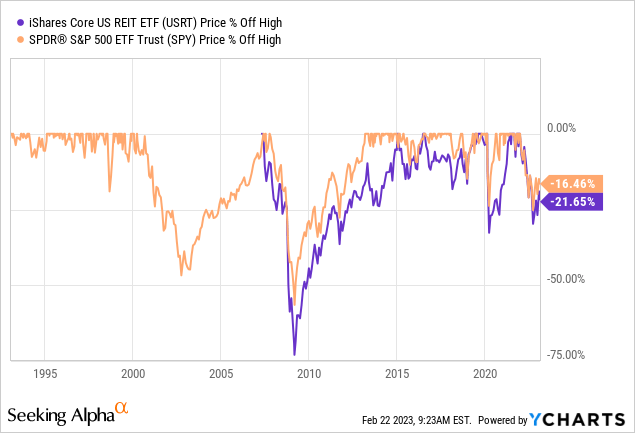

We now also look at how USRT fare in a bear market. As can be seen from the chart below, USRT also underperformed against the SPY in a bear market. It is worth noting that in the Great Recession, USRT has declined nearly 75%. In the recession caused by the pandemic in 2020, USRT also had a much larger decline than SPY. The same is true for USRT in the current bear market. As can be seen, USRT declined by 21.65% since reaching the peak in late 2021. On the other hand, SPY only declined by 16.46%.

YCharts

Distribution may be reduced substantially if rate is elevated for a lengthy period

Given the sensitivity of REITs to the changes in the economy, investors should know that in times of economic distress, REITs may be forced to cut their dividends to preserve cash. This is because REITs in general already have high payout ratios as they pay out a large proportion of their net operating incomes to shareholders. Therefore, in an economic downturn, their net operating income may diminish and they may not have enough cash to pay to their shareholders. In addition, if the rate also moves higher, they will end up with higher interest expenses. In order to prevent a payout ratio over 100%, management may have no choice but to cut their dividends.

We are currently in a high rate environment and in the same time the economy may gradually weaken as the year unfolds. Over the past few months, we have observed quite a few REITs in USRT's portfolio that had to cut their dividends. For example, SL Green (SLG) cut its dividend by 13% in November 2022 in order to preserve cash. Another example is Vornado Realty Trust (VNO) which announced to cut its dividend by about 29.2% earlier this year. We think the possibility of more dividend cuts announced by REITs in USRT's portfolio is high especially if the rate continues to stay elevated throughout the year.

Should you own USRT now?

While USRT can offer positive total returns in the long run, its return was inferior than the S&P 500. It also appears to have more downside risk as well. Since 2023 is going to be a challenging year as the Federal Reserve is likely to keep the rate elevated for a lengthy period of time and a recession may be in the horizon, we think there is substantial downside risk. We do not see the reason of owning USRT now and think investors should stay on the sidelines.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.