Mid-America Apartment Communities Can Withstand Years Of High Interest Rates

Summary

- In this article, I explain why cap rates will not increase one-to-one with interest rates.

- And why some REITs are likely to continue to do well even during a prolonged period of high interest rates.

- I will illustrate this on Mid-America Apartment Communities, which has one of the best residential portfolios in the U.S. and trades at a reasonable implied cap rate of 5.5%.

Marje

Dear readers/followers,

Recently, lots of people have been asking what will happen to real estate investment trusts, or REITs, if interest rates stay at elevated levels for a long period of time. While this is not my base case and I expect the Federal Reserve to cut rates sometime next year, it is definitely a scenario which we as investors should consider.

In order for this scenario to materialize, inflation would have to prove very sticky, which would force the Fed to keep interest rates at 5% (or perhaps even higher) for years to come. This would likely lead to a lot of pain in the economy and the market, as earnings would suffer from a weakening economy and a high cost of debt. I expect that major indexes like the S&P 500 (SP500) and Nasdaq (COMP.IND) would go more or less sideways, and we could be facing another lost decade (meaning that we wouldn't see new all-time highs for a very long time).

This is a scary scenario, especially for those living off their portfolios. The common school of thought is to buy the S&P 500 index, which has a dividend yield of under 2%. In order to be able to withdraw and live off the usual 4%, one has to sell about 2% worth of stock each year. This is perfectly sustainable under normal market conditions but will drain the portfolio significantly during a lost decade. This is why I believe it's important to prioritize income over growth in this part of the cycle and buy high-dividend stock that will increase the overall yield of the portfolio such that if we get a long period without significant growth, income investors can live off their dividends and don't need to sell their stock.

REITs can help solve this first part of the equation with their higher-than-average dividend yields. But we need to make sure that we are buying the right ones and at the right price so that we can weather a prolonged period of high interest rates, should it come. In this article I want to introduce my methodology to finding and evaluating REITs that should be resilient in the described scenario, give you a framework for valuation and give an example of one REIT that I believe should be fairly resilient - Mid-America Apartment Communities, Inc. (NYSE:MAA).

Methodology

In short, it all comes down to cap rates and leverage. When we had zero interest rates, a cap rate of 4.0% for multifamily was regarded as fair. Now that interest rates have increased, some investors are saying that cap rates should adjust one-to-one with that increase. So with rates now at 4%, cap rates should increase to 8%. Currently, cap rates have only adjusted marginally, because investors (including me) are somewhat looking through the period of high rates, expecting them to come down. But I'd argue that even if rates stay at the 4% level forever, cap rates won't go to 8%. Let's have a look at an example to illustrate why.

Suppose a REIT only owns one apartment that rents for $1,000 a month ($12,000 a year). It bought it for $300,000 and borrowed 30% of that at zero rates (of course even then they paid a margin to the bank, but ignore that for simplicity). It is clear that they bought it at a 4% cap rate and since the cost of debt is zero, they earned a net yield of 4% after debt.

Now we want to have a look at what will happen, if rates increase to 4%. The apartment will still rent for $12,000 a year (perhaps more over time with inflation), but now the cost of debt will increase to $3,600 a year. In total the REIT will earn $8,400 so a net yield of 2.8% on its purchase price (obviously lower than the initial 4% net yield).

The question is, how much would someone else pay for this apartment in this higher rate environment? A rational investor would still want a net yield of 4% on his money so if we divide $8,400 by 4% we get a price he's willing to pay of $210,000. At this price the investor is paying a 5.7% cap rate for the $12,000 of income that the apartment generates. Not 8%, but 5.7%!

On this level, it's intuitive, but the math works exactly the same way for a REIT that owns thousands of properties. So let's generalize the formula:

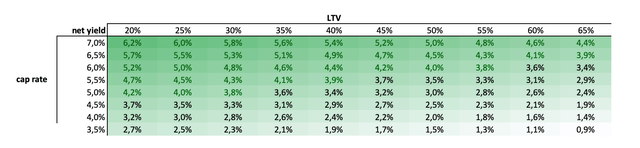

minimum implied cap rate I can pay = my required net yield + interest rate x LTV on the new purchase price (i.e., the $210,000 not the initial $300,000).

For an interest rate of 4%, the table below presents net yields based on the implied cap rate (left column) and implied LTV (top row). For example, if I want a net yield of 4% (which I regard as fair) I can buy either a REIT with an implied cap rate of 5% and an implied LTV of 25% or one with a 6.5% implied cap rate and an implied LTV of about 60%. It's always a function of the price we pay and the level of debt the company has. So now that we know what we're looking for in terms of price and debt, let's have a look at an actual company.

Created by Author based on formula above

Mid-America Apartment Communities

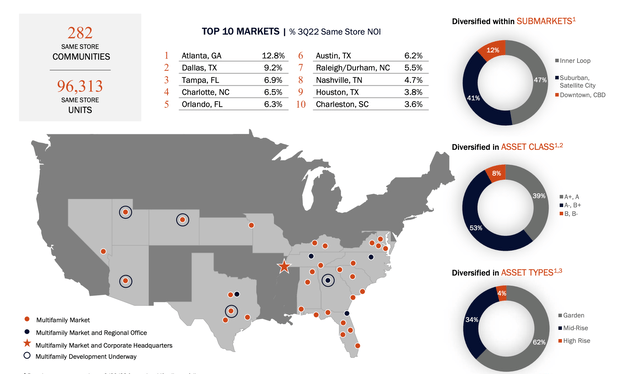

MAA owns and operates one of the best residential portfolios in terms of location. Its 282 communities with almost 100,000 units are located exclusively in major urban areas in the growing Sunbelt region, excluding California. I've covered the positive outlook for the region in detail in my article on Camden Property Trust (CPT), so I won't repeat myself here.

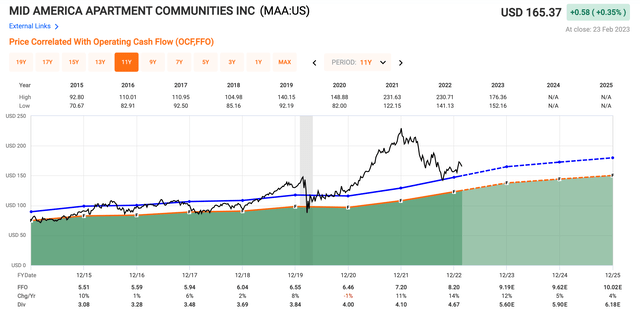

2022 results were great for the company, in particular, their funds from operations ("FFO") increased by 14% YoY to $8.20 per share, primarily driven by same-store NOI increase of 17% YoY and a solid 96% occupancy. Effective average rent per unit increased by 14.6% YoY to $1,565/month. Going into 2023, the management expects occupancy to be stable and NOI growth to slow to about 5.3-7.3%, which is still very solid and above the expected growth of most other REITs.

Like many of its peers, the company has a very active development arm, which allows it to build properties at a significantly lower cost (higher cap rate) compared to buying existing properties on the market. MAA currently has 6 communities under construction with 2,310 units due for completion over the next three years. Similarly to BSR REIT, MAA also has a redevelopment program where it essentially updates all of the units with a new kitchen, light fixtures, and flooring. Over the last three years, they have upgraded 30,000 units at an average cost of $6,100 per unit. This generated an average monthly rent increase of $133 - an impressive 26% cash-on-cash return, though I am quite skeptical of this, because the cost to update these units feels very low based on my experience of what a remodel like that costs.

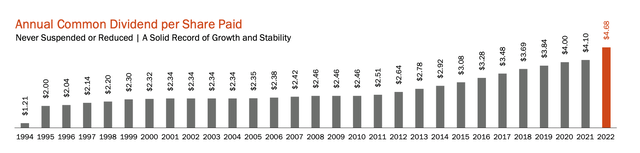

The REIT has a history of growing its dividend. Most recently, the company announced a 12% increase of its dividend to $5.60 per share (Q4 2022 Earnings Report). At today's price, this corresponds to a yield of 3.4%. With a forward 2023 FFO expected around $9 per share, this represents a payout ratio of 62%, which is very sustainable. Going forward, I think they can continue to grow their dividend, though at a slower pace, likely a bit below NOI growth.

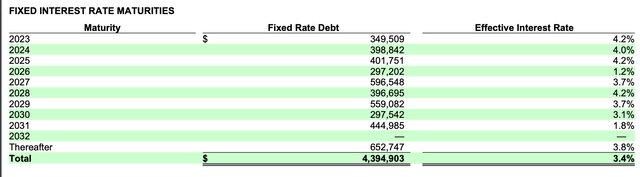

MAA has an A- rated balance sheet with about $4.4 Billion in debt, 100% of which is fixed rate, with a weighted average interest rate of 3.4%. There are significant debt maturities of $350-400 Million a year in 2023 and 2024. Since this debt currently has a 4% interest rate, when it gets refinanced, I estimate that the rate on new debt will be about 1-1.5% higher. This will translate into a $10 Million increase in interest expense. However, with over a billion in NOI, this is hardly significant. Notably, the total LTV is very low, as we'll see in the valuation section below.

Valuation

The REIT trades at a P/FFO multiple of 19.8x. This is definitely on the higher end for residential REITs and about 10% above its historical average multiple of 18.0x. Compared to peers, the company trades at a premium - I think some premium is justified, as the REIT has no exposure to California (vs. Camden), but frankly, the current premium seems a little high. Overall, from a relative valuation standpoint, the company seems slightly on the expensive side. Consequently, I wouldn't expect a significant upside from multiple expansion here.

| REIT | P/FFO multiple |

| MAA | 19.8x |

| CPT | 17.8x |

| BSR | 16.8x |

With a total NOI of $1.3 Billion in 2022, the company trades at an implied cat rate of 5.5% which is on par with other Sunbelt peers. With $4.4 Billion in debt, the implied LTV stands at just 19%. The combination of a relatively cheap valuation and low LTV will make the REIT very resilient, even at times of high interest rates. In particular at this valuation, even in a 4% interest rate environment, investors can expect the REIT to earn a healthy net yield of about 4.7% on their assets (see the sensitivity table above). This should be enough to cover the dividend and weather the high interest rate environment.

So with that said, what can we reasonably expect from MAA going forward?

- 3.4% dividend yield (growing at 5-6% per year)

- 6.3% FFO growth for the next two to three years

- no multiple expansion as the company is fairly valued here at 19.8x FFO

- -> total return of 9.7% per year.

Remember how I generate alpha:

- start with a thesis why a given industry/sector should outperform

- stay overweight in those sectors for as long as the thesis is valid

- look for companies with sound fundamentals that are either undervalued or fairly valued with exceptional growth prospects

- if a company becomes overvalued, trim the position and rotate into another stock/sector that is still undervalued

- if a company becomes increasingly undervalued and the thesis is still valid, add to the position

- generate alpha and repeat

My total return then comes from the dividend yield, EPS growth, and multiple expansion as the valuation normalizes over time. I always target a total return in excess of market returns (>8%) to generate alpha.

What things do I look for when selecting individual stocks to buy?

- strong and safe fundamentals

- good management teams with a track record of caring about shareholders

- healthy EPS growth

- well-covered dividend

- discount relative to peers and/or historical fair multiples

- other catalysts.

Verdict

Mid-America Apartment Communities, Inc. is a solid company with a very good portfolio. It has a track record of growing its NOI and dividends and will likely continue to do so in the future. The company has a fair implied cap rate of 5.5% and trades only slightly above its historical fair P/FFO as well as the multiple of peers. I think you are buying quality here and expect the stock to do well and return 9-10% per year going forward.

On top of this, Mid-America Apartment Communities, Inc. can serve as a good hedge in case interest rates remain elevated for years to come and broad indexes move sideways. In this scenario, MAA will provide a higher dividend compared to the index and thanks to its low average and a reasonable implied cap rate, will continue to earn a healthy net yield of 4.7% even in a high interest rate environment. I think you cannot go wrong with Mid-America Apartment Communities, Inc. stock and although I don't expect major outperformance, I rate it as a "BUY" here at $165 per share.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of MAA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.