Direxion Daily Healthcare Bull 3x Shares: The CURE / S&P 500 Divergence Is A Tell

Summary

- Launched in June 2011, CURE has a long track record for a leveraged ETF.

- What makes this 3x leveraged ETF truly unique is its shockingly high multi-year returns.

- Its recent divergence from the S&P 500 is a "tell" about market conditions.

- The Healthcare Select Sector SPDR Fund is now down 8 weeks in a row -- a new record. Expect a sharp snap-back to the mean.

nuttapong punna/iStock via Getty Images

The expression "timing is everything" takes on an extra level of urgency and paranoia when it comes to trading 3x leveraged ETFs. The wrong week is the difference between ecstasy and perdition.

Even the act of holding them too long is, in itself, dangerous. Leveraged ETFs are known for their natural decay. Due to a multi-day tracking inefficiency called "beta slippage," their value tends to decline and can result in losses even when their underlying index is favorable.

However, for those swing traders who know the hazards and can calmly assess the price action through technical analysis, a highly leveraged ETF can provide the perfect tactical tool.

Direxion Daily Healthcare Bull 3x Shares (NYSEARCA:CURE) tracks the composition and activity of the Health Care Select Sector Index, a core aggregate of mega-cap companies engaged in various aspects of that broad industry.

CURE's aim as a leveraged fund is to provide three times the performance of the benchmark index - specifically, achieving a magnified return on a single-day basis and not on a cumulative basis. It does this using derivatives and debt instruments. In addition to equities and cash reserves, 8.5% of its total holdings is an index swap (a hedging contract in which a party exchanges a predetermined cash flow with a counterparty on a specified date predicated on the index). In terms of its equities, the fund's largest single stock holding is in United Healthcare, with 7.21% of the investment. The second-largest investment with 6.55% is JNJ. Merck holds third rank with a 4.28% share.

Looking at the fund's basic stats: CURE is a passive ETF with a high expense ratio of .97 and small quarterly dividend of .41%. What makes this fund distinct of course is that it is a 3x leveraged passive fund: this can be seen in the ETF's high beta of 2.13 and its alpha of 5.53.

Launched by Direxion Investments in June 2011, CURE has a long track record for a leveraged ETF. Though this is unusual in itself, what makes CURE truly unique is its long term performance. It puts up very impressive returns for a short term-y, tactical, leveraged ETF:

CURE: 10 year performance (seekingalpha.com)

It clearly stomps the S&P 500 in performance over the past ten years. Notice just how great the cumulative 3 year, 5 year, and 10 year returns are in comparison to the S&P 500. Why? Healthcare on average simply has more up days than other sectors (which are typically more cyclical) and because the market legs in most dramatically when it anticipates an approaching bear.

Multi-year price performance (Seekingalpha.com)

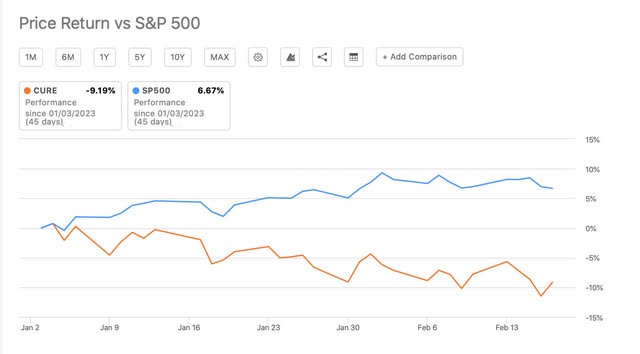

Since January 1, 2023, however, we can see a different relationship of the ETF with the S&P 500. Most often these two are positively correlated, but lately they have diverged in a dramatic way:

Jan 1 to mid Feb 2023 (seekingalpha.com)

CURE is down -9.19% vis-à-vis an S&P 500 that is up 6.67%.

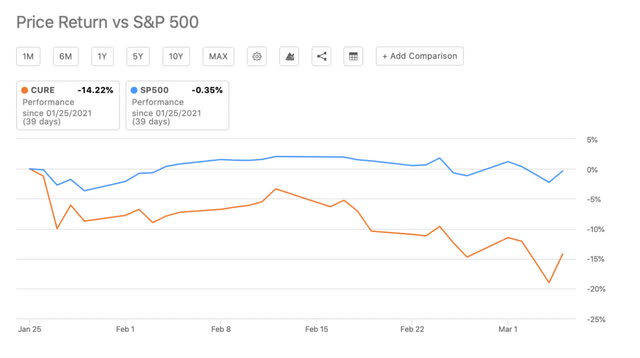

Looking back over the course of the past 13 years, I could only find one other period where there is this much divergence. That time frame was in early 2021 - specifically 38 days from late January 25, 2021 to March 4, 2021:

January 2021 Divergence (seekingalpha.com)

This was a frothy, topping period when, say, X Social Media ETF was up 14% or NVIDIA was up 12% by February 15 within a six-week period.

The CURE / S&P 500 divergence thus arguably becomes a "tell" that S&P500 has been running so hot with its more speculative sectors for the past month and half that the index could still cloak the drop from such huge healthcare megacaps.

We might have just experienced a similar period from January to mid-February 2023, with speculative risk-on trades outstripping the more defensive sectors. What is important to recognize, however, is that when the trend shifts, it usually pivots hard in the opposite direction.

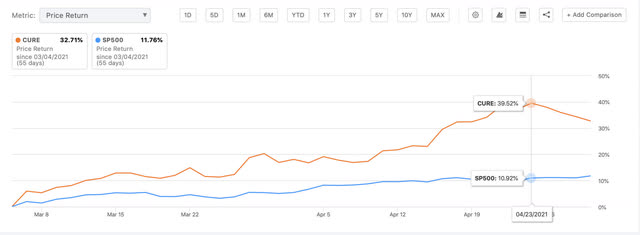

For example: after this anomalous 2021 divergence, the next six weeks offered CURE investors a pronounced bounce - up 39.50%!

March 8 to April 2021 Rebound (seekingalpha.com)

One of the critical insights of the MACD, is to see whether the price action is confirmed or not by the underlying MACD. In this case, looking at the two-year weekly chart, there is a strong argument that CURE's MACD indicator topped out August 30, 2021 with the two later price highs of December 27, 2021 and April 4, 2022 not being confirmed by its MACD. Instead, the MACD falls low in swings and ultimately puts in a "bottom" on September 26, 2022:

MACD two year weekly chart --CURE (Schwab.com)

After this top-to-bottom MACD swing over a 13-month period, we then see a price surge to early December 2022 to be followed by the recent low vol/ tight-banded drift down.

What is important today is that we are seeing a "higher low" confirmed in the MACD, particularly as we see the slow stochastic in oversold condition.

An argument can be made that -- barring exogenous events -- the market will be returning to a more risk-off, defensive posture for the next six weeks, and this will lead to outperformance for CURE (and large cap healthcare more generally) vis-à-vis the S&P 500.

Traders lightened up on defensive 2022 healthcare winners (like LLY) this January, but they might tack back as earning season ends, and they take profits in their speculative plays.

As of February 18, the Healthcare Select Sector SPDR Fund (XLV) is now down 8 weeks in a row -- a new record. CURE offers a way to play this classic "mean regression" trade.

Conclusion

Despite this technical setup, remember the risks of leveraged ETFs like CURE. 3x leveraged funds are the most dangerous of all speculative trades because they utilize enormous leverage in their attempt to achieve higher returns (and even have an added layer of counterparty risk.)

A leveraged ETF like CURE resets to its underlying benchmark index on a daily basis to maintain a fixed leverage ratio. That is not at all how your typical margin account operates. This reassignment process creates a constant leverage trap. Given an unmitigated downtown, an equity price might decline enough in one day to wipe out highly leveraged investors. As one investor website offers one prime example:

The Dow Jones, one of the most stable stock indexes in the world, dropped about 22% on one day in October of 1987. If a 3x Dow ETF had existed then, it would have lost about two-thirds of its value on Black Monday.

Investors face substantial risks with all leveraged investment vehicles -- including the risk of being wiped out. Trading the XLV or IYH offers a far safer approach to the recent divergence between healthcare and the S&P.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CURE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.