Crescent Capital BDC: 11% Yield, 24% Discount, 25% Earnings Growth From Floating Rates

Summary

- CCAP yields 10.92%, with one of the highest dividend growth rates in the BDC industry.

- Rising interest rates have ramped up earnings by 25% in 2022.

- It's selling at a much cheaper earnings multiple and P/NAV multiple than the BDC industry averages.

- It has an upcoming acquisition due to close in Q1 '22.

- Looking for more investing ideas like this one? Get them exclusively at Hidden Dividend Stocks Plus. Learn More »

8vFanI

If you're looking for high dividend stocks at a discount, maybe you should take a look at some of the Business Development Companies, known as "BDCs."

BDCs invest in privately held companies, offering retail investors access to a part of the market that's normally the domain of Venture Capital and private equity companies.

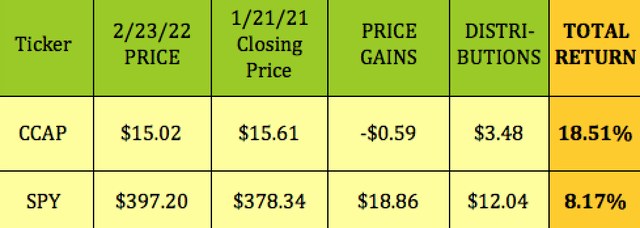

We began covering Crescent Capital BDC (NASDAQ:CCAP) in early 2021. The market has been good to CCAP since then - it has delivered a total return of 18.5%, due to its high yield distributions, vs. 8.17% for the S&P 500:

Hidden Dividend Stocks Plus

Company Profile:

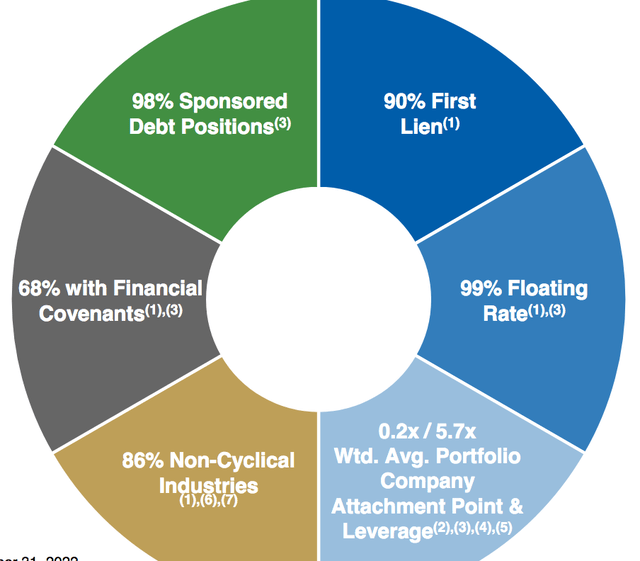

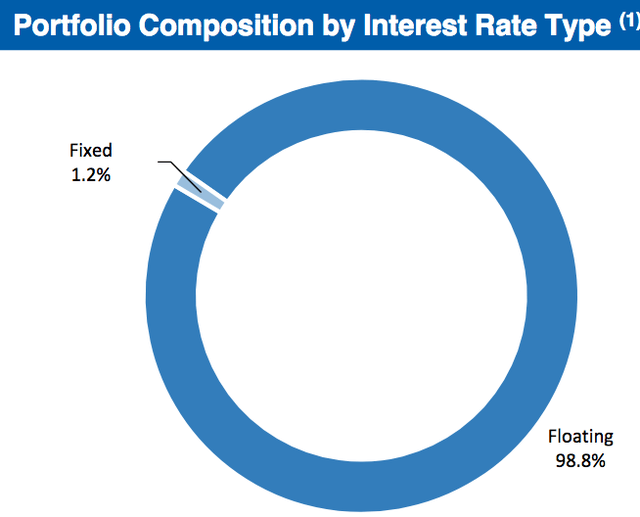

CCAP is focused on originating and investing in the debt of private middle-market companies which also are supported by sponsors. A key factor for BDCs is that the companies that they invest in also have sponsorship from Venture Capital and/or private equity companies, who will add further support to them in tough times, such as during the pandemic. Its holdings are 88% in the US, with 8% in Europe, 2% in Australia, and 2% in Canada. Its asset base is 90% 1st Lien and 99% Floating Rate, a positive in the current rising rate environment. 98% of its holdings are co-sponsored.

It has a $1.263B portfolio, comprised of 129 companies, with a median portfolio company EBITDA of $30M:

CCAP site

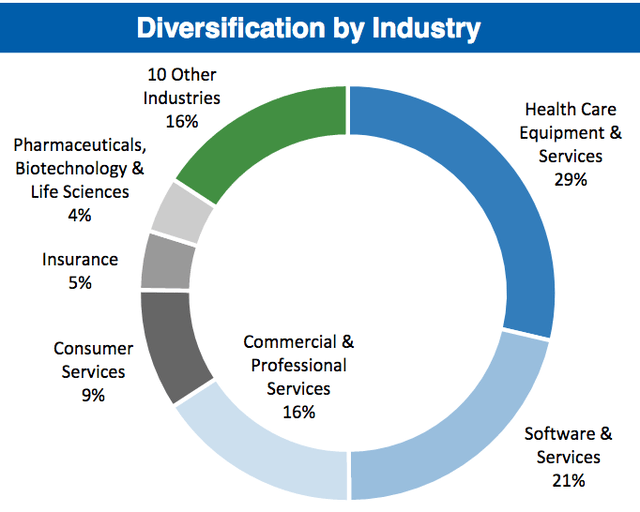

CCAP's top three industry exposures out of 16 continue to be in Healthcare, at 29%, up from 27% in Q2 '22; Software & Services, at 21%; and Commercial & Professional Services, at 16%.

CCAP site

Floating Rates

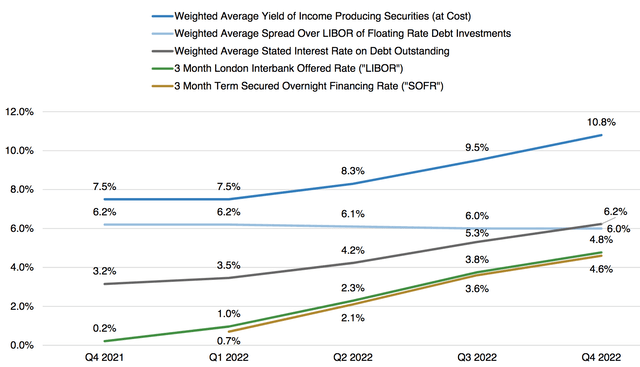

Floating rates are beneficial for CCAP, as 98.8% of its investments have floating rates.

Interest income increased by 26.6% in 2022, to $108.5M, vs. $85.7M, for full-year 2021, due to a rise in benchmark rates. CCAP's average yield on its income producing securities has risen from 7.5% in Q4 '21, all the way to 10.8% in Q4 '22, up 44%:

CCAP site

CCAP site

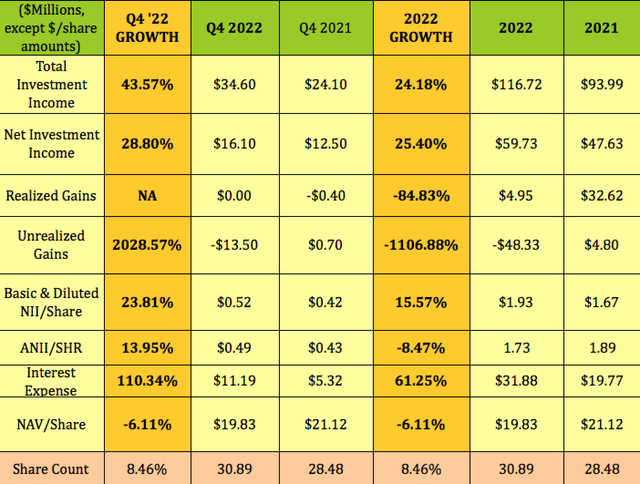

Earnings:

Q4 '22 saw strong double-digit growth in Total Investment Income, up 43.6%, NII, up ~29%, NII/Share, up ~24%, and Adjusted NII/Share, ANII, up ~14%, vs. Q4 '21.

Hidden Dividend Stocks Plus

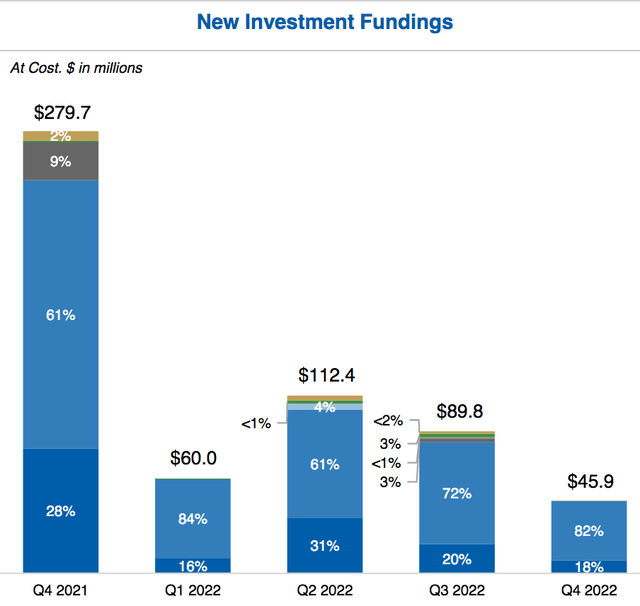

New Business:

In Q4 '22, CCAP invested $45.9M across five existing portfolio companies and several follow-on revolver and delayed draw fundings. There were $71.5M in aggregate exits, sales and repayments. 82% of new fundings were 1st Lien, with 18% in Unitranche 1st Lien. Q4 '22 was its slowest period for new fundings in the last five quarters.

CCAP site

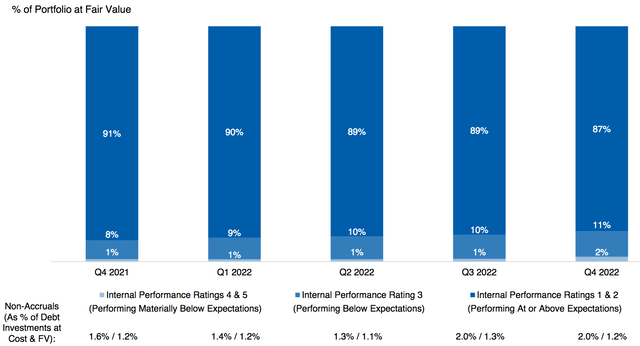

Portfolio Ratings:

Like most other BDCs, CCAP's management rates its holdings on a quarterly basis. The scale is from 1 - the highest, to 4 and 5, the lowest. Tier 4 bottomed out in Q2 '20 during the pandemic lockdowns, at 2.1% of the portfolio, with non-accruals at 2% as of 12/31/22. Upper tiers 1 and 2 have been steady since Q4 '21, at 99%, and finished 2022 at 98%:

CCAP site

Dividends:

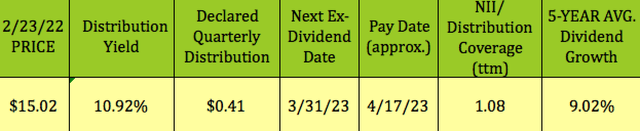

At its 2/23/22 $15.02 price, CCAP yielded 10.92%.

Management declared a regular $.41 distribution based on Q4 '22 earnings. CCAP will go ex-dividend on 3/31/23, with a 4/17/23 pay date. CCAP's five-year dividend growth rate is 9.02%, one of the highest in the BDC industry over the past five years.

Net Investment Income/Distribution coverage was a healthy 1.08X in full-year 2022:

Hidden Dividend Stocks Plus

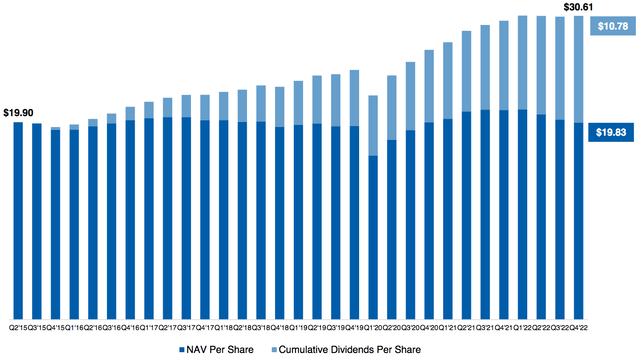

CCAP has paid out $10.78/share in dividends since its inception, while maintaining a mostly stable NAV/Share, which was $19.83 as of 12/31/23, vs. $19.90 at inception.

Hidden Dividend Stocks Plus

Valuations:

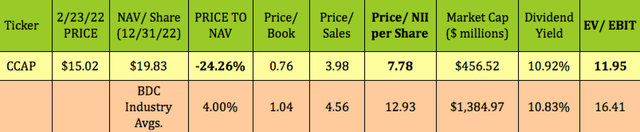

At $15.02, CCAP is selling at a very deep 24.26% discount to its NAV of $19.83, vs. the BDC average premium to NAV of 4%.

Perhaps even more importantly, CCAP is quite undervalued on an earnings basis, with a trailing Price/NII per share of 7.78X, vs. the BDC average of 12.93X. Its EV/EBIT and P/Sales valuations also is lower than average, and its 10.92% dividend yield is in line with the BDC industry average.

Hidden Dividend Stocks Plus

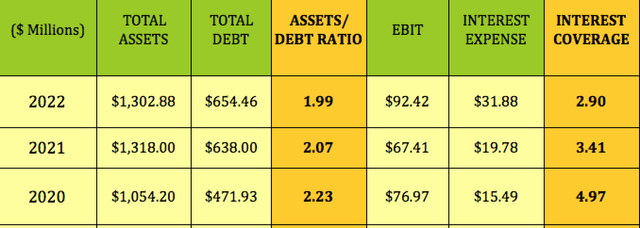

Profitability and Leverage:

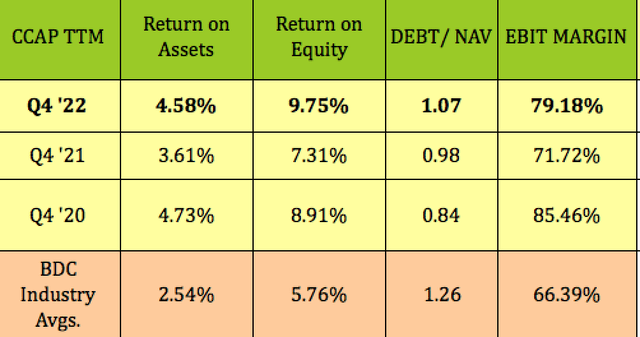

CCAP's ROA, ROE, and EBIT Margin all improved in 2022, and remained well above BDC averages. Management increased debt/NAV leverage a bit, to 1.07X, which is still more conservative than the 1.26X BDC industry average of 1.26X. Leverage was intentionally delevered a bit in Q4 in anticipation of the upcoming merger with First Eagle BDC (FCRD) in Q1 '22.

Hidden Dividend Stocks Plus

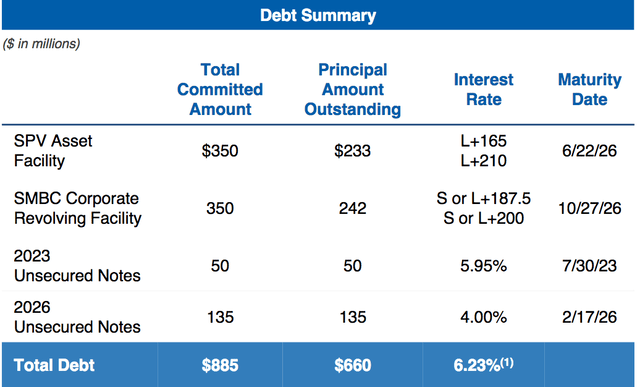

Debt and Liquidity:

CCAP has $50M in unsecured notes maturing in 2023, with no further maturities until 2026, when its Special Purpose Asset Facility, its Corporate Revolving Facility, and its 2026 Notes all come due:

CCAP site

CCAP had liquidity of ~$231M as of 12/31/22.

Its Assets/Debt ratio of 1.99X was slightly lower at year end 2022. The EBIT/Interest coverage ratio fell from 3.41X to 2.90X due to a 61% rise in interest expense.

Hidden Dividend Stocks Plus

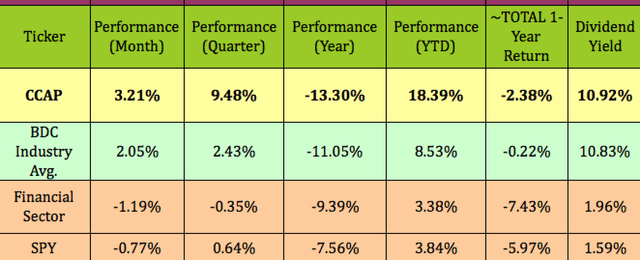

Performance:

CCAP has outperformed the BDC industry, the Financial sector, and the S&P 500 by a wide margin so far in 2023, rising over 18%. It also outperformed over the past quarter. It outperformed the Financial sector, and the S&P over the past year on a ~Total Return basis, but somewhat lagged the BDC industry average.

Hidden Dividend Stocks Plus

Upcoming Acquisition:

Management is targeting the closing of CCAP's previously-announced merger with First Eagle BDC in Q1 '22. The combined company, which will remain externally managed by Crescent Cap Advisors, LLC, a subsidiary of Crescent Capital Group (“Crescent”), is expected to have approximately $1.6B of investments on a pro forma basis.

FCRD stockholders are expected to receive a combination of (i) Crescent BDC shares valued at 100% of Crescent BDC’s NAV/share at the time of closing of the transaction in an aggregate number equal to FCRD's NAV at closing, up to a maximum of 19.99% of outstanding Crescent BDC shares at the time of the closing. There will be an additional cash payment from Crescent Cap Advisors, LLC of $35M in aggregate, or ~$1.17/share of First Eagle BDC stock.

FCRD's NAV/Share was $5.14, as of 9/30/22, with an investment portfolio of $363.2M across 73 portfolio investments. It earned NII/share of $.32 in Q1-3 '22, vs. $.31/share in Q1-3 '21.

The Boards of Directors of both companies have each unanimously approved this transaction, and CCAP will hold a special meeting of its stockholders on March 7, whereby they'll be asked to adopt the agreement and plan a merger.

Parting Thoughts:

We rate CCAP a buy based upon its continued strong earnings, its attractive, well-covered yield, and the broadening of its asset base when the FCRD merger is closed.

All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

Find out now how our portfolio is beating the market in 2023.

This article was written by

Robert Hauver, MBA, was VP of Finance for an industry-leading corporation for 18 years, and publishes SA articles under the name DoubleDividendStocks. TipRanks rates DoubleDividendStocks in the Top 25 of all financial bloggers, and Seeking Alpha rates us in the Top 5 of several categories, including Dividend Ideas, Basic Materials, and Utilities.

"Hidden Dividend Stocks Plus", a Seeking Alpha Marketplace service, which focuses on undercovered and undervalued income vehicles. HDS+ scours the world's markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

Disclosure: I/we have a beneficial long position in the shares of CCAP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.