Concentrix Aims For Higher Growth In The Second Half Of 2023

Summary

- Concentrix reported its FQ4 2022 financial results on January 19, 2023.

- The firm provides customer experience and other technology consulting solutions to clients worldwide.

- CNXC stock has produced revenue and operating profit growth but sees challenging conditions from certain client verticals in 2023.

- I'm on Hold for CNXC until we learn the extent of its macroeconomic and foreign exchange headwinds.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

everythingpossible

A Quick Take On Concentrix

Concentrix Corporation (NASDAQ:CNXC) reported its FQ4 2022 financial results on January 19, 2023, missing both revenue and EPS consensus estimates.

The firm provides a range of customer experience consulting and related services to organizations worldwide.

I'm cautious as we move further into 2023, so I'm on Hold for CNXC until we see results under changing macroeconomic conditions.

Concentrix Overview

Newark, California-based Concentrix is a global customer experience technology and services company that designs, builds, and operates end-to-end customer experience solutions to enhance customer engagement.

The firm is headed by president and CEO Chris Caldwell, who was previously Executive Vice President and EMJ Data Systems and CEO at Coral Enterprises.

The company's primary offerings include the following:

Customer experience strategy

Experience platforms

Experience design

Data & analytics

Automation & operations

CX management

Digital engineering

Enterprise modernization

Content trust & safety

Concentrix obtains new customers through a variety of methods, such as targeted digital advertising campaigns, social media marketing, and direct mail campaigns.

The company also has a dedicated sales team that reaches out to potential customers and provides them with tailored solutions to meet their needs.

Concentrix's Market & Competition

According to a 2021 market research report by 360 Market Updates, the global market for digital transformation strategy consulting was an estimated $58.2 billion in 2019 and is forecast to reach $143 billion by 2025.

This represents a forecast CAGR of 16.2% from 2020 to 2025.

The main drivers for this expected growth in IT consulting are a large transition from on-premises, legacy systems to cloud-based environments with complex architectures.

There is also expected growth in the number of industries adopting digital transformation strategies, such as manufacturing, finance, and retail, as well as a growing demand for improved customer experience.

IT consulting firms can also leverage their expertise to help companies develop and maintain new or better business models which are better suited to the digital world. Many organizations are turning to IT consulting firms to help them align their digital transformation strategies with their business objectives. This can help companies better leverage technology to improve customer engagement, boost collaboration, and reduce costs.

Also, the COVID-19 pandemic has likely pulled forward significant demand to modernize enterprise systems resulting in increased growth prospects for digital transformation consultancies.

The growth of IT consulting is expected to continue due to the evolving digital landscape, increased demand for improved customer experience, the need to develop and maintain new or better business models, and the accelerated demand for modernization due to the pandemic.

Major competitive or other industry participants include:

Globant

Thoughtworks

EPAM

Slalom

Accenture

Deloitte Digital

McKinsey

BCG

Ideo

Cognizant Technology Solutions

Capgemini

Computer Task Group

Company in-house development efforts

Concentrix's Recent Financial Performance

Total revenue by quarter has risen according to the following chart:

Total Revenue (Seeking Alpha)

Gross profit margin by quarter has trended slightly higher in recent periods:

Gross Profit Margin (Seeking Alpha)

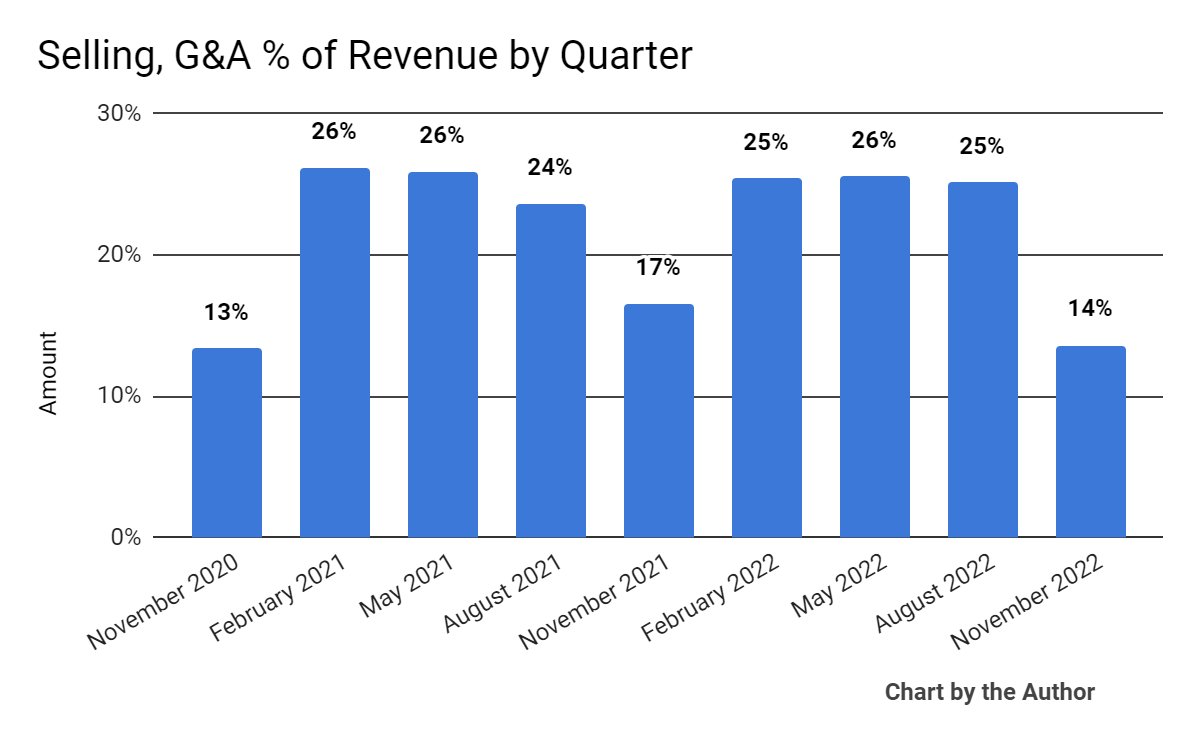

SG&A expenses as a percentage of total revenue by quarter have followed the trajectory shown below:

Selling, G&A % Of Revenue (Seeking Alpha)

Operating income by quarter has risen markedly in recent quarters:

Operating Income (Seeking Alpha)

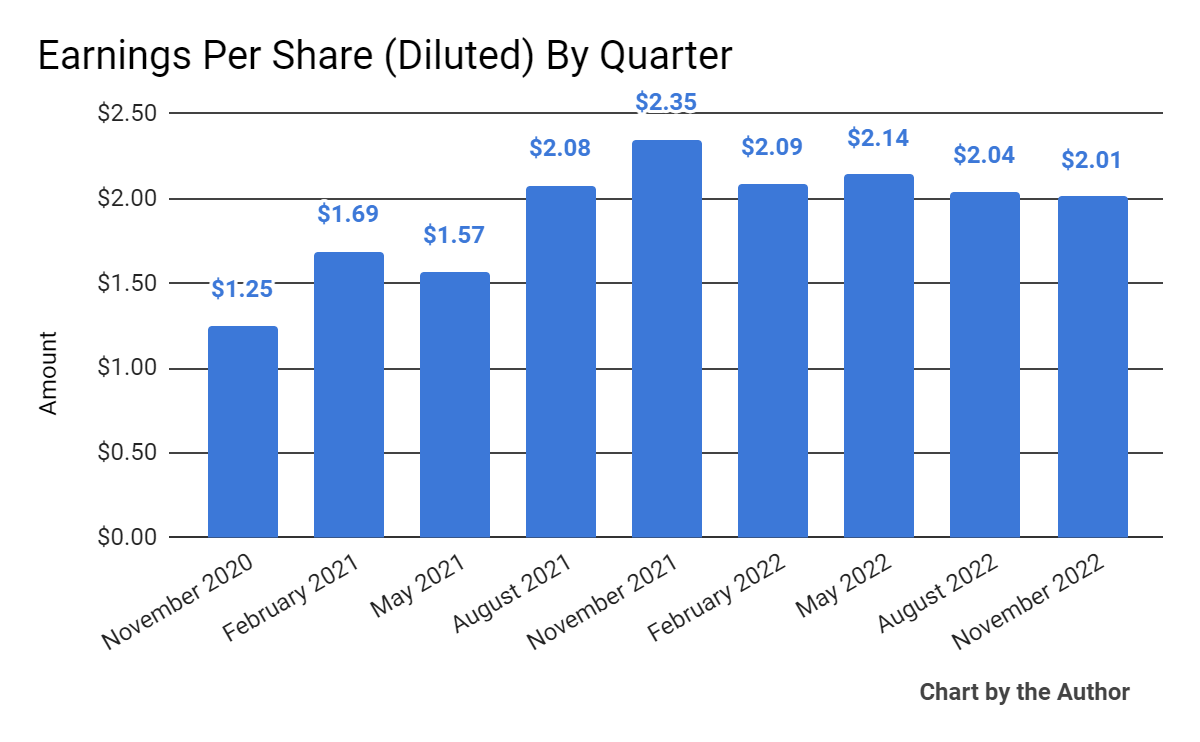

Earnings per share (Diluted) have trended lower more recently:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

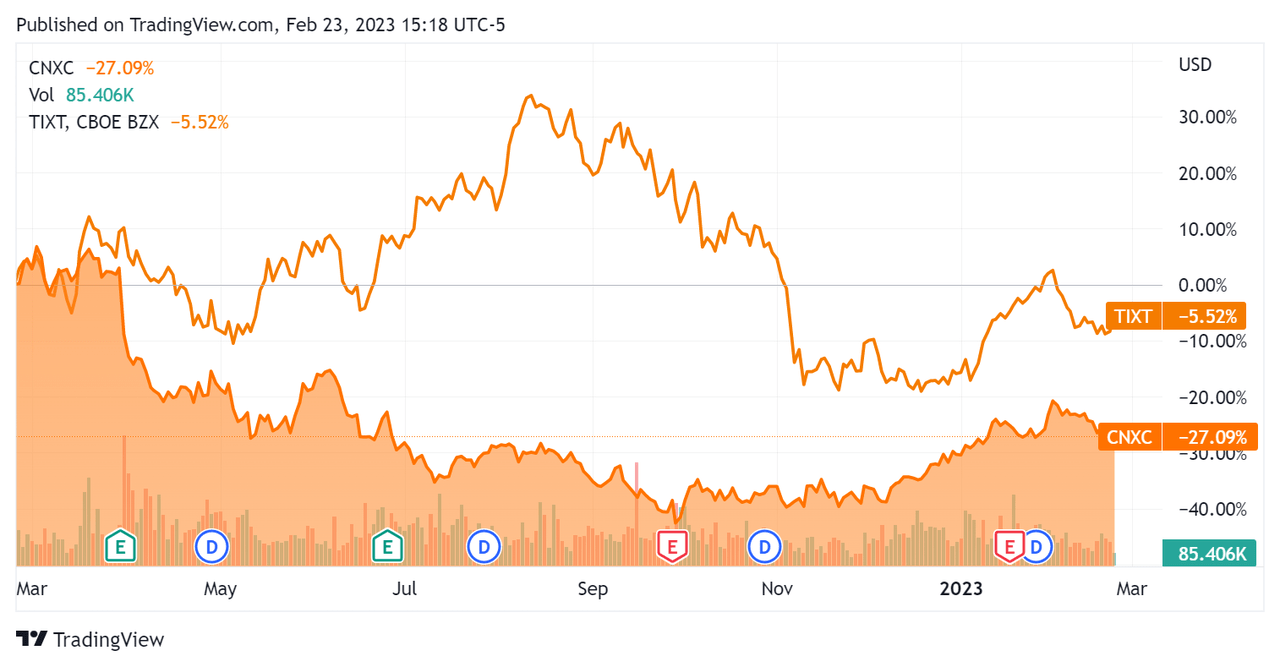

In the past 12 months, CNXC's stock price has fallen 27.1% vs. that of TELUS International's (TIXT) drop of only 5.5%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Concentrix

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 1.6 |

Enterprise Value / EBITDA | 10.0 |

Price / Sales | 1.2 |

Revenue Growth Rate | 13.2% |

Net Income Margin | 6.9% |

GAAP EBITDA % | 15.5% |

Market Capitalization | $7,250,404,900 |

Enterprise Value | $9,828,785,200 |

Operating Cash Flow | $600,720,000 |

Earnings Per Share (Fully Diluted) | $8.28 |

(Source - Seeking Alpha)

As a reference, a relevant partial public comparable would be TELUS International; shown below is a comparison of their primary valuation metrics:

Metric [TTM] | TELUS International | Concentrix Corporation | Variance |

Enterprise Value / Sales | 2.7 | 1.6 | -42.6% |

Enterprise Value / EBITDA | 13.0 | 10.0 | -22.9% |

Revenue Growth Rate | 12.5% | 13.2% | 5.7% |

Net Income Margin | 7.4% | 6.9% | -7.2% |

Operating Cash Flow | $437,000,000 | $600,720,000 | 37.5% |

(Source - Seeking Alpha)

Commentary On Concentrix

In its last earnings call (Source - Seeking Alpha), covering FQ4 2022's results, management highlighted its full-year 2022 performance, which included 'the highest customer satisfaction and innovation scores' since it started surveying customer satisfaction more than ten years ago.

The firm also noted the successful integration of its PK acquisition, which will fortify the company's customer experience technology solutions offerings.

Leadership also expanded its geographic footprint in Europe, Asia and Latin America, and has plans for more footprint expansion in 2023.

However, the company faced macroeconomic headwinds in its FQ4, with clients in the consumer electronics and retail e-commerce verticals reporting particularly weak consumer demand conditions.

As to its financial results, total revenue rose 12% year-over-year on an as-reported basis, while the company faced foreign exchange challenges due to the strong US dollar.

Management did not disclose any company or employee retention rate metrics for the quarter.

Gross profit margin has been trending higher in recent quarters while operating income rose substantially in the quarter just ended.

For the balance sheet, the company ended the quarter with $145.4 million in cash and equivalents and $2.23 billion in long-term debt.

Over the trailing twelve months, free cash flow was $460.7 million, of which capital expenditures accounted for $140.0 million. The company paid $47.1 million in stock-based compensation in the last four quarters.

Looking ahead, management expects fiscal 2023 organic revenue growth to be around 5% in constant currency terms, with higher growth expected in the second half of the fiscal year based on client feedback.

Regarding valuation, the market is valuing Concentrix at lower valuation multiples than competitor TELUS International.

The primary risk to the company's outlook is the prospect of a material macroeconomic slowdown in 2023, which would slow project implementation and new customer wins.

A potential upside catalyst to the stock could include a 'short and shallow' downturn and a return to growth after.

The company's stock price has risen in recent weeks along with the general rise in technology-oriented stocks as the cost of capital outlook has improved.

In the short term, technology stocks appear to be highly dependent on a benign interest rate environment, so investors should proceed accordingly.

As for me, I'm cautious as we move further into 2023, so I'm on Hold for CNXC until we see results under changing macroeconomic conditions.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This report is for educational purposes and is not financial, legal, or investment advice. The information referenced or contained herein may change, be in error, become outdated and irrelevant, or be removed at any time without notice. The author is not an investment advisor. You should perform your own research on your particular financial situation before making any decisions.