Cogent Communications: Investing In The Backbone Of The Internet

Summary

- Cogent Communications is a huge player in the telecommunications industry, with a global network covering 20% of all internet traffic worldwide.

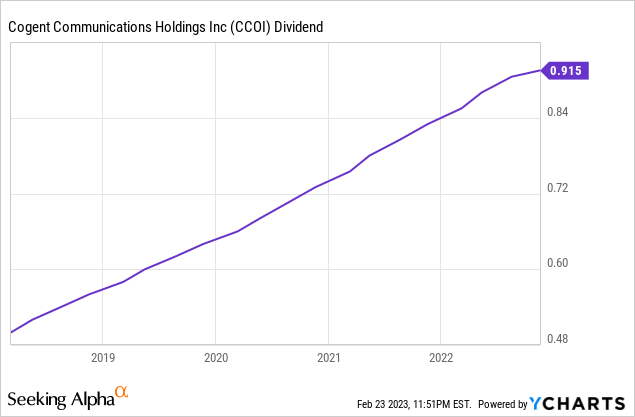

- Cogent's dividend record is strong, having increased its dividend for 41 straight quarters sequentially.

- Cogent has consistently shown growth in service revenue, net cash provided by operating activities, EBITDA margin, and adjusted gross margin over the past decade.

vm/E+ via Getty Images

Introduction

Ahhhh, the internet, it connects us. Whether we are enjoying a cute cat video or partaking in vitriolic political discourse, the internet connects us all.

When we think of companies benefiting from the internet, many of us think of companies like Alphabet (GOOG) or Facebook (META) but underpinning it all is a massive worldwide infrastructure… Infrastructure you can invest in!

Cue Cogent Communications (NASDAQ:CCOI).

Cogent is a telecommunications company that provides high-speed internet access, private network, and data center colocation space services to customers around the world. The company operates in 51 countries, serving small and medium-sized businesses, communications service providers, and other bandwidth-intensive organizations. Cogent has a global network covering 20% of all internet traffic worldwide, which makes it a huge player in the industry.

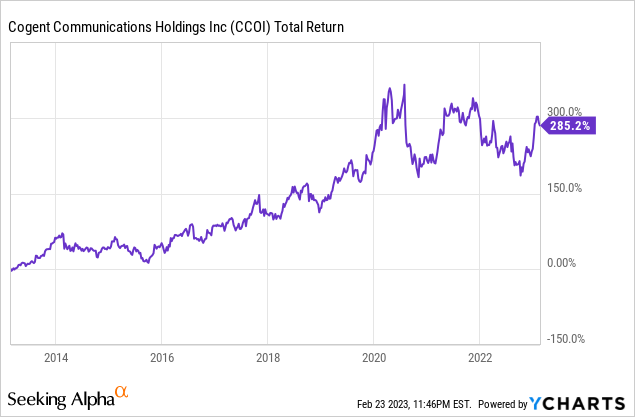

Market share is great, but how about those returns?

…They do not disappoint.

Interested in learning more? Let’s dive into Cogent Communications, so we can gain a better understanding of its operational and financial performance.

The Global Infrastructure of the Internet

While Starlink and satellite internet are cool, by and large, most of us still get our internet the old-fashioned. Via old-school fiber cable.

For context, internet fibers are thin strands of glass or plastic that are designed to transmit data over long distances at high speeds. They work by converting electrical signals into light, which is then transmitted through the fiber. This allows data to be transmitted cost-effectively at incredibly fast speeds, making it possible to stream videos, download large files, and perform other bandwidth-intensive tasks quickly and efficiently.

Cogent’s internet fibers are a critical component of modern telecommunications infrastructure, enabling people and businesses to connect from all corners of the world.

Keenly focused on value-focused capital deployment, Cogent claims to have evaluated over 800 acquisitions since 2005 passing on almost all. One acquisition it did approve was the deal it made with Sprint (TMUS), Recently, Cogent acquired Sprint's legacy wireline business for roughly $1 (less a $700mm purchase agreement with T-Mobile), which will expand its network footprint and data center locations and product offerings, including dark fiber and wavelengths.

Financials

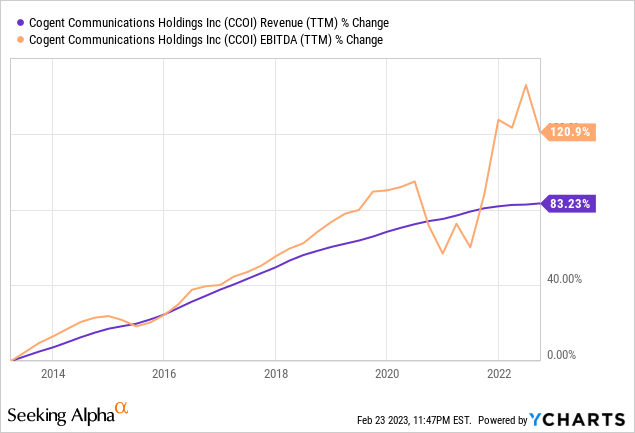

Financially, Cogent has consistently shown growth in service revenue, net cash provided by operating activities, EBITDA margin, and adjusted gross margin over the past decade. In Q4 2022, the company's service revenue increased by 1.3% to $152.0 million, while net cash provided by operating activities increased by 2.0% to $173.7 million from 2021 to 2022. Cogent's EBITDA margin was 37.6% for Q4 2022, including the impact of $0.2 million of Sprint (T-Mobile Wireline) acquisition costs, and 38.5% for the full year 2022, including the impact of $2.2 million of Sprint (T-Mobile Wireline) acquisition costs.

Return on Invested Capital

While the company has indeed grown earnings consistently, its return on invested capital is actually quite low having stayed consistently in the low single-digit range over the past decade. This may be due to the nature of the business, because without laying expensive cable or acquiring competitors it may be that they are running out of options to deploy their capital. What you have here is what I call a steady Eddie business, with low, but consistent growth.

Dividend Growth and Buybacks

Cogent rewards its shareholders. Specifically, Cogent rewards its shareholders in two ways, buybacks, and dividends.

Cogent has a very strong dividend record, having increased its dividend for 41 straight quarters sequentially. You don’t have to do much convincing to get me on board for a dividend raise each quarter! This quarter Cogent approved an increase of $0.01 per share to its quarterly dividend for a total of $0.925 per share, representing an annual increase of 8.2% from the dividend per share last year of $0.855 for Q1.

The company has also bought back over 10 million shares and returned $1.2 billion to shareholders since its 2005 public offering. Talk about rewarding your shareholders!

Insider Ownership

When considering companies to invest in, I find it reassuring to see a substantial amount of insider ownership. When insiders have a significant stake in the company, it creates an incentive for management to prioritize shareholder value, as their own net worth is tied to the success of the company.

In the case of Cogent Communications, senior management owns around 11% of the company and receives a significant portion of their compensation in the form of stock, which further aligns their interests with those of the shareholders.

Risks

While Cogent possesses an extensive network of irreplaceable infrastructure, it does face some real competition from several major players in the communications industry, including AT&T, Verizon, and Comcast, who possess abundant resources and capital to deploy.

Furthermore, Cogent faces the potential threat of competition from satellite internet providers, such as Starlink. With advancements in satellite technology, high-speed internet provision is now possible even in remote areas where installing fiber may have been previously cost-prohibitive. This poses a possible challenge to Cogent's business model, since its competitive edge lies in the limitations of physical infrastructure. If satellite internet providers offer comparable speeds and reliability at a competitive price, Cogent's market share and profitability may be at risk. While satellite internet technology is still in its nascent stages and quite expensive, it is an area that Cogent must monitor as it continues to expand its business.

Valuation

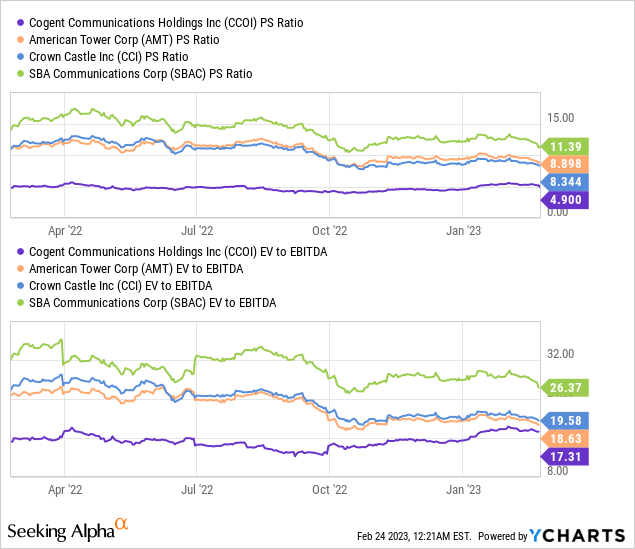

On the valuation front, Cogent appears to be low-priced versus some other large communication infrastructure players including American Tower (AMT), Crown Castle (CCI), and SBAC Communications (SBAC). Cogent has the lowest price to sales within this group at just 4.9x, while SBAC Communications trades all the way up at 11.4x. In terms of EV to EBITDA, again, Cogent appears to be cheaply priced at just 17.3x.

Conclusion

In conclusion, Cogent has shown consistent growth in service revenue, net cash provided by operating activities, EBITDA margin, and adjusted gross margin over the past decade backed by the critical infrastructure they own. While its return on invested capital is low, Cogent rewards its shareholders through consistent growth, dividend increases, and share buybacks. The company also has strong insider ownership, which aligns management's interests with those of shareholders. Cogent does face competition from major players in the communications industry and the potential threat of satellite internet providers, but that threat is mitigated by the lower cost related to using physical infrastructure that is already in place.

The growth has been consistent, and the valuation appears to be quite reasonable, for investors with moderate risk tolerance, this company could make a lot of sense. The risk-to-reward tradeoff looks favorable.

I rate Cogent Communications a Buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CCOI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please note that this article is for informational purposes only and should not be construed as investment advice. It is important to do your own research and consult with a financial advisor before making any investment decisions.