Taro Pharmaceutical: Stagnating Growth At 1.6% Trailing Earnings Yield, Rate Hold

Summary

- Taro Pharmaceutical's quarterly numbers came in with very thin growth at the operating and bottom-lines given the impact from settlement charges.

- Price erosion in its U.S. generics business continues to be a headwind.

- Question is, does the stock represent value at these compressed multiples.

- We sought to understand the same, and found the data supports a neutral view.

Pgiam/iStock via Getty Images

Investment Summary

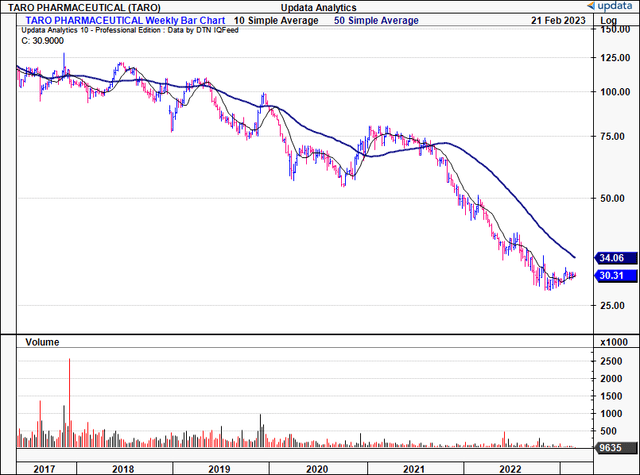

Israeli-based pharmaceutical companies are at the forefront of innovation and drug development globally. Not all opportunities are created equal, however. For those investors restricted to investing in U.S. exchanges, Taro Pharmaceutical Industries Ltd (NYSE:TARO) has been an underwhelming performer versus key benchmarks over the last 6-years to date [Figure 1]. The company posted its Q3' results last month with flat top-line growth and a substantial decrease in earnings after it booked another round of non-operating losses in its cash flow statement and P&L. As a reminder, these charges fall on the back of charges filed by the Department of Justice ("DOJ") in 2020' for conspiring to "fix prices, allocate customers, and rig bids for generic drugs". The charges came after TARO admitted to participating in "two charged conspiracies between 2013 and 2015", combined with a "second conspiracy with a generic drug company based in Pennsylvania and other individuals, from at least as early as May 2013 and continuing until at least December 2015". The outcome was a part of a wider DOJ investigation where a total of 6 companies were charged with antitrust conspiracies related to drug pricing on sales into the U.S.

As a result, TARO, along with its co-conspirator, agreed to pay a collective $426mm in penalties. Subsequently, its bottom-line has been materially impacted by the decision, leading to negligent post-tax earnings growth since FY20'. The question is, at 0.7x book value, does the company represent a potential value play, or are there too many headwinds in the picture? Here, we sought to extrapolate the latest data to gauge this. Alas, given the culmination of reasons presented in this report, the data supports that TARO stock is currently a hold. It has a large reversal ahead of itself in order to achieve a positive re-rating, meaning that investors are unlikely to be attracted to the stock until we see evidence of the same.

Fig. (1) TARO price performance FY17–date

TARO Q4 results analytics

Turning to the latest set of numbers, its prudent to perform a rigorous examination of TARO's growth percentages to see how it fared with and without the settlement charges involved. Looking in greater detail, with respect to the P&L, we'd note the following data points as key takeaways:

- Quarterly net sales came in flat YoY to $139mm as the cost of sales increased 19.4% to $75mm. To this point, TARO noted it continues to "experience price pressures particularly in the U.S. generic business" alas the price erosion in its generics footprint continues to be a remarkable headwind to top-line growth. This reflects the points raised earlier that were raised in the DOJ investigations. We see further evidence of this as gross profit clamped ~15% YoY to $64mm, leading to an 8.7 percentage point compression in quarterly gross margin to 46%. In a high-inflation environment, this could be a meaningful risk to profitability and earnings growth down the line, should this trend continue.

- TARO pared back R&D expenditure as a result of the above to ~9.3% of turnover. It also lost leverage at the SG&A line with a $25mm YoY increase to ~$50mm in general expenditures. It's important to note that these expenditures include adjustments made for the company's Alchemee acquisition, a consumer products company, back in February FY22 on a $99mm valuation. As to the success of the acquisition, we've been unable to see an organic view of the company's performance given the settlement charges discussed here.

- Moving down the P&L, and the impact from its generics' price erosion listed above are abundantly clear. It recognized a $35.7mm headwind from downsides in its U.S. generics franchise, clipping just $1.3mm in quarterly income on a razor thin 0.94% operating margin. Looking at the 9-months to December FY22, the overall impact was a $33mm headwind, where the company booked $42mm in operating income. Again, talking in terms of margin growth, this is a substantial headwind that must be worked through. We don't believe a further sub-1% operating margin is sustainable for the company without a) eating through substantial cash, or b) at least having to pare back operations substantially.

- It pulled this down to earnings of $7.3mm, a 72.2% YoY decline that came to $0.19 in EPS. Again, scrutinizing the 9-month numbers, TARO clipped $18.5mm in net income, a 40% YoY pullback to $0.49 per share. The trailing earnings yield on this is just 1.6%, well below the S&P 500's trailing earnings yield of ~4.6%. This was further realized at the cash flow level, as it clipped a substantial wind-back in CFFO of $175mm or 87.5% YoY to $24.9mm with another $54mm burnt in on-balance sheet cash. Again, the cash flow yield on this is a paltry 2.17%. The firm is still well capitalized with a combined $1.2Bn in cash and short-term and long-term equivalents, however. Still, for investors searching for quality, growth, or even value, it's hard to see an alignment with any of these factors, and the obvious pullback in bottom-line fundamentals is further support of a neutral view.

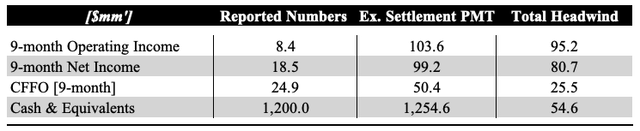

It is important to note these operating bottom-line results include the impact from its settlement and contingency charges listed earlier. Subsequently, it's important to make adjustments for the settlement payments. We refer investors to Figure 2 for the breakdown:

Fig. (2) TARO reported numbers vs. settlement-adjusted [9-months to December 2022]

Note: All figures are shown in $mm'. (Data: Author, adapted from TARO Q3 financial results)

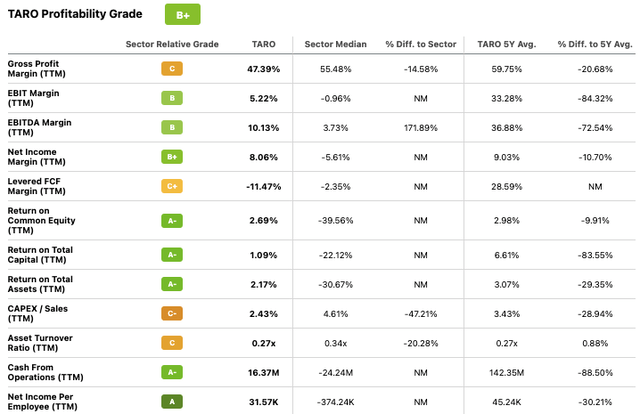

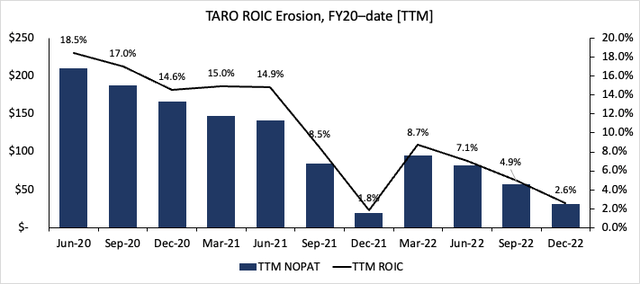

You'll see the total headwind from the prior corresponding period is quite substantial across all measures of operating income, earnings and CFFO for TARO's 9-months to December 2022. Specifically, it saw a $61.4mm adjustment from the settlement in operating income, spurring a total $95mm delta from the last year, in addition to a $31mm settlement headwind that led to earnings compression of $80mm when combined with the pullback in sales, gross margin and higher cost base. All in all, there was a cumulative $134mm headwind realized by the company when blending the impact to net income and CFFO for the 9 months. The question is, how does this impact the potential for valuation upside down the line? If we measure corporate value as a firm's ability to generate a trio of 1) post-tax earnings growth, 2) return on capital [above the cost of capital], combined with 3) growing residual cash flows to equity holders, then TARO hasn't fit the mould in this regard. How? First, profitability has suffered for the company when baking in the penalties, with a 1.1% trailing return on total capital, negative 11.5% FCF margin and ROA of 2.7% –even after the company clipped back its fixed asset base by 4.6% over the year. All are also well of 5-year averages, and below the industry [Figure 3]. Second, at the same time, NOPAT growth has been negligent, meaning it hasn't been growing its corporate value either, most likely justifying its low valuations discussed later. Subsequently, TARO's return on invested capital ("ROIC") has marched south on a sequential basis to 2.6% off 18.5% since FY20' when looking at rolling TTM figures.

Fig. (3)

Data: Seeking Alpha, see: "Profitability"

Fig. (4)

Data: Author, using data from TARO SEC Filings

Valuation and conclusion

Given the pullback in recognized earnings, the stock now trades at a substantial premium at 25x trailing earnings, and 42.5x forward P/E – a whole 60% above the industry. It also trades at 0.7x book value, and with the trailing ROE at just 2.7%, this does potentially lift the investor ROE to 3.8%, still not terrific in our eyes. The company is also cash heavy, with $864mm in cash and equivalents on the balance sheet, comprised of $92mm in actual cash and the remainder in short-term investments. The debate on how to handle cash is an interesting one. On the one hand, pundits might argue that the company be penalized for not utilizing the cash, as it is a non-operating asset, and represents an opportunity cost [especially if the company can invest in projects at a high rate of return]. But cash isn't always a negative. It provides optionality, and, in the current rates regime, can earn a tidy amount of interest if invested in money market securities like short-dated treasuries, or even in the bank. The issue is that cash must be extracted from the calculus when computing a firm's enterprise value. With TARO's market cap now at $1.15Bn, subtracting the $92mm in cash and equivalents from this, its enterprise value is just $1.06Bn – a wide disconnect.

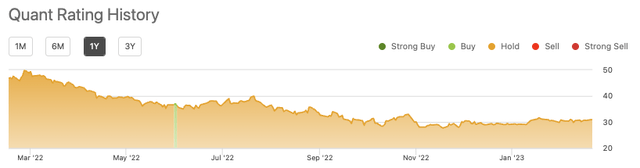

Hence, based on the culmination of findings presented in this report, its abundantly clear that TARO has a large hurdle to overcome to attract a positive re-rating to the upside, supporting a hold recommendation. This is further evidenced by the quant ratings system, that also suggests the stock is a hold for now. Adding to that, TARO has been rated a hold for the last 12 months straight, again leading to a neutral viewpoint. Net-net, we rate TARO as a hold.

Fig. (5)

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.