Aerojet Rocketdyne Stock: Time To Sell?

Summary

- Aerojet Rocketdyne stock has around 3% upside left.

- I believe opposition to the merger with L3Harris Technologies is not justified or supported by the reality of the business strengths of the companies.

- Aerojet Rocketdyne shares could be a sell, since taking profits and deploying the cash elsewhere might yield higher returns than waiting on the deal to be approved and value materialize.

- Looking for a helping hand in the market? Members of The Aerospace Forum get exclusive ideas and guidance to navigate any climate. Learn More »

3DSculptor/iStock via Getty Images

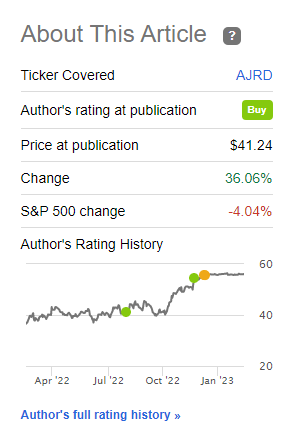

Aerojet Rocketdyne (NYSE:AJRD) stock is one that I had a positive view on for a very long time. Since the announcement of the acquisition of Aerojet Rocketdyne by L3Harris Technologies (LHX), the stock took off but it is also a moment to wonder whether it is time to sell your Aerojet Rocketdyne shares. In this report I explain why as well and I discuss the company's most recent results.

Aerojet Rocketdyne Stock Price Surged

Seeking Alpha

Aerojet Rocketdyne stock surged by 36.1% since I had a buy recommendation on the stock as I recognized that the company's quarterly results were impacted by Standard Missile charges which would actually allow the company to increase output in the future. Furthermore, I recognized the compelling position of Aerojet Rocketdyne in the current defense landscape where the importance to national security of Aerojet Rocketdyne shows. This also made the company attractive as a stand-alone business as well as an acquisition target as I pointed out.

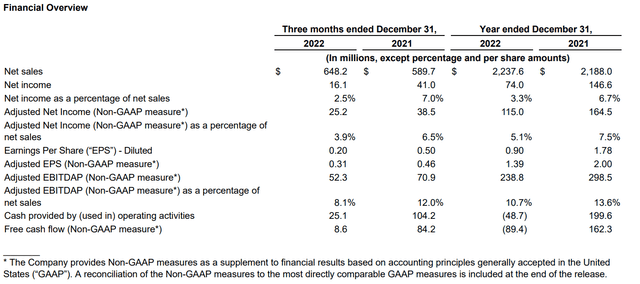

Aerojet Rocketdyne Q4 2022 Results

Looking at the sales, Aerojet Rocketdyne revenues grew by 9.9% to $2.24 billion. Net income and adjusted net income, however, dropped to $74 million and $115 million, a significant reduction from $146.6 million and $164.5 million last year. So, sales growth did not translate into higher earnings. Higher sales were driven by the Next Generation Interceptor offset by lower RS-25 engine sales, which are used on the Space Launch System.

Cost of sales grew from 82.3% of the revenues to 85.2% driven by supply chain disruptions. The Standard Missile program was also affected by this and accounting rules required some revenues and profits to be reversed as capacity had to be increased to accommodate customer requests to accelerate deliveries. Furthermore, Aerojet Rocketdyne had $43.5 million in proxy costs, litigation and legal settlements and a $22 million loss of debt. Would those not have occurred, the company would have booked a $139.5 million profit and there also was some acceleration in stock-based compensation due to the L3Harris merger agreement. What is somewhat unfortunate is that some program specific pressure such as the Standard Missile cost growth have not been quantified. Otherwise, we could have a better view on individual cost components swinging profits one way or the other. What we do know is that unusual items were $94 million compared to $29.4 million. Adjusting for that, the net income for 2022 would have been $168 million compared to $176 million last year, which I believe are not awful earnings if you consider the challenges in the supply chain. However, what is somewhat disappointing is that just as a stand-alone report the 10K does not provide a lot of detail and with the absence of an earnings call from management, analyzing the results was not easy. As an investor, you miss a lot of color that management normally does provide.

Aerojet Rocketdyne and L3Harris Acquisition News

Right now, all eyes are on an approval of the proposed merger between L3Harris Technologies and Aerojet Rocketdyne which is expected this year. I strongly believe that this merger is significantly different from the Lockheed Martin merger with Aerojet Rocketdyne as the former provides a horizontal integration while the latter provides a vertical integration with a company to which Aerojet Rocketdyne is a major supplier.

The big question is whether the FTC will approve the merger. Sen. Elizabeth Warren wrote the following opposing the merger:

This deal between Aerojet and L3Harris would reduce competition in the shrinking defense industry to a new low, and I encourage the FTC to oppose this dangerous transaction.

I strongly believe that this view is too much driven by the anti-consolidation attitude and not enough by facts recognizing the differences in business activity for L3Harris and Aerojet Rocketdyne.

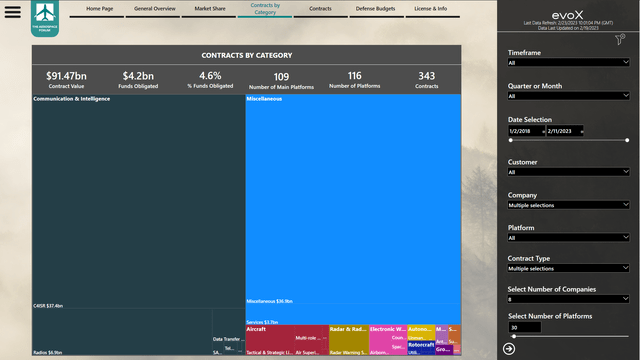

Warren argues that L3Harris could force customers to buy other products from L3Harris and also raise prices. Data from the evoX Defense Monitor shows that L3Harris derived most of its contracts and thus revenues from its products in Communication and Intelligence. It presence in missile defense and warning is mostly limited to space-based tracking which is significantly different from the rocket motor products that Aerojet Rocketdyne provides. In some way, the products could complement each other, but they can also be easily separated meaning there cannot be any force for customers to force the purchase of missile defense products from both companies. That is also not how development of defense products works as the Department of Defense or DoD lets various parties compete and it is not the case that L3Harris would be able to develop full products it could not develop before if it acquires Aerojet Rocketdyne. The dependency on other contractors remains.

Given the unique positioning providing unique capabilities in the areas or rockets for space and missiles as well as hypersonics and missile defense, but dependence on other parties I don't believe the merger would reduce competition. In fact, leaving Aerojet Rocketdyne as a smaller player on the defense market could make it more difficult for Aerojet Rocketdyne and its customers to satisfy the national security interests of the US and its partners which is the real threat here.

Conclusion: It Could Be Time To Sell Aerojet Rocketdyne Stock

When it comes to results, they were not great but also not bad. Currently the focus is more on an approval from the FTC for the merger and I believe that the merger makes a lot of sense and should not be dictated by people opposing mergers just for the sake of opposing. Aerojet Rocketdyne share prices currently are $56.11 meaning there is at least 3.3% upside left. So, if you are comfortable and believe the merger will happen then it does not hurt to sit it out. However, I also believe that with relatively limited upside and some unjustified opposition to the merger, you might want to sell your shares to deploy the funds somewhere else, especially since Aerojet Rocketdyne does not pay you a dividend to sit and wait for that 3.3% to materialize. Therefore, I am marking shares of Aerojet Rocketdyne a Hold rather than a Sell.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.