Church & Dwight: Leaving The Black Swan Behind

Summary

- Church & Dwight faced a tough year with margin compression.

- For the first time in the past 16 years, it had a negative TSR.

- However, positive news from sales and margins in Q4 set the company to recover and then execute on its reliable and steady growth path.

Amy Sussman

Introduction

Church & Dwight (NYSE:CHD) is considered by more than one investor a well-oiled compounding machine due to its ability to reach long-term results at a steady pace. The engine of this machine is the "evergreen model" of the company that focuses on innovation and on building a portfolio made up of strong brands that are usually either the top or the second largest player in a particular segment. This model makes the company committed to delivering 3% yearly organic net sales growth, gross margin expansion and 8% EPS growth.

Church & Dwight has recently held its Analyst Day and has taken part at the CAGNY 2023 conference after a tough year for the company's financials.

Let's take a bit of time to go over the whole picture to see if it can still be a train to hop on.

An overview of the company

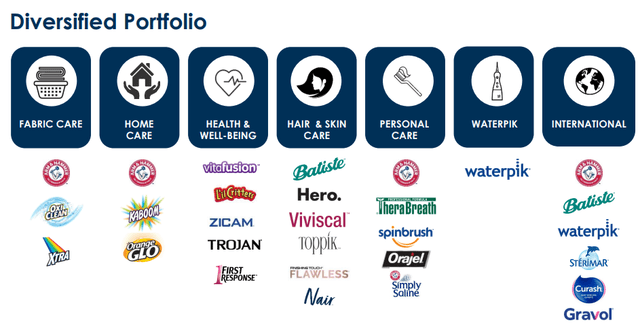

For those who don't know what the company is or does, it is enough to say that, founded back on the core business of bicarbonate of soda preparation, it has, since then, developed a broad range of products using baking soda to clean, deodorize, leaven and buffer. Currently, about 43% of the company's domestic consumer products are sold under the Arm & Hammer brand. The product portfolio is also well balanced with 40% of value products and the other 60% made up of premium segment products. As far as segments go, we have 48% of sales in the personal care segment, another 46% of total sales come from the household products one and the remaining 6% of sales coming from the specialty products division ('SPD'). Those who are unfamiliar with the main brands the company owns, can look at this slide to see how they are spread across a diversified portfolio. But I also recommend going through the CAGNY 2023 presentation to get a better understanding of the whole company's portfolio.

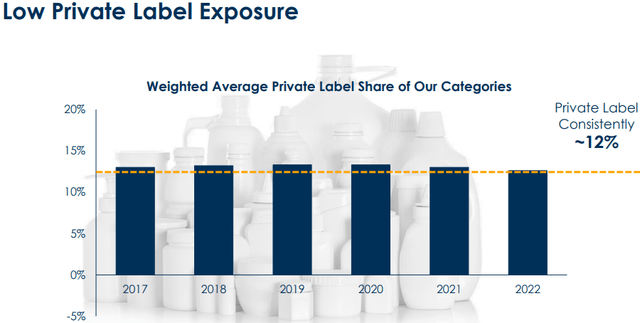

What makes Church & Dwight's portfolio rather valuable is its low exposure to private labels, as seen in this slide below, which I want to point out because it shows how the company wants to protect its margins.

In addition, only 5 of the 17 product categories Church & Dwight owns have private label exposure and these are pregnancy test kits, baking soda (where Church & Dwight owns an extremely strong brand: Arm & Hammer), gummy vitamins, toothache, clumping litter.

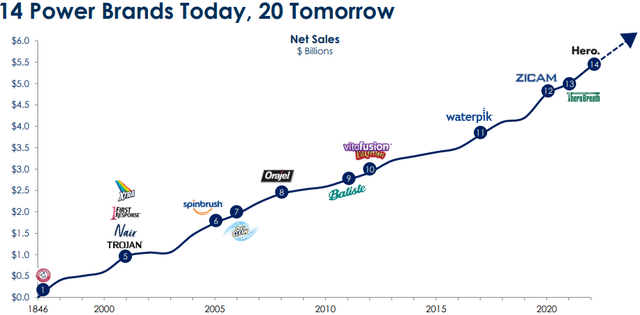

So, the company is mainly a household and personal care products one. Through its ability of carrying out good acquisitions, it has been able to grow consistently, as shown in this graph.

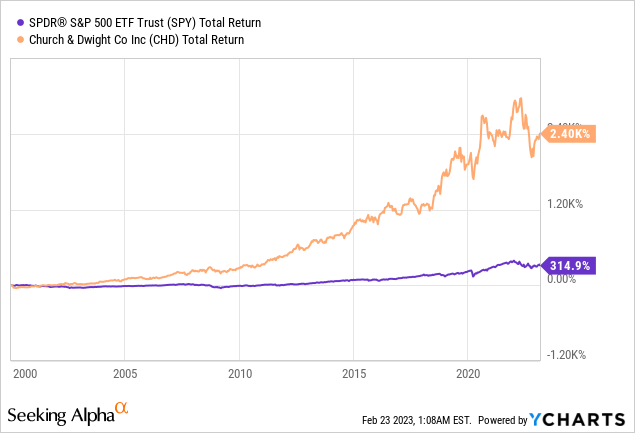

If we compare this graph with Church & Dwight's stock performance, we can see even better why it has been able to catch some attention from long-term investors: the stock has crushed the S&P500 since 2000.

Church & Dwight reported its Q4 2022 earnings and released its annual form 10-K. Let's take a bit of time to look at the company's financials once again to see how it fared through an inflationary environment that was indeed challenging for some household products companies.

Financials

The first surprise I had was to see the company state that it currently only owns 14 power brands. However, the recent Hero acquisition had brought the count up to 15. What happened?

Church & Dwight disclosed that its Flawless brand is not part of the power brands anymore as this acquisition didn't turn out as it was supposed to. In fact, Church & Dwight reported that one of its major retailers discontinued Flawless products, leading the company to include a $411 million impairment charge of Flawless intangible assets.

The latest results paint a somewhat mixed picture about Church & Dwight's performance. The company seemed to be able to meet most of its goals, as sales grew by 3.6% reaching $5.4 billion. To understand how important the power brands strategy is, investors should know that 85% of sales and profits of the company come from these 14 brands.

However, organic sales grew only by 1.4%, coming in quite short of the 3% goal the evergreen model sets. Even more concerning is the reported gross margin contraction which led to a significant -170 bps effect. When I looked at reported EPS, I was taken aback: -49% YoY. How was that possible for a company that is considered to be very solid and reliable? Here we have to spot once again the impact of the impairment charge of Flawless intangible assets. Without this, the company's EPS would have declined by only 1.7%. It still is not on target, but it is much more acceptable.

One thing I liked about Church & Dwight's management was the transparency about the disappointing results, as Mr. Farrell - President, CEO & Chairman of the company - admittedly said during the earnings call:

The first 15 years with Church & Dwight -- every year, we've had significant TSR [total shareholder return]. And in many, many years, it's been double digit. And this year, we went backwards.

And that's a disappointment to me, it's a disappointment to the management team, to the Board and our shareholders. And so, granted, we have that disappointment.

I have to say that it is not as usual as it should be to see the CEO of a company acknowledge an unsuccess, without hiding it.

In fact, we had already seen how the issue of margin compression was affecting the company due to slower sales growth and raw material costs.

Now, the company had stated more than once that in the second half of the year, as it would have had a better inventory management with lower supply chain issues, it would have started spending more adequately on marketing.

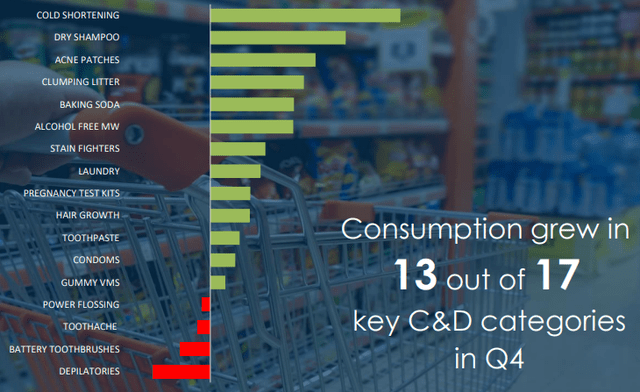

It seems like this strategy is paying off, as 13 out of 17 key categories saw a Q4 growth.

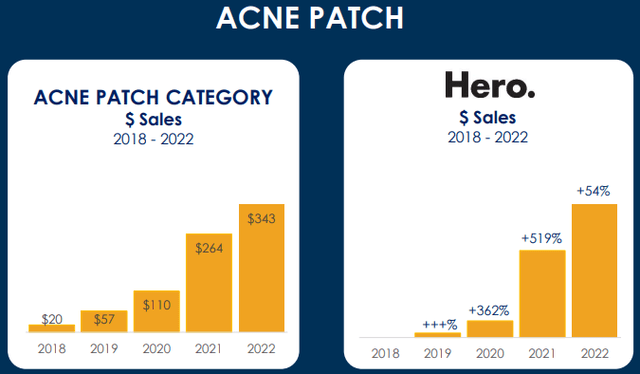

Since my last article, I was particularly interested in seeing how the Hero acquisition is performing. It seemed to be, in fact, a good purchase at a price/sales multiple of 5.5. Considering the massive benefit the Hero brand could find through Church & Dwight's scale when speaking of points of distribution, it seemed to me quite easy to understand that the real forward multiple is much lower. In fact, at the time of acquisition, Hero had a minuscule distribution network compared to other brands such as Neutrogena, Clean Clear or Clearasil. Hero has now been with Church & Dwight just for 90 days, but it looks like it is on a promising track to deliver a very strong 2023. Considering the scale effect of Church and Dwight's distribution network, I would not be surprised to see this brand double its sales by the end of the year, meaning that it could bring an extra $150 million of revenues to the company. This alone would have a 2.7% impact on net sales growth.

I actually bought the stock right after it dipped, following the announcement of the acquisition.

The issue of margin compression

The real issue Church and Dwight reported was margin compression. Gross margin came in at 41.9% of net sales, 170 bps less compared to the 43.6% of 2021, which had already been a negative margin compared to the 45 and change Church & Dwight had gotten investors used to.

Even worse was the operating margin performance, plunging from 20.8% to 11.1%. However, we have seen how this is a consequence of the impairment charge of Flawless. Though not pleasant (I want Church & Dwight to pursue accretive and valuable acquisitions), I am willing to give the company a pass since without this expense, the company would have been okay, operationally speaking, reaching an 18.8% margin. In 2021, the company was at a 20.8%, but it usually was just above 19%. So, an 18.8% in an inflationary environment is acceptable.

However, I am confident the issue is mostly behind the company both because of macro conditions, which make me think inflation has indeed peaked, and because the company had to pause its marketing expenses due to low product availability. Now that inventories are back up, Church & Dwight has increased its marketing spend up to 10.5% of sales, launching a campaign called "give it the hammer".

Valuation

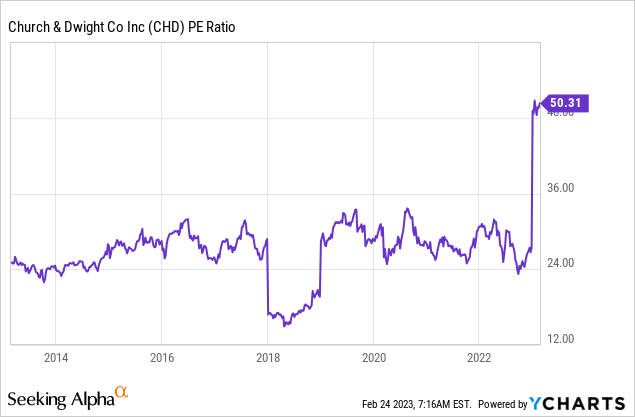

Given the EPS plunge we have seen, no wonder the TTM PE ration has skyrocketed to a 50. Here we are before an interesting situation where, without putting valuation multiples into context, we would deem right away the company as too expensive and way overpriced. However, the fwd PE looks more reasonable as it currently stands at 27. The difference between the two multiples is huge and we already know what abnormally reduced the denominator this past year. In any case, the stock is not exactly a steal, but it is nearing the lower part of the range CHD has been trading at for the past decade.

As far as my discounted cash flow analysis goes, I still stick to the one I shared a few months ago that sees a strong buy territory under $70. Currently, the stock seems to me fairly priced. This is a situation where long-term investors shouldn't be too afraid of initiating or increasing a position.

As for me, I bought my first shares just below $80. Currently I am not adding aggressively, even though I pick up some shares every once in awhile. I think this year we should see household products stocks trade down a bit, as some investors may exit their more defensive positions to build up a more aggressive portfolio. Therefore, for the patient investors, I believe we are before a time where there will be several chances to effectively dollar-cost-average into it.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of CHD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.