Dow: 2023 Is Looking Tough

Summary

- Dow posted record-setting operating cash flow during 2022, alongside record-setting free cash flow.

- This was achieved despite the second half of the year seeing their financial performance deteriorating as weakening operating conditions finally took their toll.

- When looking ahead into 2023, it seems that tough times are afoot with their guidance pointing towards more headwinds than tailwinds.

- At least their financial position is solid, which helps ensure they can handle anything on the horizon.

- Since their share price is up 20%+ following my previous buy rating, I now believe that downgrading to a hold rating is appropriate in light of this outlook.

Dgwildlife/iStock via Getty Images

Introduction

When last discussing Dow (NYSE:DOW) back in the latter half of 2022, my previous article discussed how their weak third-quarter results highlighted their desirable value. It could be said the market agreed because despite nothing improving financially nor economically, their share price subsequently rallied 20%+ but unfortunately, it seems that 2023 is looking tough with more headwinds than tailwinds evident thus far into the year.

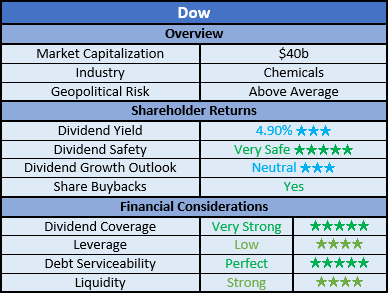

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

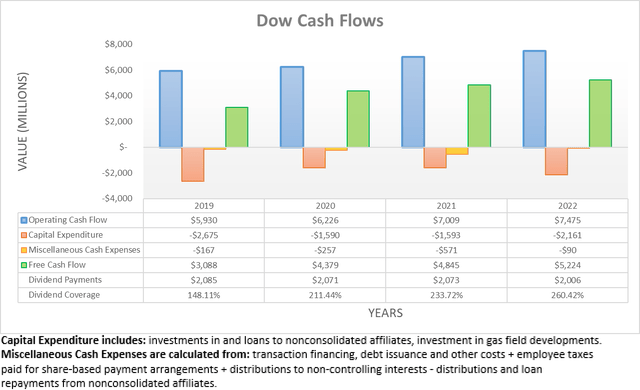

Despite seeing a strong start to 2022, the third quarter started deteriorating as weakening operating conditions finally took their toll, as my previous analysis discussed. Fast forward to the present day and they managed to push onwards and surprisingly, close out the year with operating cash flow of $7.475b, which is still higher year-on-year versus their previous result of $7.009b during 2021. This record-setting operating cash flow was accompanied by record-setting free cash flow thanks to their modest capital expenditure, thereby cementing 2022 as the high water mark with a result of $5.224b that exceeds anything in their past.

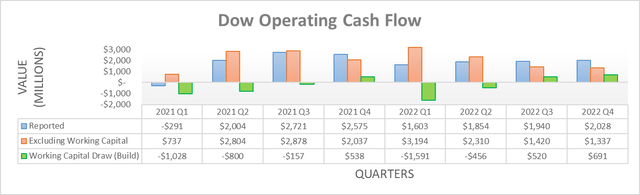

When viewed on a quarterly basis alongside their working capital movements, it shows the fourth quarter of 2022 was boosted by a sizeable draw of $691m. As a result, their underlying operating cash flow that excludes such movements was only $1.337b and thus once again down sequentially versus their equivalent previous result of $1.42b during the third quarter. That said, it should be noted their working capital draw during the fourth quarter was a result of their respective builds of $1.591b and $456m during the first and second quarters partly reversing. This means that despite weakening in the second half of the year, 2022 was still a record-setting year for their cash flow performance but at the reported and underlying levels. Despite this strong set of results, unfortunately, it seems 2023 is looking tough and thus, unlikely to surpass or even match this performance given various headwinds.

Dow Third & Fourth Quarter Of 2022 Results Presentations

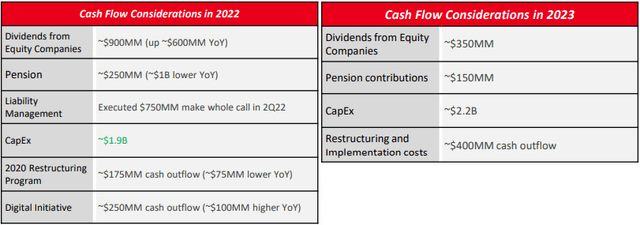

After comparing their guidance for 2023 to that of 2022, it shows they are forecasting a large $550m hit year-on-year via lower dividends from equity companies. Obviously, they cannot provide any exact overall earnings nor operating cash flow guidance given the inherent volatility of their industry but given this element, it clearly signals headwinds lay ahead in 2023 for the remainder of their core business.

When looking elsewhere at their guidance for 2023, they expect their capital expenditure to be circa $2.2b and thus, $300m higher year-on-year and in turn, shaving away more free cash flow. Whilst the first graph above states their capital expenditure during 2022 was $2.161b, this is because it includes their investment in gas field developments along with nonconsolidated affiliates, as noted beneath the graph. In my eyes, these are both capital expenditures in nature because they are repeated annual investments but that said, the more important point of this analysis is rather the relative changes between 2022 and 2023 to assess headwinds versus tailwinds for the year ahead.

Their guidance for 2023 also sees pension contributions of circa $150m, which should be circa $100m lower year-on-year, thereby providing a small tailwind. In 2022 they saw a combined $425m allocated towards restructuring and digital initiative, whereas 2023 forecasts circa $400m and thus makes for a tiny $25m tailwind year-on-year. As a side note, their 2022 guidance included a “$750m make whole call” that refers to the early repayment of debt, as per my earlier article and thus can be ignored because this does not pertain to generating free cash flow.

Once aggregating everything together, their guidance for 2023 points towards a free cash flow headwind of $675m year-on-year, net of tailwinds. Even barring any weakness within their core business, these various moving parts already stand to shave away around 13% of their free cash flow year-on-year versus its result of $5.224b during 2022.

In light of the heavily discussed weak economic outlook for the Western world during 2023, it stands to reason the remainder of the core business will see further headwinds and thus, I would expect their free cash flow to drop upwards of 20%+ year-on-year. The one possible bright spot is the reopening of the Chinese economy from their heavy-handed Covid-19 lockdowns but at the same time, it remains too early to know if this can completely offset the weakening economic conditions throughout the United States, Europe and elsewhere.

Since their dividend payments were only $2.006b during 2022, even losing around 20% of their free cash flow would see a result of circa $4b, which would still provide very strong coverage. Despite being positive and ensuring their dividends remain very safe, alas there was no discussion surrounding dividend growth during their fourth quarter of 2022 conference call and thus once again, it seems this remains off the table in the foreseeable future, especially given the aforementioned headwinds.

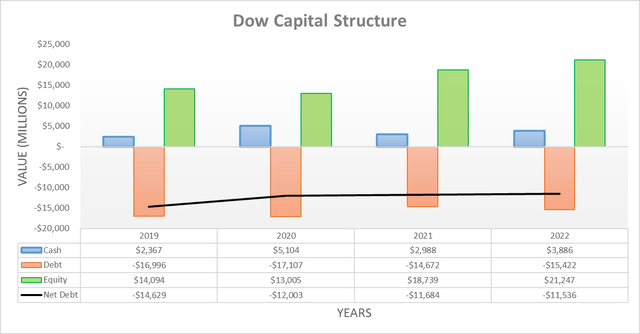

Since conducting the previous analysis, the fourth quarter of 2022 saw net debt edge slightly higher to $11.536b versus its previous level of $11.254b following the third quarter. This initially seems counter-intuitive given their aforementioned very strong dividend coverage, although this was primarily due to $770m being directed towards purchases of investments, net of proceeds from sales and maturities.

Going forwards into 2023, given their guidance it seems reasonable to expect their net debt to once again broadly track sideways, as observed during both 2021 and 2022. Since their capital structure only saw a minor change since conducting the previous analysis, it would be redundant to reassess their leverage, debt serviceability and liquidity in detail as changes would be scant, plus the outlook for 2023 was the primary focus of this follow-up analysis.

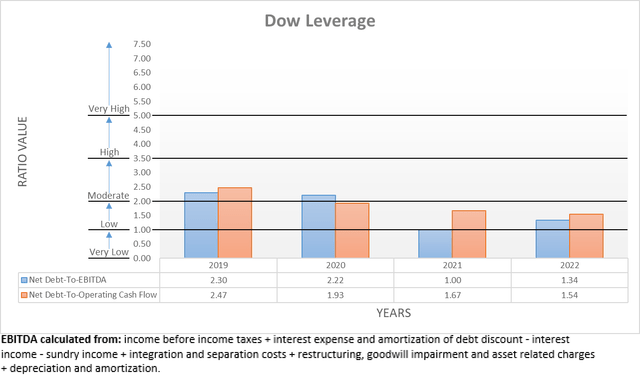

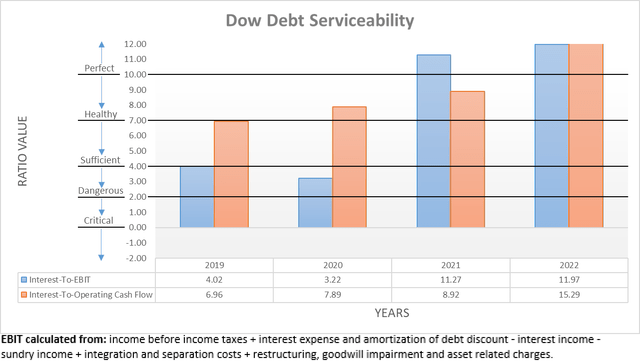

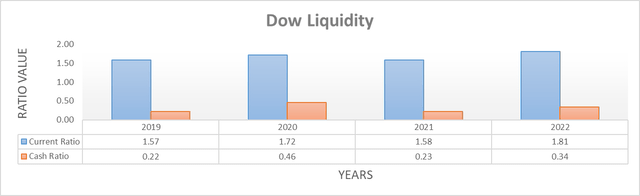

The three relevant graphs are still included below to provide context for any new readers, which shows their leverage is once again low with their net debt-to-EBITDA of 1.34 and a net debt-to-operating cash flow of 1.54 both within the applicable range of 1.01 and 2.00. To zero surprises the same story is shared by their debt serviceability, which once again sees perfect interest coverage of 11.97 and 15.29, when compared against their EBIT and operating cash flow, respectively. This is further supported by their strong liquidity, which sees a current ratio of 1.81 alongside a cash ratio of 0.34. If interested in further details regarding these topics, please refer to my previously linked article.

Conclusion

Even though only time will tell where their results land during 2023, their guidance thus far indicates material headwinds lay ahead that means 2022 is likely to remain the high water mark until 2024 or beyond. Thankfully, their solid financial position will ensure they withstand whatever may be awaiting during 2023 and conversely, if we are positively surprised, it removes any roadblocks from rewarding their shareholders with cash returns. Since their share price is around 20%+ higher following my previous buy rating, I now believe that downgrading to a hold rating is appropriate whilst awaiting to see how this tough outlook plays out, especially as it seems dividend growth is off the table in the foreseeable future.

Notes: Unless specified otherwise, all figures in this article were taken from Dow’s SEC filings, all calculated figures were performed by the author.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.