IDV: A Pricey Play On A Rebound In Developed Market High Dividend Names

Summary

- A role reversal could be taking shape between the US and international equities as to which leads the global market.

- Attractively-priced foreign equities that pay high yields are not a sexy spot, but the area has seen some relative strength in the last year.

- IDV is on the expensive side, but I do see notable price levels to watch on this low-P/E, high-yield ETF.

courtneyk

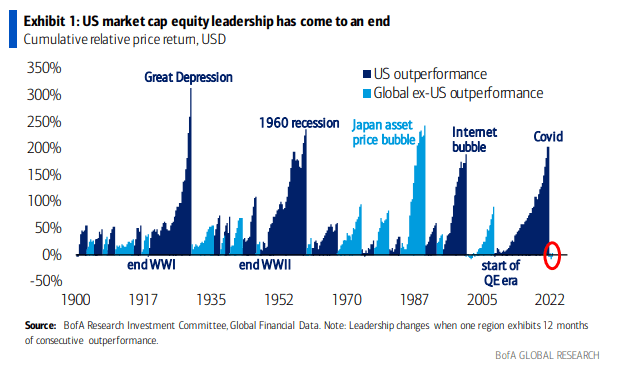

BofA had a bold call a few days ago. It pronounced dead the era of the US's outperformance against the rest of the world. At least for now.

Check out the chart below illustrating all periods of relative favor between domestic and foreign equities. The late 2000s through much of last year was a time to overweight low-dividend, US stocks. Is it time to flip the script? Is international, high dividend the new hot trade? Based on valuations, it might be the case. Let's explore a popular ETF in the space.

A New Regime?

BofA Global Research

According to the issuer, the iShares International Select Dividend ETF (BATS:IDV) seeks to track the investment results of an index composed of relatively high dividend-paying equities in non-U.S. developed markets. It does not aim to hold emerging markets stocks. The expense ratio is a bit high at 0.49% compared to other non-US index funds, so that is not a quality aspect to me. Something like VYMI (0.22% ER) might be more suitable for cost-conscious investors.

Still, IDV has been around since 2007 and has a solid $5.0 billion in AUM with high average daily volume of more than 1.4 million shares over the last 30 days, per iShares. What's more, the median 30-day bid/ask spread is narrow at just 3 basis points, so its tradeability is high. Holding 100 total positions, the 30-day SEC yield is juicy at 6.8% while the ETF's standard deviation is above that of the market's at 25%. What captures the allure of value investors is IDV's dirt-cheap 5.7x forward price-to-earnings ratio, according to iShares.

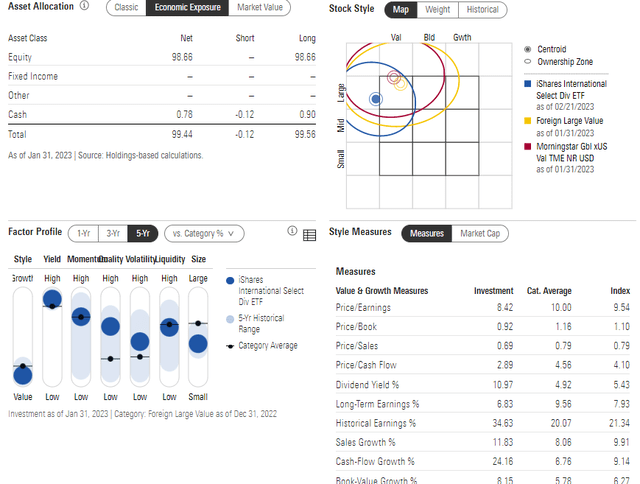

Digging into the portfolio, Morningstar shows IDV to the far left on the style box, indicative of it being heavily valued even compared to its peers. Also, it is somewhat close to being a midcap fund, given no exposure to high-growth and emerging market megacaps. So, IDV is on the extreme on both ends of the value/growth and low/high yield spectrums while other factors are more mixed.

IDV Style Box Plot & Factor Analysis

IDV turns over somewhat frequently for an index fund at 36% as of last year, and it's concentrated. Other funds are more diversified, so once again I would go with something like VYMI, but if you like the prospects of the fund's top holdings, then you might be able to capture more alpha with this one. Keep your eye on how shares of Rio Tinto (RIO) perform as it commands more than 8% of the portfolio. But let's also take a look at the sector composition, which often drives overall performance.

IDV Portfolio Positions

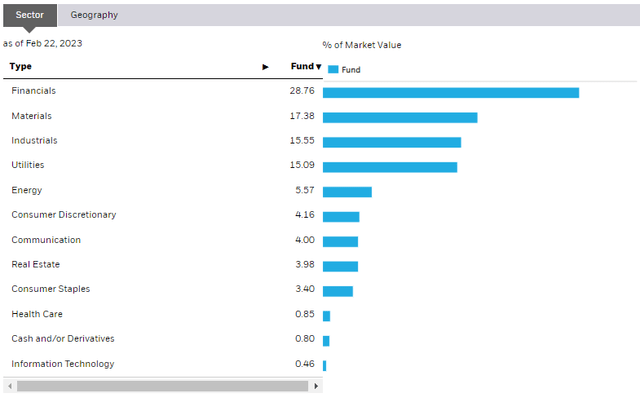

iShares notes that more than one-quarter of the fund is in the Financial sector. So, staying on top of trends in the interest rate market is key. Materials is also a big overweight compared to the breakout of sector risk in the SPX. Should we see a return to favor of cyclical stocks and away from the long-duration trade, then IDV will almost certainly outperform the S&P 500 considering it is less than 10% in the Information Technology, Communication Services, and Consumer Discretionary sectors.

IDV: Financials & Materials Major Overweights Compared to the US Market

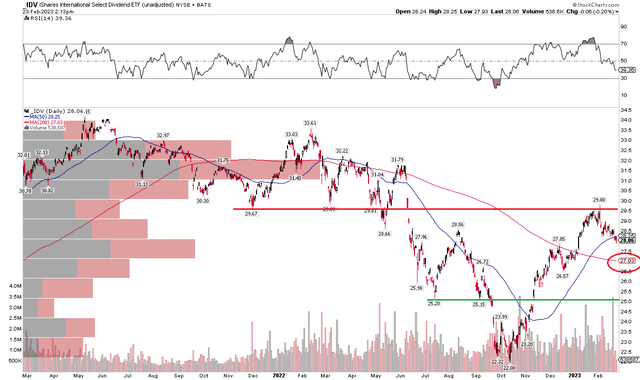

Finally, you know I have to eye the charts. IDV's rally halted right at a former battle zone just below $30. This is your bogey - above that, you can be long but below it, I would shy away. I am seeing a lot of charts like this, so I've been issuing a bevy of 'hold' recommendations, which is frustrating for readers, but that is what the tape is telling me. Here, I'd look for support around $27 - that's where shares broke out from in January, and there is some confluence with the 200-day moving average. Below that, $25 should be decent support. So, we have a few price levels to watch. Maybe nibble at $27 and buy more just above $25.

IDV: Resistance at $30

The Bottom Line

The long-term trend may be turning in favor of non-US, high-dividend names. But the reversal will not come without its fits and starts. I see resistance on the chart of IDV, and more broadly, investors should consider a lower-cost play.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.