Aehr: This One Looks Like A Dud

Summary

- Aehr is among the smallest manufacturers in the ATE industry, mirroring its low, weak competitive moat.

- Most of the company's revenue growth in recent periods stems from two customers. Sales will likely revert to the mean average in the next eighteen months.

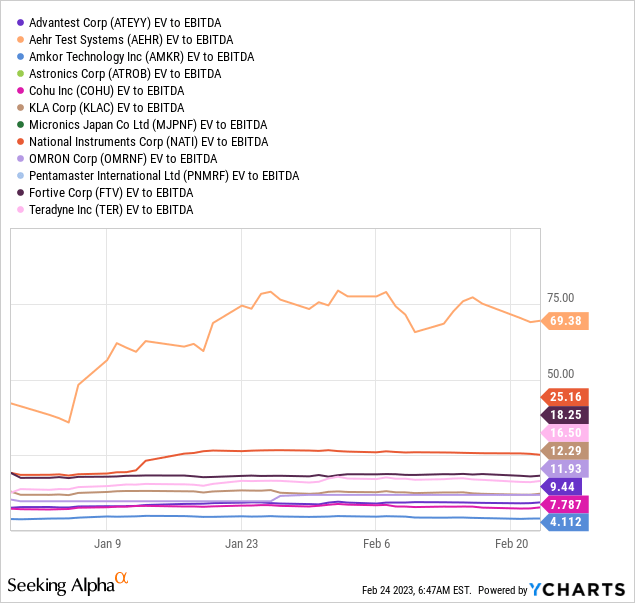

- The company is significantly overvalued compared to its peers.

- Share price momentum will likely fade in the coming 12 to 18 months.

PonyWang

Investment Thesis

Aehr Test Systems (NASDAQ:AEHR) is a small equipment manufacturer engaged in building devices used to test and inspect electric components, namely semiconductor wafers. Burn-in is a process of forcing a device to work under abnormal conditions in order to ensure its longevity. By forcing the device to work under a stressful environment, defects may be uncovered and pinpointed, thus helping to minimize any future malfunctions and failures of the electronic devices containing these semiconductors.

During the thermal screening, the temperatures are increased slowly over a period of time to ensure that the device is able to withstand extreme heat conditions without any malfunctions or breakdowns. Another component of burn-in testing is electric probing, which is the process of applying electrical current to the wafer in order to find out the weakest points.

The demand for the AEHR's wafer-screening systems is a function of CapEx decisions of a small set of customers, mainly consisting of semiconductor manufacturers such as Texas Instruments (TXN), Intel (INTC), STMicroelectronics (STM), ON Semiconductor (ON), all of which have been major customers for AEHR, with the latter driving a significant portion of the growth seen in recent quarters.

AEHR is too small to be impacted by global industry trends. In FY2021, when the industry was booming in the aftermath of COVID stimulus checks, AEHR revenue declined 27% on a YoY. Now the industry is adjusting to excess capacity, AEHR is increasing its revenue guidance. Given the company's low revenue base, single-customer orders and purchase decisions have a significant impact on growth rates.

The company is enjoying momentum, supported by a strong order backlog, big enough to push management to raise capital to fund the working capital necessary to meet demand. Shares have risen by more than ten fold since the 2021 lows, materializing the bullish thesis of many of my fellow Seeking Alpha contributors over the past few years.

At this stage, I believe that the company is overvalued. Our sell rating mirrors AEHR's high price multiples, lack of product differentiation, revenue cyclicality (for both systems and consumables), and long sales lead, weighed against short-term revenue growth from a few large customer orders. Share price momentum will likely fade in the coming 12 to 18 months.

Revenue Results

Last month, AEHR reported revenue for the three months that ended November 2022, showing a sales increase of $14.8 million. While the amount is small, the release was met with enthusiasm as results were a significant improvement from the prior period, enticing speculation that it represents a fundamental shift in the company's fortunes and market position. I can't entirely agree with this assessment. If AEHR's revenue increase was from an improvement in market position, one would have seen a more broad consumer base. Instead, during the quarter, one customer represented 80% of revenue, and another contributed 15%.

The company recently signed a $25 million agreement with a returning customer to purchase a number of Fox-P testing systems for its silicon carbide and gallium nitride semiconductors used in the automotive industry. Earlier this year, the company also announced a qualification order for one device from a new customer, also for testing EV silicon carbide applications. The company is banking on positive revenue growth due to the increasing popularity of EVs and subsequent higher demand for silicon carbide and gallium nitride semiconductors.

Forecasts from William Blair estimate that the silicon carbide market for devices in electric vehicles alone, such as traction inverters and on-board chargers, is expected to grow from 119,000 6-inch equivalent silicon carbide wafers for electric vehicles in 2021 to more than 4.1 million 6-inch equivalent wafers in 2030, representing a compound annual growth rate (CAGR) of 48.4%. This equates to almost 35 times larger in 2030 than in 2021. AEHR press release January 25, 2022.

Management argues that in the long run, the growth of demand for the Wafer-Level Burn-in Test Market will be propelled by the increased adoption of smartphones, tablets, wearable devices, and Electric Vehicles globally. The shift to Carbide-based semiconductors is also cited as a revenue tailwind, given that this material has high fault rates on the wafer level, but those who pass the test are very reliable, making Wafer-Level-Burn-In testing an attractive approach compared to other testing methods. Along these lines, the CEO states:

The beauty of it, and it's a little odd, but as a tester guy, the beauty of it for us is while silicon carbide is extremely reliable long-term, it actually has a very high infant mortality rate, which means that a higher percentage of the devices fail early in the first so many hours of use. But after that, they don't fail anymore, and they're much lower -- or much higher reliability or lower failure rates than other components. And they're much more efficient. That's the perfect dream for us because that means you need our equipment to go in and weed out the infant mortalities by testing them for hours, days at a time to remove the infant mortality, and then they're more reliable. Q1 2021 Gayn Erickson

I don't believe the company's exposure to favorable market trends is a reason to buy the stock. The company missed the 2021 semiconductor boom, and it is not guaranteed to capture the SiC tailwind. For example, between 2010 and 2021, global semiconductor sales nearly doubled from $298 billion to $580 billion, yet, AEHR only succeeded in adding $6 million to its revenue during the period, from $10 million in 2010 to $16 million in 2021.

Market Position and Valuation

While it is commonly assumed that sales will rise along with the rising use of SiC for EVs, the company's historical performance and the lack of correlation between industry tailwinds and the company's sales give me a reason to be pessimistic. The company faces competition from private SMEs such as Scientific Test, Inc, which sells its devices at a starting point of $30,000, to integrated semiconductor manufacturing system providers selling their solutions for hundreds of millions such as Teradyne (TER) to Industrial conglomerates with exposure to the ATE market such as Fortive (FTV) through its subsidies Xcerra and Tektronix. Even medical instrument manufacturers such as Agilent (A) and Danaher (DHR) compete in this market.

Despite the lack of product differentiation, AEHR stock trades at a significant price premium compared to peers, as shown in the graph below.

Summary

Aehr is one of the smallest ATE manufacturers, mirroring its low, competitive moat. The ATE market is highly fragmented and intensely competitive. The company's growth in recent quarters is attributed to orders from two customers. Beyond these orders, sales will likely revert to mean averages, given the cyclicality of demand for the company's systems and consumables. Thus, recent revenue growth in the past quarters doesn't mirror a change in the company's market position.

Although the production of semiconductors has increased exponentially over the previous decade, the company's income has remained relatively stable. Despite favorable market conditions in the long term, there is little reason to expect the company to benefit. Our sell rating mirrors the company's low, competitive moat, narrow customer base, and overvaluation relative to peers, weighed against sales momentum, low PEG ratio, and backlog build-up.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.