Cazoo: The Company Faces Several Near-Term Headwinds

Summary

- Online penetration in the UK's used vehicle industry is currently very low, setting the stage for a large market opportunity.

- Management remains focused on cash-preservation and achieving positive EBITDA in 2023.

- Cazoo's valuation remains depressed and does not reflect the company's strong potential for multi-year growth.

- However, with several quarters of cash burn ahead and macro risks emanating from a possible recession in the UK, I remain cautious and maintain a hold rating.

andresr/E+ via Getty Images

Thesis

Cazoo's (NYSE:CZOO) approach to selling cars online is positioned to benefit from the increasing trend of online automotive purchases. The company has shown that it can build brand awareness and gain market share. Despite a decline in stock price since merging with AJAX, I believe that sustained execution of the company's medium-term goals, which include scaling up sales and improving unit economics and SG&A leverage, is likely to lead to a rebound in the company's valuation. However, the company faces several headwinds in the near-term that include continued cash burn which can lead to shareholder dilution, and macro pressures from an impending recession in UK. Despite a significant decline in its stock price over the past six months, I currently maintain a Hold rating on the stock.

Outlook for 2023

For 2023, management outlook remains optimistic despite prevailing macro headwinds, with retail volumes expected to track 50%+ higher y/y along with continued sequential q/q improvement in retail GPU and SG&A leverage, albeit CZOO acknowledged that potential used car pricing moderation could result in transitory GPU headwinds for 1-2 quarters. CZOO now sees opportunity to achieve breakeven EBITDA run-rate before 2023-end, on the back of further cost cuts even if retail GPU and volumes do not scale as previously targeted. Moreover, the arrival of new CFO, Paul Woolf, in late-October could potentially prompt additional cost-saving initiatives given his historical track record, and with ~£250 million in cash and cash equivalents, the management appears confident of achieving breakeven EBITDA without needing additional external capital.

Low online penetration in UK used car market provides plenty of room for growth

Cazoo operates in a large and fragmented market of used vehicles across the UK. Currently, online penetration in the UK used vehicle industry is very low, at around 4% and is expected to grow significantly over the next several years as consumers become more comfortable with digital retail solutions. While competition from other online used car retailers such as Auto1 (OTCPK:ATOGF), Cinch, and Carzam, as well as traditional dealers with digital offerings, is expected to increase, I believe that a large and fragmented market can provide companies that provide a strong consumer experience, like Cazoo, opportunities to capture a significant portion of the market share.

Ongoing UK recession risk a key concern

Inflation is likely to stay high in the short term in the UK. This, combined with higher interest rates and the waning effects of fiscal stimulus, could push the UK into a recession, which may dampen demand for Cazoo's services. Although used vehicle sales are typically more stable during a recession than new vehicle sales, the current economic conditions may limit Cazoo's ability to grow its volumes due to factors such as declining vehicle affordability and poor consumer sentiment. This could lead to delays in achieving scale efficiencies in areas such as reconditioning, customer acquisition, and branding, ultimately slowing down Cazoo's progress toward its longer-term GPU and profitability goals.

Continued cash burn can lead to shareholder dilution in the future

Cazoo's business is still an early-stage business and is burning through a lot of cash, with the management expecting a cash burn of around £150 million in 2023. While the company has around £250 million in cash and relatively recently raised approximately £630 million in convertible notes, there are concerns about the balance sheet going forward, especially considering the consistent drop in the value of Cazoo's shares. Additionally, given the possibility of a recession in the UK, it may be difficult for Cazoo to reach profitability targets that it set out for 2023, which could lead to a longer period of cash burn and the need for additional funding rounds. This would likely be dilutive to existing shareholders unless there is a significant improvement in the company's ability to execute and scale, slowing down the cash burn. The current cash balance is expected to sustain the company until next year.

Valuation

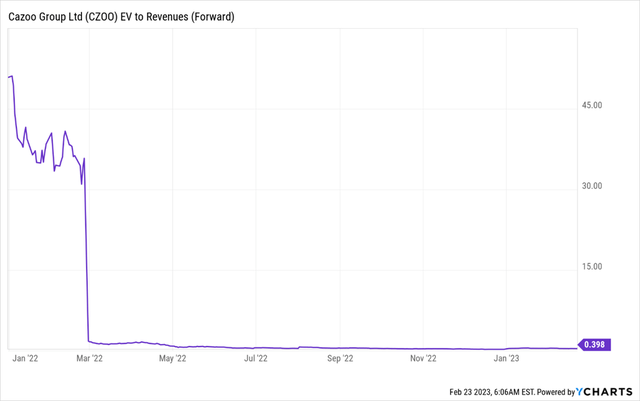

In my view, Cazoo's valuation does not reflect the company's strong potential for multi-year growth, although sustained execution towards profitable growth will be crucial for a re-rating of the stock. Compared to traditional brick-and-mortar competitors, Cazoo's business model appears to be scalable, with plenty of opportunities to capture market share in a fragmented market. CZOO shares are trading at ~0.39x 2023E EV/Sales vs. Carvana (CVNA) at ~0.62x.

Cazoo forward EV/Sales (Ycharts.com)

Final thoughts

Cazoo is positioned to the growing long-term trend of online automotive purchases, owing to its solid digital purchase experience, logistics and reconditioning network, and retail customer center locations that can serve a larger consumer base. However, the company faces several headwinds in the near-term that include the fact the Cazoo is still a relatively small firm and will likely be burning cash in the medium term. Moreover, the company faces macro pressures from a potential recession in the UK. Despite a significant decline in its stock price over the past six months, I currently maintain a Hold rating on the stock.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.