GRID: Investment Theme For The Next Decade

Summary

- GRID provides exposure to companies that are engaged and involved in the electric grid, electric meters, and devices, networks, energy storage and management, and related software used by the smart grid infrastructure.

- In order to meet Net Zero Emissions by 2050, more than $600 billion will have to be invested annually in the world's electricity grids. This should benefit the GRID ETF.

- I would use the pending pullback to build a position in GRID.

imagedepotpro/iStock via Getty Images

The First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (NASDAQ:GRID) provides exposure to companies that are set to benefit from the hundreds of billions in electric grid investments that are going to be required in order to meet 'Net Zero by 2050' goals.

The GRID ETF has outperformed the S&P 500 on a trailing 3 and 5 year basis and is likely to outperform in the future as it has recently broken out to new relative highs against the markets. I would use the upcoming pullback as a buying opportunity.

Fund Overview

The First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund provides exposure to companies engaged in the grid and electric energy infrastructure sector. The GRID ETF has $699 million in assets and charges a 0.58% expense ratio.

Strategy

The GRID ETF tracks the Nasdaq Clean Edge Smart Grid Infrastructure Index ("Index"), an index designed to measure the return of companies that are involved in the electric grid, electric meters and devices, networks, energy storage and management, and related software used by the smart grid infrastructure sector.

To qualify for the index, a company must have market capitalization of at least $100 million and minimum 3-month average daily traded value of $500,000. The security also must be classified in an eligible sector, according to the index provider, Clean Edge.

The index is modified market-capitalization weighted with 'pure play' securities given 80% of the index weight and diversified securities given 20% weight.

Smart Grids Is A Key Investment Theme

Smart grids are electricity networks that use digital and other technologies to monitor and manage the transport of electricity from various generation sources to meet the demand of end users. Smart grids coordinate and balance the needs and capabilities of all generators and end users to operate the system as efficiently as possible, minimizing costs and environmental impact while maximizing reliability and flexibility.

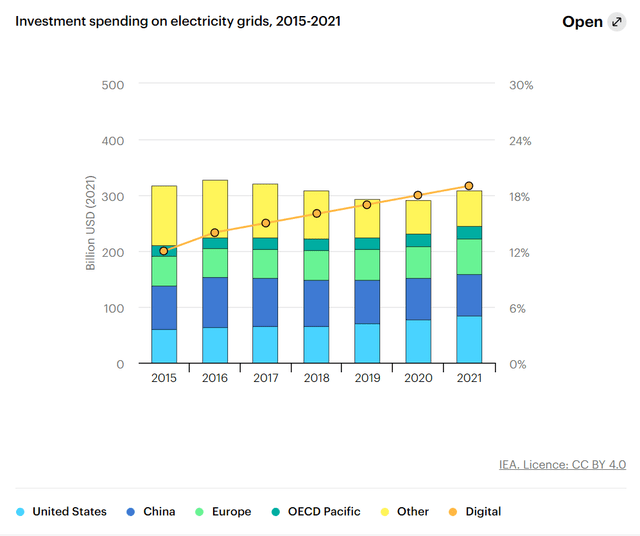

According to the International Energy Agency ("IEA"), investment spending in smart electricity grids will need to average USD $600 billion annually through 2030 in order for the world to be on track for the 'Net Zero Emissions by 2050' scenario. That is almost double the current pace of electric grid investments globally (Figure 1).

Figure 1 - Investment spending on electric grids (iea.org)

Companies exposed to this investment theme should benefit over the coming decade as governments across the world invest heavily to upgrade their electric grids.

Portfolio Holdings

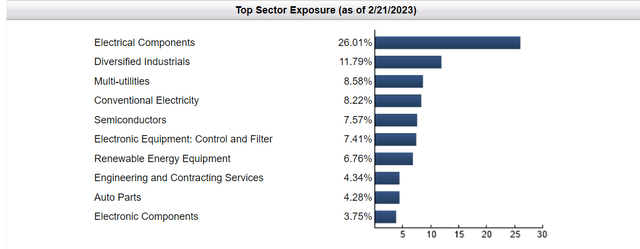

Figure 2 shows the sector weights of the GRID ETF. 26% of the fund is invested in Electrical Components, 12% in Diversified Industrials, and 9% in Multi-Utilities.

Figure 2 - GRID sector allocation (ftportfolios.com)

Figure 3 shows the top 10 holdings of the ETF, which account for 59.5% of the fund's assets.

Figure 3 - GRID top 10 positions (ftportfolios.com)

Returns

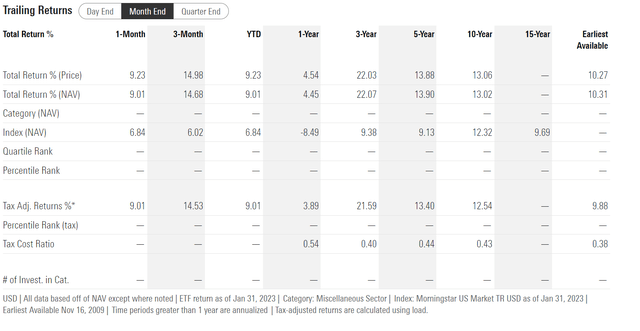

The GRID ETF has performed well historically, with 3/5/10Yr historical average annual returns of 22.1%/13.9%/13.0% to January 31, 2022. Even though 2022 was an off-year with the fund losing 13.9%, it still outperformed the S&P 500's -18.1% return (Figure 4).

Figure 4 - GRID historical returns (morningstar.com)

Distribution & Yield

The GRID ETF pays a quarter distribution with trailing 12 month distribution of $1.10 or 1.2% trailing yield.

Technicals

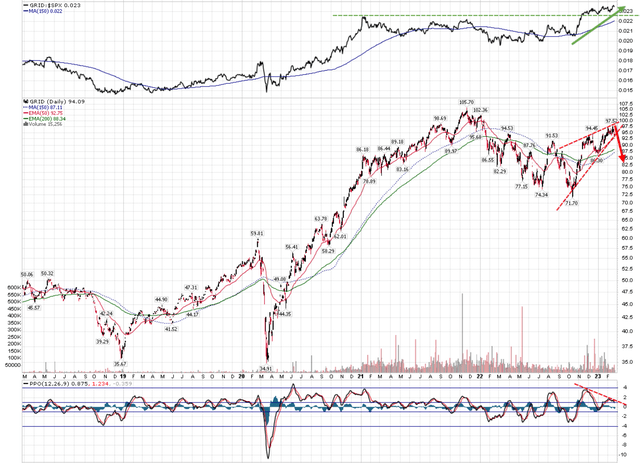

Technically, the GRID ETF has broken out to new highs on a relative basis compared to the S&P 500 Index. However, the absolute chart has a negative divergence on the PPO indicator, suggesting a pullback is occurring (Figure 5).

Figure 5 - GRID outperforming S&P 500 but a short-term pullback is in progress (Author created with price chart from stockcharts.com)

Conclusion

Electric grid investment is a key investment theme for the next decade as the world needs to repair and upgrade existing electricity grids in order to stay on track and meet 'Net Zero by 2050' goals. The GRID ETF provides exposure to companies that are set to benefit from the hundreds of billions in investments in the coming years. The GRID ETF has outperformed the markets on a trailing 3 and 5 year basis and is likely to outperform in the future as it has recently broken out to new relative highs against the S&P 500. I would use the upcoming pullback as a buying opportunity.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.