Ares Capital Blew Out Earnings

Summary

- Core earnings for Ares Capital hit a new record at $0.63.

- Yet, management decided not to continue the special dividend resulting in a cut for investors.

- Although management clearly communicated its stance to remain conservative with recession uncertainty abounding, we believe that the company will shortly face paying dividends or taxes.

Antonio_Diaz/iStock via Getty Images

Ares Capital (NASDAQ:ARCC) reported blockbuster core earnings reaching $0.63 for the December quarter. Yet, management chose to drop the special dividend of $0.03, making in effect a cut. Some investors might claim, no Ares didn't cut, but the simple truth, it did. We wanted to understand more clearly, why. This is a super managed company. We can't take that change for granted. It isn't our purpose to blast Ares. Management must have reasons. Let’s go dig into the results for a better view.

The Quarterly Results

The quarterly results include:

- Core earnings of $0.63 and Net Asset Value (NAVII) of $0.68.

- Leverage at quarters end, 1.26 with leverage at the end of January, 1.21. (The company target equals something less than 1.25.)

- Weighted average per asset equaled an EBITDA of $275 million up from $162 million at December 2021.

- An Asset Value of $18.40, slightly lower.

- For the year, core earnings of $2.02, slightly higher than 2021.

- An overall interest coverage for the total portfolio at 1.8x.

- Non-accruals at 1.6%.

- Liquidity at $4.0B.

- New loan average yield at 10.5% with a total weighted average of 10.5%.

Management noted that the strong core earnings "was largely driven by the benefit of rising market interest rates and our net interest income, but also from strong capital structure and fee income on the fourth quarter transactions." Also, the significant increase in average EBITDA reflects Ares' model with its belief that larger companies breed more stability especially during downturns.

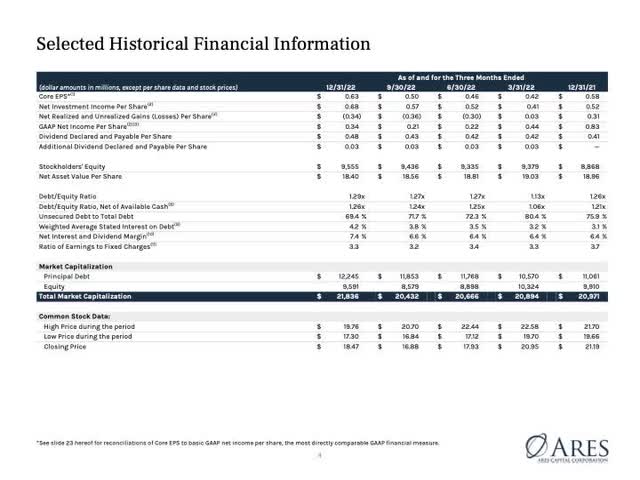

The slide, shown next, includes historical performance for the last year.

Of note, in the past two years, the fourth quarter has been significantly higher than the other three. Even with rate increases beginning with the later part of the 1st quarter, core earnings dropped significantly between the 4th of 2021 and the 1st of 2022. GAAP results, as expected, were about half of the core report.

Ares added one additional investment to its non-accrual list; yet, the total is less than 2%.

Perhaps of most importance in explaining this stellar results, or better stated, far beyond stellar, comes within the prepared remarks.

"Our 2022 earnings significantly benefited from the increase in market interest rates driving a 17% increase in net interest and dividend income per share as compared to 2021. The growth in these recurring earnings roughly offset the decline in capital structuring fees in 2022 relative to the higher fees earned during the more active 2021."

This result was driven directly from the high investment in floating rate loans, an effect that disappears when or if rates fall off significantly.

Overall, the company is again in stellar state.

The First Marker

Widening rates have increased depreciation lowering NAV to $18.40. This is a number, which in reality, is nothing more than a reflection of the market place. On the other side and important side, "Market spreads on new deals are at least 100 to 150 basis points higher than at year-end 2021, and . . . that the total return opportunity afforded by the higher base rate in addition to the spread expansion is very compelling." In other words, the negative value is offset by real cash generating opportunities. Management views "realized gains and losses is the more important metric in grading our performance than the unrealized gains and losses, which has substantially less impact on our long-term results." The statement reflects good common sense. To end this discussion, Ares noted that it is still very active in the market place and this dislocation will likely be in place for a significant period of time.

The Marketplace

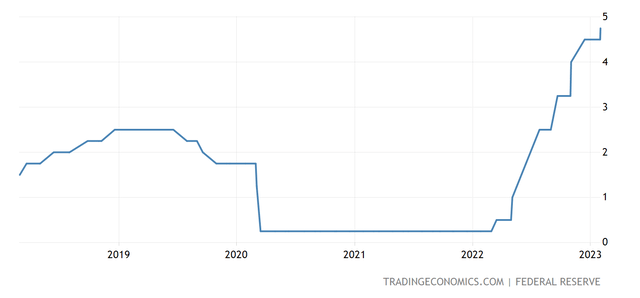

Management seems focused on two market place factors, interest rates and recession signs. First, we included a five year graph of Fed interest rates. Some market analysts, discussed below, believe more rates are in store.

Next, with a very real belief by management that a business slowdown is likely, preparations are being made. The company's goal is to identify weaknesses early and address appropriately. This action is being conducted in spite of the conservative investing approach Ares follows. Management expects a significant increase in contractual amendments moving forward.

Rationalizing The Dividend

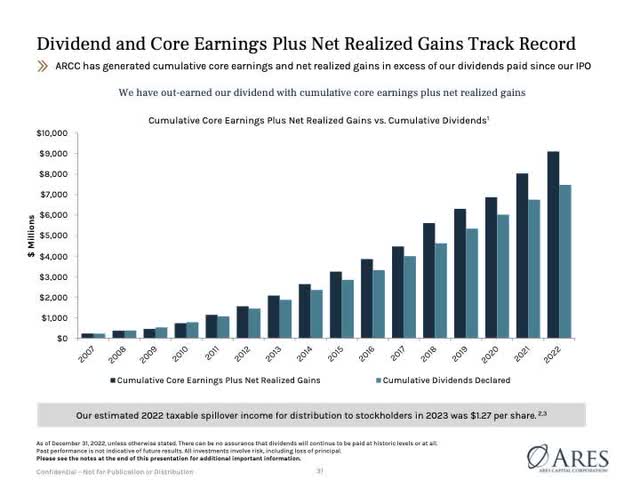

With this in place, the question and answer portion of the call added necessary detail in managements thinking on dividends. But, first, from the prepared remarks, Penelope Roll, company CFO, stated, "We recognized that we had a strong level of core earnings for the year, which far outpaced the total dividends we paid." Ares rolled over $675 million in spillover. The discussion continues later in the call with the uncertainty concerning interest rates.

Kipp deVeer, CEO, argues that interest rates leaves an unknown of such uncertainty that management is uneasy about dividend increases. Specifically,

"We can all debate how long folks think they'll stay there or not, but our best guess would be that rates will normalize and begin coming back down. My own personal view is we're unlikely to see a 30 basis point LIBOR or SOFR again anytime soon. . . . So our base case probably has rates down the line way out, normalizing down certainly from here, but my guess is as good as has as to where that is.

A significant part of blow-out earnings came from higher rates lifting floating rate loans. Continuing,

"It's been one of the reasons that we were cautious about raising the dividend as much as we did last quarter and frankly chose not to raise the dividend this quarter because we'd like a stronger view on where we see rates normalizing in the future."

Yet, Goldman and Bank of America, both, predict at least three more interest rate hikes during 2023.

With the two sides of the dichotomy, one demanding dividend increases, the other predicting a significant drop in earnings, management faces the dilemma of paying tax or dividends. This predicts, in our view, a coming special dividend. Using a graph contained in the 4th quarter equity presentation, we offer our forecast.

The above slide shows that during 2022 realized gains were approximately 20% above that payout. To maintain the 90% payout law, an additional 10% is needed or approximately $0.05/quarter. We wonder if management needs one more quarter of results before making a decision on a special. Again, we believe that specials are likely to be announced at the next quarter unless core earnings collapses.

Risk

Ares management actively expects enough dislocation within the economy to cause a significant level of contractual amendments, but believes it has in place the necessary liquidity to manage. Continued dislocation of interest rates might continue to negatively impact NAV. The price of the stock will follow changes, up or down. Investors should expect a level of volatility. But, Ares is one of the best. We own a large position and continue to do so. With a NAV near the middle $18s, adding at prices in the $18s or low $19s might be a truly lucrative entrance. We rate ARCC stock a buy on weakness.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ARCC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Buy on weakness.