Oil Refiner Par Pacific Reported A Much Strong Earnings For 2022

Summary

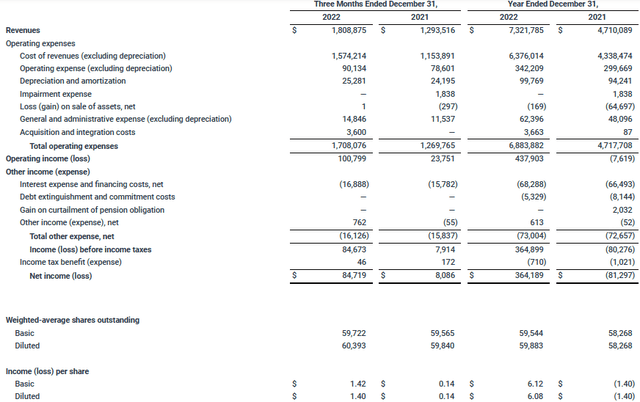

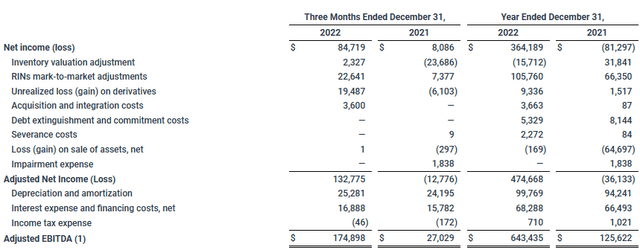

- Par Pacific reported 4Q EPS of $1.40 compared to $0.14 the year before.

- Adjusted EBITDA was $643.4 million in 2022 compared to $125.6 million in 2021.

- Huge increases in gross profit margins per barrel at their three oil refineries were the primary driver behind the improved 2022 results.

- Their purchase of 63k bpd Billings oil refinery is expected to close on June 1.

- The new $550 million refinancing should result in an overall 100 basis points reduction in interest rates.

hapabapa/iStock Editorial via Getty Images

Par Pacific Holdings (NYSE:PARR) is trading at a relatively low P/E of 4.25x based on last year's EPS of $6.08, which was reported after the close on February 22, and trades at only 2.45x EBITDA/Enterprise Value. Their three refineries had a dramatic improvement last year and with the purchase of Exxon Mobil's (XOM) Billings refinery, which is expected to close around June 1, this stock could be an interesting speculative buy. Par Pacific's 46% equity investment in Laramie Energy, which is carried on their books at zero, is an added kicker because it reported a $102 million EBITDAX in 2022 and is finally paying a distribution to Par Pacific.

Recent Results

While consumers might be very unhappy, investors are delighted that Par Pacific significantly improved their operating margins in 2022. Diluted EPS increased to $6.08 from a loss of ($1.40) in 2021. Even as their crude oil costs went up, they were able to sell their refined products at higher profit margins than in the prior year. The cash provided from operations of $452.6 million was so high that they are using $310 million of it to buy a 63k bpd refinery in Billings, Montana. (See further below.) This contrasts to 2021 when they had a negative cash flow from operations of $27.6 million.

4Q and Annual Income Statement 2022 and 2021

A major turnaround in their refinery results last year was reflected in their gross margins per bbl. Refinery operating income was $401.9 million in 2022 compared to a loss of $88.8 million in 2021. Adjusted gross margins per bbl. at their 94k bpd Hawaii refinery in 2022 was $13.99 compared to $4.56 the prior year. Their 42k bpd Washington refinery had an even more dramatic improvement to $18.00 from $2.98 in 2021. Their 18k bpd Wyoming refinery had the highest margin of $26.50, up from $14.47.

4Q and Annual Adjusted EBITDA 2022 and 2021

Besides refineries, Par Pacific has 119 retail gas stations (90 in Hawaii and 29 in Washington/Idaho) that reported EBITDA of $141.5 million in 2022, which is up from $118.9 million the prior year. Their Hawaiian operations were hit really hard by almost no tourist travel to the state during the pandemic, which put Par Pacific in very serious financial trouble in 2020 and early 2021. They even did a sale-leaseback for 22 stations to raise cash in 2021. Total retail gasoline sales, however, declined in 2022 to 105.5 million gallons from 109.2 million gallons in 2021 as drivers drove less because of higher gas prices.

Their logistics segment had basically flat EBITDA of $74.4 million in 2022 compared to $73.4 million in 2021. The revenue from logistics comes from transporting crude oil to refineries and transporting refined products to various customers. They also earn fees for storing crude and refined products for others.

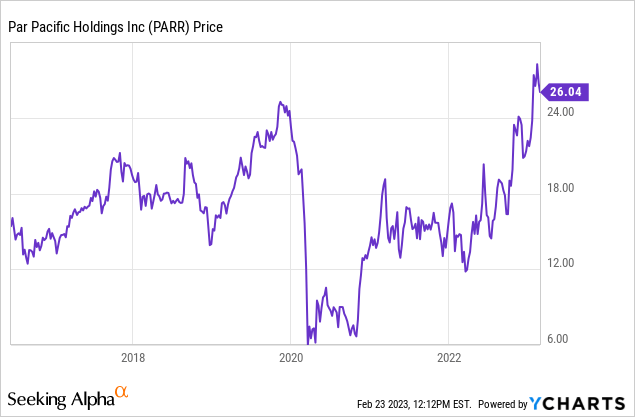

PARR Stock Price Since My June 16, 2016 Article

I expect lower energy prices in 2023 compared to 2022 and also less volatility in 2023, which could mean refinery margins in 2023 could be lower than 2022. With almost panic buying by consumers to avoid even higher prices in 2022, they were able to get higher prices for their refined products. I don't see a repeat of that in 2023. I am not able to estimate 2023 results because I don't know their hedging positions for 2023. I hope their 10-K will include information about their current hedges.

Purchasing 63k bpd Billings Refinery

Their purchase of Exxon's Billings refinery is the primary reason that I repurchased the stock last October. I think the $310 million purchase price is a great deal. According to an earlier Reuters' article the price talks the last few years between protentional buyers and Exxon was "between $300 million and $600 million". Par Pacific stated in a presentation that they were estimating an annual adjusted EBITDA of $105-110 million, before any potential synergies, which is about 3x the purchase price. The deal is expected to close around June 1 according to their February 23 conference call.

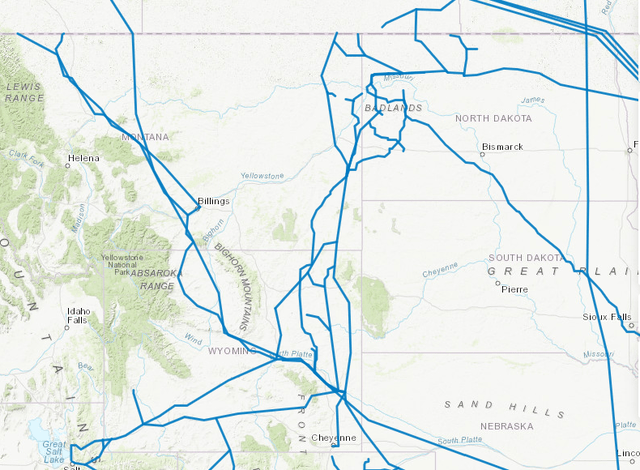

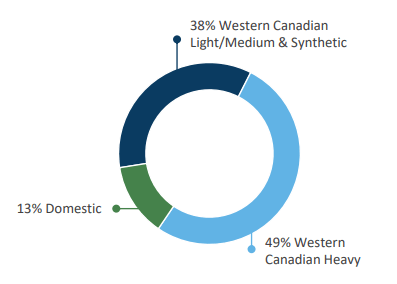

Billings Refinery Crude Oil Sources

parpacific.com

Given the Billings location one might think that their crude sources would be North Dakota or Wyoming, but 87% comes from Alberta, Canada via pipelines. Most of the remaining 13% comes from Wyoming.

Major Crude Oil Pipelines

The marketing area for this refinery is mostly to the west of Billings. It seems that their new business model will involve expanding more of their retail operations to sell the gasoline/diesel fuel between Billings to Washington. It may take some time before the refinery is fully integrated into their operations and there could be additional expenses related to purchase in 2Q, but the refinery should have a very positive impact on future results.

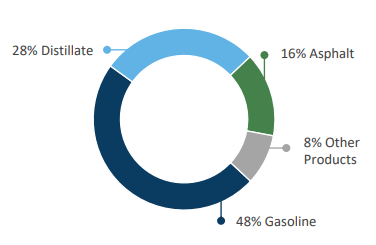

Billings Refinery Product Yield

parpacific.com

This is, however, an old refinery that was built in 1949, which causes some concern that it is a white elephant that eventually could become a large liability for massive costs to clean up their operations. Some worry it could follow a former refinery in Casper, Wyoming that closed in the 1990's and there was a very expensive reclamation project that turned the area into a golf course.

Current Refinancing

Par Pacific is in the process of completing a $550 million secured term loan deal to replace their term loan due 2026. As part of this new deal, they also initiated a cash tender offer for their 7.75% and 12.875% notes. This is not cheap borrowing, in my opinion. The interest rate is SOFR+4.25. Because it was priced at 98.5, the effective rate is actually a little higher. With a current SOFR rate of 4.55%, the current rate is 8.80% for this new term loan maturing in 2030. The rate could be reduced to SOFR+4.00% if their credit rating is upgraded to Ba3/BB-.

The interest rate on the current term loan due 2026 was LIBOR+6.75% or "Alternate Base Rate"+5.75%. Overall, according to management during their recent conference call, the new financing should reduce their interest rate 100 basis points.

With the very large cash generated from operations over the last year they could have paid down most of their current debt, but they are using $310 million cash to pay for the Billings refinery. So effectively they are actually borrowing at 8.8% to buy the refinery. Assuming their estimate of $105-110 million EBITDA is correct and using 8.8% effective interest on $310 million, which is $27.3 million, the refinery purchase should have a significant positive impact on future total company EBITDA.

Laramie Energy

Par Pacific owns a 46% interest in Laramie Energy, a Colorado natural gas developer and producer. Because Laramie was highly leveraged the low energy prices during the pandemic resulted in them needing a forbearance agreement with their lenders. At the end of December 2018, Par Pacific carried Laramie's equity value on their books at $136.7 million, but over the following years the equity value was written down to zero. Because of the reported large derivative losses by Laramie, it seems that much of their natural gas production was hedged at prices significantly lower than actual sale prices in 2022. It would be interesting to see how much and at what prices they currently have hedged since natural gas prices have dropped sharply over the last few months. They use the White River Hub that has a number of pipelines, such as the Mountain West Pipeline that goes to the west coast where prices have been higher than the Henry Hub.

This month Laramie Energy redeemed their preferred stock and replaced their term loan with a new $160 million term loan. These refinancing transactions will allow Par Pacific to receive a $10 million distribution in March. Oddly, higher natural gas prices could mean lower future distributions because the cash will be used for new drilling programs instead of being distributed according to management. With EBITDAX of $102 million in 2022 Laramie Energy is worth a few dollars per PARR share based on 60.3 million PARR shares outstanding as of October 28, 2022, and is a little extra "kicker" in the valuation of PARR shares, in my opinion.

Conclusion

I have been in and out of PARR a few times since I wrote my article in June 2016. My current interest in PARR is because of their purchase of the Billings refinery at a bargain price that should have a major positive impact on future results. Since I am rather bearish on the entire stock market, I have all my long positions hedged by short positions in other companies.

Par Pacific Holdings could be an interesting speculative buy even at higher prices than I paid for last October because it is trading at a very low P/E of a little over 4x based on last year's earnings. I am, however, putting a neutral/hold recommendation on the stock until I know details about their current hedge positions because hedges could have a significant impact on 2023 reported results.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of PARR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.