Performance Food Group Company: Strong Performance Justifies Further Upside

Summary

- Performance Food Group Company has lived up to its name, with financial results continuously revised higher.

- The picture for the business is solid and shareholders have so far been rewarded handsomely because of it.

- Though shares aren't the cheapest, they are still affordable and will likely continue rising moving forward.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Yagi Studio

The food distribution industry is filled with a wide variety of firms, many small but some large, that are necessary in order to feed the massive population that exists in the US. One player of a rather meaningful size in this market is Performance Food Group Company (NYSE:PFGC), with the company boasting a market capitalization of $9.2 billion. Recently, shares of the business have moved higher thanks to robust financial performance achieved by the business and guidance by management that is higher than what was previously anticipated. These days, PFGC stock is not the cheapest out there. But between the growth the company is experiencing and how shares are priced at this time, I would say that they are still cheap enough to warrant a ‘buy’ rating.

A tasty addition for your portfolio

Back in early October of 2022, I performed a deep dive into Performance Food Group Company to see to what extent the company might make for a valid investment prospect. In that article, I found myself impressed by the strong fundamental performance the company continued to generate. That trend, I said, was likely to continue through at least the 2023 fiscal year. This was based in part on management's own expectations for 2023. Acquisition activity was certainly a part of the pie, but so was organic growth. Add on top of this the fact that shares of the company have looked cheap, even in the event that financial performance were to revert back to levels it experienced in prior years, and I could not help but rate the business a ‘buy’ to reflect my belief that shares should outperform the broader market for the foreseeable future. Fast forward to today, and the company has done exactly that. While the S&P 500 is up 7.1%, shares of Performance Food Group Company have seen upside of 29.5%.

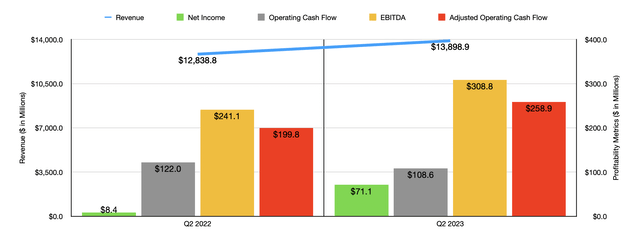

To truly understand why shares of the business have moved up so rapidly, it would be helpful to dig into the financial results covering the second quarter of the company's 2023 fiscal year. This is the most recent quarter for which data is available. According to management, revenue for this time came in at $13.90 billion. That represents a nice increase over the $12.84 billion in revenue reported one year earlier. That's roughly 8.3% increase was driven in part by a rise in selling price per case as a result of management's ability to push inflationary pressures onto its customers and because of a change in product mix. Total case volume for the company also grew during this period, climbing 3% year over year. This included a 6.6% rise associated with independent case growth. Total organic case volume reported by the company benefited from a 4.3% rise in organic independent cases sold during the quarter.

On the bottom line, the picture also improved. Net income went from only $8.4 million to $71.1 million. A favorable shift in the mix of cases sold and growth in the independent channel was instrumental in pushing profits up during this time. This was offset to some degree by $10.5 million in additional interest expense during the second quarter of the 2023 fiscal year compared to the second quarter of the 2022 fiscal year. Other profitability metrics for the company were largely positive as well. It is true that operating cash flow worsened, dropping from $122 million to $108.6 million. But on an adjusted basis, it rose from $199.8 million to $258.9 million. By adjusted, what I mean is that it ignores changes in working capital. Meanwhile, EBITDA for the business also expanded, climbing from $241.1 million to $308.8 million.

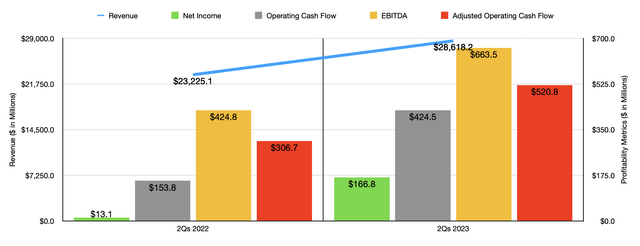

The results experienced during the second quarter of the year were very helpful in pushing up results for the first half of 2023 in its entirety. Revenue of $28.62 billion beat out the $23.28 billion reported one year earlier. Net income skyrocketed from $13.1 million to $166.8 million. Operating cash flow surged from $153.8 million to $424.5 million, while the adjusted figure for this grew from $306.7 million to $520.8 million. And finally, EBITDA for the business expanded from $424.8 million to $663.5 million.

In addition to posting robust financial results, the company has also done well to increase guidance for the year. For 2023 as a whole, revenue is expected to come in at between $57 billion and $59 billion. When I last wrote about the company, the forecast was for sales of between $56 billion and $58 billion. Profits are also expected to come in higher than previously anticipated. For instance, EBITDA is now expected to be between $1.27 billion and $1.35 billion. Management's prior guidance was for a reading of between $1.25 billion and $1.35 billion. And when I last wrote about the company, this number was going to be between $1.15 billion and $1.25 billion. By 2025, management is forecasting revenue of between $62 billion and $64 billion. Using midpoint figures, this would translate to year-over-year growth of between now and then of 4.2%. Meanwhile, the expectation is for EBITDA to total between $1.5 billion and $1.7 billion.

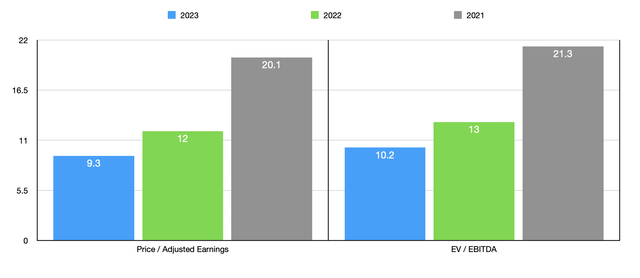

If we assume that adjusted operating cash flow will rise at the same rate that EBITDA is forecasted to, at the midpoint, for the 2023 fiscal year, then a reading of $982 million is not unrealistic. This would imply a price to adjusted operating cash flow multiple for the company of 9.3. That compares to the 12 reading that we get using data from 2022 and the 20.1 reading that we get using data from 2021. When it comes to the EV to EBITDA approach, the multiple is expected to be 10.2. This is down from the 13 reading that we get using data from 2022 and compares nicely against the 21.3 reading that we get using data from 2021. As part of my analysis, I also compared the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 5.3 to a high of 61.1. And when it comes to the EV to EBITDA approach, the range would be from 5.8 to 15.2. In both cases, two of the five companies ended up being cheaper than Performance Food Group Company.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Performance Food Group Company | 12.0 | 13.0 |

| US Foods Holding Corp (USFD) | 11.9 | 14.3 |

| United Natural Foods (UNFI) | 16.9 | 6.7 |

| The Chefs' Warehouse (CHEF) | 61.1 | 15.2 |

| The Andersons (ANDE) | 5.3 | 5.8 |

| SpartanNash Company (SPTN) | 45.6 | 8.6 |

Takeaway

As far as I can tell, Performance Food Group Company continues to do exceptionally well. The company is growing nicely, both on its top line and on its bottom line. Between this and the increased guidance that we have seen, it's no wonder that shares are up so much. Add on top of this how shares are priced right now, especially on a forward basis and including relative to similar firms, and I do believe that some additional upside could be warranted from here.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.