Jacobs Solutions: Good Growth At An Attractive Valuation

Summary

- Legislative drivers like IIJA, IRA and CHIPS Act, the onshoring trend and increased geopolitical tensions should drive growth.

- Higher-margin backlog and improvement in utilization in the PA business should help the margins.

- The stock is trading at a discount to its historical levels.

Kameleon007

Investment Thesis

Jacobs Solutions Inc. (NYSE:J) has a good order pipeline thanks to legislative drivers like the Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA), and the CHIPS Act, which is expected to contribute to revenue growth over the next few years. In addition trends like reshoring and investment in EV infrastructure, and recent geopolitical tensions are also expected to help growth. In addition, Jacobs' healthy balance sheet also indicates good inorganic growth prospects. On the margin front, the adjusted EBITDA margin should improve in the coming quarters, driven by a higher-margin revenue mix and improved utilization at PA Consulting. The stock is currently trading at a discount to its 5-year average P/E ratio, making it an attractive buy.

Revenue Analysis & Outlook

In the first quarter of FY2023, net revenue for Jacobs increased by 8% Y/Y (or 12% Y/Y on a constant currency basis), driven by healthy backlog and demand drivers like the Infrastructure Investment and Jobs Act (IIJA), Inflation Reduction Act (IRA), and Chips Act. The backlog at the end of the last quarter stood at $28.3 billion, up a modest 1% Y/Y (or 2% Y/Y on a constant currency basis). The reason behind modest backlog growth was the Kennedy NASA project, the booked portion of which was nearing completion and it had not come for a rebid till the last quarter end. The good news is Jacobs announced today (February 24th) that it has won a $3.2 billion rebid for this project and we should see improvement in backlog growth as well from next quarter.

Jacobs Solutions' backlog level, order pipeline, and revenues should also benefit from the major growth catalysts, such as IIJA, IRA, Chips Act, reshaping of supply chain and technology investments, and increased geopolitical tension. The company remains focused on four key end markets: critical infrastructure, energy and environment, advanced facilities (including E-vehicles and semiconductors), and national security, and these markets are poised to benefit from these growth catalysts.

The funding from the $550 billion IIJA act has started flowing through to the revenues and Jacobs has already helped its clients secure over $1 billion in IIJA competitive grants, despite the funding deployment still being in its early stages. Through the IRA, the federal government has announced $369 billion in investments for Energy Security and Climate Change programs over the next 10 years. With Jacob's expertise in nuclear fission and fusion energy technology and solutions, the company is well-positioned to benefit from an accelerated global green energy transition. The CHIPS Act by the U.S. government provide $52.7 billion for American semiconductor research, development, manufacturing, and workforce development. This act should create a healthy demand environment for the semiconductor industry, and benefit Jacob's revenue as well.

The global semiconductor shortage that began in 2020 has impacted numerous industries and has created long-term risks in the semiconductor supply chain. To address these issues, the U.S. government is implementing policy actions to reduce semiconductor supply chain risks and encourage reshoring. The CHIPS Act has accelerated additional investments by companies like Micron (MU) in American semiconductor manufacturing, which should benefit Jacob's growth.

Further, Jacobs is poised to benefit from growth in E-Vehicles and defense market as well. Jacobs is in a favorable position to capitalize on the E-Vehicle adoption trend, having secured project wins related to battery and vehicle manufacturing, as well as charging infrastructure, in both the U.S. and Europe. On the defense side, national security has become a paramount issue globally, given the rising geopolitical tensions, including the recent Russia-Ukraine war. The war has posed increased global threats, necessitating enhanced technology and solutions to protect against potential future risks. Jacob in a good position to benefit from positive trends in this market as well.

In addition to promising organic growth prospects, the company boasts a solid balance sheet that could provide additional revenue growth opportunities through strategic mergers and acquisitions (M&As). As of the end of the last quarter, the company had $1.2 billion in cash and cash equivalents, and gross debt of $3.5 billion, resulting in a net debt of $2.3 billion. Based on management guidance of $1440 in FY2023 adjusted EBITDA (mid-point), the company's net leverage is ~1.5x, and the company is well placed do opportunistic M&As.

So, I am optimistic about the company's growth prospects. Sell-side consensus estimates are building mid single-digit growth for the company for the next couple of years, which I believe is easily achievable.

Margin Outlook

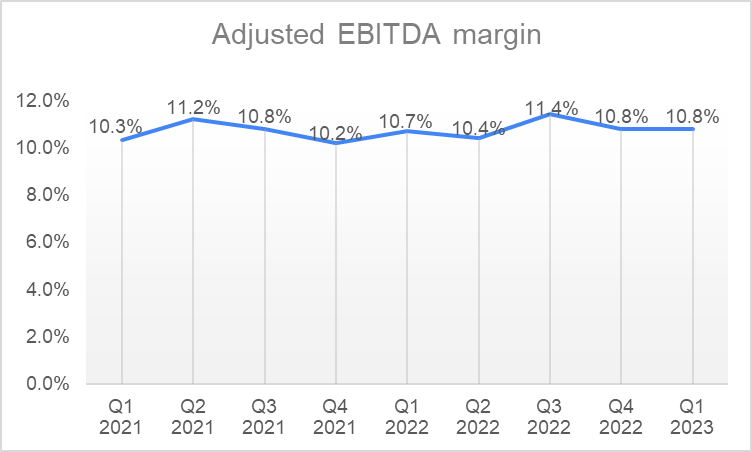

The company's adjusted EBITDA margin improved modestly by 10 bps Y/Y in the first quarter. The company ended FY2022 with a higher margin backlog, which benefited the Q1 margins. However, this was partially offset by a lower-margin remediation project and lower-than-expected utilization in the PA Consulting segment.

Jacobs Adjusted EBITDA margin (Company data, GS Analytics Research)

Looking ahead, I anticipate that the adjusted EBITDA margin will improve in the upcoming quarters, driven by a higher margin backlog mix and increased utilization. According to management, the gross margin in the backlog as a percentage of net sales is up over 100 bps Y/Y. This favorable mix should contribute to overall margin improvement in the future. Additionally, the management has identified new higher-margin opportunities in growth accelerators such as climate response, data solutions & consulting, and advisory, which should further boost the company's margin expansion.

In FY2022, PA consulting proactively hired staff in anticipation of an increase in demand from secular growth opportunities across energy transition, sustainable consumer goods, and digital transformation. While the sales pipeline has remained robust, the delayed conversion of these opportunities into revenue has impacted their utilization. Nevertheless, the company has taken significant measures to enhance utilization and, as the projects in the PA Consulting business ramp up, margins should increase. Management expects the operating margins of PA consulting to improve gradually, approaching 20% by the end of FY2023.

Valuation and Conclusion

The stock is currently trading at a P/E ratio of 16.28x FY23 consensus EPS estimate of $7.37 and 14.36x FY24 consensus EPS estimates of $8.36. This valuation is lower than the company's 5-year average forward P/E ratio of 17.52x. Given the company's strong order pipeline and higher-margin revenue mix in backlog, the company is poised for good growth over the next few years. I believe the risk-reward profile is attractive at the current levels and, hence, have a buy rating on the stock.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written by Harshit K.