United Overseas Bank Delivered A Record Result, But Is It The Bank Of Choice?

Summary

- In line with other banks in Singapore, UOB delivered record net profit in 2022.

- We look at how they perform compared to their larger peer DBS Group.

- Their NPLs are low, with limited risks to deterioration for now.

- Dividend yield is in line with other banks.

RomanBabakin/iStock Editorial via Getty Images

UOB logo (UOB)

Investment Thesis

Our only exposure to the financial industry in Singapore is through DBS Group (OTCPK:DBSDY) which we regularly cover here on Seeking Alpha.

However, Singapore has 3 homegrown banks and some international players, which have a much smaller market share of the consumer market.

Some of our avid readers have asked us about United Overseas Bank Limited (OTCPK:UOVEY), known as just UOB, as they are invested in this bank.

Apart from being a customer of UOB, we have not yet invested in it.

Let us examine how these two banks compare and look at which one is the better candidate in our view.

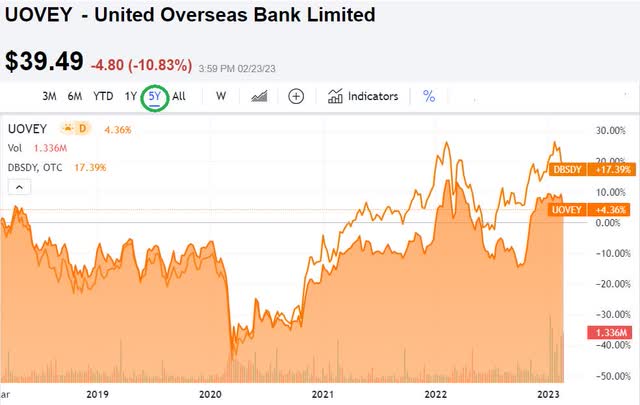

5-years share price development of UOB and DBS (SA)

Since the large drop in share prices that took place when the pandemic hit us, DBS has gone up more than UOB.

However, let us look at their financial results, business prospects, and potential risks.

FY 2022 Financial Results

Just like DBS Group, their peer UOB also delivered a record net profit for the year.

It came in at SGD4.57 billion, including one-off items. That was an increase of 12%. To be fair, we should use their core operating net profit before one-off items. When we do that, we get an increase of 18%.

When we compare UOB with DBS, we need to bear in mind that DBS is twice as large, with double the net profit. DBS also grew its net profit by 20%. In that respect, it is 1-0 to DBS.

UOB's net interest income jumped 31% to SGD8.3 billion on the back of 3% loan growth and a 30 basis point NIM improvement.

Net fee income, which was SGD2.1 billion, remained soft as weak market sentiment weighed on wealth management and loan-related activities. All the banks in Singapore have seen lower fees from their wealthy clients as their interest to trade and to do so on margin was muted due to the negative stock market.

All the banks probably expect this to pick up once there is more optimism amongst their clients.

Let us look at ROE, which is another good way to determine how much profit it makes, considering the amount of equity it holds.

We know that DBS managed to improve its ROE in 2022 from 12.5% to 15%. UOB, on the other hand, delivered a much lower ROE of 11.9%. Therefore, the score goes to 2 - 0 in favor of DBS.

UOB's CFO Lee Wai Fai communicated during his FY 2022 presentation to investors and analysts that they are looking to deliver an ROE larger than 13% by 2026.

Asset quality remained benign, with a non-performing loan (NPL) ratio at 1.6% at UOB. When we compare it to DBS, we see that DBS has a better NPL of 1.1%. We will not use this in our scorecard between the two banks, but it is good to know. To assess if a bank holds enough capital to withstand a shock with losses increasing, we need to know how much capital the bank has. This is referred to as Common Equity Tier 1, or CET-1.

UOB has a CET-1 ratio of 13.3% which is considered adequate. DBS does have a higher CET-1 ratio of 14.6%

In terms of valuation, we can consider the share price to its net book value. When we initiate a position, we like to see a number close to 1, however, those are hard to find these days. HSBC is the only one that comes to our mind with a P/NAV of 0.89.

UOB's NAV per share is SGD24.24 when we take into account their perpetual capital securities. If we were to exclude this, it becomes SGD27.39.

With a share price of SGD29.85, UOB's Price/NAV is 1.23 against DBS's Price/NAV of 1.64.

This brings the score to 2 - 1 in favor of DBS.

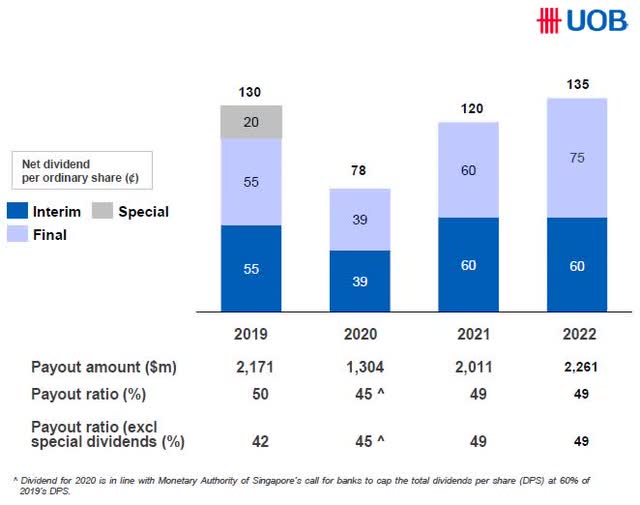

Returning Capital to Shareholders

Those that follow us here on Seeking Alpha, know that we expect companies to return some of the capital to their shareholders in the form of a dividend and/or share buybacks.

UOB's management has proposed to their board to pay out a final dividend of SGD0.76 per ordinary share. Together with the interim dividend of SGD0.60 already paid out, the total dividend for FY 2022 will be SGD1.35 per ordinary share.

This is a payout ratio of about 49%.

UOB dividend history (UOB 2022 FY Financial - CFO presentation)

The dividend yield of UOB is 4.5% against DBS's yield of 4.36% if we exclude their special dividend this year. If we include the special dividend given this year at DBS, we get a yield of 5.8%.

The difference, based on the normal dividends, excluding any special dividend, is not large, so we call this a draw in our scorecard between the two banks.

No share buyback took place in 2022, and they have not planned for any share buybacks in 2023.

Business Prospects

As we have pointed out in our last article on DBS, Singapore is a small country with just 5 million people. Therefore, growth will have to come from markets overseas.

DBS has grown the pie with businesses in Hong Kong and the Greater Bay Area surrounding Hong Kong. More can come from India, in our opinion.

UOB also had to look elsewhere for growth, Last year, they bought Citigroup's (C) consumer businesses in Malaysia and Thailand which was completed in November. The completion for Indonesia and Vietnam is planned for this year.

This strategic acquisition should help UOB to scale up the retail franchise with increased product offerings and cross-sell opportunities. Their retail customer base has expanded to nearly 7 million in the region.

Risk to Thesis and Conclusion

The risk to the thesis for UOB is very similar to that of DBS, which you can read about in that article.

UOB has traditionally been a popular bank for Singapore's SMEs. DBS, on the other hand, might have more large institutional clients. In periods of recessions, SMEs tend to be hit hard and this could be of some concern for UOB.

We return to the question of asking which of the two banks is the best investment proposal.

As we are already invested in DBS, we shall try not to fall into the confirmation bias trap and choose DBS as a result of this.

Purely on fundamentals, the score of 2-1 is in favor of DBS.

From our experience as a customer of both the banks, we do feel that DBS has an edge in terms of their ease of use on their internet platforms, and it seems they are more flexible and innovative than what we see from UOB.

From an investment point of view, we have more faith in DBS growing its business further than that of the family-controlled UOB.

We would still favor DBS, which we for the time being have a Hold stance on. The same goes for UOB, we would initiate our coverage with a Hold stance for them as well.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of DBSDY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Long DBS in Singapore.