HYG: Relative Value Case Is Extremely Compelling

Summary

- Expensive equity valuations, high real Treasury yields, and a weak nominal GDP growth outlook suggest the HYG will outperform the SPX by at least 2-3% over the coming years.

- Relative returns are likely to be much higher than this due to valuation mean reversion, particularly in the case of a bear market as the HYG has a very low duration.

- While a bear market would likely cause weakness in the HYG as credit spreads widen and default rates rise, we should also expect lower Treasury yields to provide support.

Torsten Asmus/iStock via Getty Images

The case for reducing US equity exposure and raising fixed income exposure is the strongest it has been in decades. The combination expensive equity valuations, high real (inflation-linked) Treasury yields, and a weak nominal GDP growth outlook strongly suggest a doubling of Treasuries relative to the SPX over the coming years, as I argued here. However, for more optimistic investors looking to maintain exposure to risk appetite, the iShares iBoxx USD High Yield Corporate Bond ETF (NYSEARCA:HYG) is a solid option. Read our previous coverage on HYG here.

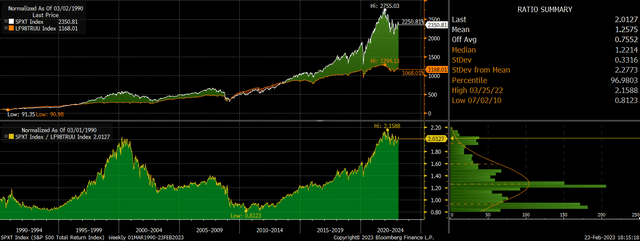

Total Return Of SPX Vs HYG (Bloomberg)

The HYG ETF

The iShares iBoxx USD High Yield Corporate Bond ETF tracks the performance of the Markit iBoxx USD Liquid High Yield Index offers a highly attractive yield to maturity of 8.6%, which is high for a fund with a low maturity of 5.2 years and a duration of just 3.9 years. The expense fee of 0.48% is on the high side.

The fund's high yield reflects the elevated yield on 5-year U.S. Treasuries, which is back to 4.1%. The additional 4.5% yield reflects credit risk, and credit spreads are actually low relative to long-term averages. While a deep US recession and financial crisis would likely cause weakness in the HYG as credit spreads widen and default rates rise, we should also expect lower Treasury yields to support returns allowing the ETF to dramatically outperform the SPX as was the case during the global financial crisis and the Covid crash. On the other hand, should the economy manage to avoid a deep contraction, credit spreads would remain low and the 8.6% yield would still allow the HYG to outperform the SPX, where returns will be constrained by high valuations and weak GDP growth.

At Least 2-3% Annual Outperformance Expected

If corporate default rates remain at 1.2% in line with 2022 rates, then then nominal returns over the coming years on the HYG will be the current yield to maturity of 8.6%, less the expense fee and plus or minus the impact of valuation changes. For the SPX, returns over the coming years should be expected to come in at the 1.7% dividend yield plus any change in dividend payments and any changes in valuations.

If there is no change in valuations, this means that we should expect the HYG to outperform the SPX by 5.7% annually before expenses (8.6%-1.2%-1.7%) minus any growth in dividends. As dividends tend to grow at the pace of sales over time, which in turn reflects nominal GDP growth, the HYG should outperform if nominal GDP growth averages less than 5.7%, which is highly likely. In fact, with 5-year breakeven inflation expectations at just 2.6%, real GDP growth would have to exceed 3% for the SPX to be expected to outperform. A more realistic real GDP growth figure is 0-1%, suggesting we should see the HYG outperform by 2-3% per year before fees and assuming no change in default rates or valuations.

Many investors view the dividend yield as an improper valuation measure as it reflects corporate capital allocation decisions and a shift towards buybacks has depressed dividend payments making the dividend yield artificially low relative to other valuation metrics. This is simply not true. Dividend payments as a share of free cash flows are above their 20-year average and compared to sales they are actually significantly above their long-term average. If anything, we should expect dividend payments to grow at a slower rate than sales and nominal GDP over the coming years as profit margins mean revert lower from currently elevated levels, which should see the HYG outperform by an even wider margin.

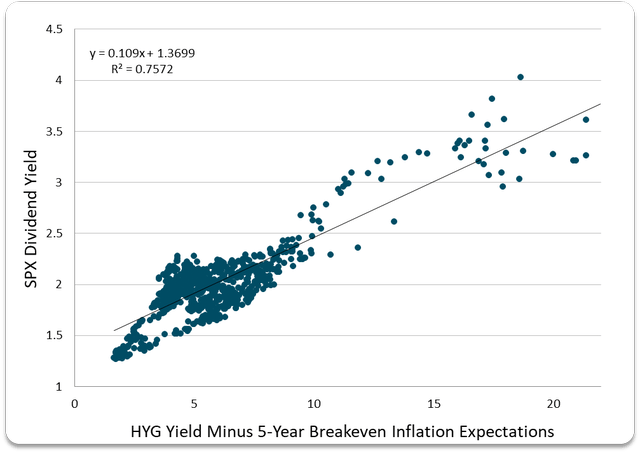

Valuation Changes Should Be Highly Supportive Of HYG Vs SPX

Another reason to expect the HYG to outperform the SPX by more than the 2-3% implied by the above assumptions is the potential for valuation changes to support relative returns. The chart below shows the real yield to maturity on bonds relative to the dividend yield on stocks. The reason for comparing the equity dividend to the real yield on bonds is that equity dividends should be expected to grow in line with inflation over time while bond payments will not. Based on this correlation, real bond yields should be trading a 2 percentage point lower than they are now, or the SPX dividend yield should be trading around 30bps higher.

Bloomberg, Author's calculations

If the yield on the HYG was to fall to 6.6% from its current 8.6% level, this would result in 8% additional returns in line with the current duration of the fund. In contrast, if the dividend yield on the SPX were to rise from 1.7% to 2.0%, this would require a 15% decline in stock prices. This reflects the significantly higher duration of the SPX relative to the HYG, and if there is a bear market in US stocks then the HYG will almost certainly outperform as was the case in 2008/9 and early 2020.

Summary

Expensive equity valuations, high real Treasury yields, and a weak nominal GDP growth outlook bode well for the HYG relative to US stocks over the coming years. The HYG is likely to outperform stocks by 2-3% annually over the long term even if there is no change in relative valuations. If we see a mean reversion in valuations, the HYG would outperform by significantly more, particularly if this occurs amid a deep US recession and bear market.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.