Snap-on: The Future Is Bright

Summary

- Snap-on has shown great margin discipline.

- The dividend yield and growth are good, but the 2-Year U.S. Treasury yields more than the stock.

- The company is fully valued, and new investors may be better off waiting for a drop of 10% or more before buying.

- Existing shareholders can generate a good income by selling covered calls.

Young777

Snap-on's (NYSE:SNA) customer base looks strong. The company may be in the midst of a multi-year growth period. The company has consistent gross and operating margins indicating the stability of the company. The dividend yield could be better, given that the U.S. 2-year Treasury yields 4.69%. The company is fully valued, and a price below $220, a 10% drop, may be the going price to venture into the stock. Existing shareholders can generate over a 1% yield for four weeks if they sell covered calls expiring March 17. Given the stock's fading momentum, these calls have a low probability of being assigned.

Good revenue growth and margins

In Q4 2022, the company reported a 4% increase in revenue. The strong dollar was a headwind for the company, reducing sales by $37.7 million, a 370 basis points hit. The company registered good organic sales growth of 8%. Nicholas Pinchuk, the CEO, remarked that the automotive repair market remains favorable since the average age of vehicles continues to increase. Nicholas noted that the complexity of the vehicles has also increased with changes in internal combustion, the rise of electric vehicles, and the expansion of vehicle autonomy. Snap-on may benefit from the factors described by Nicholas, which are long-term tailwinds for the automotive sector. The average age of light vehicles in the U.S. has climbed to 12.2 years. This average age will continue to climb higher for the foreseeable future.

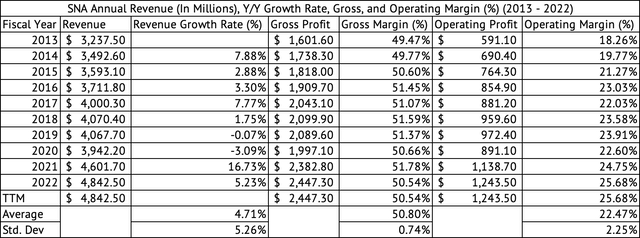

Over the past decade, the company has grown its revenues by an average of 4.7% with high variability, as measured by standard deviation, of 5.2% (Exhibit 1). During the June 2021 quarter, the company saw a spike in revenue growth compared to the same period in 2020, as the pandemic drop in demand became a spike. Quarterly revenue growth during 2022 averaged 5.2% compared to the same period in 2021.

Exhibit 1:

Snap-on Annual Revenue, Gross, Operating Profit, and Margins (Seeking Alpha, Author Compilation)

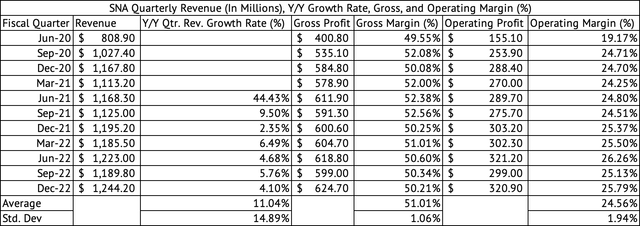

The company's quarterly gross margins have improved by 21 basis points since June 2020, to 51.01%, but the variability has also increased, with a standard deviation of 1.06% (Exhibit 2). Snap-on is a consistent margin generator if it can maintain this low variation in gross margins of 100 basis points or less. Its quarterly operating margins have more variation of 194 basis points. But, overall, the company can manage its margin effectively.

Exhibit 2:

Snap-on Quarterly Revenue, Gross, Operating Profits, and Margins (Seeking Alpha, Author Compilation)

Good free cash flow (FCF) and yield.

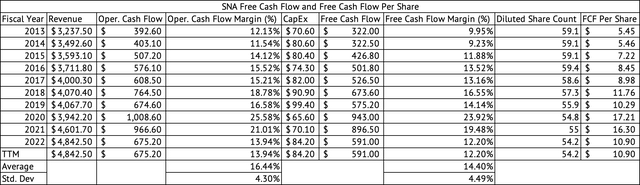

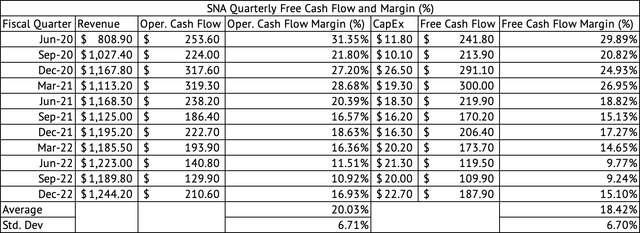

The company generates good operating cash flow and free cash flow. Its free cash flow margin (operating cash flow - CapEx) has averaged 14.4% (Exhibit 3) over the past decade, while its quarterly free cash flow margin has averaged 18.4% (Exhibit 4). But, the company reported a dramatic fall in its free cash flow margin, with free cash flow margin below its quarterly average. The company's average quarterly operating cash flow margin declined to 13.9% in 2022 compared to its quarterly average of 20.03% since June 2020. The company's average quarterly free cash flow margin was 12.1% for 2022. The stock has a good FCF yield of 4.4% based on the current stock price of $246.

Exhibit 3:

Snap-on Annual Free Cash Flow and Free Cash Flow Per Share (Seeking Alpha, Author Calculations)

Exhibit 4:

Snap-on Quarterly Free Cash Flow and Margin (%) (Seeking Alpha, Author Calculations)

High inventory reduced cash flow

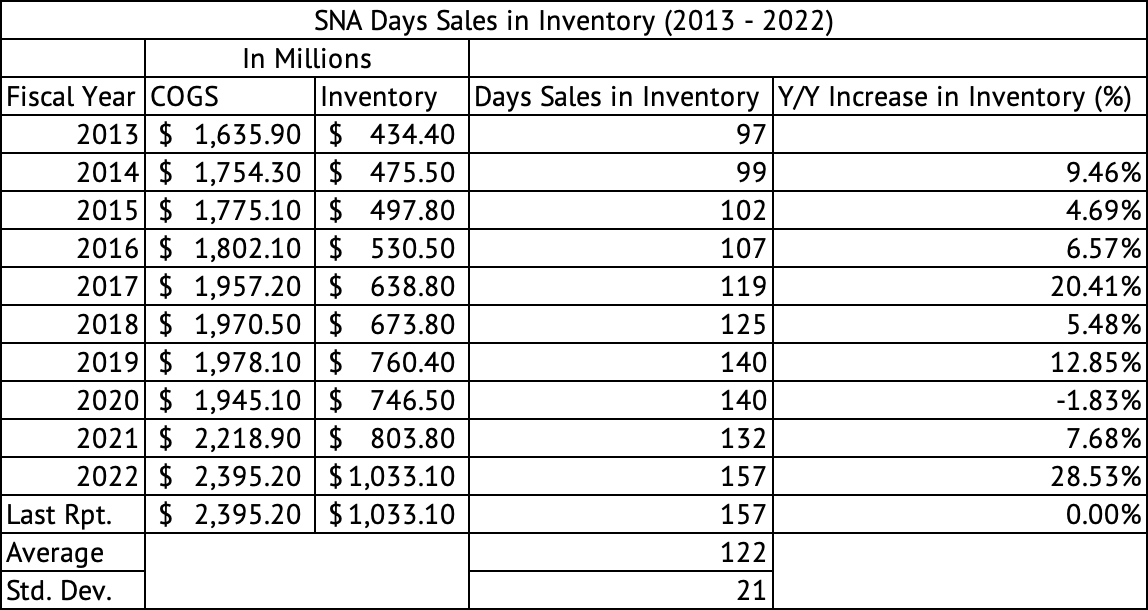

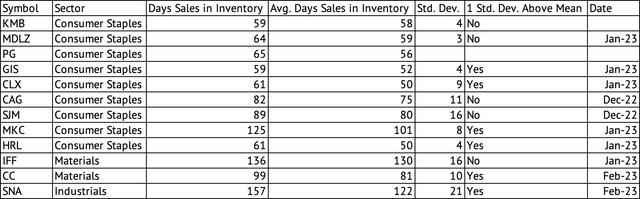

Much of the decrease in the operating cash flow can be traced to the increase in inventory cost. At the end of 2022, the company carried 157 days' sales in inventory, compared to its average of 122 and a standard deviation of 21 over the past decade (Exhibit 5). The current inventory carrying cost is one standard deviation (sum of average + standard deviation) above the mean, a negative sign for sales and margins. Many companies have seen increased inventory costs over the past year and suffered lower margins and sales (Exhibit 6). But inflationary pressures are waning, potentially giving companies a chance to lower their inventory costs in the coming months. However, the current inventory acquired at a high cost can still impact margins if price increases are not passed to its customers.

Exhibit 5:

Snap-on Day's Sales in Inventory (Seeking Alpha, Author Calculations)

Exhibit 6:

Days' Sales in Inventory for Various Companies (KMB, MDLZ, PG, CC, SNA) (Seeking Alpha, Author Calculations)

Debt, Stock Repurchase, and Dividend

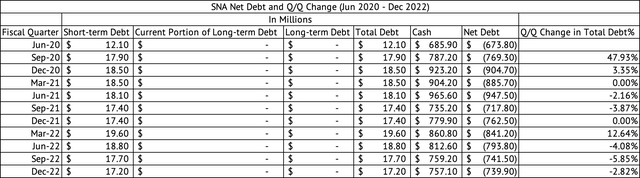

The company has a very low debt of $17 million and maintains a strong balance sheet (Exhibit 7). The debt the company's financing arm holds is not included in this debt calculation. At the end of 2022, the company's finance division carried short-term liabilities of $4.2 million and long-term debt of $1.18 billion. The company's financial services division, Snap-on Credit [SOC], extends credit to franchisees for their vehicle and business needs and for their customers to buy tools, diagnostics, and equipment products.

Exhibit 7:

Snap-on Debt and Cash (Seeking Alpha, Author Calculations)

The company paid $313 million in total dividends in 2022. The stock offers a dividend yield of 2.65% and a conservative payout ratio of 34%. The company's forward annual per-share payout is $6.48. The company has grown its dividend for 13 consecutive years and has consistently paid a dividend for 33 years. The company's dividend looks promising, given its operating cash flows. At the end of 2022, the company generated $277 million in cash after accounting for CapEx and dividends, about 5.7% of revenue.

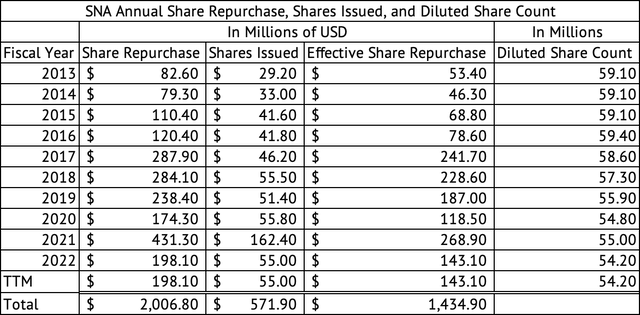

The company's stock repurchases have not reduced its diluted share count. The company has spent $2 billion in share repurchases and issued nearly $571 million in new shares (Exhibit 8). The company has made several acquisitions over the year and may have issued shares as part of the transaction. Its acquisitions may be why the diluted share count has stayed the same.

Exhibit 8:

Snap-on Share Repurchase, Issuance, and Diluted Share Count (Seeking Alpha, Author Calculations)

Given the aging U.S. vehicle fleet, the company's end-customers of vehicle technicians look strong. Wages need to be increasing faster for workers. Wages have not kept pace with inflation in recent years. Most low-wage consumers can barely pay for their necessities without an increase in wages and disposable incomes. The high inflation over the past year has robbed people of their purchasing power, stressing their finances.

The recent wave of technology layoffs may impact high-wage earners, and a lack of economic and wage growth may keep the middle class from spending on new automobiles. The lack of wage growth may be a recent phenomenon experienced by high-wage workers in the U.S. These long-term trends should benefit Snap-on as more people spend money on repairs rather than a new vehicle.

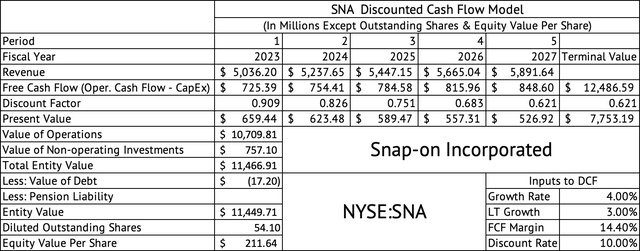

Fully valued

The company may be fully valued at a forward GAAP PE of 14.4x, comparable to its five-year average of 14.2x. A discounted cash flow model estimates a per-share equity value of $211 (Exhibit 9). This model assumes a long-term growth rate of 3% and a free cash flow margin of 14.4%, its average over the past decade. The stock is trading at $246.21. Investors may be better off buying at or below $220.

Exhibit 9:

Snap-on Discounted Cash Flow Model (Seeking Alpha, Author Calculation)

Fading price momentum

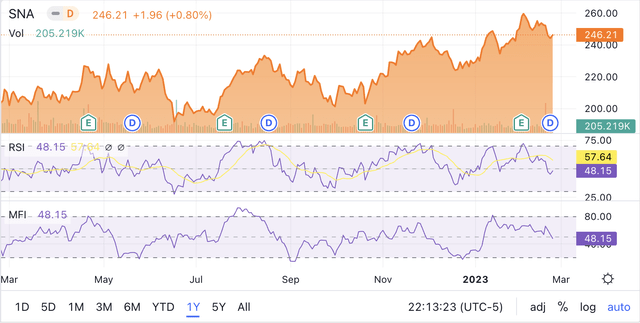

The stock price is also approaching its 52-week high. Investors who own the stock can generate good income by selling covered calls. It may be worth considering covered calls if it yields a premium above 1%. The March 17 $250 covered call last sold for $3.30, generating a 1.3% yield. Snap-on has performed exceedingly well over the past year returning 20.9%. But, the momentum may be fading over the past three months.

The company released earnings in February, so a significant catalyst to move the stocks may have disappeared, reducing the probability of further gains. The RSI and MFI technical indicators have dipped below 50, another sign of fading momentum in the stock (Exhibit 10). These factors should reduce the probability that the call will be assigned.

Exhibit 10:

Snap-on RSI and MFI Technical Indicators (Seeking Alpha)

Snap-on is a great company that could be an excellent addition to a long-term portfolio. But, the stock is fully valued, and the dividend yield is low compared to the U.S. 2-year Treasury. A sell-off below $220 may be an excellent price to venture into Snap-on slowly. Existing holders may consider selling covered calls to generate income.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of SNA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.