Alibaba Remains A Top Pick For 2023

Summary

- Alibaba reported results for its December quarter yesterday.

- The e-Commerce company disclosed revenue growth in the low-single-digit and strong free cash flow.

- Alibaba’s China commerce retail business is set for a big rebound as reopening effects get reflected in successive quarters.

- Strong buybacks could provide support for Alibaba’s stock price.

maybefalse/iStock Unreleased via Getty Images

Alibaba (NYSE:BABA) reported earnings for the December quarter yesterday and the Chinese e-Commerce company delivered a massive EPS beat, although results overall were mixed. Alibaba continued to suffer from COVID-19 lockdowns in China in the December quarter, which resulted in yet another quarter of sluggish revenue growth. However, Alibaba continued to generate a ton of free cash flow… which the company could funnel into stock buybacks. As China's economy continues on its reopening path, I believe Alibaba will benefit from pent-up demand in its China-centric commerce business, and the company could potentially see revenue acceleration in 2023!

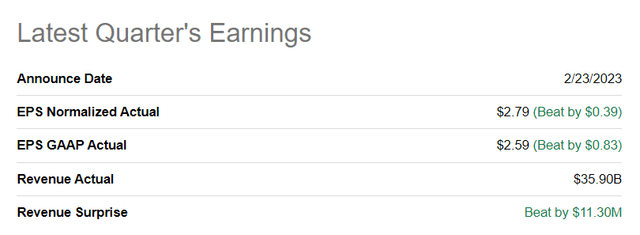

Alibaba delivered a strong EPS beat

Alibaba reported FQ3'23 revenues of $35.9B, which slightly beat the average analyst estimate. The e-Commerce company smashed earnings expectations, however, reporting adjusted EPS of $2.79 compared to an average analyst estimate of $2.40.

Alibaba's FQ3'23 financial performance examined

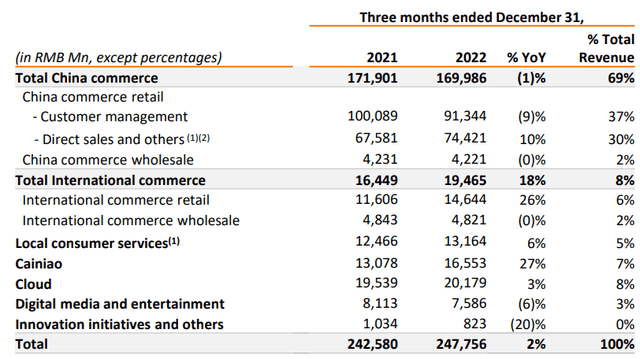

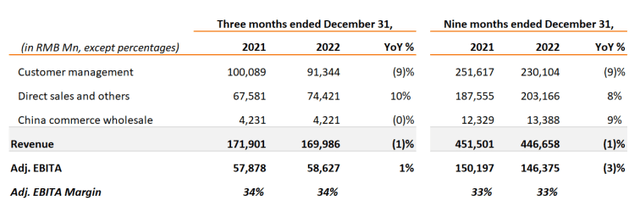

Alibaba's revenue performance was not as great as I expected it to be, as COVID-19 restrictions in the December quarter still hurt Alibaba's recovery. Alibaba reported topline growth of only 2% and revenues of 247.8B Chinese Yuan ($35.9B), showing a 1 PP deceleration compared to the September quarter which saw 3% revenue growth year over year.

Alibaba's China commerce segment generated 165.8B Chinese Yuan ($24.0B) in revenues in the last quarter, showing a decrease of 1% year over year. Including Alibaba's commerce wholesale business - which showed no growth on a year-over-year basis at all - the e-Commerce company reported a year-over-year decrease of 1% in its topline to 170.0B Chinese Yuan ($24.6B). The China commerce business also saw a 1% revenue decline in FQ2'23.

With COVID-19 restrictions getting lifted in December 2022, however, there is a possibility for a strong rebound in Alibaba's China commerce sales as the year progresses. China commerce (both retail and wholesale) accounted for 69% of Alibaba's consolidated revenues, with no other segment coming even close regarding revenue contribution. The two largest segments following China commerce are International commerce and Cloud, with revenue shares of approximately 8%.

Alibaba's China commerce business deserves a closer look, since the company is heavily reliant on its consumer-facing segment for revenue growth. The segment chiefly includes large e-Commerce platforms like Taobao, Tmall and discount website Taobao Deals which are very popular with Chinese customers.

Within China commerce, Alibaba's customer management revenues dropped 9% year over year to 91.3B Chinese Yuan ($13.2B) due to slowing consumer demand and a new wave of COVID-19 cases in December which resulted, according to Alibaba, in a "mid-single-digit decline of online physical goods GMV". GMV stands for gross merchandise value and represents the amount of Chinese Yuan that gets processed through the platform. I believe investors can expect a rebound in customer management revenues as well as GMV in 2023 as China's economy moves from reopening to recovery and consumer spending levels adjust to the upside.

While customer management suffered from the factors described above, Alibaba's direct sales business continued to do well and provided a crucial offset to revenue declines in customer management. This business generated 74.4B Chinese Yuan ($10.8B) in revenues in the December quarter, showing 10% year over topline growth due to strong order momentum at Freshippo, a high-tech supermarket chain offering fresh food to Chinese customers. The direct sales business has been a revenue driver for Alibaba for a while and has been able to offset customer management weakness in the September quarter as well.

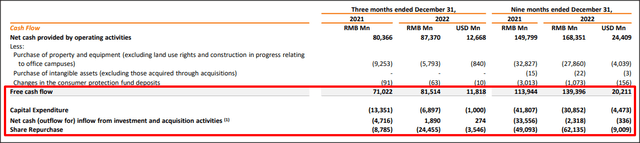

Free cash flow and stock buybacks

Alibaba is a deeply profitable e-Commerce company based off of free cash flow. The firm generated 81.5B Chinese Yuan ($11.8B) just in the last quarter in free cash flow, showing 15% year over year growth. In the first nine months of Alibaba's FY 2023, Alibaba's business operations generated 139.4B Chinese Yuan ($20.2B) in free cash flow… which translates to an average quarterly free cash flow level of $6.7B. This gives Alibaba a lot of firepower to invest in strategic growth areas like Cloud but also to return a lot of cash to shareholders through stock buybacks. In the last quarter, Alibaba repurchased 24.5B Chinese Yuan ($3.5B) of its shares, which calculates to approximately 30% of FQ3'23 free cash flow (45% of free cash flow in the last nine months).

Alibaba has considerable stock buyback potential, chiefly because of its enormous free cash flow that is available to management. On average, Alibaba spent $3.0B on buybacks in each of the last three quarters and I believe Alibaba could report a much higher stock buyback program, in the amount of $50B, in 2023.

Alibaba's valuation

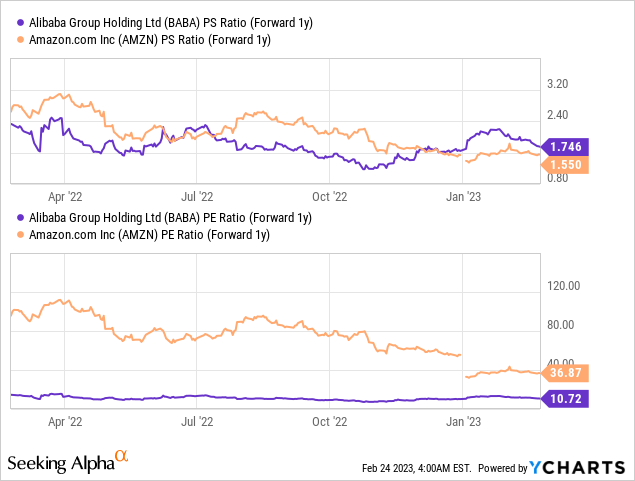

One of the most attractive features of Alibaba - besides its strong free cash flow and recovery potential in the context of a full reopening of China's economy - is the e-Commerce company's valuation. Alibaba's low valuation based off of sales and earnings makes the company an attractive large-cap investment, especially when compared to Amazon (AMZN), for investors that want exposure to e-Commerce or China, or both.

Alibaba is trading at a P/E ratio of less than 11X, which is less than a third of Amazon's forward P/E ratio of 37 X. The lower earnings multiplier reflects higher operating risks for Alibaba in China. However, the discount relative to Amazon is excessive and indicates that investors undervalue Alibaba's growth potential in the expanding global e-Commerce market.

Risks with Alibaba

The biggest commercial risk for Alibaba is a sequential slowdown in its topline growth. Should Alibaba report negative topline growth in 2023, the company's stock could come under new pressure, which may result in yet another down-leg for BABA. However, considering that China's economy is in the process of fully reopening, I believe Alibaba is more likely to see an acceleration of its revenue growth down the line than a deceleration. What would change my mind about Alibaba is if the company saw a material decline in its free cash flow or if Alibaba's China commerce business deteriorated.

Final thoughts

Alibaba's earnings card for the December quarter was mixed, but I believe it showed a lot of promise. Alibaba's topline growth of 2% was underwhelming and disappointing, but China's reopening has not yet been fully reflected in Alibaba's results. Some operating segments, like the commerce business, are set to profit from a recovery in consumer spending in the coming quarters. Alibaba's huge free cash flow and new stock buybacks could also help stabilize the stock price. Since Alibaba's shares are so cheap based off of earnings, I believe Alibaba is a top pick for 2023 for investors believing in China's market potential as well as post-pandemic recovery theme!

This article was written by

Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.