CUBA Is A Fund I Would Skip

Summary

- CUBA provides exposure to companies that benefit from developments in the Caribbeans.

- The CUBA fund has a history of volatile returns and high expenses.

- In fiscal 2022, CUBA began paying its unsustainably high distribution through dilutive shares. For a fund trading at a steep discount, this may leave shareholders worse off.

- I would avoid this fund.

Wildroze/E+ via Getty Images

While the Caribbean is a fantastic vacation destination, I think investors should skip the Herzfeld Caribbean Basin Fund (NASDAQ:CUBA). The fund is expensive and has poor investment performance. Recently, the fund has been paying 80% of its distribution via dilutive share issuances. For a fund trading at a steep discount, a cash distribution is one way to surface value. By switching to a share distribution, investors may be worse off.

Fund Overview

The Herzfeld Caribbean Basin Fund is a closed-end fund ("CEF") that focuses on long-term capital appreciation by investing in companies that benefit from economic, political, structural, and technological developments in the countries in the Caribbean Basin. For the purpose of the CUBA fund, the Caribbean Basin includes Cuba (when permitted), Jamaica, Trinidad and Tobago, the Bahamas, the Dominican Republic, Barbados, Aruba, Haiti, the Netherlands Antilles, Puerto Rico, Mexico, Honduras, Guatemala, Belize, Costa Rica, Panama, Colombia, and Venezuela.

Fund Manager Wrote The Book On CEF Investments

The CUBA fund is managed by Thomas J. Herzfeld, one of the pioneers of the CEF industry and a man who literally wrote several books on CEF investing.

Portfolio Holdings

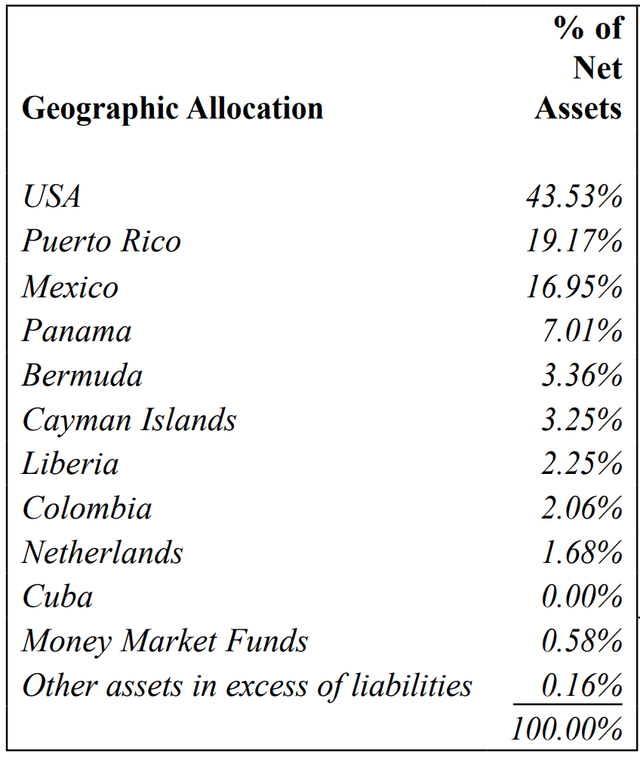

Figure 1 shows a geographical summary of the CUBA fund's portfolio as of June 30, 2022. Approximately 44% of the fund's assets are domiciled in the U.S., with Puerto Rico and Mexico receiving allocations of 19% and 17%, respectively.

Figure 1 - CUBA geographical allocation (CUBA 2022 annual report)

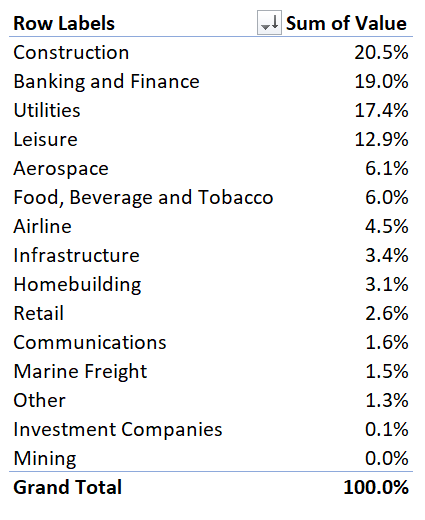

Unfortunately, the CUBA fund only reports holdings quarterly. As of September 30, 2022, the fund's industry allocations are shown in figure 2. The fund's biggest allocation is in Construction companies accounting for 20.5% of the fund. Banking and Finance account for 19.0% and Utilities account for 17.4% respectively.

Figure 2 - CUBA industry allocation (Author created from CUBA Q3/2022 holdings report)

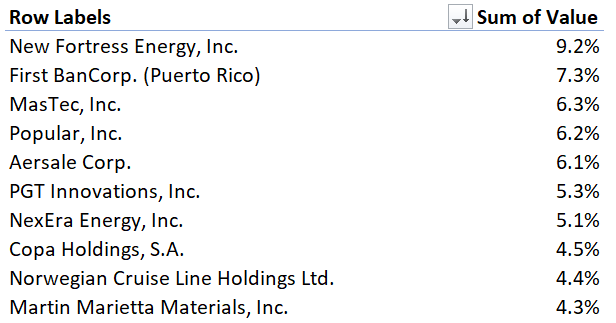

Figure 3 shows the fund's top 10 holdings, which account for 58.5% of the fund.

Figure 3 - CUBA top 10 holdings (Author created with CUBA Q3/2022 holdings report)

Returns

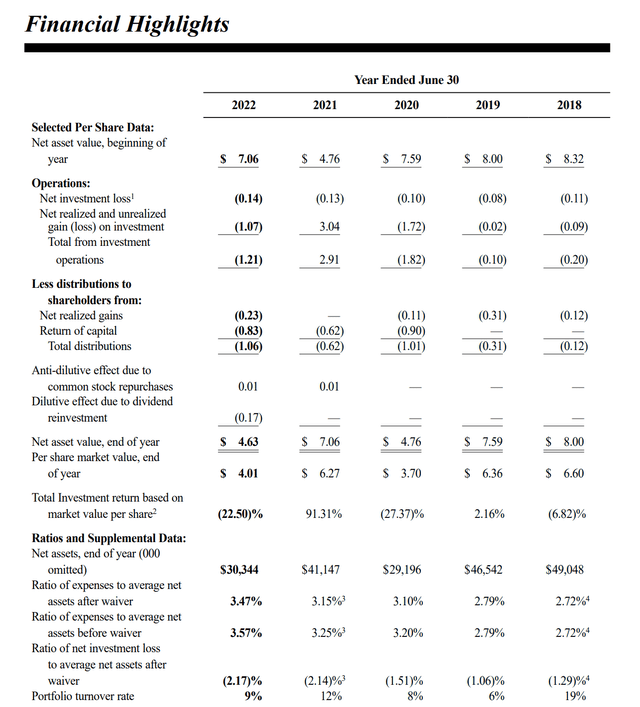

Figure 4 shows the annual and historical returns of the CUBA fund. The fund's performance has been very volatile and erratic, with returns swinging from a gain to a loss from one year to the next. Overall, the fund has delivered poor historical returns, with 3/5/10/15Yr average annual returns of 1.6%/-0.2%/2.2%/2.8% to January 31, 2023.

Figure 4 - CUBA annual and historical returns (morningstar.com)

Distribution & Yield

The CUBA fund pays a high quarterly distribution, currently set at $0.173625/share or a forward annualized yield of 17.4%. On NAV, the fund is yielding 14.3%. However, before investors rejoice, they should know that only 20% of the CUBA fund's distribution is paid in cash (up to 20% of shareholders can elect to receive cash), and the rest are paid in newly issued shares of the fund.

Furthermore, looking at the fund's historical financials, we can see that the fund has historically generated 'negative' net investment income ("NII") due to high investment expenses and had been funding its distribution through realized gains and return of capital ("ROC") (Figure 5).

Figure 5 - CUBA financial highlights (CUBA 2022 annual report)

With a managed distribution yield of 15% that is far above the historical returns of the fund, the CUBA fund's distribution appears unsustainable. Beginning with the September 2021 distribution, the fund also appears to be running out of liquid assets, resorting to its recent policy of paying 80% of its quarterly distribution in newly issued shares.

Paying Distribution In Shares Is Smoke And Mirrors

For a fund trading at a steep 19% discount to NAV, paying distributions with newly issued shares appears to be a sleigh of hand and may leave investors worse off. To understand why, consider an example.

Assume a fund has $1,000 of assets and 100 shares, so the NAV/share is $10. Due to poor investment performance and low liquidity, the fund's shares are only trading at $8/share in the market. Now assume the fund announces a $1/share dividend. In the first scenario, the dividend is paid in cash by liquidating NAV. Each shareholder receives $1 in cash, so the fund's NAV declines to $900, or $9/share. Assuming the fund's discount to NAV is constant at 20%, the share's market value fall to $7.20, so the shareholder now has $8.20 in 'market value' after the cash dividend (ignoring tax obligations).

In scenario two, assume the $1 dividend is paid in newly issued shares. Since the fund has 100 shares outstanding, total dividends paid is $100, or 12.5 newly issued shares. As cash did not leave the door, total assets remain at $1,000. However, with 112.5 shares outstanding, the NAV/share will fall to $8.89. Investors who owned 1 share of the fund will now own 1.125 shares, or the same $10 worth of NAV assets. However, if the fund continues to trade at a 20% discount to NAV, the market price of each share would fall to $7.11, and the shareholder will only have $8.00 in 'market value' shares.

Fees

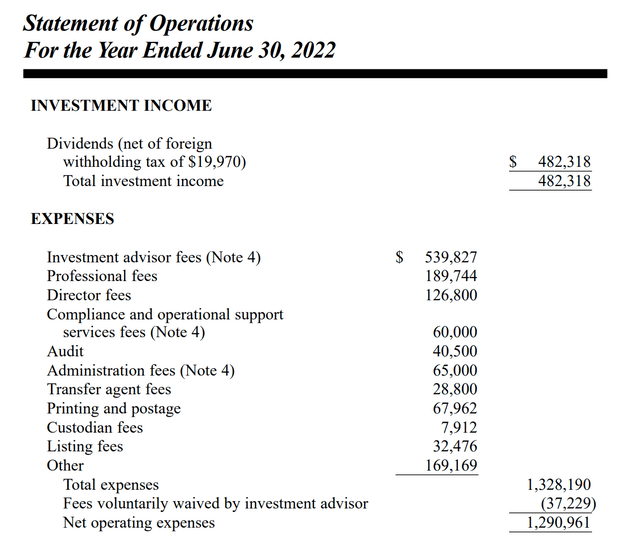

Looking at the financial summary in figure 5 above, we can see that the CUBA fund charges a high and increasing expense ratio. For fiscal 2022, expenses were 3.57% of net assets.

The main problem with CUBA's fees is that the fund is sub-scale and the manager continues to charge more than a million dollars in fees, year after year (Figure 6).

Figure 6 - CUBA fund fiscal 2022 fees (CUBA 2022 annual report)

With a shrinking NAV due to the fund's unsustainable distribution, fees as a percent of net assets keep increasing.

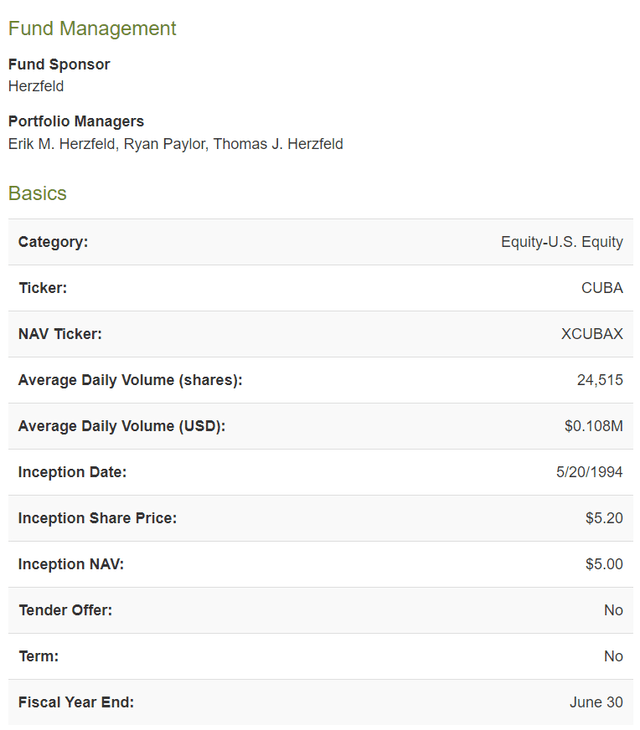

Watch The Liquidity

Another problem with a sub-scale fund like CUBA is that it has poor trading liquidity, with average daily volume of only 24k shares or $100,000 (Figure 7). Investors wishing to buy or sell their shares will have to face wide bid/ask spreads.

Figure 7 - CUBA has low liquidity (cefconnect.com)

Conclusion

While the Caribbean is a fantastic vacation destination, I think investors should skip the CUBA fund for a number of reasons. First, the CUBA fund is sub-scale, this means that trading liquidity is poor. Furthermore, as a percentage of net assets, CUBA's management fees and other expenses are high due to the fund's small scale. Returns have been volatile and poor. Finally, the fund appears to be running out of liquid assets to fund its distribution and is resorting to issuing dilutive shares to pay for 80% of its distribution.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.