Backblaze: Middle Market Cloud Storage Provider Growing Revenues, Yet Losing Money

Summary

- Backblaze is a niche cloud provider focused on object storage, a type of storage best utilized for 'unstructured' data such as photos, videos, and audio.

- The company is growing revenues by double digits YoY, and QoQ growth rates also remain solid.

- Yet, it is losing money from operations and appears to be getting further away from positive cash flows.

- All of this, combined with the competing object storage offerings of the major cloud players, amount to a material set of concerns for this stock. It is already somewhat discounted by the market.

- As such I would call this a hold until we see further data throughout this year.

simarik/iStock via Getty Images

Overview

Backblaze Inc (NASDAQ:BLZE) is a cloud storage SaaS company. The company operates similarly to AWS in that it provides a set of application programming interfaces that connect to their server farm in order to allow companies to readily store and query data via the cloud. Backblaze has always had, and maintains, a strategic focus on cloud data storage in particular. Their storage offering comes in two primary forms; readily-accessible cloud storage as well as slower backup storage. The backup service is offered to both businesses and personal computer users.

The company's core offering is for 'object storage' systems. This is a type of digitized information storage that is particularly efficient for 'unstructured' data. Unstructured in this context is a technical term and refers to data that cannot readily fit into the common SQL (standard query language) paradigm; this includes basically anything that isn't numerical in nature. Examples of data types that work particularly well in object storage are photos, videos, and audio. This kind of storage is not efficient for transactional systems such as point-of-sale or website logging.

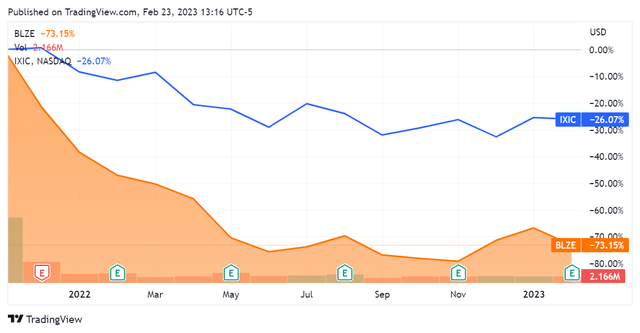

Backblaze was founded in 2007 and quite recently listed itself on the public markets, in Q4 2021. Initially priced at $16 per share, Backblaze has since seen its shares depreciate significantly and has underperformed the NASDAQ by roughly 3-to-1.

In the age of AWS as well as cloud storage products from Google (GOOG) (GOOGL) and Microsoft (MSFT), it is natural to be concerned about a niche cloud provider such as this one. Yet, I don't think it's fair to jump to conclusions. This article will review the company's financial statements as well as its valuation in order to determine where it's headed.

Financials

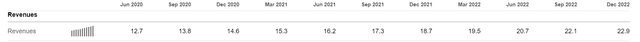

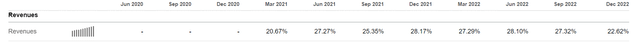

Backblaze is very much still a growing company, and it has posted 10 straight quarters of double-digit YoY growth.

SeekingAlpha.com BLZE 2.23.23 SeekingAlpha.com BLZE 2.23.23

These figures also look good on a quarter-over-quarter basis. While the quarterly revenue growth rate was the lowest yet as of the previous Q4 2022 quarter, I wouldn't read too far into this just yet. These revenues and their progression look fairly standard for a relatively young technology firm.

Data: SeekingAlpha.com BLZE 2.23.23 [Excel]![Data: SeekingAlpha.com BLZE 2.23.23 [Excel]](https://static.seekingalpha.com/uploads/2023/2/23/47904909-16771784043268478.png)

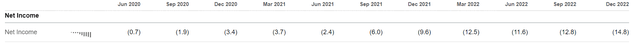

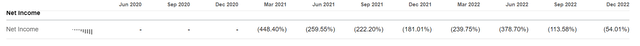

As to profitability, Backblaze isn't showing the same trendline and appears to still be in the 'growth' phase of its lifecycle. Net income has been negative throughout each of the last 10 quarters and appears to be increasingly so YoY. Since revenues have been going up throughout this period, it's clear that the company is funneling resources back into itself and attempting to grow - and we should look at its cost footprint as it does so.

SeekingAlpha.com BLZE 2.23.23 SeekingAlpha.com BLZE 2.23.23

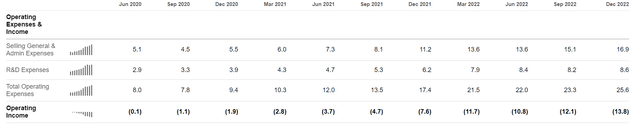

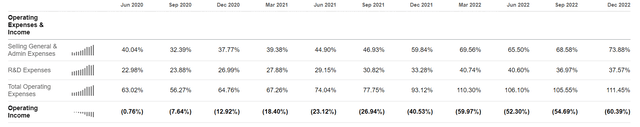

Looking over at its operating performance, we see that it is indeed scaling up its costs across the board.

As of the last quarter it appears that Backblaze has hit record SG&A costs, a significant 73.9% of revenues. This has filtered into what are also record levels of operating expenses, at 111.5% of revenues. It isn't surprising to see that operating income is negative due to this, but this growth in costs is more significant than its growth in revenues - not a good sign.

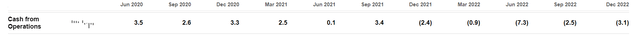

This scenario indicates clearly that the company may not be able to fund itself with its own cash. Indeed, this is the case. We can see that Backblaze has had negative cash from operations for 5 quarters running, with the company losing 13.5% of its overall revenues throughout its operating cycle last quarter.

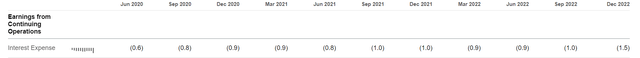

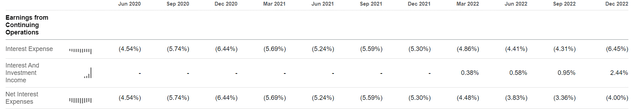

Along with this, we see the firm paying a rising interest expense in order to continue operating. While the previous quarter also saw a record (marginally) level of interest expense, this appears to have been offset by an uptick in interest income. The financial team at Backblaze was thus able to keep net interest expenses at 4% of revenues, which isn't overly concerning at present.

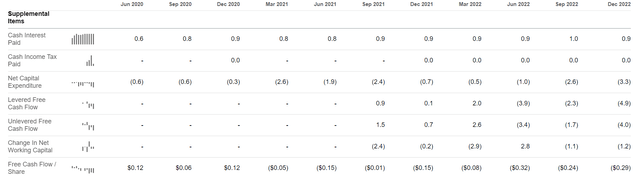

SeekingAlpha.com BLZE 2.23.23 SeekingAlpha.com BLZE 2.23.23

Rounding this out with cash flows, we unsurprisingly see a negative trendline here as well. In addition to the cash lost from operations, non-operating cycle costs are weighing down on the firm and caused it to lose record levels of cash ($4.9M) in the last quarter. Notably, free cash flows per share have been negative since Q1 2021 - and this doesn't seem like it will reverse any time soon.

Overall I would reiterate that these financial statements are indicative of a company trying to grow. Nonetheless, the trendline is concerning and cash efficiency is evidently decreasing. Additionally, operations continue to lose cash. This metric is generally a good canary in the goldmine for whether the business can turn growth into profits; there is no proof of this just yet.

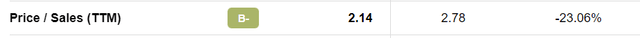

Valuation

Since Backblaze is neither profitable nor cash-flow-generative, the only valuation metric that is sensible here would be a multiple of its sales. Looking at the trailing twelve months figure for this, we see that it is trading at a 23% discount relative to the information technology GICS sector. Considering all of its financials together, I don't consider this enough of a discount to make the stock a buy.

Conclusion

There is a lot to be concerned about with this stock. Yet, we must keep in mind that there are many examples of technology firms having poor fundamental metrics across the board but growing revenues briskly until the other metrics catch up. This could be the case here, and Backblaze does have a robust roster of clients spread across the globe - over 150,000 according to the firm. YoY revenue growth continues to be in the double digits. Nonetheless, the core operating cycle of the company is still losing money. This variable needs to turn the corner before the company succumbs to a vicious cycle of losing cash and payer higher interest to continue doing so. Since it's already trading at a discount, I won't go and call it a sell. This stock is a hold at best for the time being.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.