Nvidia Q4: Join The Hype? Check Out Insider Activities First

Summary

- Nvidia Corporation stock price soared almost 13% after releasing an upbeat FY Q4 earnings report.

- However, recent Nvidia insider activities have been completely one-sided: insiders have all been selling their shares.

- More notably, the latest selling activities in the $200+ price range are of particular relevance in my view.

- I agree with these insiders’ selling decision given the risks ahead.

- Looking for a helping hand in the market? Members of Envision Early Retirement get exclusive ideas and guidance to navigate any climate. Learn More »

cagkansayin/iStock via Getty Images

Thesis

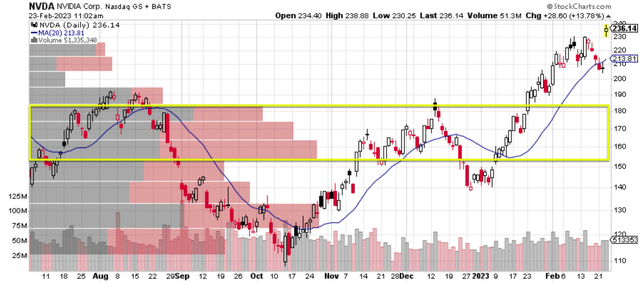

NVIDIA Corporation (NASDAQ:NVDA) just released its FY Q4 earnings report (“ER”). And by this time, I am sure that you have been informed of all the good news already. As a brief recap, its Q4 results exceeded expectations, with gaming recovery as the most important driver. As its CEO Jensen Huang commented during the ER, "Gaming is recovering from the post-pandemic downturn” and Huang further went on to comment on the promise of AI as the “inflection point.” Its stock price soared by almost 13% after the ER, as you can see from the following chart, and hovers around $236 as of this writing, the highest level since July 2022.

If you are thinking about joining the buyers now, the thesis of this article is to remind you to check out insider activities first. After all, the insiders are usually more informed about the true value of their own business. And in NVDA’s case, its recent insider activities have been 100% selling activities. And next, I will explain why I agree with these insiders’ selling decisions given the risks ahead.

Source: Author based on data from stockcharts.com

NVDA’s insider activities

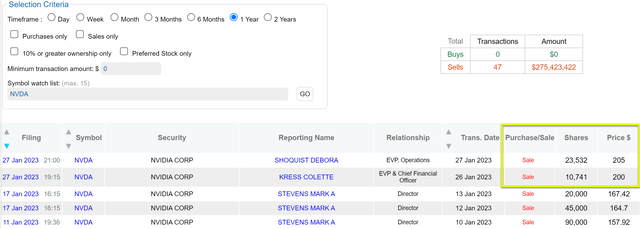

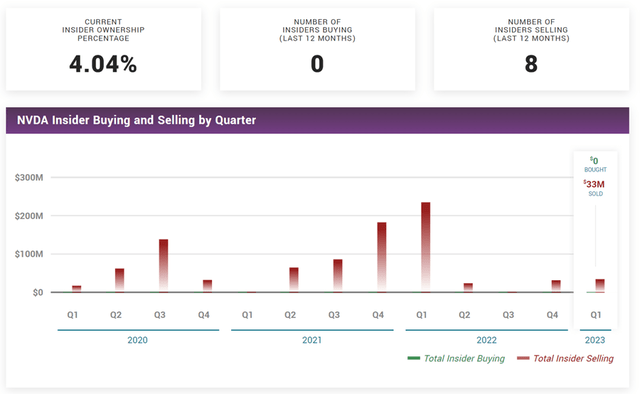

The chart below shows NVDA’s insider activities in the past 12 months. As seen, over the past year, there have been a total of 47 insider transactions, and 100% of them were selling activities. The cumulative amount from these 47 selling transactions was about $275 million.

More notably, the latest selling activities in Jan 2023, from two of its EVPs (as highlighted in the yellow box), were in the $200+ price range. I think these latest transactions are especially relevant and should serve as a caution for potential investors who are thinking about buying into the hype now. As you can see from the 1st chart above, NVDA’s trading activities in the past 6 months or so were largely in the price range from $155 to $185 (as highlighted in the yellow rectangle in the chart). And trading volume above this range (like in the $200+ range those two EVPs have sold their shares) is very minimal, and thus very opportunistic in my view.

Finally, before I move on, a few more words about the above insider activities. First, the above insider activities from DataRoma are confirmed by the information provided by MarketBeat data, too (see the next chart below). As seen, MarketBeat data show zero insider buying in the past 12 months, too, and a total of $33 million insider selling in Q1 2023 alone. And secondly, as detailed in my earlier article,

When it comes to insider activities, usually I pay more attention to buying activities than selling activities. The reason is that selling activities can be triggered by a range of factors irrelevant to business fundamentals (such as divorce or buying a new house). In contrast, insider buying activities usually have only one explanation – the insiders think the stock is undervalued.

Despite my usual skepticism towards insider selling activities, I take notice when the selling is so overwhelming, as in NVDA's case here. And next, I will examine the business prospects further and explain why I think these insiders are selling rationally (rather than to raise money to buy a new yacht).

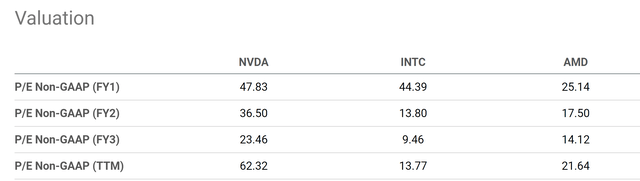

Valuation risk too high

To begin with, the valuation risk is too high. And the significant price advancement after ER made it even higher. NVDA is just trading at an unjustifiable premium the way I see things. Its TTM price-to-earnings (P/E) ratio is currently at 62.3x, which is higher than its peers such as Advanced Micro Devices (AMD) (at 21x) and Intel Corporation (INTC) (at 13x) by almost a factor of 3x and 5x, respectively. And next, I will examine the headwinds that NVDA is/will be facing in the next section. And you will see why I view NVDA's current premium valuation as unsustainable.

Other Risks

First, NVDA has been suffering from contraction in several of its key segments in recent quarters, including gaming (second-largest market) and professional visualization businesses. The recovery in gaming in the past quarter might be only temporary, and the headwinds on its other segment could persist. In particular, as detailed in my earlier article, the collapse of cryptocurrency prices (more than halved during 2022) will keep pressuring its high-end units as my analyses showed that the company’s revenues are correlated with crypto mining.

Second, the trade tension between China and U.S., especially in the chip space, remains a wildcard and could escalate. NVDA’s data center demand fell significantly in China in the past quarter, and management attributed the decline due to China’s macroeconomic slowdown and also the U.S. government’s export restriction on its products. Even though the export restrictions have been eased with revised policies, the trade tension has largely remained the same and as such so do the risks. In the case the trade tensions escalate, it could severely disrupt not only a key end-market for NVDA, it could also disjoint its supply chain and manufacturing operations in China. Nvidia relies on Chinese manufacturers for the production of some of its products, so any disruption in the supply chain could impact its ability to meet demand and lead to delays in product launches.

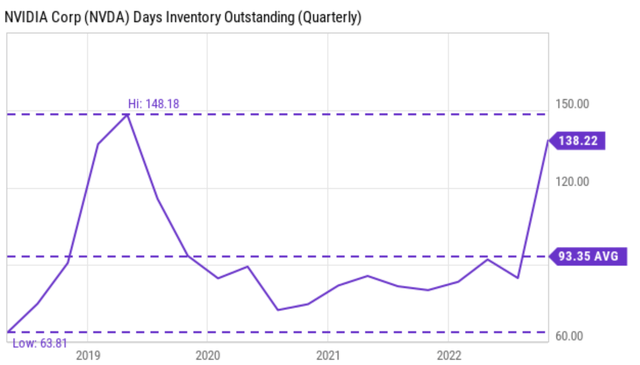

Finally, NVDA is still sitting on a large inventory, which could cause large balance sheet and also profit risks. As argued in our earlier article, NVDA is facing a situation similar to hoarding toilet paper during the COVID. It has a substantial amount of excess inventory as seen in the chart below. To wit, the company now sits on 138 days of outstanding inventory, almost 50% above its long-term average of 93 days and near the peak level since 2018.

Such a large inventory will take time to clear, and likely at reduced prices. Furthermore, it also carries significant balance sheet risks as time passes and market conditions change. For example, the company had to take a $1.2 billion write-off for inventory and related reserves last quarter.

Upside risks and final thoughts

NVDA certainly delivered a great quarter. And the good news appears even better given all the bad news it has been reporting in recent quarters. As a result, it's understandable that its stock price soared right after the ER. So there are certainly upside risks to the thesis also, and many of these have been detailed by other Seeking Alpha authors in the past few days. Here, I will just focus on an upside risk that is more specific to my thesis here: institutional activities.

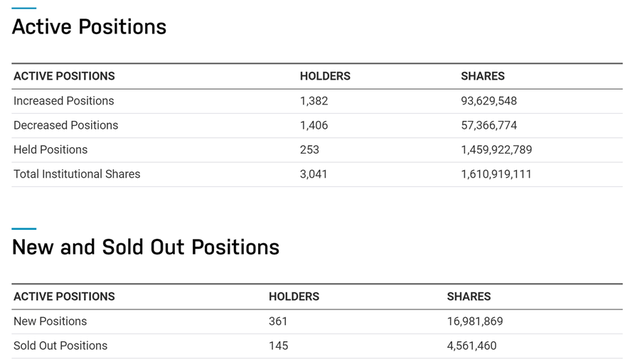

Besides insider activities, another major market force that can impact stock prices is institutional activities. And the most recent institutional activities on NVDA are shown below. As seen, the picture is a bit more mixed. Overall, 1,382 institutional holders increased their NVDA positions in the past reporting period, and 1,406 decreased their positions. So, there has been an almost an equal number of institutional sellers and buyers. Although in terms of trading volume, the buyers bought more than the sellers sold (93.6 million shares of buying vs. 57,366,774 shares of selling).

To conclude, I won’t join the Nvidia Corporation buyers now and do not recommend you do that either. To the contrary, I view the insider selling activities to be more rational. Especially, I view the latest selling activities that happened in January at the $200+ price as even more telling. Given the trading volume and business fundamentals, I view selling in the $200+ range as very opportunistic.

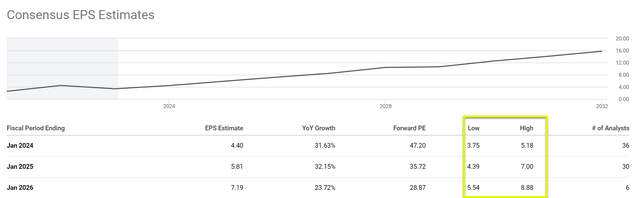

Before closing, one final chart captures much of the business risks and valuation risks mentioned so far. As seen, consensus estimates show such a wide variance for its EPS even for the next two years. Its FY 2024 EPS projection is between $3.75 and $5.18. This wide range of variance reflects the high level of uncertainties and further exacerbates the valuation risks in my mind. Should the EPS turn out to be toward the lower end, its FY1 P/E would be about 62x – approaching a bubbling regime the way I see it.

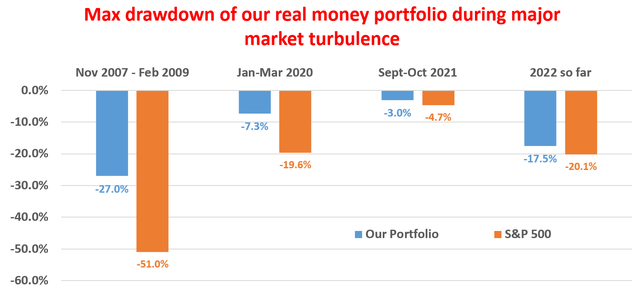

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.

This article was written by

** Disclosure: I am associated with Sensor Unlimited.

** Master of Science, 2004, Stanford University, Stanford, CA

Department of Management Science and Engineering, with concentration in quantitative investment

** PhD, 2006, Stanford University, Stanford, CA

Department of Mechanical Engineering, with concentration in advanced and renewable energy solutions

** 15 years of investment management experiences

Since 2006, have been actively analyzing stocks and the overall market, managing various portfolios and accounts and providing investment counseling to many relatives and friends.

** Diverse background and holistic approach

Combined with Sensor Unlimited, we provide more than 3 decades of hands-on experience in high-tech R&D and consulting, housing market, credit market, and actual portfolio management. We monitor several asset classes for tactical opportunities. Examples include less-covered stocks ideas (such as our past holdings like CRUS and FL), the credit and REIT market, short-term and long-term bond trade opportunities, and gold-silver trade opportunities.

I also take a holistic view and watch out on aspects (both dangers and opportunities) often neglected – such as tax considerations (always a large chunk of return), fitness with the rest of holdings (no holding is good or bad until it is examined under the context of what we already hold), and allocation across asset classes.

Above all, like many SA readers and writers, I am a curious investor – I look forward to constantly learn, re-learn, and de-learn with this wonderful community.

Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.