SCHO: Why Some Bond Funds Fail To Deliver For Parking Cash

Summary

- Investors need to pay attention to the ETFs and mutual funds they are utilizing to park cash; the goal should be to generate income while maintaining stable NAV values.

- SCHO is not a good option for parking cash, however it could be a great way to play a Fed pivot.

- Until the yield curve is no longer inverted, investors will not be able to "cheat" the market by simply extending further out the curve with cash allocations.

DNY59

We were recently asked about the Schwab Short-Term U.S. Treasury ETF (NYSEARCA:SCHO) as a vehicle to generate additional yield on the cash position of a portfolio. This person thought that by going a little further out on maturities that they would generate additional yield; and while that was correct for the comparison they performed of what they received with the available options in their brokerage account (an SIPC-insured Sweep or a FDIC-insured vehicle), it once again draws attention to our main thesis on cash since May 2022.

We have discussed quite a few times over the last six to nine months how investors need to understand the bond funds they are trying to utilize to generate interest income from their cash holdings. We have actually thrown out a few funds we believe to be really good cash equivalents for those not looking to utilize a money market mutual fund (See here and here). In the current market environment, the key is to match your cash assets to a suitable maturity/duration range while paying particular attention to whether you are attempting to generate interest income or gains from total return investing.

From the conversations we have had with those asking this question, the answer is that they are almost always attempting to generate income. In years past, when looking at their workplace retirement plans and the suite of fixed income funds offered, many chose the fund which offered the most income for their "cash proxy". Generally this worked out as they benefitted from higher coupon bonds which generated higher income and rising bond prices which allowed the managers to book profits from capital gains.

In today's world though, buying duration or longer maturity securities (basically the stuff you would not find in a money market mutual fund as it pertains to duration and maturity) is the exact wrong thing to do if you are looking to park your cash somewhere.

Why Is This?

It's the yield curve! Generally speaking, a normalized yield curve will rise from the lower left of the chart to the upper right. Logically this makes sense as in normal environments one should expect to pay a higher yield to borrow for longer. However, sometimes the yield curve inverts. This can happen for quite a few reasons, but one in particular, the fear of recession, occurs as the market prices in the fact that rates will be headed lower as stimulus (lower rates) will be needed.

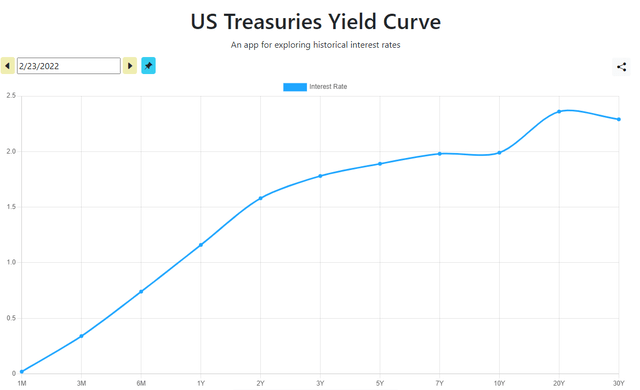

One year ago the yield curve was essentially normal. (USTreasuryYieldCurve.com)

In a normal world, with a yield curve that looks like it did one year ago (shown in above chart), an investor can extend out from money market funds into some ultra short bond ETFs and increase the yield from their cash - all while not really putting their cash at risk. This is because as those higher coupon bonds within the bond fund roll down the yield curve, the price of that bond generally rises, either towards par value or even above it if the yield curve is steeper on the left side. This is the yield curve structure where investors can make money not only from holding higher coupons, but also from the capital gains from bonds rolling down the yield curve.

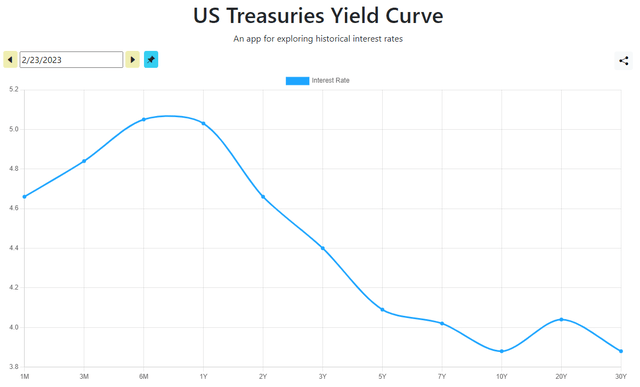

The current yield curve is a beast and wreaking havoc on portfolios as capital losses eat into returns. (USTreasuryYieldCurve.com)

In today's world, with the market worried about the Federal Reserve overreacting and the expectation that rates are heading lower soon, the yield curve is inverted and basically creating a headache for every bond fund out there. An inverted yield curve, especially when shaped like the current curve (shown above), basically generates paper losses on a daily basis even when rates remain unchanged. This is due to the higher rates on the shorter end of the curve which cause losses as lower coupon bonds are rolling down the yield curve and must trade at ever lower prices in order to provide investors comparable yields to newly issued higher coupon securities.

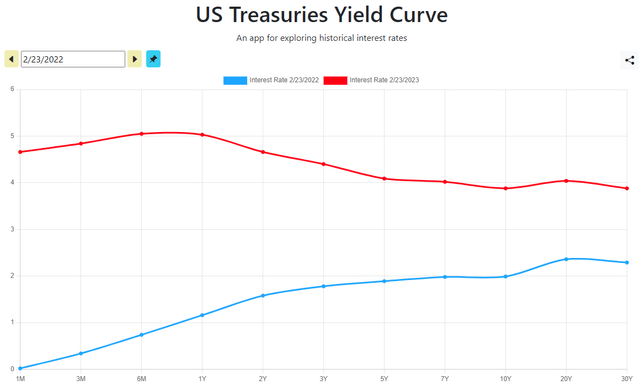

The comparison of the current yield curve vs the yield curve a year ago highlights just how brutal it has gotten for short duration and ultra short duration bond funds. (USTreasuryYieldCurve.com)

Making matters worse, when we take the yield curve from last year and this year and compare, not only is there an issue with the structure of the curve, but there is the fact that the U.S. Federal Reserve has been quite aggressive in raising interest rates. So when looking at a fund such as the Schwab Short-Term U.S. Treasury ETF, one must understand how the yield curve is positioned first, but must also understand how these funds operate.

Fund Structure

Nearly every ETF and mutual fund these days utilize an easily replicable index as the underlying benchmark. Since most in the industry now view deviating too much from the benchmark (both in outperformance and underperformance) as bad, many now focus on trying to replicate the returns of their benchmark and achieving marginal outperformance - which is relatively easy to accomplish in the fixed income industry.

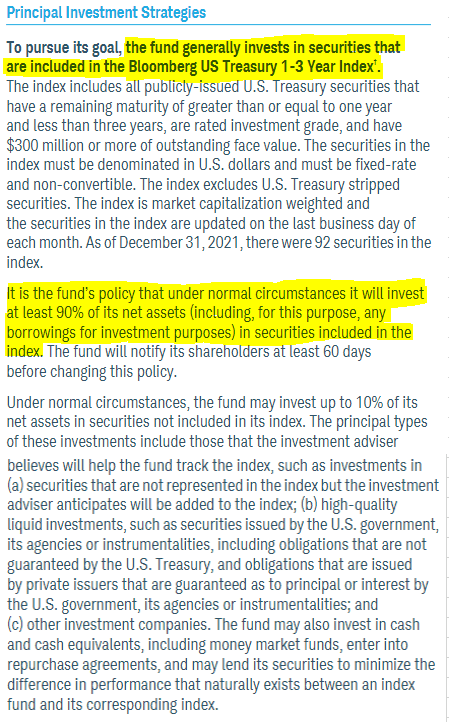

The SCHO Prospectus explains that the fund will keep 90% of the assets invested according to the index. Not deviating has proven to be problematic. (SCHO Prospectus)

While the performance may match up to the benchmark, returns can get wonky due to how these indices are constructed. As it pertains to the Schwab Short-Term U.S. Treasury ETF, the benchmark (like nearly all of the other bond indices) essentially requires that the manager of the ETF sells off securities once their maturity date is less than a year away. Having traded large bond portfolios, our specific experience saw a number of the large ETF and/or mutual fund companies offer on a monthly basis the securities that were soon to fall out of the index - usually with maturities of 13 months in order to beat others to the market and in some cases get premium pricing.

Each one of these sales to address future out-of-index securities in the fund is currently generating losses as rates were not only lower in previous months and years but the yield curve is inverted and basically at its highest yield right at the tenor where sales have to occur. Surprisingly managers refuse to allow some of these securities to roll down further, or even mature in order to avoid some losses, but this is in part due to the higher coupons they are now able to secure - which can offset the losses created by the sale.

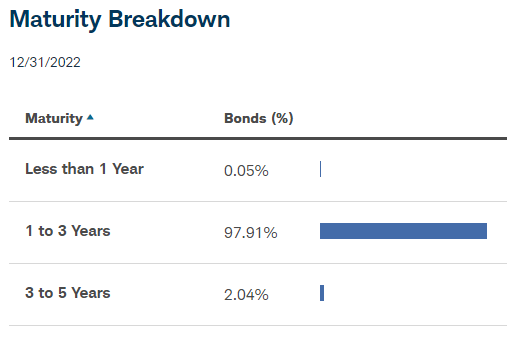

The Maturity Breakdown for SCHO. (Schwab Asset Management )

If we were running this fund, we would utilize some T-Bills in order to generate some additional income and lend support to the NAV. As you can see above, they are deviating from the 1-3 Year mandate already, which is allowed, but we would look to generate additional income now, while extending maturity dates on new purchases to delay any sales until the yield curve hopefully normalizes (which also helps manage duration).

Final Thoughts

The Schwab Short-Term U.S. Treasury ETF is not a suitable vehicle for investors to use for their cash or cash equivalent needs. While it generates a positive yield, investors are better off utilizing funds focused on being shorter, having floating rates or even just plain boring money market funds. We do think that the Schwab Short-Term U.S. Treasury ETF is suitable for investors finally looking to move some of their fixed income allocations further out the curve (which we discussed with a fund having a similar duration and average maturity late last month), and under that scenario one must recognize that they are giving up yield for potential capital gains.

So long as the yield curve is inverted, we think investors need to only utilize ETFs such as the Schwab Short-Term U.S. Treasury ETF for trading purposes or rebuilding their fixed-income allocations. The yield of the ETF will remain low and below even money markets so long as the rates one year and in trade at such high yields.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.