Representative image

Russia's war against Ukraine completes a full year on February 24, with the US President Joe Biden making a surprise visit to Kyiv to mark it. While the situation in Ukraine remains grave, the spillovers of Russia's aggression have seemingly ebbed.

Moneycontrol takes a quick look at the major issues the global markets and the Indian economy have been confronted with and how these forces have evolved over the last year.

Global supply chains have been hit massively in the last two years. First came the coronavirus pandemic in early 2020, which forced countries to shut down and brought global trade to its knees. Then came the Russia-Ukraine war, which endangered supplies of grains and energy products in particular.

But global supply chains have returned to pre-war levels – at least if one looks at the Baltic Dry Index.

The index, compiled by the London-based Baltic Exchange, measures the average price of shipping dry bulk across several routes and is considered a lead indicator of economic activity.

The index was as high as 5,650 in early October 2021 before it fell to under 1,300 by the end of January 2022. However, the Russia-Ukraine war pushed the index over 3,000 by May 2022. It has since collapsed to under 1,000.

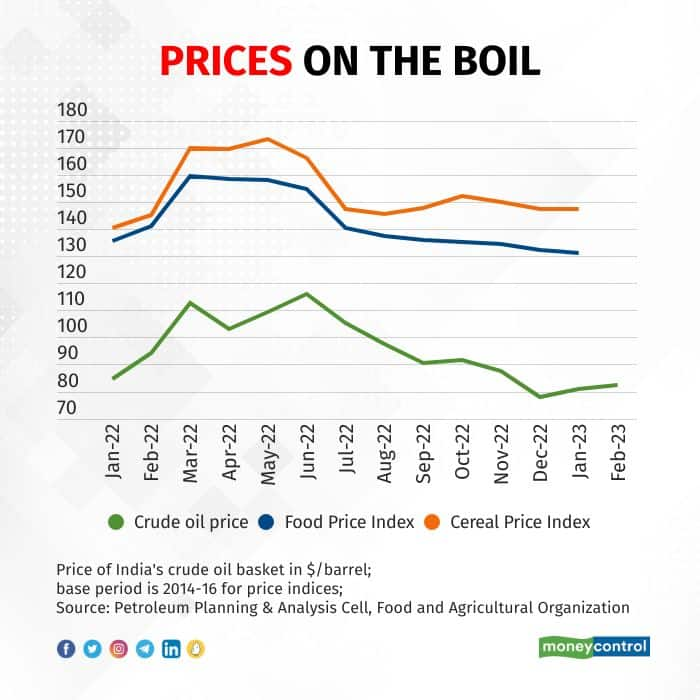

A natural consequence of supply chains being disrupted is higher prices, and this has been clearly visible for food and fuel items.

The Food and Agriculture Organization of the United Nations' Food Price Index is now back at pre-war levels, although the cereals price index – at 147.4 in January – is higher than its January 2022 level of 140.6.

The price of India's crude oil basket has also fallen appreciably in recent months and is averaging just over $80 per barrel in February, sharply lower than $116.01 in June.

For a net energy importer like India, the surge in fuel prices last year led to a massive deterioration in the trade balance as merchandise imports hit record monthly highs.

While the merchandise trade deficit remains large – although the latest data for January shows a sharp decline to $17.75 billion from $22.11 billion in December – services trade has been going great guns. A combination of record services exports and easing global commodity prices have helped bring down India's overall trade deficit to just $1.27 billion in January 2023 from $16.32 billion in September 2022.

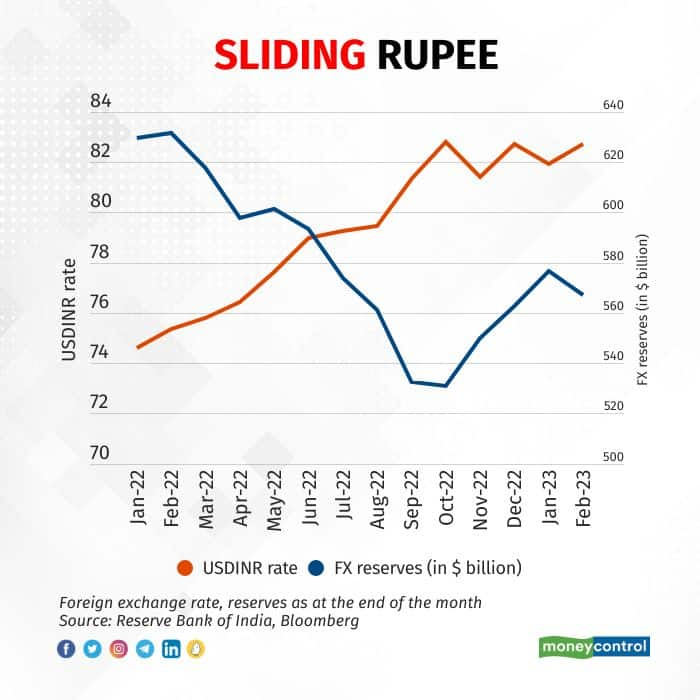

The widening of the trade deficit puts pressure on the exchange rate and the rupee is no exception.

The Indian currency hit multiple all-time lows against the US dollar in 2022, forcing the Reserve Bank of India to sell record amounts of foreign exchange from its reserves to reduce the exchange rate volatility. The central bank has maintained that its reserves, now under $600 billion, remain adequate, while the exchange rate has retreated below the 83-per-dollar mark.

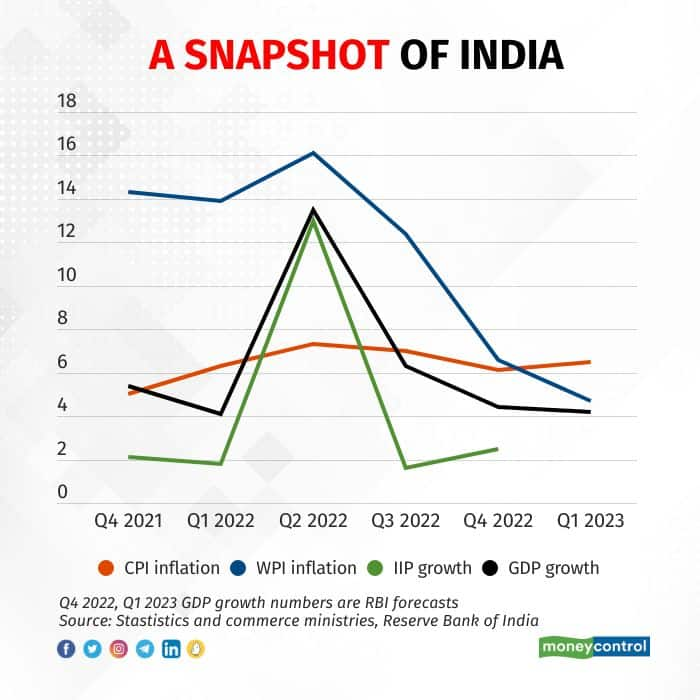

As is to be expected, the war's impact on the Indian economy has been adverse.

Inflation has risen – although wholesale inflation has crashed in recent months thanks to lower commodity prices – while growth has suffered. Economists expect the rapid tightening of monetary policy in developed countries to combat multi-decade high inflation will hurt external demand for India's exports and push its GDP growth rate close to 5 percent in 2023-24 from 7 percent this year.

More than 50 years ago, in protest against the US war in Vietnam, Edwin Starr famously asked what is war good for. The answer, as Russia’s invasion of Ukraine has demonstrated, remains: “Absolutely nothing”.