CEF Merger Arbitrage: Sell ACP And Buy IVH

Summary

- ACP is overvalued heading into its merger with IVH.

- Potentially make 10% in two weeks by selling ACP and buying IVH.

- One risk is that their NAV profiles diverge.

- Looking for a portfolio of ideas like this one? Members of CEF/ETF Income Laboratory get exclusive access to our subscriber-only portfolios. Learn More »

ayo888

Author's note: This article was released to CEF/ETF Income Laboratory members as part of our CEF Weekly Roundup on February 6, 2023, with certain numbers updated.

Merger arbitrage in abrdn/Delaware CEF mergers

The mergers of four Delaware funds into the abrdn funds are slated to be completed in about 2 weeks' time, on March 10, 2023 (press releases here and here). We have previously discussed the mergers in a previous CEF Weekly Roundup.

Because the mergers are on a NAV-to-NAV basis, it makes sense to buy the cheapest of every group of funds undergoing consolidation, regardless of whether it is the acquiring fund or the target being acquired.

- abrdn Income Credit Strategies Fund (NYSE:ACP) will acquire Delaware Ivy High Income Opportunities Fund (NYSE:IVH)

- abrdn Global Dynamic Dividend Fund (AGD) will acquire Delaware Enhanced Global Dividend and Income Fund (DEX) and Delaware Investments Dividend and Income Fund, Inc. (DDF)

- abrdn Global Infrastructure Income Fund (ASGI) will acquire Macquarie Global Infrastructure Total Return Fund (MGU)

We have created a Corporate Actions Tracker page for Income Lab members to help them keep track of CEF corporate actions (i.e. rights offerings, tender offers, mergers, liquidations, are announced). A screenshot of from our tracker page is reproduced below:

Income Lab

Sell ACP and buy IVH

We can see from the tracker that the spread between the acquiring fund, ACP, and the acquired fund, IVH still remains very wide at +10.92%.

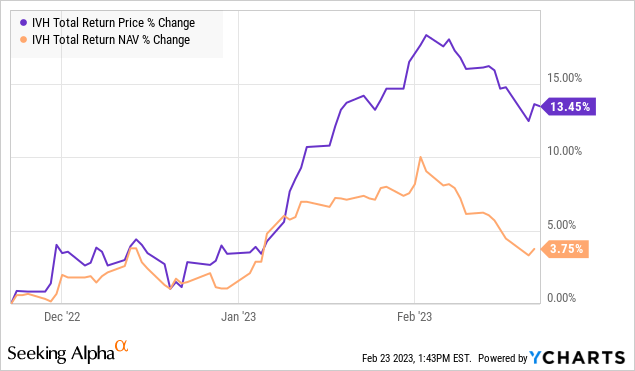

This means that those own ACP should buy swap to IVH. We bought IVH in our Tactical Income-100 portfolio at the end of last year to take advantage of this discount spread.

Income Lab

Our position is nicely in profit since that trade, but there may still be further gains ahead.

The reason is that the discount spread between ACP (at a +10.92% premium) and IVH (at a +0.59% premium) is expected to close to zero in two weeks' time, when IVH is acquired by ACP. Whether this occurs as a result of ACP's premium coming down, or IVH's premium rising higher (or some combination of the two) remains to be seen.

Nevertheless, holders of ACP should switch to IVH and capture the 10% premium spread between the two funds, which is a massive spread given that the merger is only two weeks away.

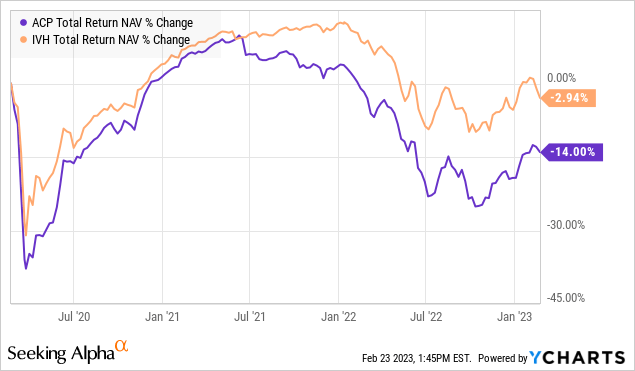

One risk of this trade is that the NAV profiles of ACP and IVH may diverge over the next two weeks. While both are high-yield fixed income funds, ACP runs a "junkier" portfolio than IVH. Thus, if markets were to shift back into risk-on mode, ACP could outperform IVH at a NAV level, negating some or all of the anticipated benefit from the discount spread closing.

Summary

Holders of ACP should sell ACP and buy IVH to take advantage of the 10% premium spread between the two funds which should close by March 10, 2023 when ACP acquires IVH.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Don't know how to profit (or avoid losses) from CEF corporate actions?

We keep track of corporate actions such as rights offers, tender offers and mergers and how to profit from them in the members area of CEF/ETF Income Laboratory.

Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

CEF/ETF Income Laboratory is a premium newsletter on Seeking Alpha that is focused on researching profitable income and arbitrage ideas with closed-end funds (CEFs) and exchange-traded funds (ETFs). We manage model safe and reliable 8%-yielding fund portfolios that have beaten the market in order to make income investing easy for you. Check us out to see why one subscriber calls us a "one-stop shop for CEF research.”

Click here to learn more about how we can help your income investing!

The CEF/ETF Income Laboratory is a top-ranked newsletter service that boasts a community of over 1000 serious income investors dedicated to sharing the best CEF and ETF ideas and strategies.

Our team includes:

1) Stanford Chemist: I am a scientific researcher by training who has taken up a passionate interest in investing. I provide fresh, agenda-free insight and analysis that you won't find on Wall Street! My ultimate goal is to provide analysis, research and evidence-based ways of generating profitable investing outcomes with CEFs and ETFs. My guiding philosophy is to help teach members not "what to think", but "how to think".

2) Nick Ackerman: Nick is a former Financial Advisor and has previously qualified for holding Series 7 and Series 66 licenses. These licenses also specifically qualified him for the role of Registered Investment Adviser (RIA), i.e., he was registered as a fiduciary and could manage assets for a fee and give advice. Since then he has continued with his passion for investing through writing for Seeking Alpha, providing his knowledge, opinions, and insights of the investing world. His specific focus is on closed-end funds as an attractive way to achieve income as well as general financial planning strategies towards achieving one’s long term financial goals.

3) Juan de la Hoz: Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He is the "ETF Expert" of the CEF/ETF Income Laboratory, and enjoys researching strategies for income investors to increase their returns while lowering risk.

4) Dividend Seeker: Dividend Seeker began investing, as well as his career in Financial Services, in 2008, at the height of the market crash. This experience gave him a lot of perspective in a short period of time, and has helped shape his investment strategy today. He follows the markets passionately, investing mostly in sector ETFs, fixed-income CEFs, gold, and municipal bonds. He has worked in the Insurance industry in Funds Management, helping to direct conservative investments for claims reserves. After a few years, he moved in to the Banking industry, where he worked as a junior equity and currency analyst. Most recently, he took on an Audit role, supervising BSA/AML Compliance teams for one of the largest banks in the world. He has both a Bachelors and MBA in Finance. He is the "Macro Expert" of the CEF/ETF Income Laboratory.

Disclosure: I/we have a beneficial long position in the shares of IVH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.