Altimmune's Peptide-Based Therapies Offer Substantial Opportunity

Summary

- Altimmune is a pioneer in creating peptide-based therapies for obesity and liver disease, with a unique approach to product development.

- Altimmune's R&D expenses have dropped year-on-year due to the discontinuation of certain projects, but the company has been actively advancing other programs that are expected to deliver noteworthy revenues soon.

- Pemvidutide has demonstrated promising outcomes in studies for non-alcoholic fatty liver disease, showing the potential to dramatically lower liver fat content and liver inflammation.

- Altimmune's success in the peptide-based therapies market demonstrates its effectiveness as an alternative to biologics and small molecule medications.

Christoph Burgstedt/iStock via Getty Images

Altimmune stock (NASDAQ:ALT) has established itself as a pioneer in the creation of peptide-based therapies for the treatment of obesity and liver disease. It offers an appealing investment opportunity for those wishing to invest in the biotech sector because of its distinctive approach to product development, which has produced a solid pipeline of cutting-edge and potent medicines.

Altimmune's emphasis on creating treatments for numerous diseases is one of its main advantages. The corporation has diversified its product offerings using this strategy, which lowers risk exposure and improves possible revenue streams. Due to its distinctive strategy for creating peptide-based treatments, varied pipeline, and solid product line, Altimmune stands out when compared to its rivals. These elements, along with its strong financial position, create a solid bullish outlook for the company's future.

Company Financials

Due to the cessation of development operations for the T-COVID and NasoShield programs in 2021, revenue for the three months that ended September 30, 2022, was negligible compared to the same period in 2021 - the company made the decision to pivot away from these programs. Altimmune may now concentrate on more intriguing pipeline prospects, such as pemvidutide and HepTcell, which have the potential to completely alter the way that obesity and chronic hepatitis B virus (HBV) infections are treated. The company is well-positioned for significant expansion in the upcoming years due to its emphasis on attractive pipeline candidates and the financial runway provided by its solid balance sheet.

As of September 2022, Altimmune held $201.9 million in cash, cash equivalents, and short-term investments, providing a strong balance sheet to fund its development pipeline without seeking external financing. Despite reporting minimal revenue for Q3 2021 compared to 2020, this was primarily due to the discontinuation of T-COVID and NasoShield projects. However, Altimmune has been actively advancing other programs which are expected to deliver noteworthy revenues shortly.

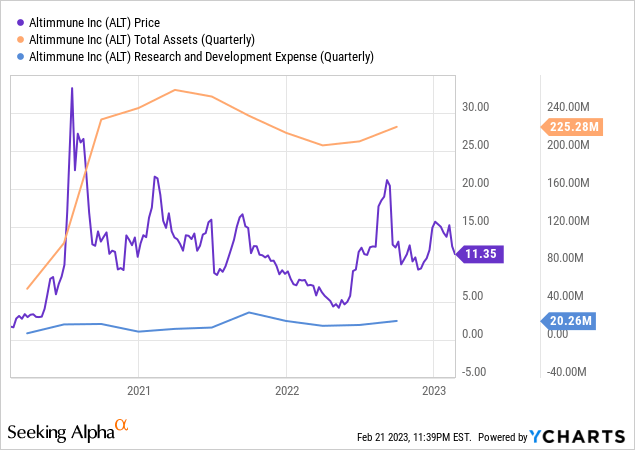

ycharts.com

The firm's R&D expenses dropped from $29.2 to $20.3 million year-on-year; largely due to the halted progress of T-COVID and NasoShield but also because direct costs related to pemvidutide and HepTcell advancement totaled $15.8 million. Additionally, G&A expenses increased slightly - from $4.2 to $4.5 million - likely because of stock compensation expenditure associated frequently with expanding businesses like Altimmune's.

Finally, while a net loss of $23.5 million was reported by Altimmune in Q3 of 2022, this marked an improvement of $10 million from Q3 2021; displaying the firm's cost optimization capabilities as well as their efforts to push forward their pipeline developments.

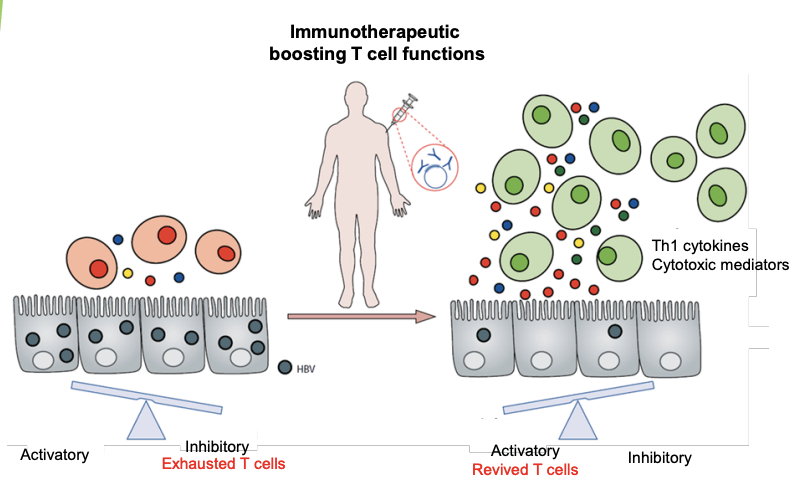

An Innovative Pipeline

The company's product line includes several innovative products that are in various stages of development. HBV immunotherapy aims to suppress HBV replication long-term by driving T-cell response to the disease genotype. HepTcell, which has demonstrated strong antiviral efficacy in a mouse model of chronic HBV infection, is yet another interesting option in the pipeline. This shows that the therapy may be successful in treating this severe and persistent illness, which impacts 296 million people globally.

ir.altimmune.com

Pemvidutide, the most promising candidate in Altimmune's pipeline, deserves special attention because it has the potential to revolutionize the way obesity and non-alcoholic steatohepatitis (NASH), which currently has no approved therapeutic, are treated. Pemvidutide is a next-generation GLP-1 receptor agonist, that has the potential to reduce liver fat specifically by enhancing glucose regulation and lowering body weight.

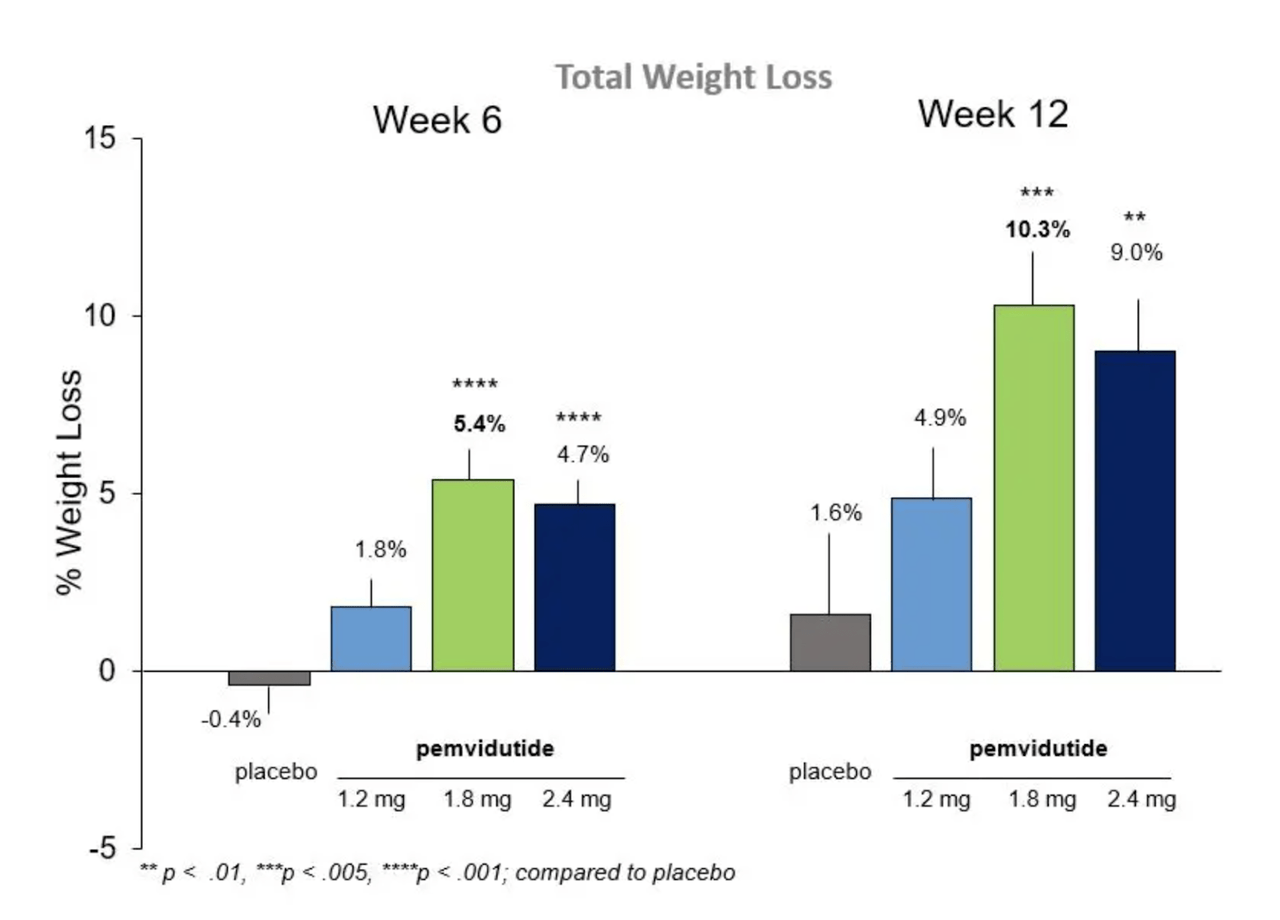

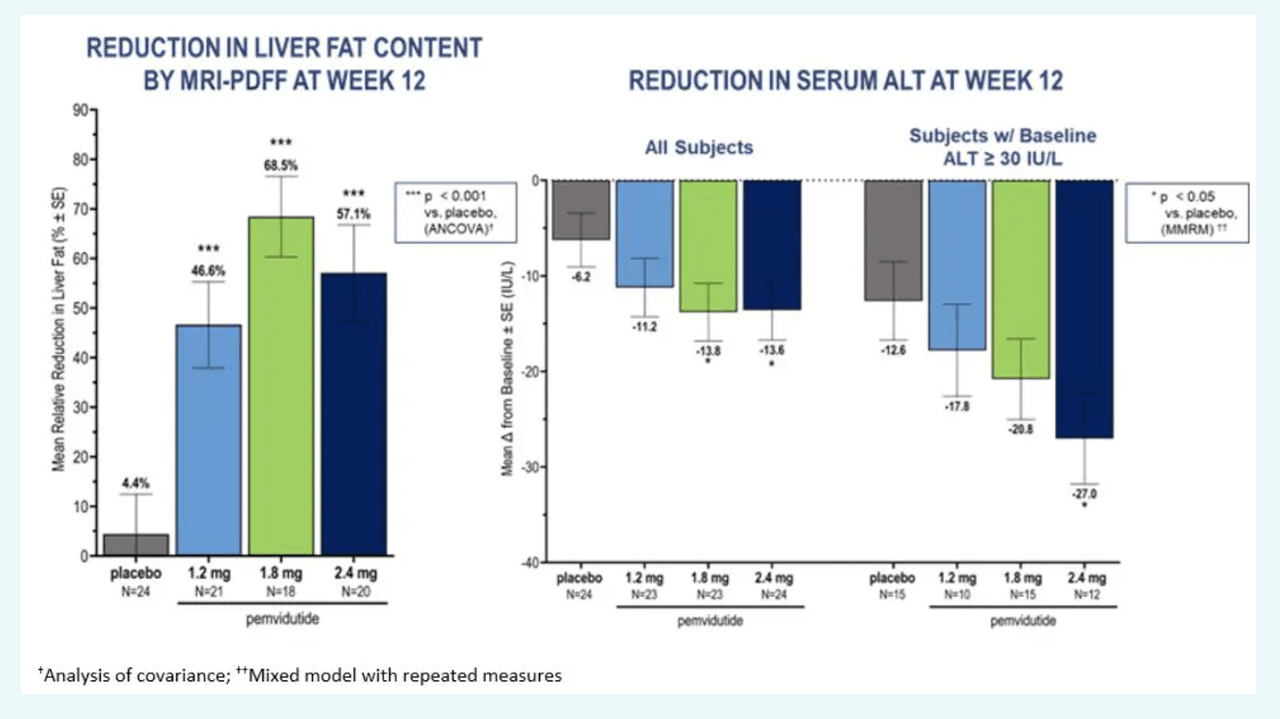

Pemvidutide Outcome News

Pemvidutide, a once-weekly GLP-1 receptor agonist, has demonstrated promising outcomes in studies for nonalcoholic fatty liver disease, according to the company Non-Alcoholic Fatty Liver Disease (NAFLD). There are presently no licensed treatments for this illness, which affects an estimated 25% of adults in the United States alone. According to the trial's findings, Pemvidutide may be administered as a stand-alone therapy without further dietary and activity modifications to dramatically lower liver fat content and liver inflammation.

altimmune.com

This finding is very interesting because it gives Altimmune the chance to establish itself as a pioneer in the creation of cutting-edge medicines for NAFLD and associated diseases, giving it a substantial competitive advantage. Also, Pemvidutide's tolerability and the trial's excellent trends in glycemic control and blood pressure reduction support the drug's potential as a promising therapeutic choice.

altimmune.com

The fact that Altimmune was able to achieve the main endpoint across all Pemvidutide treatment groups is extremely encouraging for the company's future. The commercial potential for this treatment is substantial given the scarcity of recognized therapies for NAFLD and the rising prevalence of the disorder. I will be closely monitoring Altimmune's ongoing development of this therapy because the company's trial findings mark an important milestone and are a positive sign toward further promising future developments.

Peptide Therapy Market

Notwithstanding the dangers in this industry, Altimmune is a promising investment opportunity in the peptide-based therapies market. Due to the great specificity and effectiveness of peptides, there are worries about the availability of alternatives, potential adverse effects, regulatory barriers, and competition as the industry continues to expand and become more well-known. Altimmune, however, has demonstrated its success in this sector with a number of promising peptide-based medicines such as Pemvidutide and HepTcell.

The market for peptide-based therapies also faces regulatory obstacles which can prove to be a major risk to any biotech company. Because of their special characteristics, peptides can be more difficult to generate and regulate than other treatment choices. In terms of broader market competitive risk, Altimmune has a competitive advantage due to its extensive line of drugs in development and its expertise in the industry. The price and profitability of Altimmune's products may be impacted by greater competition, but the company's performance so far shows that it has the tools and know-how to overcome this obstacle.

Company Specific Risks

One significant risk is the company's heavy reliance on the success of its pipeline of peptide-based treatments, including Pemvidutide and HepTcell. If the clinical trials fail to deliver positive outcomes or regulatory approval is not granted, it could lead to significant losses for the company, impacting the share price.

The availability of alternatives is a significant risk in this market. While biologics and small molecule medications have long dominated the therapeutic landscape, Altimmune's success with peptide-based treatments demonstrates that it is an effective alternative. Proteins and peptides are vulnerable to acidic pH in the stomach. Enzymatic degradation by pepsin in the stomach and/or pancreatic proteases in the intestine, and aminopeptidases existing in the brush-border membrane are other major barriers to oral protein and peptide delivery.

Lastly, Altimmune's financial position has seen improvement, but the company still operates at a net loss. A prolonged period of losses could affect the company's ability to continue developing its pipeline or impact its ability to attract new investors. While Altimmune's financial position is currently strong, it is important to note that the company has experienced minimal revenue for Q3 2022 due to the discontinuation of the T-COVID and NasoShield programs. This underscores the potential impact of the failure of pipeline candidates on the company's financial performance. In general, investors should be aware of the potential risks associated with investing in any early-stage biotech company and carefully evaluate Altimmune's pipeline and financials before making any investment decisions.

Competitors in Immunotherapeutics

Theratechnologies and Altimmune are both involved in hepatic disease treatment, although Altimmune's specific peptidal approach is unique and has almost no direct competitors. Still, even when compared to Theratechnologies, I believe Altimmune comes out on top. The fact that Altimmune has a strong financial position, with more than $127 million in cash and cash equivalents as of September 2022, is another one of its advantages. This puts the business in a good position to finance the growth of its pipeline and other strategic projects, such as possible joint ventures or acquisitions. Theratechnologies, on the other hand, is in a far worse financial condition, as of Q32021, it only has $23 million in cash and cash equivalents. In comparison to bigger, better-funded biopharmaceutical businesses, this limits the company's ability to fund the development of its pipeline and other projects.

Moreover, Altimmune recently reported encouraging clinical trial outcomes for pemvidutide, its lead candidate, in people with NAFLD. Theratechnologies, on the other hand, has not yet disclosed any noteworthy clinical trial data, which raises the possibility that the business may have a more difficult time obtaining regulatory approval in the coming years.

Performance Relative to Sector

Admittedly, traditional valuation metrics fall a bit short in valuing growth-oriented companies such as biotechs, where the primary driver of growth is arguably the core technology and its efficacy.

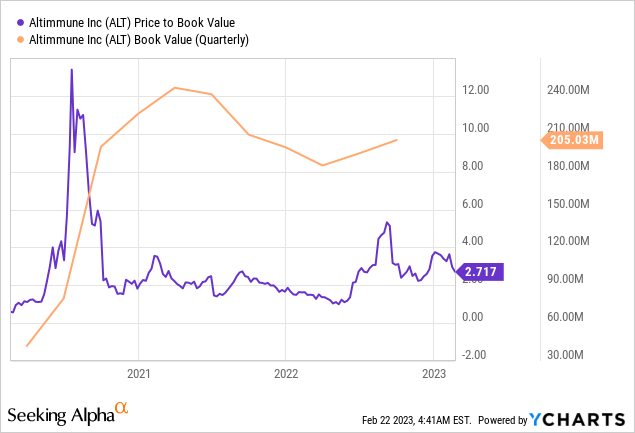

ycharts.com

That said, basic valuation metrics are still worth looking at to contextualize the market's current sentiment on the company. The price-to-book ratio for Altimmune is 2.87 right now, greater than the sector average of 2.17. While this indicates that the current price is overvalued on paper this is likely due to investors factoring in future growth from the success of recent clinical trials.

The Big Picture

Due to its innovative platform technology and a strong pipeline of treatments, Altimmune is a business that investors should give serious consideration to. The company stands out from its rivals and enjoys a competitive edge in the market thanks to its focus on peptide-based treatments in high-demand segments of the pharmaceutical industry, such as obesity, HBV, and NASH. With a healthy cash position and balance sheet that give the business the freedom to explore strategic growth opportunities and invest in its product pipeline, Altimmune's financials also indicate a promising future. Altimmune presents an appealing investment option for those who are ready to take on some risk, notwithstanding the hazards associated with investing in any early-stage biotechnology company.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.