Nvidia: Up Sharply On Continued AI Speculation

Summary

- Nvidia Corporation stock surged close to 9% after the company reported FY Q4 2023 results, beating analyst expectations with regards to both the top line and earnings.

- Moreover, Nvidia management also gave a bullish outlook for FY 2024 Q1 and the company's AI ambitions.

- CEO Jensen Huang noted that generative systems had marked an "inflection point" following a decade of artificial intelligence research.

- Although I acknowledge the tailwind that Nvidia is likely to see from AI computing, as a function of valuation (x18 EV/Sales), NVDA stock remains a "Hold."

BlackJack3D

Thesis

NVIDIA Corporation (NASDAQ:NVDA) stock surged close to 9% after the company reported FY Q4 2023 results. Although Nvidia's performance in the final quarter of FY 2023 topped analyst expectations with regards to both revenue and earnings, the market arguably was more focused on Nvidia's upbeat outlook with regards to nascent AI opportunities -- opportunities which CEO Jensen Huang sees "at an inflection point." According to CEO Huang, Nvidia is set to generate significant revenue from services such as selling access to supercomputers and pre-trained AI models, potentially [soon] generating "hundreds of millions of dollars" in sales.

Although I acknowledge the tailwind that Nvidia is likely to see from AI computing, as a function of valuation (x18 EV/Sales), NVDA stock remains a "Hold."

Nvidia's FY 2023 Q4 Results

Nvidia closed FY 2023 reporting strong Q4 results, topping analyst consensus projections for both revenue and earnings. During the three months ending January 2023, the chip designer generated revenues of around $6.05 billion, representing a 2% QoQ growth from $5.9 billion one quarter prior. Additionally, the company surpassed the estimated $6.03 billion of revenues as estimated by analyst consensus estimates, indicating somewhat lagging market sentiment.

In terms of profitability, NVDA achieved noteworthy improvements in FY Q4 2023, with GAAP gross margin expanding to 66.1%, up from 56.1% in FY Q3 2023. Similarly, on the backdrop of both margin and revenue expansion, Nvidia's operating income for FY Q4 2023 jumped to $2.2 billion, as compared to $1.5 billion for Q3 2023 (up 45% QoQ). EPS for the quarter came in at $0.88, beating analyst consensus estimates by 8 cents.

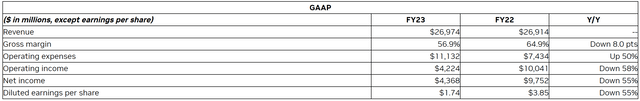

FY 2023

For the full fiscal year 2023, Nvidia's revenue remained approximately flat as compared to FY 2022. Gross margin, however, contracted to 56.9%, as compared to 64.9% for the same period one year prior. Similarly, operating income fell to $4.2 billion, down 68% YoY versus FY 2022.

A Note On Nvidia's Segments

Nvidia's Gaming division saw a 16% increase in fourth-quarter revenue compared to the previous quarter, although it was down 46% from the previous year. The company unveiled its latest GeForce RTX 40 series for laptops, which promises the largest-ever generational leap in performance and power efficiency. Furthermore, Nvidia signed a 10-year agreement with Microsoft (MSFT) to bring the Xbox PC game lineup to GeForce NOW.

Nvidia's Automotive and Embedded division recorded a record revenue of $294 million in the fourth quarter, up 135% from a year ago and 17% from the previous quarter. Nvidia recently announced a strategic partnership with Foxconn to develop automated and autonomous vehicle platforms. In addition, the company released major updates to the Nvidia Isaac Sim robotics simulation tool, which now includes AI capabilities and cloud access.

The Professional Visualization division of Nvidia reported a fourth-quarter revenue of $226 million, representing a decline of 65% YoY, but a 13% increase QoQ. Fiscal-year revenue was down 27% to $1.54 billion. The division made significant progress during the year by enhancing the capabilities of Nvidia Omniverse Enterprise to allow teams to build connected 3D pipelines and develop large-scale 3D works more efficiently -- partnering with Lockheed Martin Corporation (LMT) and Mercedes-Benz (OTCPK:MBGAF, OTCPK:MBGYY).

Nvidia's Data Center division recorded a fourth-quarter revenue of $3.62 billion, representing an 11% increase YoY, but a 6% decline QoQ. The fiscal-year revenue rose 41% to a record $15.01 billion. The division made notable strides in partnering with Deutsche Bank (DB) and Dell Technologies Inc. (DELL) to expand the use of AI for commercial purposes.

AI Tailwind

These days, investing in Nvidia is all about investing in Artificial Intelligence. With that frame of reference, in the post-Q4 earnings call CEO Jensen Huang talked up the commercial potential of generative AI. He noted that generative systems had marked an "inflection point" following a decade of artificial intelligence research:

AI is at an inflection point, setting up for broad adoption reaching into every industry... From startups to major enterprises, we are seeing accelerated interest in the versatility and capabilities of generative AI.

adding that:

We are set to help customers take advantage of breakthroughs in generative AI and large language models. Our new AI supercomputer, with H100 and its Transformer Engine and Quantum-2 networking fabric, is in full production. We are set to help customers take advantage of breakthroughs in generative AI and large language models. Our new AI supercomputer, with H100 and its Transformer Engine and Quantum-2 networking fabric, is in full production.

However, Nvidia management did not give any guidance or estimate of how generative AI will translate into financial value creation, except that revenue from services such as selling access to supercomputers and pre-trained AI models could potentially [soon] generate "hundreds of millions of dollars" in sales. Moreover, the growth of Nvidia's data center business, up 11% YoY, is an early bullish signal that supports the potential for continued benefits from artificial intelligence software, such as ChatGPT and Microsoft Bing's AI chatbot.

Confident Going Into FY Q1 2024

Notably, on the backdrop of recovering demand for Gaming...

Gaming is recovering from the post-pandemic downturn, with gamers enthusiastically embracing the new Ada architecture GPUs with AI neural rendering

... paired with accelerating AI ambitions...

From startups to major enterprises, we are seeing accelerated interest in the versatility and capabilities of generative AI.

... Nvidia has announced its outlook for the first quarter of fiscal 2024. According to the chip designer’s latest Q4 2022 report, management expects revenue to reach $6.50 billion, with a potential margin of error of 2%. GAAP and non-GAAP gross margins are anticipated to be 64.1% and 66.5%, respectively. Furthermore, the company's operating expenses for the quarter are estimated to be around $2.53 billion and $1.78 billion for GAAP and non-GAAP, respectively. Assuming the above estimates to be correct, Nvidia FY Q1 2024 operating income could fall anywhere between $1.7 billion to $2.5 billion.

Valuation Still Excessive

I understand that, as a business, Nvidia has lots of potential. However, I also would like to point out that the potential has an excessively rich price tag attached. According to data compiled by Seeking Alpha, Nvidia is valued at a one-year forward P/E of x67, which represents a more than 173% valuation premium versus the information technology sector. Nvidia's P/B is x21 and P/S is x18, valuation premia of 450% and 535%, respectively.

Conclusion

Nvidia stock surged close to 9% after the company reported FY Q4 2023 results, beating analyst expectations with regards to both the top line and earnings. Moreover, Nvidia management also gave a bullish outlook for FY 2024 Q1 and the company's AI ambitions. However, despite the positivity, it is difficult to argue that Nvidia stock is a "buying opportunity." In fact, valued at FWD x10 EV/Sales, Nvidia Corporation stock is trading too expensive to warrant an investment, in my opinion. I reiterate a Hold" recommendation.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice.