TravelCenters of America: It's Fun When It Works

Summary

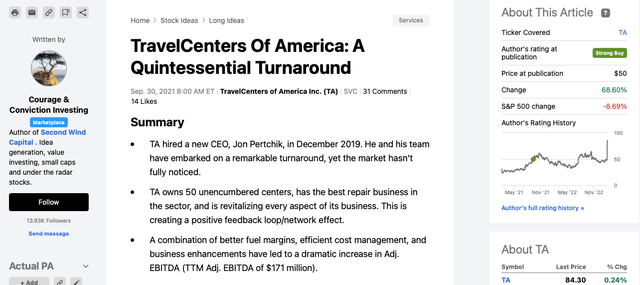

- On September 30, 2021, on SA's free site, I shared my in-depth long thesis on TravelCenters of America. At the time, TA shares were trading at $50.

- On February 16, 2023, BP p.l.c. announced the acquisition of TA, for a cash purchase price of $86 per share.

- I discuss my original TA thesis, and updated thesis (November 19, 2022) and explain why BP bought TA.

- Across accounts, in 2023, I made $45,241 in realized investment gains.

- This idea was discussed in more depth with members of my private investing community, Second Wind Capital . Learn More »

vitpho/iStock via Getty Images

Successful value investing is difficult. There are north of three thousand publicly traded companies to potentially invest in and on a daily basis, there are literally hundreds, if not thousands, of newly minted articles published throughout the broader financial press. Moreover, strongly reinforced throughout the financial media landscape by the structure of the industry, far too many people's bandwidth and attention seem to get diverted and misallocated to the siren song of market timing, reaching for yield, or chasing the latest and greatest Wall Street narrative. Along the way, the underlying valuation and margin of safety of a particular investment seem to get lost in the sex appeal of a compelling narrative, perfectly honed, crafted, and packaged by both the 'On' and 'Off' Wall Street selling machine and sales force. Unfortunately, far too many people are looking for shortcuts, easy answers, and echo chambers to support their latest perspectives and often emotionally charged views. In addition, human emotions and sentiment tend to move stock prices well above and below the equator of intrinsic value.

And perhaps the saddest thing of all is that good marketers, people that really aren't any good at generating alpha seem to draw the largest audiences. After all, and a bit off tangent, look at how wildly successful so many YouTube content creators and personalities are. Let's face it, the great works of Sir Warren Buffett (BRK.A) (BRK.B), and his treasure trove of annual letters are available for free (see here), and yet very few people seem to actually read his work.

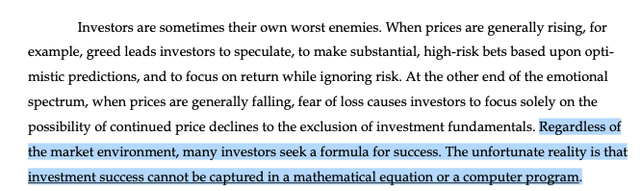

In fact, in 1991, Seth Klarman, the Founder and Chairman of the highly successful Baupost Group, located in Boston, MA, published Margin of Safety. This is a fantastic 250-page book, and enclosed below I shared a few excerpts.

Being a value investor usually means standing part from the crowd, challenging conventional wisdom, and opposing investment winds. It can be a very lonely undertaking.

(Source: Page 100 - Margin of Safety)

There are no magic formulas, mathematical equations, or computer programs (see below)

Seth Klarman - Margin of Safety

My long-winded preamble is an ode to value investors. Even though most of my time is spent in the pursuit of value investing and questing for alpha, admittedly, even for me, this is a very hard game. I understand the game, how it is played, and even still, it is much harder than it looks.

We live in a 'what have you done for me lately world' and it is really, really hard to find patient, long-term oriented investment capital or members. Value investing is just too hard for most people, that is why it is far less popular than growth investing.

TravelCenters of America (NASDAQ:TA)

On February 16, 2023, me and my marketplace group of members, awoke to some most encouraging news. That morning, we learned that BP p.l.c. (BP), yes that $117 billion market capitalization energy company, had agreed to purchase TA stock for $86 per share.

In late August 2021, after spending fifteen to twenty hours of work, including intense synthesizing, I wrote my TA long thesis - A Quintessential Turnaround. Albeit with about a thirty-day lag, I shared this compelling long thesis with the broader Seeking Alpha community, see below.

Crazy TA Share Price Volatility

From the time of publication, September 30, 2021, and again, we originally bought TA shares between $41 and $42, as the piece was published with a lag, TA shares leapt to a high of $64.58, on November 8, 2021. However, and this is exactly Seth Klarman's point on why value investing is so difficult, by June 13, 2022, TA shares got cut in half, and bottomed out, at $31.19!

Remarkably, in fact, TA's fundamentals had never been better! Better yet, by October 28, 2022, TA leapt to $65.33. However, the volatility remained a constant, as very good Q3 FY 2022 earnings and a solid outlook (I follow this company very closely and was on the conference call live, that day), somehow translated into the stock losing a third of its value and dropping down to $42.13, on December 13, 2022.

As someone that purchased the stock, at $42, back on September 2, 2021, I had a front-row seat and watched TA shares move from $42 to $64, then back to $32, then to $65 and more recently back down to $42. It was remarkable how completely disconnected TA's stock price was with its fundamentals. Outside of a few periods, when the stock was in the $60s, and those were fleeting, Mr. Market failed to recognize the exceptional fundamentals and the strong turnaround engineered by Jon Pertchik and his team!

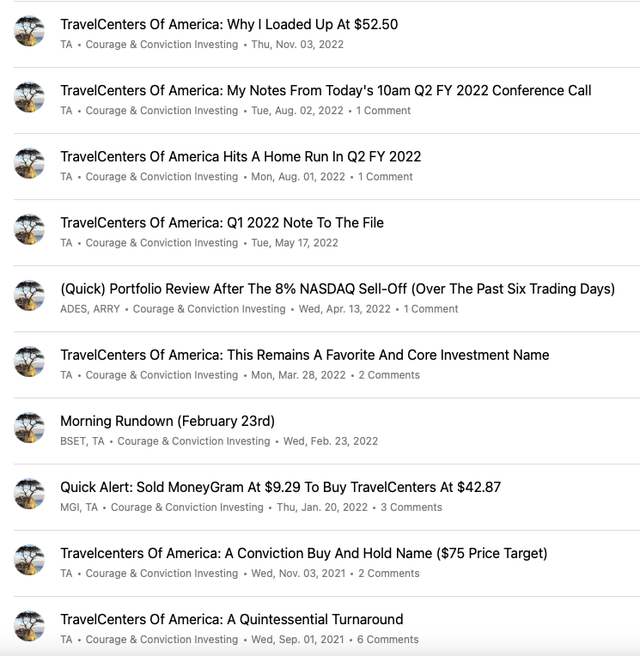

Lo and behold, and behind the scenes, my conviction never wavered. Enclosed below is a snapshot of the articles I wrote on TA, to my marketplace group.

November 19, 2022 SA Pro Interview - Reiterating My Buy and Hold Thesis On TravelCenters of America

Also, on November 19, 2022, the SA Pro team and me did an interview on value investing.

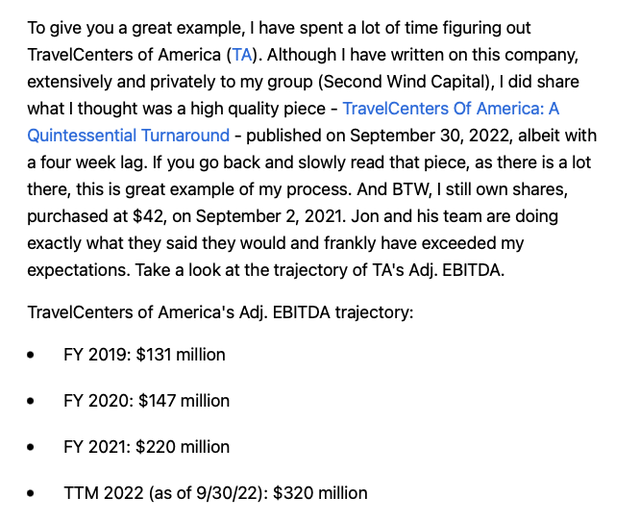

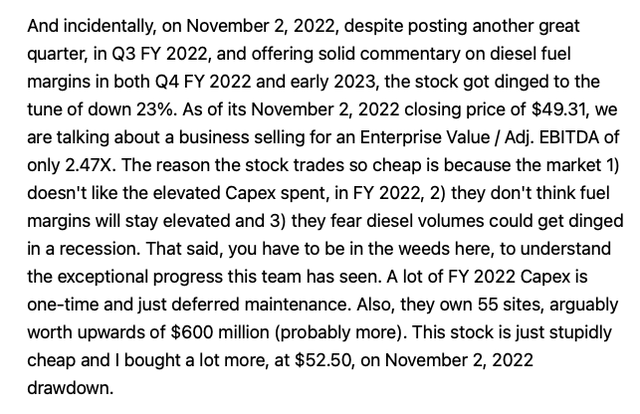

Within that article, enclosed below is exactly what I wrote on TA:

SA Interview: Value Investing With Courage & Conviction Investing (11/19/22) SA Interview: Value Investing With Courage & Conviction Investing (11/19/22)

Next, and rightly so, you might be wondering how I made out on my TA long investment thesis. I've just told readers that I loved TA, thought the company was ridiculously mis-priced, and I owned it. As it turns out, I'm happy to report that, across accounts, the two actively managed family accounts, and my small Buy and Hold personal account, in total, the cumulative gain on TA was $45,241. In retrospective, and hindsight is 20-20, I should have really loaded up, in the $30s, on the hard-to-explain May 2022 and June 2022 sell-offs. That said, at that time, I had limited dry powder and was off tilting at windmills and battling Mr. Market on other names and fronts.

Total Realized Gains: $45,241

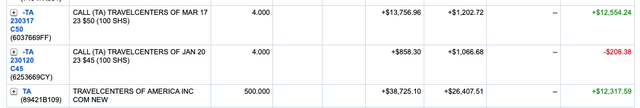

Across three accounts, my total realized gains were as follows:

Flagship Account: +$24,663

Fidelity 2023 Closed Positions

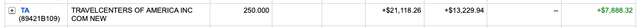

Small Actively Managed Account: +$7,888

Fidelity 2023 Closed Positions

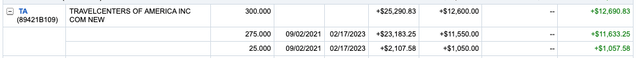

Buy And Hold Personal Account: +$12,690

And please note, I've been long TA shares, in this account since September 2, 2021, with an original cost basis of $42. And on February 17, 2023, nearly 18 months later, I sold at $84.30, to capture a 100% gain.

Fidelity 2023 Closed Positions

Reasons Why BP Bought TA For $86

It makes a lot of sense why BP agreed to buy TA. TA owned about 54 of its site outright, so think ownership of business structures, business, and the land. And in 2022, they spent a bunch of CAPEX acquiring some really high volume, high EBITDA sites, at reasonable valuations. The company's TTM Adj. EBITDA, as of September 30, 2022, was $320 million, up from $131 million in FY 2019! The company's robust operating cash flow enabled the company the opportunity to catch up on a lot of deferred maintenance CAPEX programs. This investment will keep the Adj. EBITDA stable and this will drive future Adj. EBITDA, now for BP. If you looked at TA's most recent balance sheet, its 8% baby bonds and debt start to become callable, and the company had very limited net debt, excluding the operating leases. As I noted, in my original piece, TA owns the best repair business. Also, under the CEO's leadership TA's fuel margins dramatically improved and there is still room to go, as the small fleet program and AI learning probably mean the normalized fuel margins are much higher than in prior year periods. Lastly, TA's franchise segment is highly profitable and is set to come on strong, in 2023 and beyond. And one other nuance here, most of TA's site are 10 acres to 20 acres. This is much larger than many of its peer, and this opens the door to EV charging and other enterprising business ventures, given the size of the real estate and its many well-located site, at key transportation throughways.

If anyone was actually paying attention to the fundamentals of the business, I don't think BP over paid at all. And just think, Adam Smith's invisible hand of capital is alive and well. When the intrinsic value of a publicly traded business gets materially disconnected, eventually, smart private equity folks or other publicly traded businesses work this out, and they just buy out the publicly traded shares. Eventually, the valuation disconnect gets arbitraged away by Mr. Market.

Putting It All Together

As I often say in my group, 'It's fun when it works'. This means it is a lot of fun when you craft an investment thesis and see something that few people see, and eventually, this gets recognized by a diabolic Mr. Market. That said, value investing is very difficult. I wake up every single weekday morning, bright-eyed and brush-tailed, and intellectually curious. And despite practicing this crazy art form, with religious zeal, for many years, I still strike out and get things wrong. Markets are incredibly dynamic. 2022 was one of the hardest periods in markets, I've ever experienced. I saw the 2008/09 crash coming, and was well positioned, so I gracefully side-stepped the carnage. In 2022, though, I was blinded sided, by how aggressively the Fed would take up its Federal Funds rate. Moreover, I underestimated or underappreciated how high inflation would get and how sticky it would be.

Lastly, value investing is so hard because it is often a very lonely game. You can be at your intellectual best, doing great work, synthesizing very well, and for long periods of time, Mr. Market will tell you, at least if stock prices are your barometer, that you're wrong. It is par for the course, and something very few people can stomach.

In closing, here's to value investing. It is fun to celebrate a nice win, but that celebration must be short-lived, as you're only as good as your last idea, and most people have very short memories. I hope a number of my long-time readers were invested in TA shares and that their patient and steadfast devotion to the lost art of value investing was recognized here.

It's fun when it works!

Second Wind Capital is a value oriented investment service with a strong recent track record of exceptional outperformance. The focus is mostly small cap value and special situation equities. From January 1, 2020 - December 31, 2022, the flagship account has compounded at 43.7% per year.

This article was written by

I actively invest my own capital and for a few family members.

Favorite quotes:

“When you are inspired by some great purpose, some extraordinary project, all your thoughts break their bonds: Your mind transcends limitations, your consciousness expands in every direction, and you find yourself in a new, great and wonderful world. Dormant forces, faculties and talents become alive, and you discover yourself to be a greater person by far than you ever dreamed yourself to be.” (Author - Patanjali)

“Tentative efforts lead to tentative outcomes. Therefore, give yourself fully to your endeavors. Decide to construct your character through excellent actions and determine to pay the price of a worthy goal. The trials you encounter will introduce you to your strengths. Remain steadfast...and one day you will build something that endures: something worthy of your potential.” (Author - Epictetus)

"Hope sees the invisible, feels the intangible, and achieves the impossible." (Author - Unknown)

"When I stand before God at the end of my life, I would hope that I would not have a single bit of talent left, and could say, 'I used everything you gave me." (Author - Erma Bombeck)

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.