NMZ: The Buy Case For High Yield Munis - It's Not For Everyone

Summary

- NMZ has seen the weakness of late and that may have opened up a buying opportunity for those who can withstand some risk.

- The fund went from par value to a 4% discount to NAV. That signals some inherent value.

- High-yield munis have diversification benefits and low correlations with other assets. Still, they have unique risks that make them a right fit only for certain investors.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

vm

Main Thesis & Background

The purpose of this article is to evaluate the Nuveen Municipal High Income Opportunity Fund (NYSE:NMZ) as an investment option at its current market price. It is a closed-end fund with an objective "to provide high current income exempt from regular federal income tax. Its secondary investment objective is to seek attractive total return consistent with its primary objective."

As 2022 was drawing to a close, I reviewed NMZ and put a "hold" rating on it. I saw some headwinds that were going to make gains difficult to come by, and that thesis proved to be correct in the short term:

Fund Performance (Seeking Alpha)

Given this weakness, I thought another look at NMZ would be timely. After doing so I actually see a few reasons to upgrade my rating to "buy" going forward. I would note this type of fund is not for the risk-averse, as it holds a lot of non-rated debt. But for those who want above-average income and whose risk tolerance aligns with this - there is some value here. I will explain why in the following paragraphs.

Updates Since November - Income Cut

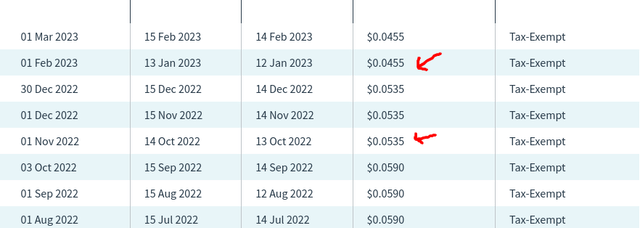

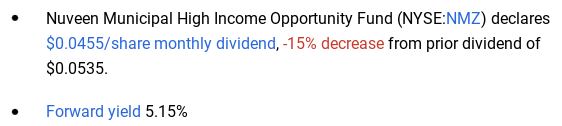

To start I will touch on one of the negatives since November. This is yet another distribution cut for NMZ which surely has holders of this fund shaking their heads. After seeing two in 2022, the fund cut the distribution again to start the year in February:

This was a 15% cut, but still leaves current positions yielding near the 5% mark. When we factor in tax savings that is not too shabby:

Recent Cut Announcement (Seeking Alpha)

The truth is there is not a lot of "good" news one can draw from this. Income cuts hurt. They decrease expected income over time and usually result in drawdowns (or at least heightened volatility) in the share price. Neither are good for current holders.

But they do often open up reasonable buys for new positions. In the case of NMZ the yield is still attractive as I mentioned. Plus it has a current distribution ratio around 100% that signals the new distribution is actually in-line with what the fund is able to earn:

Current Income Metrics - NMZ (Nuveen)

This provides a level of comfort that should help draw in new buyers going forward. With inflation still stubborn and the prospect for higher rates from the Fed, we cannot rule out the possibility of another income cut. This is especially true with respect to highly leveraged funds like NMZ. I say this because readers need to evaluate their own risk tolerance, need for income, and amount of leverage already in their portfolio. Whether NMZ is truly a good fit depends on those factors and others.

Value Has Emerged

I will now shift to some of the good that has happened since I last covered this fund. This is specific for readers wanting new positions - not necessarily for those who have been holding up until now!

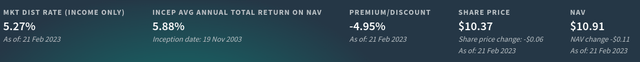

The primary metric of note is the fund's valuation. Back in November the fund was trading slightly above par value on the open market. Today that story has shifted, with NMZ offering investors a healthy discount to NAV:

Can the discount widen from here? Of course. A discount does not signal automatic gains by any means. The fact is many muni CEFs trade at persistent discounts over time. But NMZ has traded in and out of this range and generally gives out positive total returns if investors buy in at similar levels.

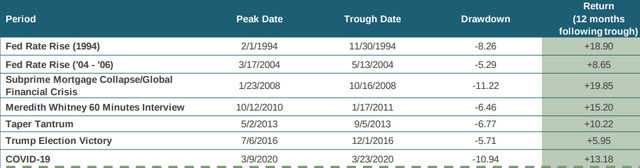

Further, the broader muni market appears ripe for a move higher. After a terrible 2022, this would be a welcome reprieve. It is also not far-fetched. In past periods where munis have seen sharp losses, they are usually followed by out-sized gains, as shown below:

Past Performance (Muni Sector) (New York Life Investments)

What I am suggesting is that history supports a marked move higher for munis. Whether or not that will include NMZ and if NMZ's discount will work in its favor remains to be seen. But I believe it will on both counts. Buying in to sectors and funds when they are unloved and have strong historical backing is usually a winning formula. I expect it will be the case this time around as well.

Is Puerto Rico The Right Fit?

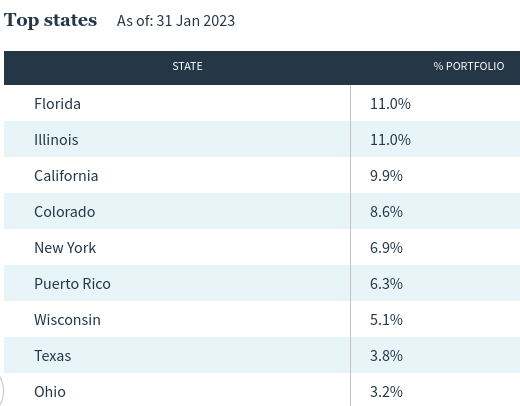

Digging deeper in to NMZ specifically, I want to hone in on the state and jurisdiction exposure. This is a fund I have generally been reluctant to own over time because of its "high yield" focus. I generally prefer IG quality debt for munis, but there is a case that can be made for below IG-rated credit. One point of contention is this usually comes with Puerto Rico bond exposure and that is an area I am not very fond of. The territory is well known for its recent credit crisis and bankruptcy which was not kind to muni investors. This is a key risk when considering NMZ as the fund holds more than 6% of its bonds from that jurisdiction:

NMZ's State Exposure (Nuveen)

I will manage expectations here by saying I am not a bull on this particular debt myself as it comes with elevated risk I don't really want from the muni space. But it also comes with a higher yield - so that can be the right fit for money. In particular, many muni investors do find PR bonds attractive because the interest is exempt from federal, state, and local taxes for U.S. residents.

This can be particularly appealing to those in high-tax taxes (think California, New York, New Jersey, etc). While residents of those states have their own in-state options for muni bonds, Puerto Rico's bonds can be appealing to those residents because it gives them the opportunity to diversify without losing the triple-tax exemption. By contrast, if one diversifies out-of-state, they normally lose out on the in-state tax deduction. This can be a big blow to high-income residents in high-tax states and make PR's bonds attractive by comparison.

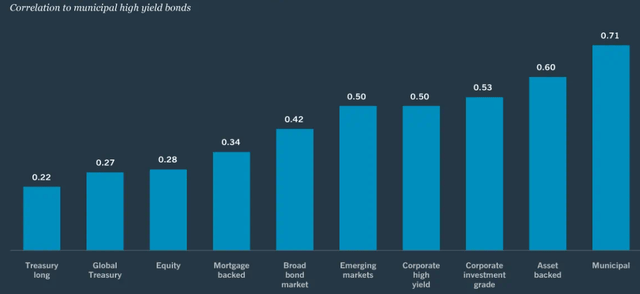

High Yield Munis Have Low Correlation With Other Sectors

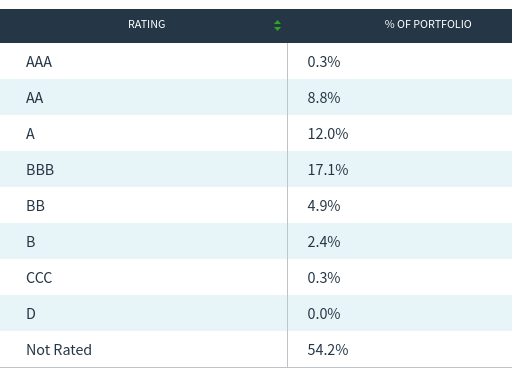

A final macro-point I want to make refers to high yield munis as a whole. This is relevant for NMZ but any other high yield muni fund by extension. Again, "high yield" implies heightened risk. So readers need to remember this before buying in. Even in the muni world defaults happen. When they do, it is often in non-rated or junk rated debt, which makes up the majority of NMZ's portfolio:

NMZ's Credit Quality (Nuveen)

The appropriateness of this type of credit backdrop really does depend on the individual. But aside from higher income, what does one get in terms of benefit by moving down the quality ladder?

A critical element that is especially useful in volatile times is a lower correlation to other asset classes. This makes high yield munis useful to round out a portfolio - and it actually has a lower-than-expected correlation with the rest of the muni universe. This suggests even those with muni exposure already could benefit from this type of holding:

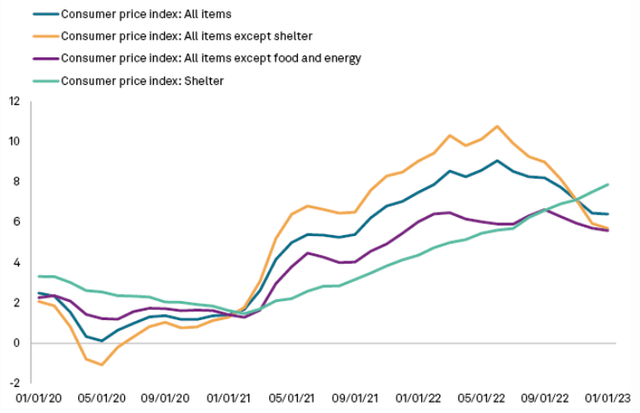

I think we are reaching a point where the time is ripe to start building income positions. This includes corporate debt, treasuries, and munis - both IG and high yield. The reason being inflation is finally starting to subside. While the Fed has hinted at more increase and inflation is still elevated, the trend suggests the end is near:

Current CPI Figures (as of 2/14) (S&P Global)

Of course, this is another area that could reverse and turn the thesis presented here on its head. But with corporate layoffs mounting and stimulus (finally) dying down, I think inflation's moderation will continue. This bodes well for NMZ and a host of other income-oriented names out there.

Bottom-line

NMZ has been in a downtrend but I see potential for that to reverse. I think the headwind of income cuts is gone for the short-term and the discount to NAV signals value. High yield munis also offer higher income and diversification benefits that may fit well with investor portfolios.

Of course, this comes with heightened risk, especially with the Puerto Rican exposure. This is something readers need to evaluate carefully. Finally, leverage doesn't mix well with inflation and Fed rate hikes. I believe we are nearing the end of the cycle but, if not, watch out for more turbulence. Ultimately, I think there is merit here for a "buy" rating, but caution readers to evaluate risk-on positions very carefully at this time.

Consider the Income Lab

This article was written by

I've been an investor since 2008, which was an invaluable and humbling experience. This is central to my strategy of looking for quality, value, and diversification - generally staying away from risky/over-hyped ideas. I won't pump any investment nor discuss a topic I don't genuinely follow / research. In that spirit, I list my portfolio here for transparency.

I'm a native New Yorker and I work for a major U.S. bank. I escaped to North Carolina for graduate school and I don't see myself ever leaving. I was a D1 athlete in college (men's tennis) and compete competitively to this day. My Bachelor's and MBA are both in Finance.

Broad market: VOO; QQQ; DIA, RSP

Sectors: VPU / BUI; VDE, RYE; KBWB; XRT

Non-US: EWC; EWU; EIRL; EWA

Dividends: DGRO; SDY, SCHD

Municipals/Debt Funds: NEA, BBN, PDO, PCK, VCV, PML

Stocks: WMT, JPM, MAA, SWBI, MCD, DG, WM

Cash position: 30%

Disclosure: I/we have a beneficial long position in the shares of NEA, PML, PCK, VCV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.