Buying Chesapeake Stock, Cautiously

Summary

- Chesapeake re-emerged from bankruptcy as an almost pure shale gas producer, which was seen as a handicap last decade, but it could be its strongest attribute this decade.

- The end of the EU-Russia economic ties puts the US in a position to become Europe's largest supplier of natural gas, especially since Norway's production might also start declining soon.

- On the supply side, US natural gas production is inching up just very slightly; therefore between increased export demand and a lack of robust production growth, higher market prices are the likely outcome.

- I bought Chesapeake stock, but only cautiously because there is a significant chance that its stock price might go even lower in the next few months as natural gas prices are likely to see a soft patch extended until perhaps fall.

amandine45

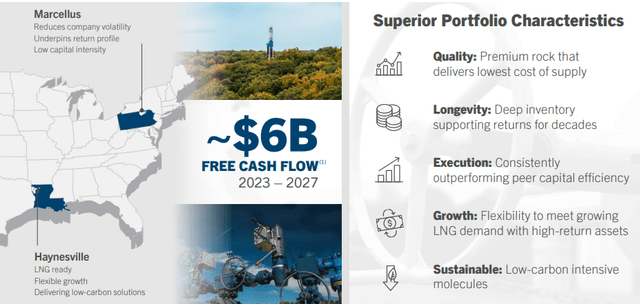

Investment thesis

Chesapeake's (NASDAQ:CHK) long-term outlook seems secure, mostly as a result of geopolitical changes that took place in the past year. America's natural gas industry gained a new major, permanent dependent, in the form of the EU, which is likely to lift US average natural gas prices, at least for this decade. Europe's potential demand is equivalent to as much as a fifth of all US current natural gas production, while US supply prospects suggest that at most, production will increase at a very modest pace. Within this context, CHK stock looks attractive at current valuation levels, given that its production is almost entirely natural gas, and some of its production is strategically positioned to directly participate in the growing LNG trade.

Chesapeake's last few quarters came in great, but there might be a few softer quarters ahead

In the last few quarters, Chesapeake saw some very positive results, which helps to alleviate any fears of the company having to declare bankruptcy again. For the year, it saw net income attributable to shareholders of $4.87 billion, on revenues of $11.74 billion. The fourth quarter report shows a handy beat of estimates, with adjusted net earnings per share of $4.22, versus expectations of $2.90. Adjusted net earnings came in at $618 million.

Other highlights include a stock repurchase of $406 million for the quarter, which helps to underpin shareholder value. Chesapeake currently has total debt of just under $3.1 billion, which amounts to about a third of its current market cap. A quarterly dividend of $1.29/share announced for March, makes the investment all the more attractive.

A new divestment deal was also announced together with the fourth quarter report, which netted Chesapeake $1.4 billion for part of its Eagle Ford oil assets, which will make this an even more natural gas-focused company.

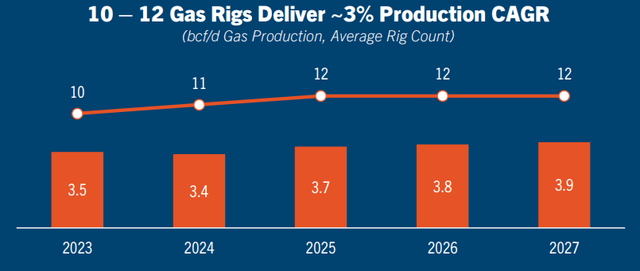

Other highlights of interest include Chesapeake's own natural gas production outlook.

As we can see, Chesapeake actually expects production to decline for the next two years or so, and then increase thereafter, which is somewhat difficult to gauge in terms of to what extent their expectations of a production rebound after a significant period of decline may be an accurate forecast.

The evolving geopolitical realities of natural gas

Chesapeake's long-term future prospects are currently tied to global geopolitical evolutions perhaps more so than most other US energy companies, perhaps aside from pure LNG plays, such as Cheniere (LNG), which is a pure LNG export company. The major shift of Russian energy supplies that up until recently fed the EU economy, to Asia, has become a monumental event in global energy markets.

In the shorter term, we are looking at a significant Russian natural gas export decline. Even as exports to Asia continue to grow, the roughly 155 Bcm/year in supplies that used to go to the EU has declined to just a trickle. As a result, Russia's gas exports are set to decline to about 100 Bcm this year, which will then gradually recover back to about 200 Bcm by the end of the decade, with most of the gas flowing to Asia and to Turkey. A growing volume of Russian gas will also probably start to flow onto the global market, in the form of chemical goods.

This leaves a roughly 155 Bcm supply gap in the EU. Demand is currently down by about a fifth to a quarter, by most estimates, which amounts to about half of the gas that the EU used to import from Russia. The other half of lost supplies is now mostly covered by US LNG. No doubt, at some point the EU economy will bounce back to something close to what used to be full demand. In other words, EU natural gas demand is set to grow by about 75 to 100 Bcm/year in the next few years, unless they will give up on much of their industrial base.

There was some hope that other major LNG exporters such as Qatar will fill a large portion of that void. It seems however that Qatar is more interested in capturing a long-term presence in the Asian market. It has been signing long-term supply deals with China, and it seems that India is looking to increase long-term purchases as well. Qatar prefers very long-term deals, which Europeans have been reluctant to sign, given their green energy plans. There are some signs that more African supplies of natural gas will be made available to Europe, but it is not entirely clear how much more.

In the meantime, Norway, which is currently competing with the US as the number one supplier of natural gas to the EU, might be just a few years away from reaching a peak in production, followed by a permanent decline, that will reduce supplies to Europe every year.

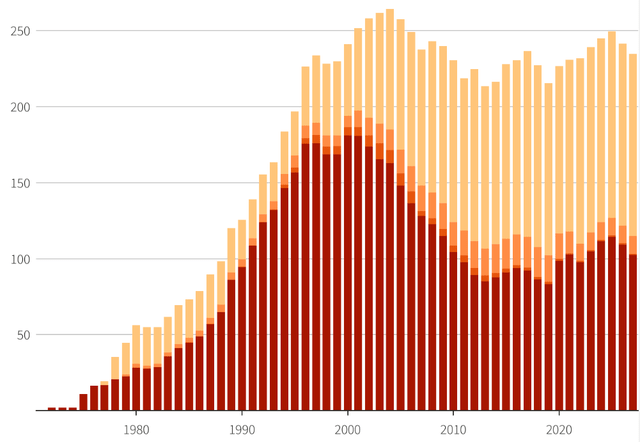

Norway current & forecast oil & gas production (Reuters)

Far from participating in filling the major supply gap that opened up in the EU economy, Norway is set to become an additional negative factor in the ongoing energy crisis that the EU is facing. It is therefore more than likely that US LNG supplies to Europe will have to increase further from current levels.

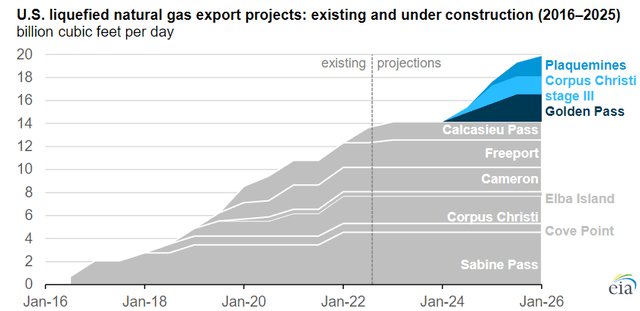

While looking at projected LNG export capacity alone tells a lot of the story, looking at the destination of the extra LNG and why it is headed in that direction, is important because we need to understand that political intervention that may undermine the coming increase in exports, out of domestic considerations, is not likely to happen. There probably will be some political pressure to limit exports of LNG, as natural gas prices for domestic US consumers will increase dramatically in the next few years. Given Europe's energy predicament, however, which arguably the US had a major role in shaping, by actively opposing Europe's economic relations with Russia, it will be very hard to back out of what has now become a moral obligation to some of America's most important allies, namely the EU and the UK.

Furthermore, it is imperative to supply that gas to Europe, unless we are prepared to see a probable economic implosion of the continent, which would risk significant global economic upheaval as the fallout would affect every aspect of the rest of the global economy. Chesapeake is therefore on seemingly very solid ground in terms of the long-term US natural gas market price outlook for this decade, and most likely beyond.

It should be noted that Chesapeake's Haynesville acreage is poised to take direct advantage of growing LNG exports from GOM LNG facilities.

It is more than probable that natural gas supplies that will have a direct regional contribution to the LNG trade will see a price premium, over natural gas that will remain landlocked, such as the gas produced from the Marcellus field.

Investment implications

I recently bought Chesapeake stock as its price declined from over $100/share a few months ago, to just under $80 recently. It seems like a decent buying opportunity, given a forward P/E ratio of just under 5. I did so just cautiously, however, because I do believe that there is a relatively good chance that the next few quarters will come in weaker than the last few quarters. If that is the case, there may be an opportunity to buy more Chesapeake stock at a lower price. If it turns out not to be the case, I will personally be happy to ride my current position higher.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of CHK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.