Why RWE Is A Solid Utility Investment And Should Be On Your List

Summary

- There is somewhat of a dearth of coverage on German company RWE AG, the second-largest multinational energy company headquartered in Essen.

- I don't yet own a massive stake in the business, but intend to provide coverage for the company starting here on out. I don't believe one should ignore it.

- RWE is one of the 300-400 largest businesses on earth - and here is what you could potentially see in terms of returns if you were to invest.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Andreas Rentz/Getty Images News

Dear readers/subscribers,

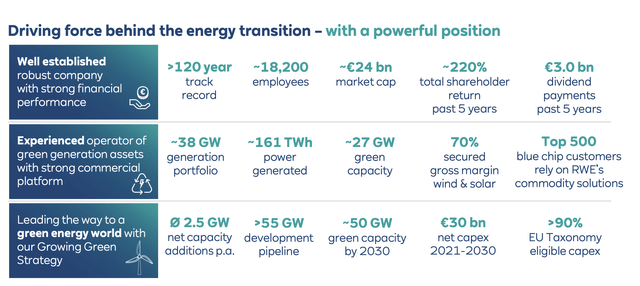

The company we're going to take a look at today is named RWE AG (OTCPK:RWEOY). It's one of the largest energy companies on earth, the second-largest in Germany, and actually one of the largest companies, no matter what kind, on earth - at least in the top 400. With roots going back to the Rhine and Westphalia region in the late 19th century, the company's current name RWE AG was adopted in 1990. It very early on expanded by buying up several power plants, infrastructure companies, and the like. Typically, at the time, RWE owned both electricity/generation companies, but also ancillary businesses like trams, as well as gas networks - and at one time owned the largest gas network in Europe.

The company quickly drew public shareholders and was quickly after only 7 years following World War 2, excluded from the control of the allies. RWE then went on to build the first nuclear reactor in Germany, and over the next 60 years would go on to acquire assets in all of Europe, only to later dispose and sell off many of them.

The latest relevant developments for this part of the business were in 2016 when RWE transferred its renewable, retail, and network business to a company called Innogy, listed on the Frankfurt exchange, which was acquired by giant E.ON (OTCPK:EONGY) back in -18. A very complex deal including multiple asset swaps resulted in RWE taking a 16.7% E.ON stake. Because of this asset swap, RWE is now set to become the continent's third-largest renewable producer, only beaten out by Spanish Iberdrola (OTCPK:IBDRY) and Italian Enel (OTCPK:ENLAY).

You may notice if you follow my work that I invest heavily not only in Enel and E.ON but in Iberdrola as well.

So, let's look at what RWE has to offer us today.

Looking at RWE AG

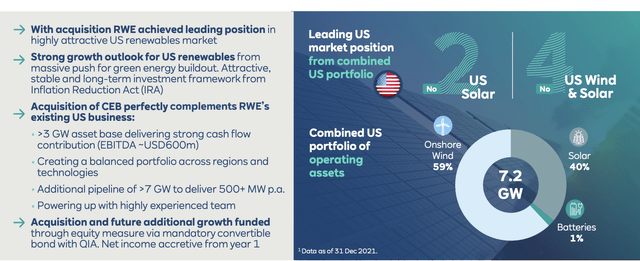

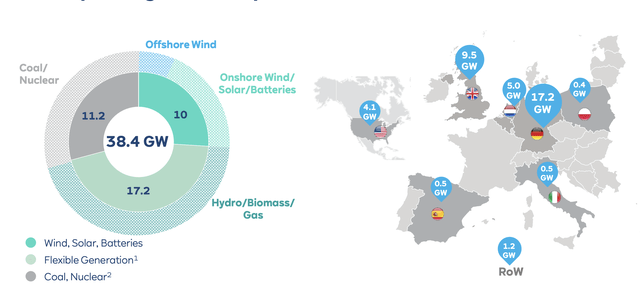

RWE is a legacy energy company gone renewables. What was once considered RWE, even by people with knowledge in the industry, is no longer what the company "is" today. The company has a very attractive set of renewable assets that seems to be growing year-over-year. What's more, the company has already become a leader in US solar and Wind/Solar.

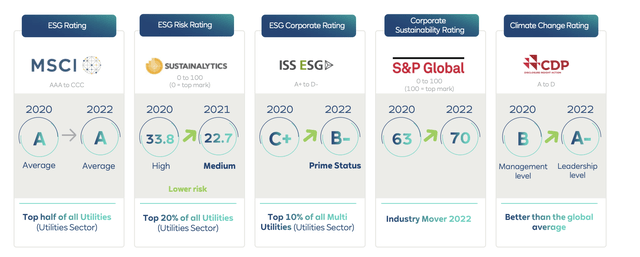

RWE is set to leave coal behind as early as 2030, and already has some of the more impressive sustainability ratings around if you're interested or invest based on that sort of thing.

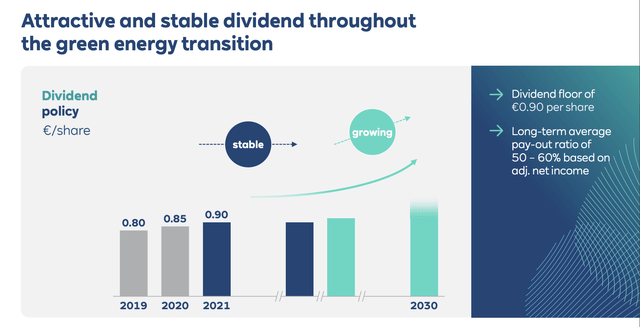

The company is investment-grade rated, with BBB+ and Baa2, and targets a post-2025E leverage ratio of below 3.5x - currently below 3x. RWE is going to continue to grow both organically and inorganically, and is committed to a dividend floor as well as a growing dividend going forward, with an average payout ratio of 50-60% based on adjusted net income.

That overall floor of €0.9 means that the current yield on a share price of around €40/share native is less than 2.5%, which does mean that as far as energy companies go, RWE is one of the lower-yielding ones. However, remember that this company considers this a floor, and realistic yields might be higher - just maybe not at this particular time.

RWE is a surprisingly stable stock for the transition it's going through. Over the past 5 years, its share price development has been close to linear and growing at 23% per year or 143% over 5 years. This trounces the S&P500 and other indices by a wide margin, and makes me regret not investing much more, and sooner in the company.

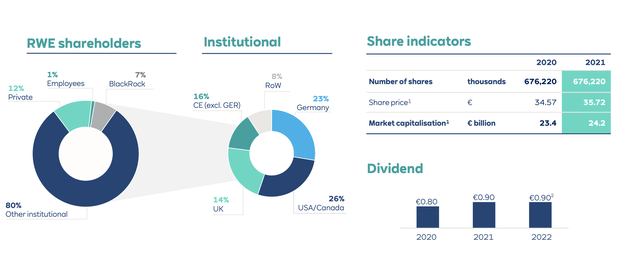

RWE today is an Essen-based market-leading operator of green generation assets combined with a strong commercial platform. It has exposure to EU, NA, and APAC, and its EBITDA of around €4B comes from a 76% core business, with around 24% left from coal and nuclear. It's an attractively-held company with 80% institutional investor shareholding, 7% of the company held by BlackRock (BLK).

The company calls its generation and commercial platform unique - a stretch, but it's an impressive set of numbers to be sure. The company has 20 years in renewables behind it, and is the #2 global player in offshore, while at the same time having the second-largest gas fleet in Europe, almost a dozen battery projects, hydrogen projects, and a strong commercial platform with almost 700 bcm of gas traded per annum.

Unlike many other German companies, the shareholder structure is attractively diversified in terms of geographies - and more NA shareholders than German ones actually exists.

The company's maturities are extremely well-laddered, with nothing maturing before 2025, and most of it beyond 2028. The company will also be continuing to issue green bonds going forward.

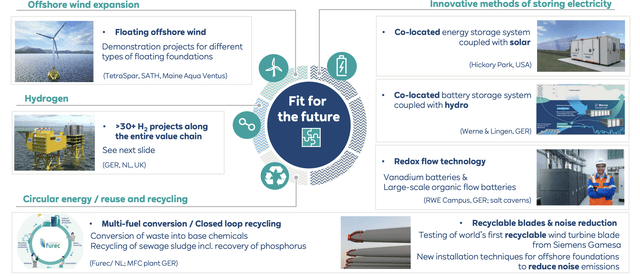

The company is also a very active R&D'er in the green field. Here are some examples of the recent projects that the company works with.

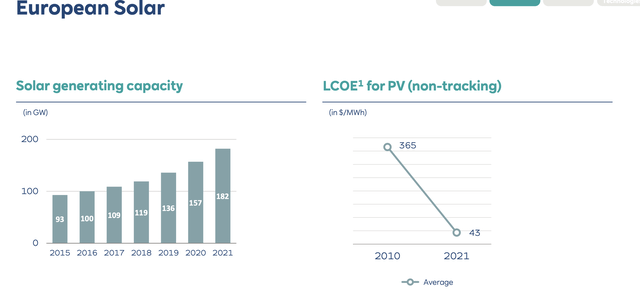

Both onshore and offshore generation of wind has been steadily growing, almost now at 2x compared to 2015 in 2021. Furthermore, the costs for onshore wind per MWh have been steadily declining. What was once an LCOE of $100 is now down to $43, which is less than 12 years. The same development for photovoltaics is even better and makes wind look conservative and expensive.

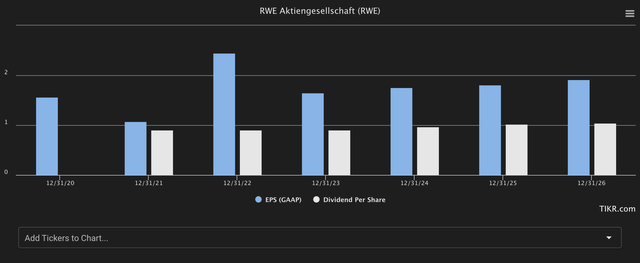

RWE, given its broad exposure, has a very complex regulatory regime that involves multiple nations and multiple regulatory bodies, with renewables alone in various countries under more than 5 different ones - what can be said is that RWE generally gets the rates it needs to stick to its current earnings growth rate and CapEx requirements. The current forecasts for RWE are generally positive. As RWE's transformation has slowly gone toward more and more renewables and the plan is slowly being executed upon, we're seeing more of a forecastable earnings and dividend nature, which is what we want to be seeing. Here is the current set of 2026E estimates.

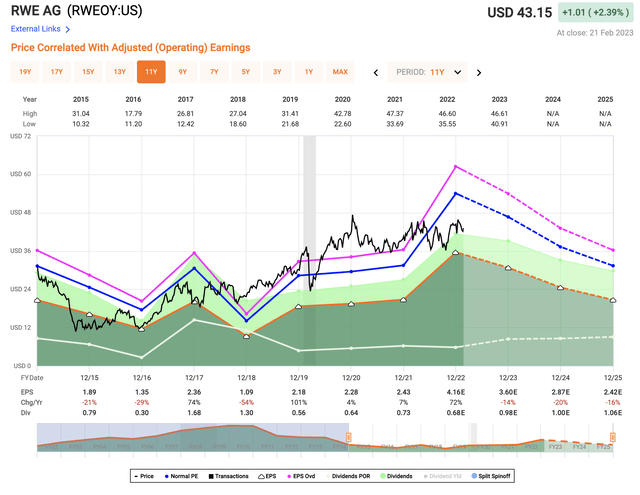

As you can see, 2022 will likely be an outlier for the company, with the company's normalized EPS being somewhat lower, but stable. This isn't I believe a company that will generate triple-digit RoR in the short term, because this EPS needs to come through first, with valuations normalizing.

Let's see where this puts our current valuation thesis for this energy company.

RWE - The valuation

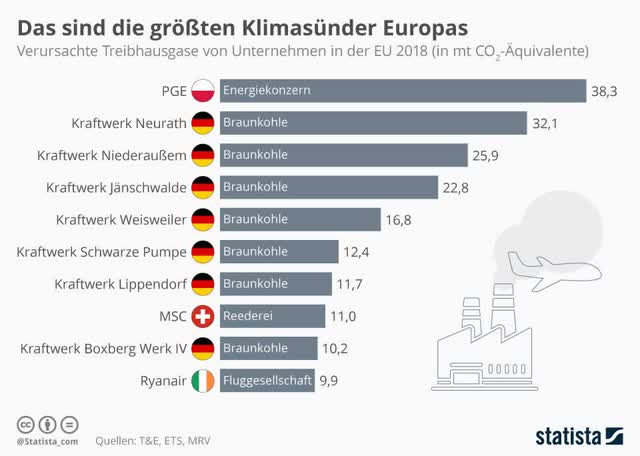

There is obviously a whole host of "green" concerns that I've elected not to focus on in this article. RWE is one of the "dirtiest" companies in all of Europe right now due to its lignite operations in Germany and the assets it owns that still use the stuff as fuel. A quick glance at statists shows us how bad the company's assets are when compared with a broader EU perspective.

Statista DE, Dirtiest Assets/companies (Statista)

However, there are some reasons I choose not to overly focus on this part - in part because it's being wound down, in part because I invest not in green companies, but in profit.

Besides, there are plenty of downsides to be talked about in valuation without needing to go into that part of the argument. And here are some of them.

RWE stock trades at a current normalized higher P/E ratio due to its excellent earnings. We can illustrate this with a simple F.A.S.T graphs.

RWE valuation (F.A.S.T graphs)

So, some of the valuation issues that we have at the company's core, is how the multiples will hold up in the face of an adjusted EPS decline - though I want to point out that the native share decline is far lower, and only in 2023, as compared to what FactSet is forecasting here. And I find S&P Global to typically be somewhat more accurate than FactSet. The fact that the company's analysts on FactSet miss more than 75% of the time, positive or negative, with a 10% margin of error, tells me that these analysts don't really do all that well with the company, which is why I stick to different datasets.

Now, RWE is an independent energy producer, which means it trades with peers like Uniper (OTC:UNPPY), EDP Renovaveis (OTCPK:EDRVY), Edison, and others. In this peer group, apart from the ever-undervalued for good reason Uniper, RWE stands out as undervalued, trading at only a 10.9x P/E, despite BBB+ and what I view as solid safety and a good plan for the next 8-or-so-years.

We can, in fact, compare RWE to more traditional electric utilities as well, and apart from undervalued Enel and Fortum (OTCPK:FOJCF), RWE is undervalued in this peer group as well. The discount is pronounced enough that the analysts following the company, of which there are 16, give the company an average PT of €51/share, from a range of €45 to €59. You will note that the company's current share price is no higher than €40, which means that every single analyst views this company as a "BUY" based on PT. This is also the case with analyst recommendations. RWE is the first company I've ever reviewed where every single analyst is at a "BUY" or equivalent positive rating/PT, and where the current upside to that PT is around 28.1%.

RWE trades at a 1.38x revenue and 0.78x sales, which is significantly below its historicals. The same is true for P/E, and the same is true for book multiples. No matter which standard multiple you look at, the market is currently undervaluing this company.

While RWE as a company still has a heavy exposure to lignite and other forms of power generation which even to an uncaring investor as myself might come off as a bit carbon-excessive, the company's future is green. RWE is working every bit of its strength towards this ambition in the next 8+ years, and its current generation portfolio fully supports this, based on how its changed for the past 10 years.

Even if F.A.S.T graphs and FactSet analytics don't see a clear upside based on earnings trends, I consider it far more likely that RWE will deliver stable results from the end of 2023E and upward. That leaves me only with one question - and that is how exactly the company's valuation will react to a drop in earnings this year.

Because the yield is still somewhat meager, and the potential for a drop-off is there, my position in RWE is still relatively small.

However, it's one I intend to quite quickly build out, if needed or if warranted - and any significant decline in share price that puts the upside to a PT above 30%, is to me a good signal to "BUY" more.

I do believe the company is a "BUY" here. There's too much positive in the mix today to ignore it. But I also believe that in the future, annualized upside at this time might be higher in other companies.

That's why Enel is a priority for me, and why I have massive Enel exposure. Also, Iberdrola, as well as E.ON.

But, RWE is getting there, and I'm getting ready.

So should you.

Here's my current RWE thesis for 2023.

Thesis

- RWE is among the class-leading renewable companies on earth, though with a still-existing legacy portfolio with exposure to lignite and other non-friendly (in environmental terms) fuel. The company is working to reduce this, and exit coal by 2030. It's BBB+ rated, has a well-covered yield of over 2%, and is set, as I see it, to stabilize its earnings in the next couple of years.

- Because of this, I view RWE as a "BUY" with an appealing conservative PT of €49/share for the native - below even the analyst average, but still enough to interest potential investors.

- I own RWE here - and I intend to slowly build more as time passes and earnings come in.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

I debated whether to call RWE stock "cheap", but in the end, I cannot justify it, despite the upside. The company, therefore, fulfills 4 out of my 5 criteria - not perfect, but good enough.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Disclosure: I/we have a beneficial long position in the shares of RWEOY, BLK, EDRVY, ENLAY, EONGY, FOJCF, IBDRY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks I write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.